NZ business number NZBN. Cost, procedure and need-to-knows

Are you a foreigner about to set up a business in New Zealand, or have you just done so? You may need to apply for several things, including an NZ business...

Starting a business in New Zealand as a foreigner? Good decision. The World Bank1 declared it number one for “ease of doing business.” Favourable taxes, low corruption, transparent regulations, streamlined bureaucracy, and a stable, growing economy make New Zealand a prime candidate for foreign investment.

But starting a business abroad can prove tricky for the global entrepreneur. We’ve put together a guide to help foreigners untangle the red tape in New Zealand. Read on to learn about visas, structures, registrations, regulations, finances, and more.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

Starting a business in New Zealand is relatively straightforward for foreigners with the appropriate visa.

You’ll need to develop a business plan and select a structure. Then, it’s a matter of researching the market, registering your business, and complying with legal, tax, regulatory, and employment obligations.

In August 2025, New Zealand Immigration scrapped its long-standing Entrepreneur Work Visa and introduced the Business Investor Visa2 as a replacement.

Aimed at well-established foreign businesspeople, the new visa requires at least 10x more capital than the old Entrepreneur Work Visa. Investors who can stump up the cash have two pathways to start a New Zealand business and eventually obtain residency.

Applicants can start their own business or stake 25% in someone else’s to meet the minimum threshold. The visa lasts up to 4 years and costs $12,380.

Eligibility requirements:

Specific sectors not eligible for the business investor visa are: fast food, gambling, adult entertainment, drop shipping, home-based businesses, immigration advice, convenience/discount stores, and nicotine manufacturing.

The business structure affects growth, outside investment, taxation, employment, and your ability to sell the business.

The three main business structures3 in New Zealand are:

The sole trader structure is popular among tradies and online entrepreneurs. You pay tax on your earnings, and can offset expenses to reduce your taxable income.

One downside is liability; your personal assets may be used to repay debts. Also, obtaining investors and loans can prove challenging.

A partnership is the go-to structure when multiple individuals go into business together. Accountants, lawyers, and architects, among other white-collar professionals, often use this structure.

All partners share expenses and can acquire investors. The downsides mirror those of the sole trader–personal assets may be used to repay debts.

Tax isn’t payable as a business; it’s paid on each partner’s earnings. That makes things fairer, should one work harder than another.

The company structure allows shareholders to limit their personal liability. Other benefits include receiving dividends as shareholders, lower tax rates, and increased business credibility. Companies often find loans easier to acquire and can grow indefinitely.

However, this structure is comparably complex, has stricter regulations, and takes longer to establish.

New Zealand has a small but robust economy, driven by the agriculture, tourism, and technology sectors.

Kiwis have an inherent preference for sustainability, innovation, and quality, locally made products. Consumers value traits like trust, transparency, inclusion, and authenticity.

Auckland is the country’s leading commercial hub for its well-developed finance and business sectors. The capital, Wellington, excels in tech and governance, while the South Island city of Christchurch is strong in engineering, manufacturing, and agri-tech. Regional areas make sense for tourism and agriculture, mainly meat, dairy, wine production, fishing, and forestry.

The registration process depends on your structure. Each must apply for an Internal Revenue Department (IRD) number.4

Sole traders can begin doing business without registering anything other than a personal or business IRD number.

If you’re employing staff, you’ll need to register as an employer. You may also need to register for GST.5

Partnerships need to register an entity IRD number.

The entity must file a Partnership Income Tax Return (IR7) to allocate profits or losses to each partner. Partners declare income via their personal IRD numbers.

As with sole traders, partnerships may also need to register as employers and for GST.6

This entity type requires the most amount of work. You need to:7

Learn more about registering a company in New Zealand.

While not compulsory, some locals may hesitate to trade with you if you don’t have a New Zealand Business Number (NZBN). Companies automatically receive one, while sole traders and partnerships can apply for an NZBN online.

As a well-developed nation with strict regulations, many New Zealand industries have licensing and certification requirements. You and your employees must hold the relevant qualifications to trade.

Sectors that typically require qualifications include:

Hospitality businesses require a Food Control Plan to serve food and a Liquor License for alcohol.

All New Zealand businesses must pay tax. Taxable income varies depending on the amount earned and the business structure.

| Business structure | Tax rate |

|---|---|

| Self employed | Standard rate on an individual tax return (IR3) |

| Partnership | Standard rate on an individual tax return (IR3) for each partner, plus two income tax returns (IR7) for the business |

| Most companies | Company income tax return (IR4) with a rate of 28%8 |

New Zealand businesses usually file a tax return at the end of the first year and pay tax in a lump sum. Keep enough aside to pay your bill. After the first year, most businesses pay taxes in instalments called provisional tax9, which is usually combined with GST.

While this guide is a quick run-through of what you’ll need to know, it’s always advisable to have local professionals in your corner when establishing a business abroad. A financial advisor, a tax accountant and a corporate lawyer will be able to guide you through any unclear processes.

Once you expect to start earning $60,0009 a year, you must register for GST. Save time by doing it when you register your company. Other structures can sign up for GST online.

A business bank account separates personal and business expenses, making life easier for you and your accountant come tax time. The best business accounts integrate with accounting software, like Xero and QuickBooks, to automate reconciliations and other tedious manual tasks.

Here’s a quick, step-by-step guide for how to start doing business in New Zealand as a foreigner.

If your company is incorporated in another country, you’ll need to provide the following documents to register for trading in New Zealand:10

You must also choose a balance date and month for annual filing. Entrepreneurs can begin the process through the New Zealand Companies Office.

For the foreign entrepreneur, establishing the financial bedrock of their New Zealand venture with a dedicated business account is a critical, yet often challenging. Beyond the universal benefit of separating business and personal finances for easier tax reporting, a business account provides a clear, auditable trail of the significant investment capital required for the Business Investor Visa.

However, approaching traditional banks as a non-resident or recent arrival can create immediate roadblocks. Many institutions require in-person appointments and proof of a local address, a classic catch-22 for those trying to organise their affairs from overseas or in the very early days of their move.

Furthermore, transferring large sums of startup capital through conventional banking networks often involves poor exchange rates and hidden SWIFT fees, eroding a portion of your investment before it even lands.

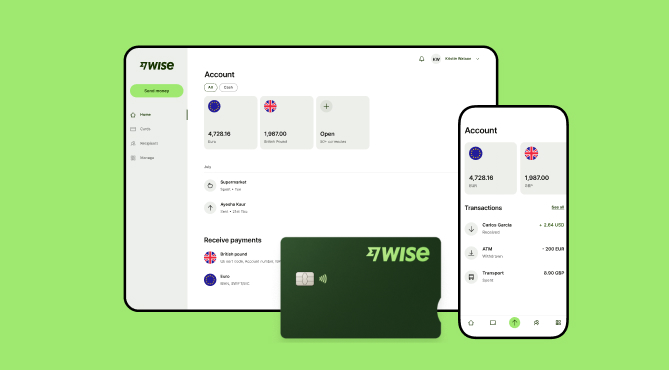

Wise Business helps address these cross-border financial hurdles, making things easier for international founders. With a Wise Business account in the home currency, businesses have the ability to easily open local account details in 8+, including NZD. The local account details in the respective currency can then be used to receive local payments, bypassing the immediate need for a local address and in-person verification.

It also allows business to transfer initial investment capital and manage funds at the mid-market exchange rate with low, transparent fees, ensuring more money arrives intact. Moreover, Wise provides local bank details not just for New Zealand but for 8+ currencies, allowing the business to seamlessly pay international suppliers or receive payments from overseas customers as if they had a local bank account in that country, simplifying global finances from day one.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Are you a foreigner about to set up a business in New Zealand, or have you just done so? You may need to apply for several things, including an NZ business...

Is Amazon FBA available in New Zealand? Can you sell using Amazon Australia fulfilment? Let’s find out.