Guide on free business bank accounts in New Zealand

Learn what to look for when comparing low-cost business bank accounts and discover the top free options available in New Zealand.

Forget queues, commutes, or even clothes. In today’s digital age, you can open a business account online from the comfort of your couch. No need to put on pants, let alone a suit and leather shoes.

This guide covers the benefits of opening a business account online, as well as common document requirements and considerations for non-residents. We’ll then walk you through the application process and provide examples of accounts you can open entirely online.

| Table of contents |

|---|

Opening a business account used to be a formal, long-winded process. You’d travel to the nearest branch, meet with a business manager at a pre-defined time, and comb through a mountain of printed paperwork together. Some ambitious entrepreneurs would even dress to impress in slick business attire.

But nowadays, with reliable online databases and secure ID verifications, you can finalise the process in minutes from your phone.

Benefits include:

The precise paperwork can vary between banks, the specific business account, and your company structure. Existing customers can often skip the ID verification step. Whille the requirements might vary based on different providers, these are some of the most common details that will be requested to open a business account online:

Non-residents obviously can’t prove their residency status. That makes it tricky, if not impossible, to open a business account with many New Zealand banks and certain providers.

Some banks, such as BNZ, allow immigrants and returning Kiwis to apply for an account online while overseas, and then activate it upon arrival in New Zealand. But you’ll need to visit a branch in person and provide proof of your residential address.1

ANZ has a Migrant Banking package with a business account option. However, applicants must have a valid New Zealand resident visa or work visa. Individuals with working holiday visas are exempt cannot apply for a business bank account online.2

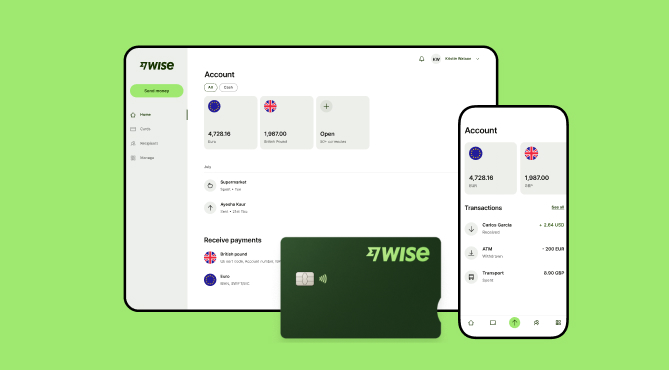

Business banking alternatives, such as Wise Business, offer a global, multi-currency solution for foreigners starting a business in New Zealand. Non-residents on any visa type can register for a Wise Business account in their home country, then create a local account in NZD. That takes the hassle out of the application process and lets you send and receive money for free in the native currency, just like a local Kiwi.

Of course, you’ll need a suitable visa to perform any work or business-related activities in New Zealand.

Sign up for the Wise Business account! 🚀

Again, the precise process varies between banks, business accounts, and your company structure.

We’ve covered the likely required documentation. But it’s best to know the specifics. Review the registration details of your business account to determine the necessary paperwork. It is advisable to go through documentation list specific to each provider and have them prepared before applying online.

Compile legible digital copies of each required document, ideally under 3MB per file. PDF is the file type of choice, though JPEG/JPG, PNG, and TIFF may be accepted. Merge multiple-page documents into a single PDF, and assign each file a descriptive name.

Banks invest heavily in UX and web design to make online applications easy for the everyday user–you don’t need elite computer skills. Follow the on-screen instructions and upload your documents when prompted. Enter all details accurately, as a small typo can become a big headache.

While the documentation requirements might be similar across different banking solutions, it is worth noting that each provider might request unique information required for their account creation process. Most solutions also offer online support that can help you with registration process if one comes across a blocker while applying for a business account online.

Online identity verification usually involves uploading a copy of your ID, then using your smartphone to send selfies. You might often be requested to take multiple snaps from different angles to satisfy the facial recognition technology.

Some banks incorporate third-party biometric services, including the government-backed RealMe Login. While no digital asset is ever 100% safe, rest assured that banks spend a fortune on cybersecurity. The chances of someone stealing your biometrics are low.

Approval timeframes vary depending on the provider, complexity, verification requirements, and any pre-existing relationship with the bank.

Some online applications get approved within hours, while others take up to 7 business days. If denied, a bank may provide a reason and encourage you to reapply with extra documentation.

Once your approval gets through, users will be notified of the next steps. This would generally entail configuring your business account. Broadly, setup process would involve:

Many big New Zealand banks–such as BNZ,0 KiwiBank,0 and WestPac0–let you initiate an application online, but require a phone call to finalise the process. A handful of others allow you to complete the entire procedure online.

No need to wait in queues or hop through hoops. As an alternative to business bank accounts, Wise Business is a cinch to open from anywhere in the world. Plus, if you already have a Wise personal account, you can link your new business account to access both with the same credentials.

Here's the steps to opening a Wise Business account online:

Most Wise Business applications get reviewed within 2 business days. Learn more about how to open a Wise Business account and verify a business.

Sign up for the Wise Business account! 🚀

ASB3 lets customers open a business account using a simple web form that takes approximately 15 minutes to complete. Customers must submit:

| 👆Check out our guide on ASB business account for more info on features, fees, and more |

|---|

New Zealand’s biggest bank lets you apply online for its ANZ Business Current4 account in less than 5 minutes. Simply select the products you wish to apply for and provide your personal information.

Existing customers will be contacted once ANZ has reviewed the application. New customers must visit an ANZ branch with the following documents upon approval:

If you’re applying for the ANZ Business Start-up Package5 online, you must also provide documentation to prove you meet eligibility requirements.

With an easy online setup for locals and non-residents, Wise Business offers a simple, hassle-free banking alternative in New Zealand.

Businesses sending money abroad can save significant sums through low, transparent pricing on international transfers that use the mid-market exchange rate.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

1. Is it safe to create a business account online in New Zealand?

Yes. Banks have cutting-edge security protocols to protect your personal details when creating an account online.

2. How long does it take to create a business account online?

It usually takes 5–15 minutes to complete an application, depending on the bank and whether you have the paperwork ready.

3. Can I open a business checking account online?

Yes, but it depends on the bank. Some let you open a business checking account online, while others make you visit an office in person.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn what to look for when comparing low-cost business bank accounts and discover the top free options available in New Zealand.

Learn who needs a business account, its benefits, how to open a business bank account in NZ, and compare top options for effortless tax and record-keeping.

Wise Business vs Wise Personal: Understand the differences between Wise Business and Personal accounts in New Zealand. More on price and feature comparisons.

Looking to open a business bank account with TSB? We’ve got you covered. Here’s all you need to know about the fees, account types and requirements.

Your essential guide to BNZ business bank accounts, including how to open one and the fees you need to know about.

Here is a list of the top Foreign Currency accounts in New Zealand. Their fees, main features and what to know.