Airwallex NZ: Guide to business accounts, fees & global payments

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Got a ripper of a business idea? Don’t jump the gun and start trading straight away. Writing a business plan clarifies your objectives, tactics, and budget to pave a roadmap for success.

That’s not conjecture. According to Harvard Business Review, “Entrepreneurs who write formal plans are 16% more likely to achieve viability.”1

But don’t worry. You don’t have to be a Harvard scholar to pull this off. We’ll teach you how to write a business plan and provide a simple, ready-made template.

We’ll also introduce Wise Business, a low-cost banking alternative that saves Kiwi companies money when transferring funds overseas.

| Table of contents |

|---|

A business plan is a fundamental document defining core company objectives, potential challenges, and a blueprint for growth. It also documents company operations, from marketing strategies to milestones and management.

The business plan doesn’t have to be an intricate, Lord of the Rings-length saga. Often, small businesses can benefit from snappy 1-pagers.

| 👆Wondering what it looks like? Wise has prepared a business plan template you can download and use for free. |

|---|

A well-executed business plan can:

Facebook Marketplace flippers and sole-trading plumbers probably don’t need one. But companies with staff and plans for scalable growth with potential for investment funding, definitely do.

From online entrepreneurs to behemoth multinationals, all businesses should nail down a business plan. The document is crucial when demonstrating viability to investors.

Every business is different. There’s no definitive, one-size-fits-all formula for how to write a business plan in NZ. We’re providing examples of what companies can include in a business plan. You choose what best applies to your brand, depending on your industry, size, structure, and ambitions.

The executive summary sits atop the document to provide a snappy overview. Think of it like an elevator pitch, where you’ve got 30 seconds to sell your idea. Write this section last after you’ve clarified the fine details.

This section provides a concise company summary, covering the products/services, history, mission, legal structure, management, and target market(s). An overview lets readers rapidly understand your company’s value and purpose.

Outline materials, labour, production processes, supply chain logistics, lifecycles, refunds, and potential intellectual property conflicts. Think about functionality and compare expenses to pricing to evaluate profit potential.

How will you beat the competition? Determine whether you’ll compete on price, quality, customer support, expertise, or an innovative feature.

Highlight your Unique Selling Proposition (USP), a specific benefit that differentiates your business and provides value to the customer. Consider the customer’s problem or need, then outline your solution. The USP will guide your marketing.

Define your direction and core objectives, following the SMART formula:

Once you’ve set SMART objectives, it’s time to make some milestones. For example:

Be realistic and leave wiggle room. Missing a milestone doesn’t mean your business has failed. But it’s great to have something to aim for.

A SWOT analysis evaluates what you do well and how you can improve. Strengths and weaknesses tend to be internal (within your company), while opportunities and threats relate to external factors.

Draw a large square and split it into quadrants, one for each element.

Defining each element helps to build on strengths and opportunities and mitigate weaknesses and threats. Repeat the process for your main competitors.

Research your industry to evaluate the viability of your business idea. Collect data on the market’s size, growth, future, and consumer trends that could present challenges. Compare competitor pricing to determine where to position your business: budget, mid-range, or premium?

Define the demographics–age, income, gender, and location–of your ideal consumer and evaluate their buying habits. Do they have enough disposable income or motivation to purchase your product? An intimate understanding of your customer guides your marketing.

Study competitors to understand their strategies, financials, and market share. Look at strengths, such as brand recognition, and weaknesses, like inefficient processes. A SWOT analysis will help.

Visit stores and purchase products or services to evaluate quality and value. Compare pricing and advertising, then consider how your business can compete.

Contemplate how you’ll promote your business and highlight its USP. Common online channels include a Search Engine Optimised (SEO) website to drive organic traffic, Social Media Marketing (SMM) to foster engagement, and Pay-Per-Click (PPC) advertising to attract warm leads. Traditional methods, like TV and print ads, can yield solid results but may be expensive for small businesses.

Set targets that cover not only sales, but also metrics like new customers and repeat business. Create a marketing budget and determine what you’ll outsource to an agency or undertake in-house. Devise ways to measure marketing success.

Consider the strengths and weaknesses of your employees and assign them appropriate positions. Define who is responsible for which business operations and carefully select management based on merit.

Identify skill gaps and address them. Evaluate how your business will attract and retain future talent, whether in-house or through a recruitment agency. Companies seeking investors should showcase each employee’s expertise and draft charts to outline hierarchical structures.

Estimate your expenses and quarterly operating budget, factoring in debts, franchising fees, and interest repayments.

Financial forecasts evaluate how much income you need to cover expenses and the leftover profit. Consider hiring an accountant when approaching investors, as the finance section is critical for obtaining external funding. A cash flow and balance sheet forecast can help build confidence in your idea.

The following tips will help optimise your business plan:

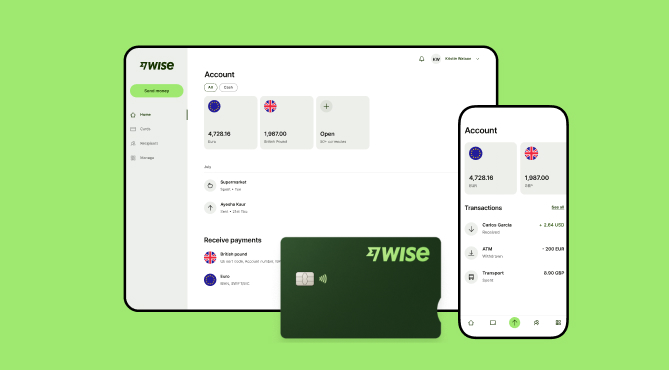

For Kiwi companies sending money across borders, a Wise Business account can lower expenses through cost-effective international transfers. Wise Business uses the mid-market exchange rate for currency conversions and has a fair pricing policy with no hidden markups or sneaky extra fees.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

How long should a business plan be?

The greater the investment, the longer the business plan. Small businesses often prefer a simple 1-page document. Go into more detail if you’re seeking investors.

Can I use AI to create a business plan?

AI can help, but you must fine-tune prompts and make manual adjustments. You have a unique business, and LLM output is generally rather generic.

Where can I source information for a business plan?

Statistics New Zealand, trade organisations, and big NZ banks publish free reports on market trends. Publicly traded companies must also publish financial reports; check their website for an investor relations section.

How to write an executive summary for a business plan?

Write the body of the business plan first to clarify the major points, then create an elevator pitch-style executive summary covering the most essential info.

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Comparison of Airwallex vs Wise for NZ businesses. Overview of difference fees, features, and usability to find the best fit for your business. Read here!

Learn how to start a business in New Zealand. Our guide details business structures, registration steps, tax & GST rules, costs, and how to overcome challenges.

Learn what documentation you need to open a business account online, the steps you must follow, and which New Zealand banks offer online setups.

Learn what to consider when weighing up different payroll options. Compare some of the top payroll solutions for small businesses in New Zealand.

Looking for the right business banking in NZ? We compare products, fees, and services from top banks in New Zealand to help you choose the best fit.