Permanent TSB business account opening: Requirements and options

Read about how to open a business account with PTSB in Ireland, including the requirements you may need to meet.

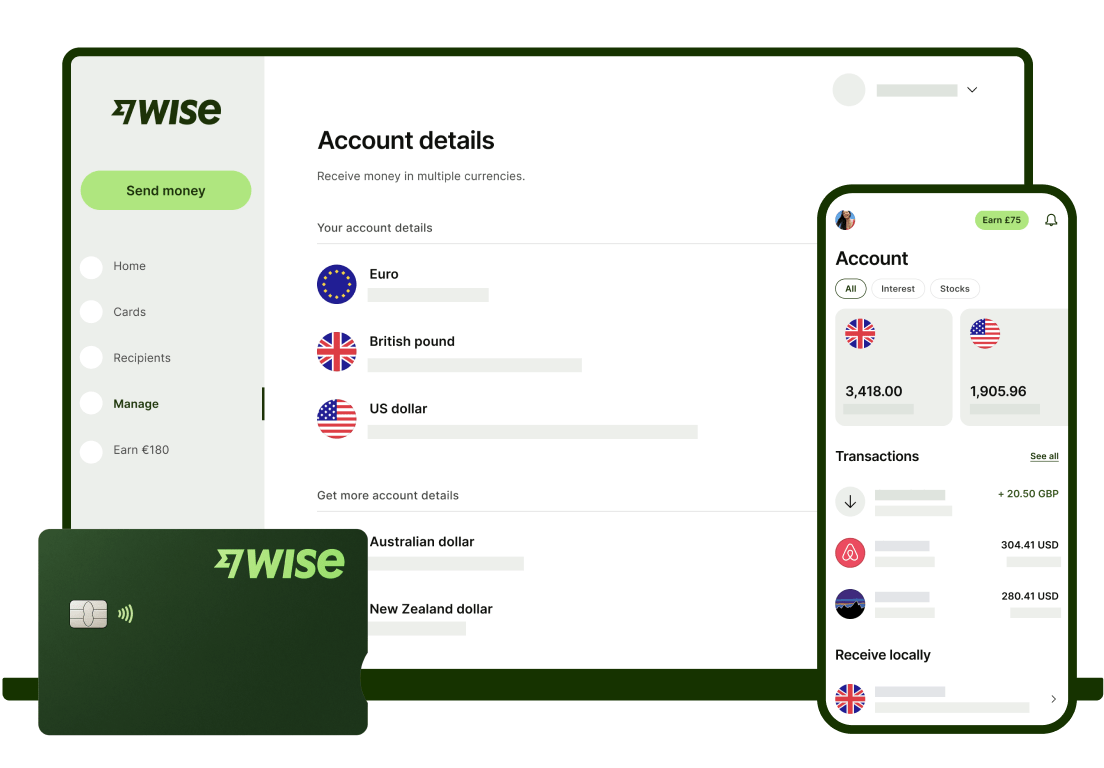

In Europe, Wise is a regulated payment institution known for its smart and transparent solutions for international transactions. Wise offers two types of accounts: the Wise Personal account and the Wise Business account.

Both accounts allow you to send, receive, and convert money in multiple currencies at low costs. However, the Wise Business account offers more advanced features designed to meet the needs of freelancers, startups, and SMEs. These include the ability to issue invoices in foreign currencies, automate payments, manage access and budgets for your employees, and streamline accounting through integrated software.

This article compares the differences between Wise Personal vs Business in Ireland. Check the Terms of Use for your country or visit the Wise Pricing section to see the most up-to-date fees and charges.

Discover how Wise

works in Ireland 💡

Wise offers two types of accounts, designed for different customer profiles: the Wise Personal account for private use and the Wise Business account for freelancers, sole traders, and companies. Both accounts share some basic features, but there are significant differences in use cases and available functionalities.

The Wise Personal account is ideal for individuals who need to manage their money in common scenarios like:

- Frequent travel abroad to spend like a local by paying directly from any of the 40+ currencies you hold in your account. If you don't have the currency, it converts automatically for a low fee at the mid-market rate

- Students living abroad who want to save on rent and general expenses

- People sending or receiving money to/from family abroad with transparent fees and mid-market rate.

The Wise Business account is a cost-effective and efficient solution for Irish businesses that send or receive payments from abroad in multiple currencies, with transactions at the mid-market exchange rate. This account includes useful tools for business management, cost control, and timely payments.

⚠️ It’s important to note that using a Wise Personal account for commercial purposes violates Wise's Terms of Use. If you're a freelancer or small business owner, you must open a Wise Business account to access tools tailored to your business needs.

Let’s take a look at the features of Wise Business that you won’t find in the Personal account. Note that Wise Business does not charge a monthly fee. By paying a one-time €50 activation fee, you and your team get access to all the features below. If you're not running a business, opening a Wise Personal account is free.

Create, send, and manage invoices directly from your account, with the option to share a direct payment link.

This makes payment processing faster and easier in the currency of your choice. You can also monitor how clients pay you by tracking past and upcoming invoices from your Wise account.

Both accounts let you send fast international payments with low fees in over 40 currencies to 160+ countries.

However, the BatchTransfer feature available with Wise Business allows you to pay up to 1,000 people (customers, contractors, or employees) in a single operation.

Just upload an Excel or .CSV file to simplify salary and payment management.

Integration with software like Xero and QuickBooks simplifies, streamlines, and speeds up your business accounting tasks.

Syncing these tools with your Wise Business account helps you manage expenses and international payments more efficiently.

If multiple employees handle payments, Wise Business lets you organize account access. You can assign different permission levels and define who (individuals or departments) can spend or manage business funds. Additionally, you can set personalized spending limits by creating groups.

| 🔎 Read more: Wise Business Account - Key Features At a Glance |

|---|

The following table summarizes the differences between Wise Personal and Wise Business:

| Feature | Wise Business | Wise Personal |

|---|---|---|

| International payments at the mid-market rate with low, transparent fees | ✔️ | ✔️ |

| Ability to hold over 40 currencies | ✔️ | ✔️ |

| Local account details in multiple currencies, including EUR, GBP, USD | ✔️ | ✔️ |

| Send money to over 140 countries | ✔️ | ✔️ |

| Interest on held funds* | ❌ | ✔️ |

| Free invoice creation | ✔️ | ❌ |

| Integration with accounting software | ✔️ | ❌ |

| Bulk/multiple payments | ✔️ | ❌ |

| Multi-user permissions | ✔️ | ❌ |

| Receive payments from Stripe and Amazon | ✔️ | ❌ |

| Integration with accounting software | ✔️ | ❌ |

| Wise API for process automation | ✔️ | ❌ |

| Wise Business card | ✔️ | ❌ |

| Business cards for employees with custom budgets | ✔️ | ❌ |

| Download account statements, tax documents, and financial reports | ✔️ | ❌ |

*Growth is not guaranteed and your money is at risk if governments default or interest rates go negative. Variable rates are based on 7 day performance as of 26/03/2025.

Cost transparency is Wise’s hallmark — there are no monthly fees for either the Personal or Business account.

Let’s take a quick look at Wise Business fees compared to those of Wise Personal:

| Wise Personal | Wise Business | |

|---|---|---|

| Account opening | Free | €50 |

| Monthly fee | Free | Free |

| Hold 40+ currencies | Free | Free |

| Send foreign currency | From 0.61% | From 0.61% |

| Receive local payments in 8+ currencies | Free | Free |

| Receive SWIFT payments | ||

| Order card | €7 | Free (first card only) |

| Team member cards | Not available | €4 per card |

| Accounting software integration | Not available | Free |

| Multi-currency invoicing tools | Not available | Free |

| Batch payments | Not available | Free |

| Permission and custom budget management | Not available | Free |

📌 For detailed and updated fee information, visit the Wise Business pricing page.

With Wise Business, you also gain access to accounting software integration, invoicing tools, and more — all at no additional cost. No premium subscriptions like the competition. Just sign up online and use the features you need when you need them.

Discover Wise Business:

Easy to open, easy to use 🚀

The Wise Business account is exclusively for commercial use. Every quarter, more than 600,000 business customers rely on Wise.

Here’s who can use Wise Business in Ireland:

- Freelancers, sole traders, and self-employed professionals

- Public and limited liability companies

- Business partnerships

- Charities, non-profits, and trusts in select countries: Europe, UK, Canada, US, Switzerland, Australia, New Zealand.

Remember, opening a personal account for business use violates Wise’s Terms of Use. You can also check the list of prohibited activities for more information.

- Better visibility and organization of business finances. Useful for accounting reconciliation and tax audits

- Administrative controls for users. Assign specific tasks to team members

- Receive payments from e-commerce platforms like Amazon or Stripe

- Free invoicing tool. Available only with a Business account

- Create professional invoices using Wise’s invoice generator or templates

- Accounting integration with tools like QuickBooks for easy and quick reconciliation

You don’t need to convert your Wise Personal account to Business. You can simply open a personal account alongside your Business one.

It’s good practice to have separate accounts for personal and business use — it makes business accounting and tax checks easier. Also, remember that using a Wise Personal account for commercial purposes is not allowed.

How to open a Personal account from your Business profile:

- Click your name in the top right corner of the screen

- Select "Create a personal account" from the dropdown

- Follow the steps to complete the registration

If you want to use only the Personal account, you can withdraw the money from your Business account and close it, leaving only the Personal one active.

When deciding between Wise Business vs Personal, the main question is which one best suits your needs.

If you run a business, opening a Business account is a smart way to keep your company finances separate. Wise Business lets you do that — and much more. You cannot use a Wise Personal account for business transactions, so Wise Business is what you need.

Whether it’s syncing invoices through QuickBooks, paying employee salaries in one click, or receiving payments from abroad, Wise Business is designed to simplify your financial operations.

These features are not available with a Wise Personal account.

You can open a Wise Business account easily online, no lines or appointments needed.

Open your Wise Business account 💼

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read about how to open a business account with PTSB in Ireland, including the requirements you may need to meet.

Discover if you can open a business bank account in Canada as a non-resident and how it works.

If you're wondering how you can open a business account with AIB in Ireland, read this guide to understand the whole process.

Discover what are the fees and charges your business will need to pay when using PayPal in Ireland.

Discover what you need to open a business bank account in Ireland, including documents, process and how it works.

Read what you need to do to close your Revolut business account, and if you need to pay any fee.