Best 24-Hour Money Changers in Singapore: 2025 Guide

Find the best late-night money changers in Singapore with our guide. Compare rates and find out how to save on your next exchange.

If you’re a DBS customer in Singapore, you can use the DBS Remit¹ service to send money to people overseas conveniently and with low or no transfer fee to pay. DBS Remit supports payments to 50+ countries, to bank accounts, and also to local wallets.

Sending a payment to the Philippines? In this guide, we cover key questions - including can DBS send money to GCash²? And if I send DBS Remit to GCash how long will it take for my money to arrive?

We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Yes. DBS Remit supports payments to banks and also to GCash in the Philippines³.

If you're sending money to someone in the Philippines, this can be a convenient way to get money to them quickly, as GCash is a widely used e-wallet that allows customers to spend, send, and withdraw their funds easily.

You can set up a DBS to GCash payment through the DBS Digibank Mobile and Digibank Online services, which means you don’t need to go to a branch to get your transfer moving.

If you want to send money to GCash from DBS, you’ll need to get some information from your recipient and then add their details to your DBS account before making your payment. Here’s what you need to ask the recipient to give you:

Once you have this on hand, you can add the information to your DBS account to set up a new recipient. You only need to do this once; subsequent transfers can be made by simply selecting the recipient from your list.

Here’s how to set up a new GCash recipient with DBS Remit⁴:

Once you have your GCash recipient added to your DBS account, you can send them a payment through the Digibank app using just your phone⁵:

If you prefer to manage your DBS account using your computer, you can also send money to GCash through Digibank online:

For most payments to a bank account, there’s a DBS Remit cut-off time that you’ll need to hit to ensure the fastest available payment. If you get your transfer request in before this cutoff, your funds should be received on the same day you send them.

With GCash, it works a little differently. The good news is that there’s no DBS to GCash cut-off time⁶.

No matter what time of day you transfer, the DBS to GCash transfer time on a Monday to Saturday should be pretty fast. Transfers are received on the same day they're sent - and if you arrange your payment on a Sunday or a public holiday, it should be processed and received on the next working day.

When you send a DBS to GCash transfer from Singapore, there’s a fee of 1 SGD for payments of 150 SGD or less, waived for higher value payments. There’s no GCash incoming payment fee to pay⁷.

Bear in mind that, in addition to any possible transfer fee, an additional charge may be applied to the exchange rate used for currency conversion. DBS will convert the SGD in your account to PHP for deposit to GCash. The exchange rate is set by DBS, and may include a markup - a fee.

To illustrate how this works, let’s take a quick example of a payment of 100 SGD to GCash, with DBS Remit and Wise:

| Provider | Transfer fee | Exchange rate | Recipient gets |

|---|---|---|---|

| DBS Remit | 1.5 SGD | 1 SGD = 43.6433 PHP | 4,298.87 PHP |

| Wise | 1.43 SGD | 1 SGD = 44.3828 PHP | 4,374.81 PHP |

*Details taken from Wise and DBS websites, 12th August 2025

In this example, because Wise does not add a fee to the exchange rate used for currency conversion, but splits out all fees separately, the recipient gets more. We’ll look at how Wise works for Wise to GCash transfers in a moment.

It’s also helpful to note the transfer limits for DBS to GCash. DBS limits are set as follows:

On top of this, there are GCash incoming payment limits which will apply⁸. The amount you can receive to your GCash account depends on the type of account you hold.

If you have a basic account, you can only receive 5,000 PHP a month and hold a maximum of 10,000 PHP. If you have a fully verified account, you can receive and hold up to 100,000 PHP a month. The top-tier account - GCash Platinum - can receive and hold 1 million PHP a month.

So while the DBS limits are pretty generous - 200,000 SGD is close to 9 million PHP - you can’t actually receive or hold that much in GCash. This means that understanding the GCash limits is crucial before you start to make a transfer.

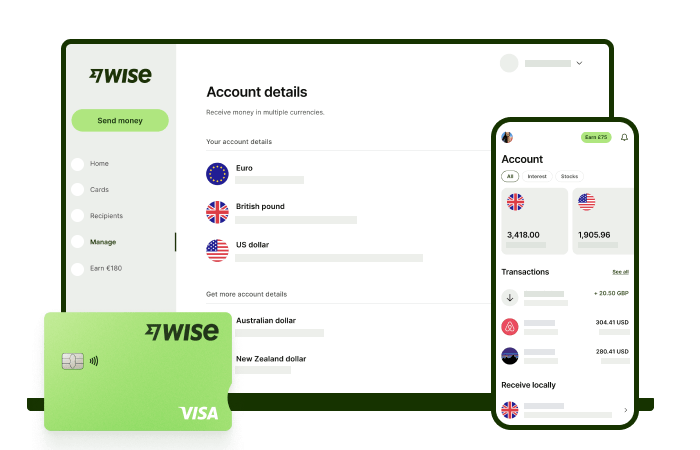

Wise international money transfers can be set up online or within the Wise app with low fees from 0.26% and the mid-market rate, to over 140+ countries. There’s no markup added to the exchange rate that’s used to convert your currency, which makes it easier to see exactly what you're paying for a transfer, and what the recipient will get in the end. Just transfer the amount indicated in SGD and let Wise do the rest.

Track your transfers easily when you create a free Wise account, and manage, hold, and convert your money in SGD and 40+ other currencies. You'll get the same great rates, and be able to track your transfers all from one place. As a bonus, you can also get 8+ local account details to be able to receive money in SGD, USD, GBP, and more.

✍️ Sign up for a free account now

Sources last checked: 19 August 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find the best late-night money changers in Singapore with our guide. Compare rates and find out how to save on your next exchange.

Is JiPay a great money management app for migrant workers in Singapore? Read more from our review about JiPay's features, remittance and more.

Looking for the best money changer in Singapore? We compared the 5 most popular Singapore money changers and the exchange rates

We compared who comes out on top in transfer fees and rates Singapore - Instarem vs Wise (formerly Wise).

We reviewed Western Union trasfer fees in Singapore: ✓Exchange rates ✓Charges ✓Transfer methods and more. Read more here!

PayNow is a secure, fast and convenient way to make instant SGD payments from one Singapore bank to another, without sharing bank details. Here's how it works.