GXS vs Trust Bank (2025): Which digital bank is best for you in Singapore?

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates

If you hire a domestic helper, you should open a bank account for them to guarantee secure salary payments, give them safe access to their earnings, and allow them to manage their own finances. A POSB account is a popular choice, thanks to its wide accessibility and simple setup. But receiving their pay is only the first step, most helpers want to send part of their income back to their families.

We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees. By pairing a POSB account with Wise, you make it possible for your helper to transfer money home affordably, with direct payouts to services like GCash in the Philippines or bank accounts in Indonesia.

| Table of contents |

|---|

Yes, domestic helpers, better known as migrant domestic workers (MDWs) in Singapore, can open a bank account if they’re on a work permit. Banks like POSB offer accounts made specifically for work permit holders, typically with features like no minimum deposit requirements, low fees, and easy access to ATMs. This allows your domestic helper to receive their salary, withdraw cash, and make local transfers.

If you’re hiring a new domestic helper or transferring one to your employment, you can select the option to open a POSB Payroll Account for Work Permit Holders when you’re applying for their work permit. To do this, you’ll need your helper’s consent.

Once the work permit is approved, the Ministry of Manpower (MOM) will share your MDW’s name, date of birth, nationality, gender, and residential address with POSB, so you don’t need to provide any additional documentation.¹

When your MDW arrives, they need to bring the following documents to pick up their card¹:

- Original passport

- In-Principle Approval (IPA) letter or work permit card

Existing MDWs can open their own POSB account online with these documents²:

- Valid passport

- Front and back copy of the work permit or IPA letter

- Mobile number

- Email address

- Screenshot of the SGWorkPass app where your residential address is displayed

- Proof of mobile number ownership³

To open a POSB account for your new domestic helper, you need to¹:

Existing MDWs can follow these steps to open their own POSB account³:

If you’re not sure whether POSB is the right choice for your domestic helper, you can also look at other banks by comparing the following features:

Although a POSB account works well for managing a domestic helper’s earnings, sending money abroad can be expensive due to hidden fees and unfavourable exchange rates. Wise offers a cost-effective alternative, allowing FDWs to send funds home with transparent, low fees and competitive rates. Helpers can use Wise to send money directly to their family’s bank accounts or to mobile wallets like GCash in the Philippines.

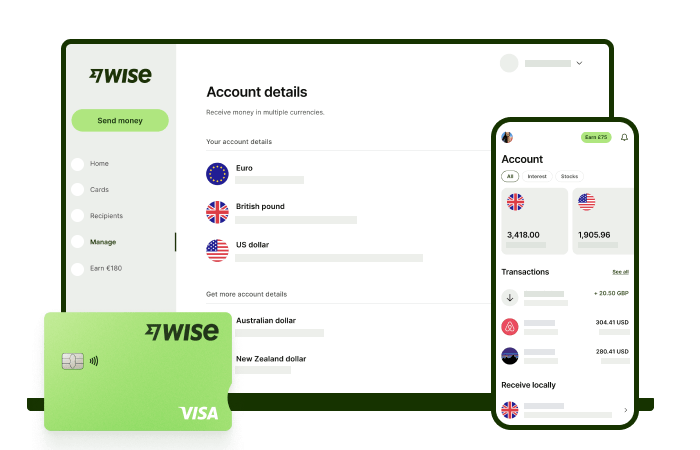

Wise international money transfers can be set up online or within the Wise app with low fees from 0.26% and the mid-market rate, to over 140+ countries. There’s no markup added to the exchange rate that’s used to convert your currency, which makes it easier to see exactly what you're paying for a transfer, and what the recipient will get in the end. Just transfer the amount indicated in SGD and let Wise do the rest.

Track your transfers easily when you create a free Wise account, and manage, hold, and convert your money in SGD and 40+ other currencies. You'll get the same great rates, and be able to track your transfers all from one place. As a bonus, you can also get 8+ local account details to be able to receive money in SGD, USD, GBP, and more.

✍️ Sign up for a free account now

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before

Both Wise (formerly Wise) and Revolut offer digital multi-currency accounts for managing money across borders - which one is better in Singapore?

Here's everything you need to know about the best multi-currency accounts and wallets in Singapore: Fees, Features, Exchange rates and more.

Looking to open a bank account online? Here are some options available in Singapore

Looking how to sign up for a PayPal account in Singapore? We covered the process step-by-step, from signing up to verifying your account