Airwallex NZ: Guide to business accounts, fees & global payments

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Starting a successful business lets you become your own boss, escape the 9-to-5 grind, and build a lifelong legacy. But where does the would-be Kiwi entrepreneur begin?

Whether you’re planning an in-person brand or bootstrapping an online start-up, this post covers how to start a small business in New Zealand. We’ll outline paperwork, planning, strategising, and compliance requirements so you can kick-start your dream enterprise.

| Table of contents |

|---|

Not sure what to do? Here are some small business ideas for New Zealanders, both online and offline.

It’s possible to start a business in New Zealand without investing a cent. But you will need to sacrifice some “sweat equity,” AKA “blood, sweat, and tears.”

Becoming a sole trader, for example, doesn’t require any fees or a formal registration process. Therefore, you could start offering services such as writing, tutoring, graphic design, and consulting on freelancing platforms or LinkedIn. Tradies can do odd jobs like gardening or gutter cleaning. However, more specialised professions, such as plumbers and electricians, must first invest in formal training.

Marketing with a $0 budget is tricky but not impossible. Free approaches include building a following on social media, creating a DIY website, and networking with your local community.

Eager to get the ball rolling. Here’s how to start a small business in New Zealand.

No point going to all this effort for a product nobody wants. Market research determines if there is viable demand. Evaluate customer demographics, including age, income, gender, occupation, location, and spending habits.

Google Maps and search can find similar in-person small businesses in your area and online competitors. Assess whether the market is saturated; if others are struggling, you may too. Analyse the competition’s strengths and weaknesses, and what your business can do better. Trade organisations, publicly traded companies, and Statistics New Zealand publish free industry-specific data that can guide your analysis.

Even if you’re starting a small side hustle, it’s worth learning how to write a business plan. This fundamental document defines your offering, processes, objectives, and challenges; it’s like a blueprint for growth. You don’t need to pen a novel. Most start-ups draft a quick 1-pager or use free business plan templates.

What should you include? It depends on your circumstances. At the very least, you should clarify what your product is, where you’ll sell it, and how you’ll stand out. Subsections might include your value proposition, business objections, milestones, a SWOT analysis, budgeting, and financial forecasts.

| 👆Looking to draft your own business plan? Check out this guide on how to write a business plan |

|---|

A small business has a small marketing budget, so start with the basics. Think about your customers’ needs, motivations, and pain points. Are they cost-conscious? Do they prefer personable services? This info will guide your messaging.

The best marketing strategies for small businesses depend on your industry, budget, and objectives. Online options include creating an SEO-optimised website, listing a Google Business Profile, and building a social media following. If your in-person business targets a small geographic region, you could throw in flyers, posters, and face-to-face networking.

Most small in-person and online businesses will use one of three structures.

All three structures must pay tax and can hire staff or export products overseas.1 Switching structures can be complex, so get it right the first time. Seek advice from a certified lawyer or accountant and check out Business NZ's '“'Choose a Business Structure' tool.2

Now you’ve settled on a structure, the next step is to get registered.

Good news for sole traders: New Zealand doesn’t have any formal registration requirements. The only thing you must do is inform the Inland Revenue Department (IRD) of your intentions to trade.3

Partnerships involve more paperwork. A joint venture requires registering a L.P. business name, providing physical, service, and postal addresses, certifying a partnership agreement, signing consent forms, obtaining a New Zealand Business Number (NZBN), and more. A small registration fee applies.4

Registering a business in New Zealand is somewhat challenging; you must also appoint directors and shareholders, file consent forms, and declare an ultimate holding company (UHC), among other tasks. Fees apply, and you’ll have 20 days to complete the process.5

Brainstorm a business name that appeals to customers and casts your brand in a positive light. Catchy names are suitable for small, casual businesses, while those in more serious sectors, such as consulting or accounting, often prefer formal titles.

ChatGPT can provide ideas, though they often require tweaking. Ask friends for feedback to see which names resonate.

Use the NZ ONE Check Tool6 to see if your business name is available in New Zealand and if it clashes with existing web domains, trademarks, and social media accounts. Companies can register their name through the Companies Register.7

All businesses must pay taxes and register for GST as soon as they expect to generate a turnover of $60,000 or more in the next 12 months. 8 Other tax rates and requirements vary between structures.

If you’re running a business from home, you could possibly claim some expenses as a tax deduction. Common work-related write-offs include telephone and internet bills, electricity and water, and sometimes even rent.9 A certified accountant can navigate bewildering regulations and optimise your return. Getting a business account that integrates with bookkeeping software often helps simplify time spent on tax reconciliation.

Sign up for the Wise Business account! 🚀

Just because your business is small doesn’t mean you can skirt the rules. As a well-developed and heavily regulated nation, doing business in New Zealand requires compliance with a laundry list of laws.

Tradespeople may require licenses, white collar professionals might need qualifications, and home-based businesses must adhere to council rules. Anyone serving food or beverages for human consumption should understand New Zealand food safety legislation.

The Business NZ Compliance Tool10 provides helpful, industry-specific advice.

Setting up a business account allows you to separate personal and business expenses, establish credibility, and streamline tax returns. Many institutions allow you to open a business account online in a matter of minutes.

Choosing a suitable business bank account depends on your business needs and prioritizes. Small businesses dealing with cash might prioritise nearby ATMs and branches, while high-volume companies could benefit from solutions that offer a comprehensive array of features to help manage everyday finances effectively.

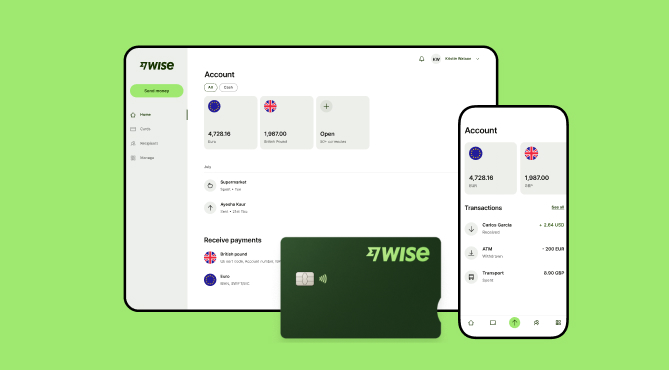

Starting a small business in New Zealand often involves international transactions, and Wise Business offers a cost-effective solution for globally operating companies. Unlike traditional money transfer services that rely on multiple intermediaries and poor exchange rates, Wise Business facilitate business transactions at the mid-market exchange rate with transparent fees and pricing.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Comparison of Airwallex vs Wise for NZ businesses. Overview of difference fees, features, and usability to find the best fit for your business. Read here!

Learn how to start a business in New Zealand. Our guide details business structures, registration steps, tax & GST rules, costs, and how to overcome challenges.

Learn what documentation you need to open a business account online, the steps you must follow, and which New Zealand banks offer online setups.

Learn what to consider when weighing up different payroll options. Compare some of the top payroll solutions for small businesses in New Zealand.

Looking for the right business banking in NZ? We compare products, fees, and services from top banks in New Zealand to help you choose the best fit.