GXS vs Trust Bank (2025): Which digital bank is best for you in Singapore?

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates

YouTrip¹ is a popular local provider with a multi-currency ewallet and card for international spending and withdrawals. Recently the company has expanded their offering for Singapore residents, with the YouTrip overseas transfer service. You can now make a YouTrip transfer to bank accounts in 40+ countries, sometimes with instant or same day delivery times.

This guide looks at the YouTrip overseas transfer features, fees, speed and exchange rates, so you can decide if it’s right for you. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

So - can YouTrip transfer money to an overseas bank account?

The good news is that you can now send a YouTrip international transfer², by topping up your YouTrip wallet in SGD, and then sending the money for deposit in a bank account overseas. YouTrip will convert the SGD balance to the required currency, with preferential exchange rates, and pass it over to your beneficiary, often quickly or even instantly.

The countries and regions you can send money to with YouTrip include:

To send money to an overseas bank account with YouTrip you just have funds in your YouTrip SGD balance to cover the transfer and any applicable costs. You can only transfer funds which you have added yourself using PayNow or a linked bank account. If another YouTrip user sends you funds, this is not considered a transferable balance and therefore can not be sent to a bank account.

Once you have added enough money to your YouTrip account in SGD to cover the costs of your YouTrip international transfer, you can get started. Here’s how to send money to an overseas bank account with YouTrip step by step:

- Log into the YouTrip app and tap Transfer, and then Transfer Overseas

- Select the country and currency to send to, and enter the payment value

- Add or select your recipient

- Confirm the reason for the payment, from the list provided

- Check everything over and tap to confirm the payment

If you have never sent money to this recipient before you’ll need to add them to your recipient list before you can process the payment. You’ll be prompted to do this in the app and can then enter the banking or account information for the recipient and confirm the details with a one time code which is sent to your phone. You might also be requested to enter more information about the payment, such as the source of the funds or the reason for making the payment.

If you’re sending over 1,000 SGD with YouTrip you’ll also need to adjust your payment limits. The app sets the default limits as 1,000 SGD per payment, but you can change it up to the maximum amount of 20,000 SGD if you’d like to³.

Here’s how to change your YouTrip international transfer limit if you need to do so:

- Log into the YouTrip app

- Tap the More icon on the bottom right

- Tap on Wallet & Transactions Limit

- Select Overseas Transfer Limit

- Enter the amount you want, up to 20,000 SGD maximum

Not sure if YouTrip international transfer is right for you? Compare YouTrip against Wise to see which might suit you best.

Wise has been offering international transfers since 2011, and is trusted by millions of active users globally. You can send money with Wise to 140+ countries in 40+ currencies with the mid-market exchange rate and delivery times which can often take seconds. Here’s a quick overview of Wise vs YouTrip on international transfers, to give you a flavour.

| Feature | YouTrip | Wise |

|---|---|---|

| Eligibility | Singapore residents | Residents of Singapore and many other countries and regions |

| Supported countries and currencies | Send in 9 currencies, to 40+ countries | Send in 40+ currencies, to 140+ countries |

| Transfer fee | Variable fees based on the transfer details | Low, variable fees based on currency and payment value |

| Exchange rate | YouTrip rate | Mid-market rate |

| Transfer limit | 20,000 SGD | High limits - up to 2 million SGD |

| Speed | Duitnow, GCash and UPI can be delivered instantly or on the same day Other transfer methods can take longer | 60%+ of transfers are instant (completed under 20 seconds), 80%+ are delivered in less than 1 hour |

*Details correct at time of research - 19th July 2025

As you can see, Wise serves a broader range of countries and currencies, including all of those covered by YouTrip and many more. Both offer variable fees and good exchange rates - you can even model your payment online with Wise to see the costs, with no obligation. This makes it easy to check and compare your payment with other providers to see which presents the best value and the quickest delivery time.

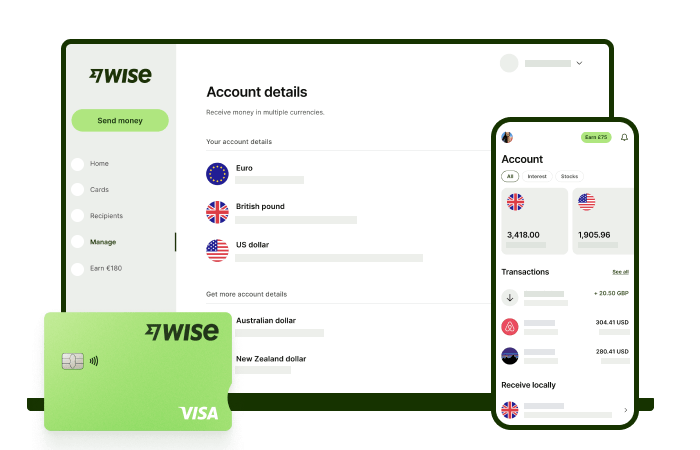

Like using YouTrip for the handy wallet and multi-currency payment card? Wise can also help there, with 40+ supported currencies available in the Wise account, including a linked debit card for easy spending and withdrawals. Compare YouTrip and Wise for account, card and international payment services to see which is the best fit for your unique needs.

Before you send a payment overseas, it’s a smart plan to compare the costs of using different providers to find the best fit for your needs. To give an idea, here’s how YouTrip and Wise perform in an example transfer of 10,000 SGD sent to Australia. Fee and exchange rate data is taken from the YouTrip app, accurate as of 23rd July 2025:

| YouTrip | Wise | |

|---|---|---|

| Exchange rate | 1.187 | 1.189 |

| Transfer fee | 24.96 SGD | 23.33 SGD |

| Recipient gets | 11,840.37 AUD | 11,858.07 AUD |

If you want to send a payment to someone overseas, it’s worth comparing the costs with both YouTrip and other providers including Wise. Double check both the upfront transfer fee, and the exchange rate used to convert your dollars to the required currency, to compare. As fees can be added to the exchange rate, a low transfer fee doesn’t necessarily mean the lowest overall cost for your payment. It helps to look at the amount the recipient gets in the end, to make sure you’re getting the very best available deal - or pick a provider like Wise which does not add fees to the exchange rates offered, for transparency and to make it simple to compare providers.

If you’re a YouTrip account holder already, the YouTrip overseas transfer service might be a convenient choice if you have enough transferable balance to cover your costs. However, the service is relatively limited at the moment, with only 9 supported currencies. This may mean you’re better off looking at an established provider like Wise which covers more countries and currencies, with fast or even instant transfers to banks and mobile wallets.

Sources last checked: 23 July 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before

Both Wise (formerly Wise) and Revolut offer digital multi-currency accounts for managing money across borders - which one is better in Singapore?

Here's everything you need to know about the best multi-currency accounts and wallets in Singapore: Fees, Features, Exchange rates and more.

Looking to open a bank account online? Here are some options available in Singapore

Looking how to sign up for a PayPal account in Singapore? We covered the process step-by-step, from signing up to verifying your account