Permanent TSB business account opening: Requirements and options

Read about how to open a business account with PTSB in Ireland, including the requirements you may need to meet.

Whether you’re launching a startup or growing an established company, part of having a business is opening a dedicated business bank account.

In this guide, we’ll look at how to open a business account with AIB in Ireland, including what’s required, and how long it takes.

We’ll also let you know about an option worth considering, the Wise Business account. It's easy to manage, designed to meet the needs of modern businesses and you sign up online.

Wise: Discover an international

business account 💼

AIB has a few different business accounts on offer that serve various purposes.¹ Some are more general in nature while others are directed at a specific type of business.

For daily business banking needs there are the AIB Current Accounts:

- Business Current Account: For your everyday business banking needs

- Start-up Current Account: For new or start-up businesses

- Young Farmers Current Account: For young people starting out in farming businesses

For international transactions there’s a couple of foreign currency accounts.

- Currency Current Account: For making and receiving payments in foreign currency without needing to convert your money

- Currency Deposit Account: To hold and earn interest on foreign currency

Finally, there are AIB Business Savings Accounts.

- Demand Deposit Account: A flexible deposit account to hold money in that you can still access

- Business Notice Deposit Account: A deposit account where funds can be added anytime and accessed with 31 days' notice

- Business Fixed Term Deposit Account: A set term deposit account with fixed interest applied to the lump sum

- Alternative Deposit Options: For customers with €3 million or more to deposit, additional savings options may be available through the AIB Treasury team.

🔎 Note: This guide focuses on the standard Business Current Account, which is intended for everyday business banking.

The standard way to open an AIB Business Current account is to fill out the online form and follow AIB’s directions from there.²

If you prefer to do everything in person, it’s possible to print and fill out a paper form, then take it into an AIB branch to complete the next steps.

Keep in mind though that you may need to make an appointment with a business relationship manager.

The process for opening a standard AIB business bank account online varies depending on the type of business you have.²

If you’re a Sole Trader you can apply to open an account online by filling out the digital form then completing the electronic application AIB will send you via DocuSign. After that you’ll need to visit a branch and give proof of ID, address and a sample signature.

For Partnerships the account application process can be started by filling out the digital form. AIB will then send a DocuSign to one partner first then the other, and you will need to agree on the type of account, whether you want debit cards and whether payments require one or two signatures.

Companies need to complete the digital form then complete the DocuSign application form sent by AIB. They will then email within five business days with the next steps, which involves directors and a company signatory (can be the same person) visiting a branch. After that, there’s a final check which can take up to 10 business days.

While it varies depending on the type of business, these are some general requirements AIB has³:

- Business name and address

- Business type and purpose

- Information about the business such as number of employees and years in business

- Applicant, partners or directors proof of ID, address and sample signature

Accounts for Sole Traders and Partnerships will be opened within 5 business days of the application if accepted.¹ Businesses take longer, with the final check taking up to 10 business days.

If you are looking for something else, there’s the Wise Business account, which offers international transfers to 140+ countries and currency conversion at the mid-market exchange rate.

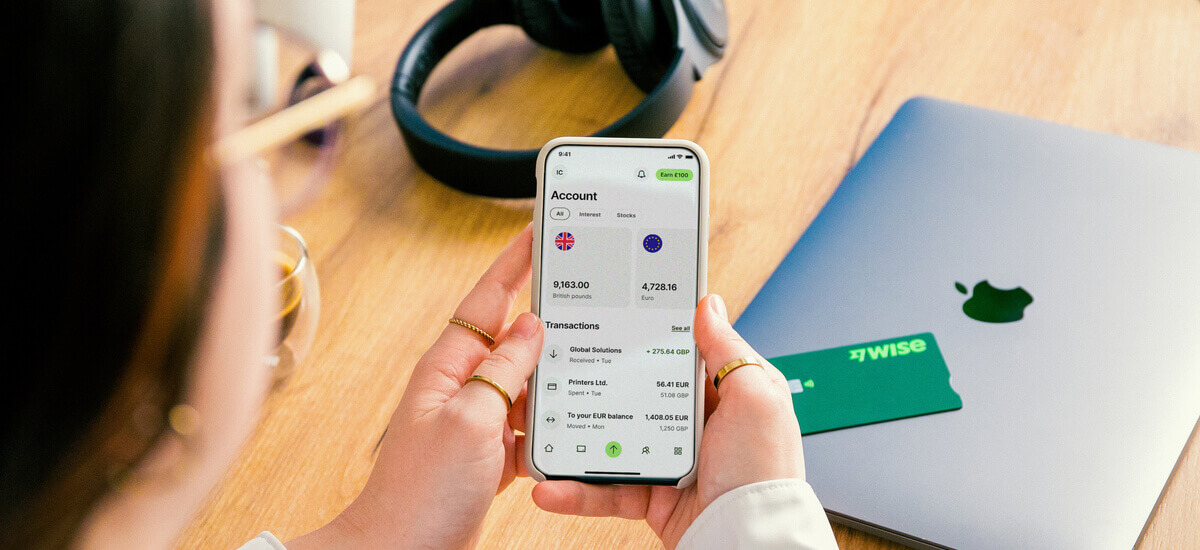

The Wise Business account is built for companies of all sizes, from freelancers to growing startups and established businesses. You can open an account entirely online, with no minimum turnover or complicated paperwork.

Once set up, it lets you send payments internationally, hold and convert 40+ currencies, and receive payments by getting local account details for 8+ major currencies, including EUR and GBP. You can also get paid via SWIFT in more than 20 currencies, and convert your money using the mid-market exchange rate (the same you normally see on Google). All this with no hidden fees.

Here are some of the other things you can do with a Wise Business account.

- Order Wise Business debit cards for you and the team

- Integrates with platforms like Xero and QuickBooks

- Make batch payments to up to 1000 people with a single click

- No monthly fees or account maintenance

- Give team members access with tailored permissions.

Open your

Wise Business account online 🚀

The AIB Business debit card make daily spending with a business bank account simple, providing a convenient and secure payment method.⁴

It can be used to make purchases in person and online wherever Visa is accepted, as well as withdraw up to €600 cash from an ATM daily. The card supports contactless and is compatible with certain digital wallets, including Google Pay and Apple Pay.

There’s no annual fees to worry about and each company can have up to 10 cards issued to authorised signatories.

The Wise Business account also offers business debit cards.

Check some features about it:

- Spend in 40+ currencies in 140+ countries

- First card on the account is free

- Get cards for your team members

- No annual fees, overall

- Set spending limits and control the payment methods

- Track team spending and get instant notifications for transactions

- Create virtual cards that can be used online or through digital wallets.

Discover the Wise business

debit card 💳

Sources used:

Sources last checked on date: 5 April 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read about how to open a business account with PTSB in Ireland, including the requirements you may need to meet.

Discover if you can open a business bank account in Canada as a non-resident and how it works.

If you’re deciding between Wise Business vs Personal in Ireland, chances are you’ll benefit from the business account. Read this full comparison to see why.

Discover what are the fees and charges your business will need to pay when using PayPal in Ireland.

Discover what you need to open a business bank account in Ireland, including documents, process and how it works.

Read what you need to do to close your Revolut business account, and if you need to pay any fee.