Best 24-Hour Money Changers in Singapore: 2025 Guide

Find the best late-night money changers in Singapore with our guide. Compare rates and find out how to save on your next exchange.

Trust Bank, which opened in 2022¹ and is partnered with Standard Chartered and FairPriceGroup,² has quickly become one of Singapore’s most popular digital banks. It is known for its simplicity, rewards, and zero fees, making it a solid choice for everyday local banking needs. However, Trust Bank has some limitations when it comes to international transactions.

This article explores whether a Trust Bank overseas transfer is possible and what alternatives you can use. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

Unfortunately not. Trust Bank was designed for the Singaporean market, which makes it a great option for local use. Customers can open and manage accounts, apply for loans and insurance, invest, take advantage of rewards like coupons, and transfer money within Singapore, all without any fees.

However, a Trust Bank overseas transfer isn’t possible. That doesn’t mean Trust Bank isn’t a good everyday banking option still; you’ll just have to do your international transfers elsewhere. This is where alternatives like Wise come in.

With Wise, you can send money internationally at the mid-market exchange rate, pay low, transparent fees, and move your funds to over 140+ countries with ease.

To ensure Trust is the best fit for all your everyday local banking, see how it compares to other Singaporean digital banks in our GXS vs. Trust Bank breakdown.

No, Trust Bank does not currently offer international remittance services. Its platform is designed exclusively for domestic fund transfers within Singapore.

The main reason is that Trust Bank only supports SGD-based transfers within Singapore’s local banking network.³ It is not connected to global payment systems required for international transactions.

For domestic transfers, Trust Bank utilises services like PayNow.

PayNow allows you to send and receive money instantly using just a mobile number, NRIC/FIN, or a business's Unique Entity Number (UEN). However, the PayNow network itself is also limited to Singapore, so it cannot be used for overseas transfers.³

While Trust Bank does not offer a multi-currency account, you can still use your card for overseas spending.

Here’s how it works:

- Automatic currency conversion: When you use your card abroad for purchases or dining, your payment is automatically converted from SGD to the local currency

- Zero foreign exchange fees: Unlike most traditional banks, Trust does not charge a fee on foreign currency transactions, helping you save money on your travels

- ATM withdrawals: When withdrawing cash from an overseas ATM, Trust recommends choosing to be charged in the local currency to get a better exchange rate³

If you’re going abroad and want to use your Trust Bank card, make sure you enable it for overseas usage on the app first. Otherwise, Trust Bank may block your transactions.

👀 Planning a trip? See how the Trust card compares with other multi-currency cards like Youtrip in Singapore.

💳 Click here to order a Wise card

Finding a solution for overseas transfers can feel complicated, especially when your bank doesn’t support them. But there are services built specifically for this purpose. Let’s look at how Wise offers a different way to move your money internationally.

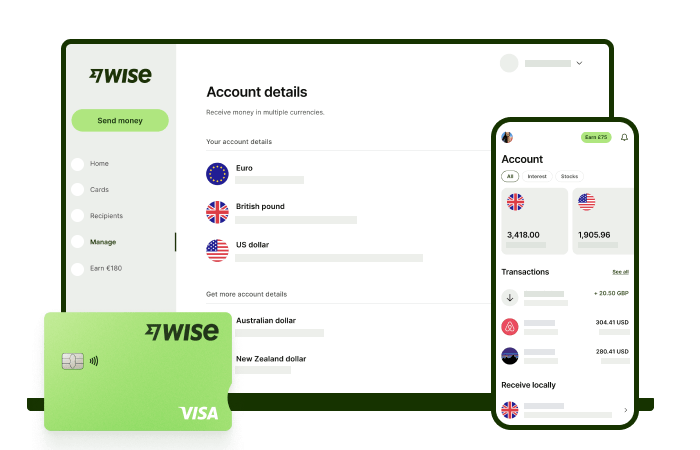

Wise international money transfers can be set up online or within the Wise app with low fees from 0.26% and the mid-market rate, to over 140+ countries. There’s no markup added to the exchange rate that’s used to convert your currency, which makes it easier to see exactly what you're paying for a transfer, and what the recipient will get in the end. Just transfer the amount indicated in SGD and let Wise do the rest.

Track your transfers easily when you create a free Wise account, and manage, hold, and convert your money in SGD and 40+ other currencies. You'll get the same great rates, and be able to track your transfers all from one place. As a bonus, you can also get 8+ local account details to be able to receive money in SGD, USD, GBP, and more.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find the best late-night money changers in Singapore with our guide. Compare rates and find out how to save on your next exchange.

Learn how to transfer money from your DBS account to GCash in the Philippines. This guide covers the steps, transfer times, fees, and daily limits.

YouTrip for overseas transfers? Learn how it works, compare features & fees with Wise, and find the best international remittance option.

Is JiPay a great money management app for migrant workers in Singapore? Read more from our review about JiPay's features, remittance and more.

Looking for the best money changer in Singapore? We compared the 5 most popular Singapore money changers and the exchange rates

We compared who comes out on top in transfer fees and rates Singapore - Instarem vs Wise (formerly Wise).