Airwallex NZ: Guide to business accounts, fees & global payments

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Kiwis trading across borders have grown tired of lousy exchange rates and sky-high international transfer fees. Affordable fintech alternatives, like Airwallex and Wise Business, offer better rates than the banks, saving global traders a tidy sum in the long run.

This post weighs up Airwallex vs. Wise Business. We’ll comb through the fine print to compare the feature-rich financial arsenal of Airwallex to the slick, user-friendly interface of Wise Business.

This article is provided for general information purposes and has been prepared without taking into account your objectives, financial situation, or needs.

| Table of contents |

|---|

Airwallex1 is a global payment and financial services platform designed for growing businesses. The brand operates in multiple countries worldwide, including New Zealand, and serves over 150,000 companies. Airwallex exclusively caters to businesses; it’s not possible to open a personal account.

With Airwallex, you can open a global business account, manage company spend, accept payments, and build high-level customisations through integrated APIs. All this occurs through a single, unified platform for a one-stop-shop-style fintech solution.

Airwallex has divided its diverse range of products into four categories.

Airwallex primarily targets businesses with relatively complex financial needs seeking a comprehensive, all-in-one fintech solution.

| 👆Click here to learn more about fees and products offered by Airwallex in NZ |

|---|

Formerly known as Wise, the brand has been specialising in low-cost international transfers since 2011.

The story began with two Estonian friends living in London, one paid in euros and the other in pounds. Both grew sick of paying lofty international transfer fees. Every month, they looked up the mid-market exchange rate and sent money to each other’s accounts by-passing the slow and expensive SWIFT transfers offered by the banks.

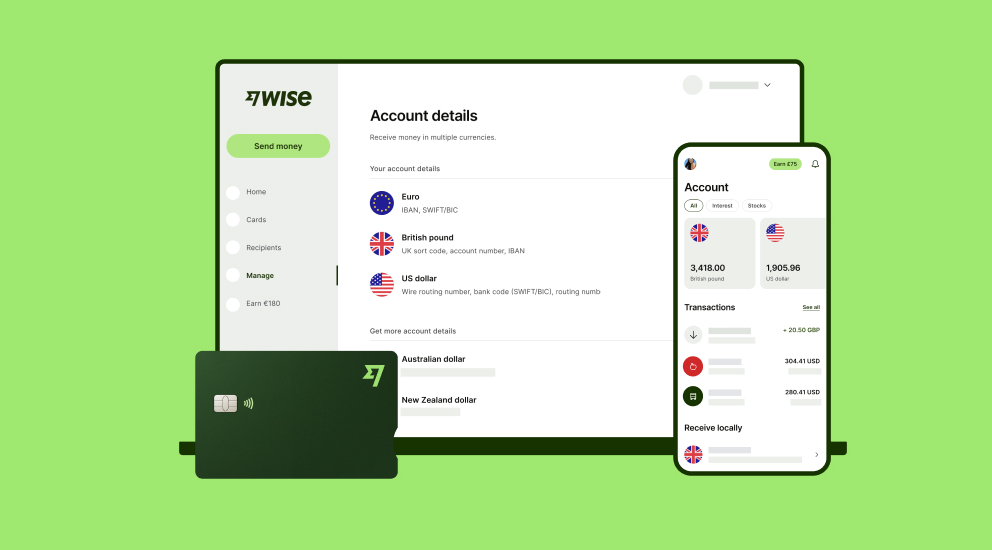

That’s how Wise still works today. The company maintains a bank account in every country where it operates. Money never actually crosses borders, which slashes prices and processing times. Wise has over 16 million personal users and 700,000 global business customers. The platform’s popularity stems from its user-friendly interface and transparent, low-cost international transfers.

Unlike Airwallex, Wise offers both personal and business accounts. We’ll focus on Wise Business for a like-for-like comparison.

| 👆Click here to learn more about the difference between Wise Business vs. Personal accounts. |

|---|

For Kiwi businesses that prioritize straightforward, low-cost international money management, Wise Business offers a simple, user-friendly, yet transparent solution. Centered on providing the mid-market exchange rate for all conversions, Wise Business ensures there are no hidden markups on currency exchange. Businesses can get local account details in over 8+ major currencies (like NZD, AUD, USD, and EUR) for a small, one-time setup fee, allowing them to receive payments from overseas fee-free, just like a local company.

A fair, transparent pricing policy lets you know the exact cost of every transfer upfront.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Both brands help New Zealanders save money when trading abroad. They serve as more cost effective and faster mode of money transfers for businesses operating across borders.

Let’s compare some of the features available in Wise Business and Airwallex.

| Wise Business | Airwallex | |

|---|---|---|

| TrustPilot |

|

|

| Business account |

|

|

| Receive Money |

|

|

| Invoicing |

|

|

| Cards |

|

|

| Integrations |

|

|

| Tiers |

|

|

| Custom APIs |

|

|

Airwallex offers three pricing tiers for businesses with varying needs, as well as a custom plan featuring APIs for larger enterprises. Wise Business has no tiers, but charges a one-off fee to receive money in local accounts.

| Wise Business | Airwallex2 (NZD) | |

|---|---|---|

| Registration |

|

|

| Receive money in local currencies |

|

|

| Monthly fees |

|

|

| Cards fees |

|

|

| Sending money |

|

|

| Expense management |

|

|

Note that prices provided by Airwallex are exclusive of GST.

Selecting a financial solution for your business requires careful consideration of your specific needs. Both services provide an effective, low-cost alternative to traditional banking for international money transfers.

One option caters to businesses with more intricate financial requirements, offering advanced management features and customizable integrations. While these capabilities may come with a subscription fee, they can be valuable for high-volume operations. Conversely, another solution is favored for its straightforward interface and clear pricing, which can lead to significant long-term savings for businesses with simpler, more direct needs. The choice between the two ultimately depends on whether your priority is powerful, customizable functionality or ease of use and cost efficiency. Before making a decision, it's essential for readers to conduct their own research to determine which solution best fits their unique business needs.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about Airwallex in New Zealand. Our guide covers its all-in-one business accounts, products and features offered, and fees.

Learn how to start a business in New Zealand. Our guide details business structures, registration steps, tax & GST rules, costs, and how to overcome challenges.

Learn what documentation you need to open a business account online, the steps you must follow, and which New Zealand banks offer online setups.

Learn what to consider when weighing up different payroll options. Compare some of the top payroll solutions for small businesses in New Zealand.

Looking for the right business banking in NZ? We compare products, fees, and services from top banks in New Zealand to help you choose the best fit.

Learn some of the leading online and offline marketing strategies for small businesses in New Zealand, from building a website to enhancing your presence.