Opening a business account in Canada: Requirements and how do as a non-resident

Discover if you can open a business bank account in Canada as a non-resident and how it works.

No matter the size or stage of your business, opening a separate account to manage your business finances is an important step to take.

In this article we’ll cover everything you need to know about opening an Irish business bank account with Permanent TSB, including the steps to take and what documents you’ll need to provide.

We’ll also let you in on another option, the Wise Business account. It’s a fully online business account that comes with some great tools and features to support your business goals.

Wise Business: Manage, send and receive

money in different currencies 💰

PTSB offers a range of banking services to businesses including bank accounts, overdraft, loans, mortgages and merchant solutions.¹

For bank accounts they have two main options:

- Business Current Account

- Business Deposit Account

For this article we’re going to focus on opening a PTSB Business Current Account.

To open a PTSB business account you can complete the process online, or make an appointment over the phone to meet a Business Banking Manager at a branch or at your place of business.²

It’s also possible to take advantage of the Current Account Switch process if you already have a business account at another Irish bank, and want to move to Permanent TSB.

Opening an PTSB account online is possible if you’re a Sole Trader, Partnership or Limited Company.² Each has a dedicated online application form which can be accessed on the PTSB website.

Along with a completed application form there are certain documents that need to be provided to open a Permanent TSB business bank account. What PTSB requires depends on the type of business you have.³

| Documents | Sole Trader | Partnership | Limited Company |

|---|---|---|---|

| Proof of ID and address for signatories | Yes | Yes | Yes |

| Proof of ID and address for registered internet banking users | Yes | Yes | Yes |

| Certificate of Registration of Business Name | Yes | Yes | Yes |

| Bank Mandate (Available from the local branch) | Yes | Yes | Yes |

| Partnership Agreement | Not applicable | Yes | Not applicable |

| Certificate of Incorporation | Not applicable | Not applicable | Yes |

| Memorandum and Articles of Association | Not applicable | Not applicable | Yes |

| All directors and their details listed on a company letterhead and signed by an approved person | Not applicable | Not applicable | Yes |

| All shareholders with a 25% share or more in the company listed on company letterhead with their details and signed by an approved person. | Not applicable | Not applicable | Yes |

| Proof of ID and address for for shareholders with a stake of 25% or more of the issued share capital | Not applicable | Not applicable | Yes |

Unfortunately, Permanent TSB doesn’t share their processing times online so you’ll need to contact them directly to find out how long you can expect to wait.

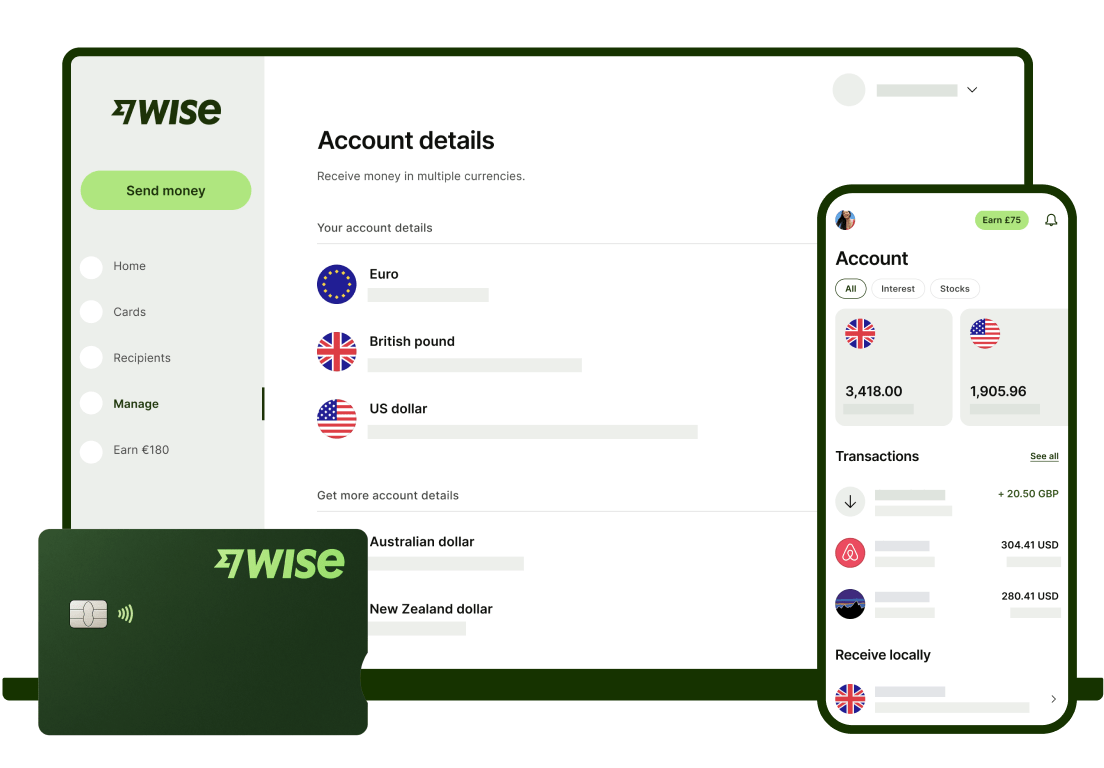

If you’re not sold on the idea of a PSTB Business Account, consider the Wise Business account instead.

Wise Business is a great option for companies looking to manage international payments and day-to-day expenses more efficiently. Whether you're a sole trader, freelancer, or run a growing business with global clients, Wise lets you open a business account online without ever needing to visit a branch or meet a minimum turnover.

With Wise, you can hold money in 40+ currencies, pay invoices abroad, convert money with the mid-market exchange rate, and get local account details in major currencies like EUR, GBP and USD to receive payments like a local company.

It’s designed for modern businesses offering low fees, transparent pricing, and tools like batch payments to make managing your finances simpler.

Once you have an account you can then order Wise Business debit cards for you and the team, and generate virtual cards that are compatible with digital wallets. Customs limits can be set on the cards and it’s easy to track spending with real-time notifications.

Wise Business account benefits:

- Money is exchanged at the mid-market rate with no hidden fees or markups

- Pay up to 1000 people simultaneously with batch payments

- Integrates with supported software including QuickBooks and Xero

- Give access to team members with customised account permissions

- Easily receive money from international platforms such as Amazon and Stripe.

Wise Business: Open your

account online here 🚀

Sources used:

Sources last checked on date: 15 April 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover if you can open a business bank account in Canada as a non-resident and how it works.

If you’re deciding between Wise Business vs Personal in Ireland, chances are you’ll benefit from the business account. Read this full comparison to see why.

If you're wondering how you can open a business account with AIB in Ireland, read this guide to understand the whole process.

Discover what are the fees and charges your business will need to pay when using PayPal in Ireland.

Discover what you need to open a business bank account in Ireland, including documents, process and how it works.

Read what you need to do to close your Revolut business account, and if you need to pay any fee.