How to Open a POSB Bank Account for Your Domestic Helper in Singapore

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

Moomoo¹ is a popular digital brokerage that allows customers to buy and sell assets, including stocks, treasuries, and more, on markets in the US, Singapore, Japan, and Hong Kong. You can set up an account online or in the app, and trade easily with nothing more than your phone.

This Moomoo guide looks at how to use the Moomoo app and online system to add money, buy and sell assets, and ultimately withdraw your funds to your preferred account. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Moomoo is a trading platform that launched in 2018 in the US and has been available in Singapore since 2021. You can open a Moomoo account to invest and trade in assets including US, Singapore, Japan, and Hong Kong stocks, crypto, US treasuries, and REITs. Moomoo has over a million users in Singapore, and offers varied fee options depending on asset types, including no commission on US stocks, ETFs & fractional shares.

Moomoo accounts cover both cash and margin products, which means there are options for both new investors and experienced investors looking to access more complex and risky trades. Read on for our full Moomoo for beginners introduction.

This guide is for information only, and does not constitute advice. The value of investments can go down as well as up - get professional advice before you put your money at risk.

Here’s how to set up your Moomoo account easily in Singapore - if you have Singpass, the process can be done in just a few steps²:

If you have a Singpass account, you can authorise it to pre-populate key information about yourself and your address. This means you don’t need to upload documents to prove your ID or address, although you may still need to confirm information about your employment status, financial status, and tax status.

If you don’t have Singpass, you’ll need this detail, plus your NRIC or passport, and proof of address. This could be a document like a phone bill or bank statement, or a letter from a government agency, for example.

You can fund your Moomoo account3 from a Singapore bank, or a foreign bank - either by making a direct transfer, or by using a platform such as Wise.

If you have a Singapore bank account and want to add money in SGD, Moomoo recommends you use a demand deposit account (DDA) instant deposit.

If you have a foreign bank account or want to deposit in a currency other than SGD, you may prefer to use a platform like Wise. This allows you to deposit in different currencies directly to Moomoo, which can be cheaper than sending a cross-currency transfer from your bank. Here’s how to fund your Moomoo account from Wise, as an example⁴:

You can withdraw SGD, HKD, and USD from Moomoo⁵. Available funds for withdrawal include uninvested cash and the funds returned to your Moomoo account once you sell an asset.

Here’s how to withdraw money from Moomoo⁶:

Withdrawal times vary a lot depending on the currency, where the beneficiary account is located, and the value, from 1 - 5 business days in most cases.

| Buying or selling a stock or shares that aren’t traded in your local currency? Don’t let the currency conversion trip you up. Convert your stocks or shares into any currency with our handy tool, and you’ll always know what you’re getting. Check out our international stock ticker tool. |

|---|

| Explore international stocks 🌍 |

Disclaimer: Wise's international stock ticker provides information for reference purposes only. This tool and platform does not offer to buy or sell stocks, and the data displayed here should not be considered financial advice. All investment decisions should be made after thorough research and consultation with a qualified financial advisor. We make no guarantees regarding the accuracy or completeness of the information provided, and users should exercise caution and seek professional guidance when making investment choices.

There are no Moomoo deposit fees, although your own bank or provider may charge a fee when you send a payment to Moomoo for deposit. This is especially likely if you send a cross-currency transfer - sending from your Singapore SGD account to be received by Moomoo in USD, for example. In this case, the bank may include a fee for the transfer and additional charges for currency conversion.

Using a specialist provider like Wise to add funds in foreign currencies to Moomoo can help avoid or reduce these Moomoo exchange rate charges. Using a service like Wise for any transfer in or out of your Moomoo account, which requires currency conversion, can help you keep more of your money by reducing the overall cost of fees.

There are some Moomoo withdrawal fees which depend on the currency, value, and recipient bank used⁷:

| Currency | Payment value | Fee |

|---|---|---|

| SGD | Up to 200,000 SGD |

|

| SGD | Over 200,000 SGD |

|

| USD/HKD | Any |

|

| SGD/USD/HKD to a bank outside Singapore | Any |

|

*Details correct at time of research - 14th August 2025.

👀 Check out our detailed article on Moomoo’s commission fees

Here’s how to use Moomoo to trade⁸ for a market order for instant activation at the live market price⁹:

You can also use a similar process to place a limit order¹⁰ for some asset types, which allows you to set a price at which the purchase will initiate. This allows you to hold off until the value of an asset has reached your desired target range, and have Moomoo automatically start the transaction when it’s the optimal time.

Both the buy and sell processes are guided by onscreen prompts to help you understand the information that’s needed to safely buy or sell any asset available.

It's helpful to know that Moomoo accounts automatically include a margin facility. This allows you to borrow from the platform to complete a trade. This can make it easier to buy assets quickly, but it is very risky and can mean you lose more than you invested in the first place. It’s not usually a recommended option for newer investors due to this increased risk.

You can not turn off the margin facility in Moomoo. If you don’t want to use this option, you must make sure you have enough funds in your Moomoo account to cover the cost of any trade you make, including any fees¹¹.

Moomoo doesn’t charge a deposit fee when you add funds to your account, but it does charge a withdrawal fee when you take money out of your portfolio in a foreign currency. Your bank may also charge fees on its side. This is where the Wise account can come in handy.

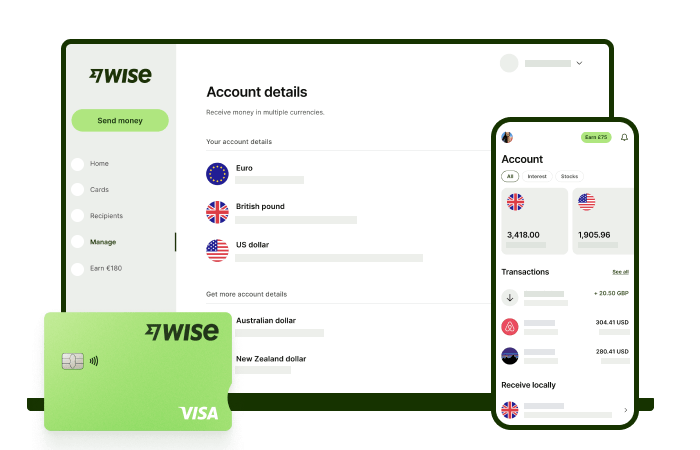

The Wise account is an easy way to hold and exchange 40+ currencies, including SGD, MYR, EUR, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.26% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 350 SGD when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in SGD and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

How to close a Moomoo account?

To close your Moomoo account, you must ensure you have no funds left in the account and then drop an email to clientservice@sg.moomoo.com requesting the account closure.

Is Moomoo safe in Singapore?

Yes. Moomoo is licensed and regulated by the Monetary Authority of Singapore (MAS). The platform is run by Futu Singapore Pte Ltd, a subsidiary of Futu Holdings Limited, and has additional safety measures like two-factor authentication.

Is Moomoo a good choice for beginners?

Yes, Moomoo is considered a strong choice for beginners due to its user-friendly interface, low costs, and extensive educational resources.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

Planning a Trust Bank overseas transfer? We reveal if the service is available and compare it to a transparent, fast, and low-cost alternative

Thinking about the Revolut metal plan and card in Singapore? Our detailed review covers the benefits, features and fees to help you decide if it’s worth it.

Looking for the best CIMB travel card in Singapore? We review the top cards for airport lounge access, travel insurance, cashback and more.

Looking for a detailed review on Saxo Singapore? Check out our guide on their platform, fees, features and investment products.

Compare the AMEX KrisFlyer Ascend, KrisFlyer, and Platinum cards. See their miles earning rates, annual fees, and perks to pick your best AMEX travel card.