Permanent TSB business account opening: Requirements and options

Read about how to open a business account with PTSB in Ireland, including the requirements you may need to meet.

Used by businesses around the globe, PayPal has been a popular choice of financial service for a long time. The question is, what does it actually cost to use their system?

Knowing how much you’ll pay to send and receive money is an important part of choosing the right payment partners for your business, so to help out we’re going to run you through some of the main fees for using an Irish PayPal business account, including using the PayPal Business Debit Mastercard.

We’ll also introduce you to the Wise Business account, an online account that allows you to receive money in diferents currencies.

Discover the

Wise Business account 💼

You can open a PayPal Business account for free, as well as maintain it without costs. The fees your business will have to pay are based on your usage of the account.¹

When you use your PayPal Business account there are various fees that can apply, with most being structured around sending and receiving money, as well as exchanging currencies.

Merchant transaction fees apply to the commercial transactions processed by your PayPal Business account. To give you an idea of what this encompasses, here’s some examples¹:

- Buying and selling goods or services

- Receiving QR code payments

- Sending or receiving charity donations

- Receiving a “request money” payment.

The charges vary based on things like the type of transaction, whether it was domestic or international, and if there’s a currency exchange taking place.

One of the features PayPal offers Irish businesses is QR code payments which customers can do through the PayPal app. If you decide to offer QR payments for your business, here’s the fees you’ll need to consider.

| QR Code Transaction Type | Fee¹ |

|---|---|

| Domestic transactions worth €10.00 and below | Fee of 1.20% + fixed fee |

| Domestic transactions worth €10.01 and above | Fee of 0.90% + fixed fee |

| International transactions worth €10.00 and below | Fee of 1.20% + fixed fee + percentage fee for international commercial transactions |

| International transactions worth €10.01 and above | Fee of 0.90% + fixed fee + percentage fee for international commercial transactions |

The fixed fee for QR code transactions varies depending on the currency. For your customers paying in Euros, the fee is:

- €0.05 fixed fee for transactions of €10.00 and below

- €0.10 fixed fee for transactions €10.01 and above

The percentage fee for international commercial transactions is something we’ll cover further down the page, along with the PayPal foreign exchange rate.

If you’ve been approved to use PayPal’s Online Card Payment Services then there are another set of fees to be aware of.¹

| Payment type | Fee |

|---|---|

| Advanced Credit and Debit Card Payments Blended Pricing Fee Structure for Visa & MasterCard | 1.20% + fixed fee |

| Advanced Credit and Debit Card Payments Interchange Plus Fee Structure for Visa & MasterCard | Interchange Fee (usually 0.2% to 3%) + 1.20% + fixed fee |

Once again the fixed fee depends on the currency, and for Euro transactions it is €0.35.

The commercial transaction fees for sending and receiving money with PayPal Business in Ireland are also determined based on the individual circumstances of the transaction, but here are some of the common ones you may run into.

Let’s start with the normal rates for receiving domestic transaction:

| Transaction Type | Fee¹ |

|---|---|

| Alternative payment method | 1.20% + fixed fee |

| Card payment from users of ‘Terms of Payments without PayPal account’ | 1.20% + fixed fee |

| QR Code transactions | As above |

| Online card payment services | As above |

| All other commercial transactions | 3.40% + fixed fee |

The general fixed fee for commercial transactions and alternative payment method transactions also depends on the currency, and for Euros it’s €0.35.

When you receive money from an international transaction there’s an additional percentage based fee that’s applied on top of the normal domestic or QR code fees.¹ What that percentage is, is determined based on the sender's region.

| Region | Fee |

|---|---|

| EEA | No fee |

| United Kingdom | 1.29% |

| All other markets | 1.99% |

Keep in mind that alternative payment method transactions are exempt from this fee.

When a currency conversion needs to take place there’s a fee of 3.00% above the base exchange rate set by PayPal.¹

To find the current PayPal exchange rate you need to log into your PayPal Ireland Business account and follow these steps²:

There are a few situations where PayPal will apply their exchange rate.

- Money is sent in a currency that’s not your default, which in Ireland is Euros

- Money is withdrawn in a different currency

- A currency balance is converted

- Payment is accepted in another currency and automatically converted

By comparison, Wise uses the mid-market exchange rate for all transactions, with no margins or hidden fees. If you haven’t heard of the mid-market rate before, it’s the midway point between the buy and sell prices on the currency market, making it a fair way to decide.

Using PayPal Payouts it’s possible for your business to send money via PayPal to other people such as suppliers and staff.¹ The fee charged is percentage based with a maximum fee cap that depends on the payment currency.

| Transaction | Fee¹ |

|---|---|

| Domestic PayPal Payouts | 2.00% of the transaction amount not exceeding the Irish domestic fee cap of €12.00 |

| International PayPal Payouts in Euro or Swedish Krona between accounts registered in the EEA | 2.00% of the transaction amount not exceeding the domestic fee cap of €12.00 or 100 SEK |

| International PayPal Payouts to other regions | 2.00% of the transaction amount not exceeding the international fee cap. Example: * Cap for payments in UK pounds sterling is 60.00 GBP * Cap for payments in US dollars is 90.00 USD |

If you’re withdrawing from your PayPal Business balance to your linked bank account there’s no fees, unless a currency conversion is involved.¹ When it is, the currency conversion fee applies.

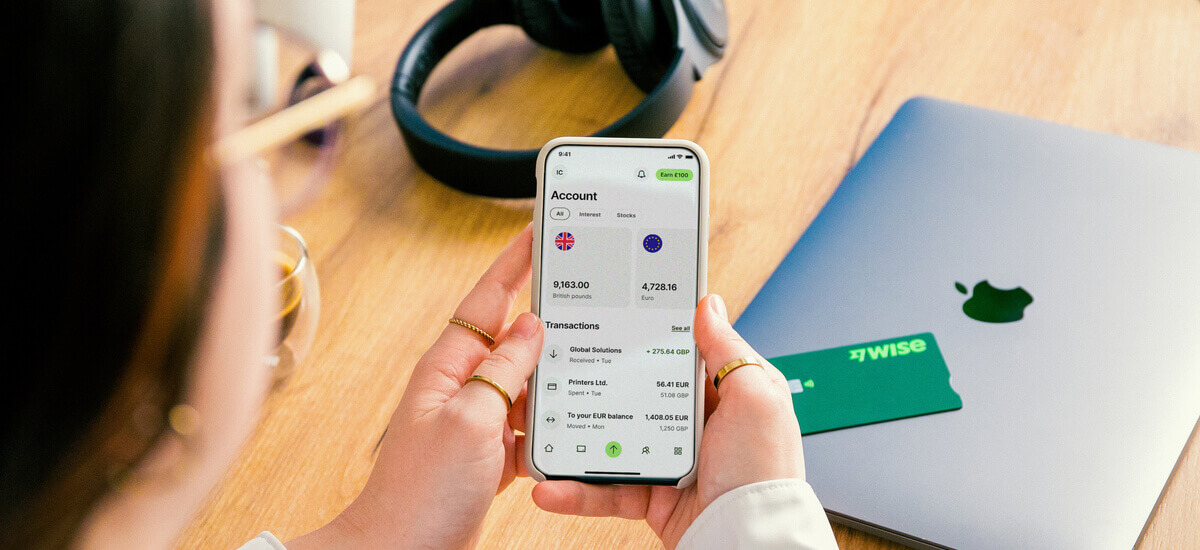

At the start we mentioned an alternative, the Wise Business account.

Designed for global payments, the Wise Business account allows you to manage over 40 currencies through a single account. For 9 of those, including EUR, GBP and USD, you also get account details that allow you to receive money like a local business, making it easy to withdraw from Amazon, Stripe and more.

As well as payments, the Wise Business account comes with tools to help make managing your company finances easier. It integrates with accounting software such as Xero or Quickbooks for faster reconciliation and there are invoice templates to make getting paid simpler.

There’s also access to batch payments as well as the Wise Business debit card, but more on that soon.

Open your Wise Business

account online 🚀

Eligible business accounts are able to get a PayPal Business Debit Mastercard which can be used to help with daily business expenses. As you may expect, there are some fees associated with using the card³:

| Service | PayPal Business Debit Card | Wise Business Card |

|---|---|---|

| Order a card | No fee |

|

| Order additional cards | Not possible at this time | Yes |

| Cash withdrawal fee | €2.00 | For 2 or less withdrawals it is free up to €200 per month, then 1.75% fee applies For 3 or more withdrawals per month it’s €0.50 per withdrawal plus 1.75% of the amount over €200 |

| Transaction fees | No fee | No fee |

| Currency conversion | No currency conversion fees from PayPal | Variable conversion fee starting at 0.48% |

| Exchange rate | Mastercard rate | Mid-market exchange rate |

As you can see the Wise Business account also has a business debit card, but there are a few differences in what it offers when compared to the PayPal Business Debit Mastercard.

Able to be used in-store and online, the Wise Business Debit Card supports spending in 40+ currencies and 150+ countries.

As a business owner you can order multiple debit cards for team members to use, then set individual spending alerts, spending limits, check card activity and even freeze cards if needed. It gives you complete control and peace of mind, while removing the need for staff to use their personal accounts for business expenses.

As well as physical cards Wise also offers digital cards, which can be generated for free and used to buy online or pay with compatible digital wallets. These can be created in an instant, no need to wait for the mail to arrive.

Sources used:

Sources last checked on date: 10 December 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read about how to open a business account with PTSB in Ireland, including the requirements you may need to meet.

Discover if you can open a business bank account in Canada as a non-resident and how it works.

If you’re deciding between Wise Business vs Personal in Ireland, chances are you’ll benefit from the business account. Read this full comparison to see why.

If you're wondering how you can open a business account with AIB in Ireland, read this guide to understand the whole process.

Discover what you need to open a business bank account in Ireland, including documents, process and how it works.

Read what you need to do to close your Revolut business account, and if you need to pay any fee.