Microsoft 365 and Copilot pricing and plan guide UK 2025

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

While many factors can motivate employees, like growth opportunities and a supportive work environment, timely and accurate pay remains at the top. No matter the era, money matters. Now imagine a company that claims to value its people, invest in their growth, and build their confidence, yet consistently fails to deliver salaries on time or gets the numbers wrong. Would you want to work there?

Nearly 9 in 10 UK businesses admit to making payroll mistakes, with staff getting paid late or incorrectly at least once a year1. These errors don’t just frustrate employees. They cost companies time, too, with teams spending around 18 days a year fixing them. It clearly indicates that outdated payroll processes are holding businesses back2.

If you’re a business caught up in the dreaded payroll cycle and failing to meet optimal standards, you’ve landed at the right place. This guide covers all that a UK business needs to know about setting up an efficient and accurate payroll management system.

And while we’re on it, we’d suggest you check outWise Business. It offers a simple way for UK companies to pay local and overseas employees. You can send money to 140+ and move money between them using themid-market rate. It keeps you in complete control of your cross-border finances.

💡 Learn more about Wise Business

Payroll management is all about making sure your employees are paid correctly, on time, and in accordance with UK laws and tax rules. It covers everything from calculating wages and bonuses to deducting income tax, National Insurance, and pension contributions, and then paying those to HMRC or the relevant bodies.

It’s not just about sending out payslips, though. A sound payroll system also keeps track of employee records, handles statutory payments like sick pay or maternity leave, manages benefits, and ensures everything is reported correctly.

Small teams may manage payroll on their own, while larger companies often use in-house specialists or external providers. In all cases, accurate payroll ensures happy employees and keeps the business compliant.

Payroll management is more or less the same across the world. It starts with collecting and processing data about employees’ work hours, taxes, perks, and deductions. This is then used to calculate the net amount for each worker.

Most of the time, the process is conducted via specialised payroll management software. This can automate monotonous tasks, such as tracking attendance and curating payslips. Once the process ends, the payroll system makes direct deposits and backs up all the data for future reporting and auditing.

See the diagram below to get a visual insight into this process:

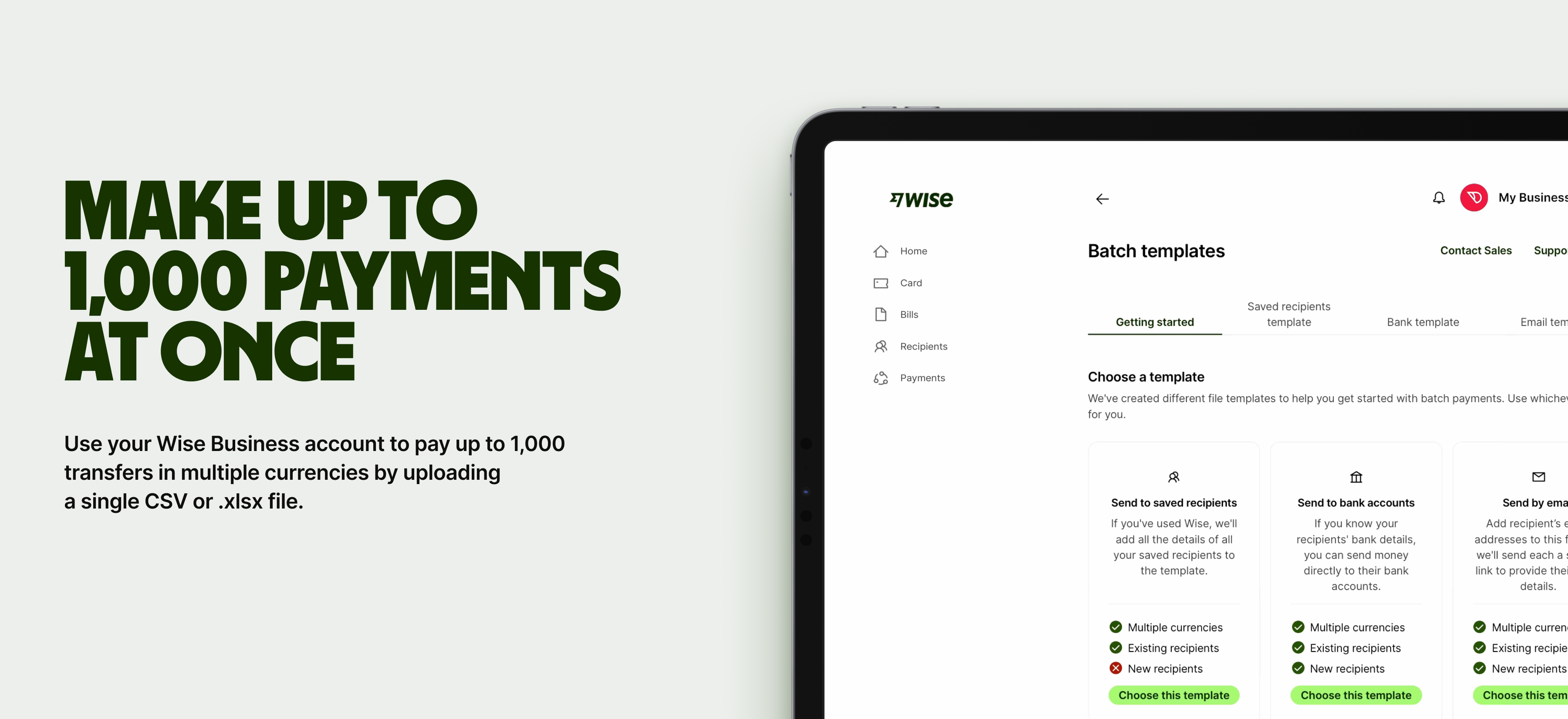

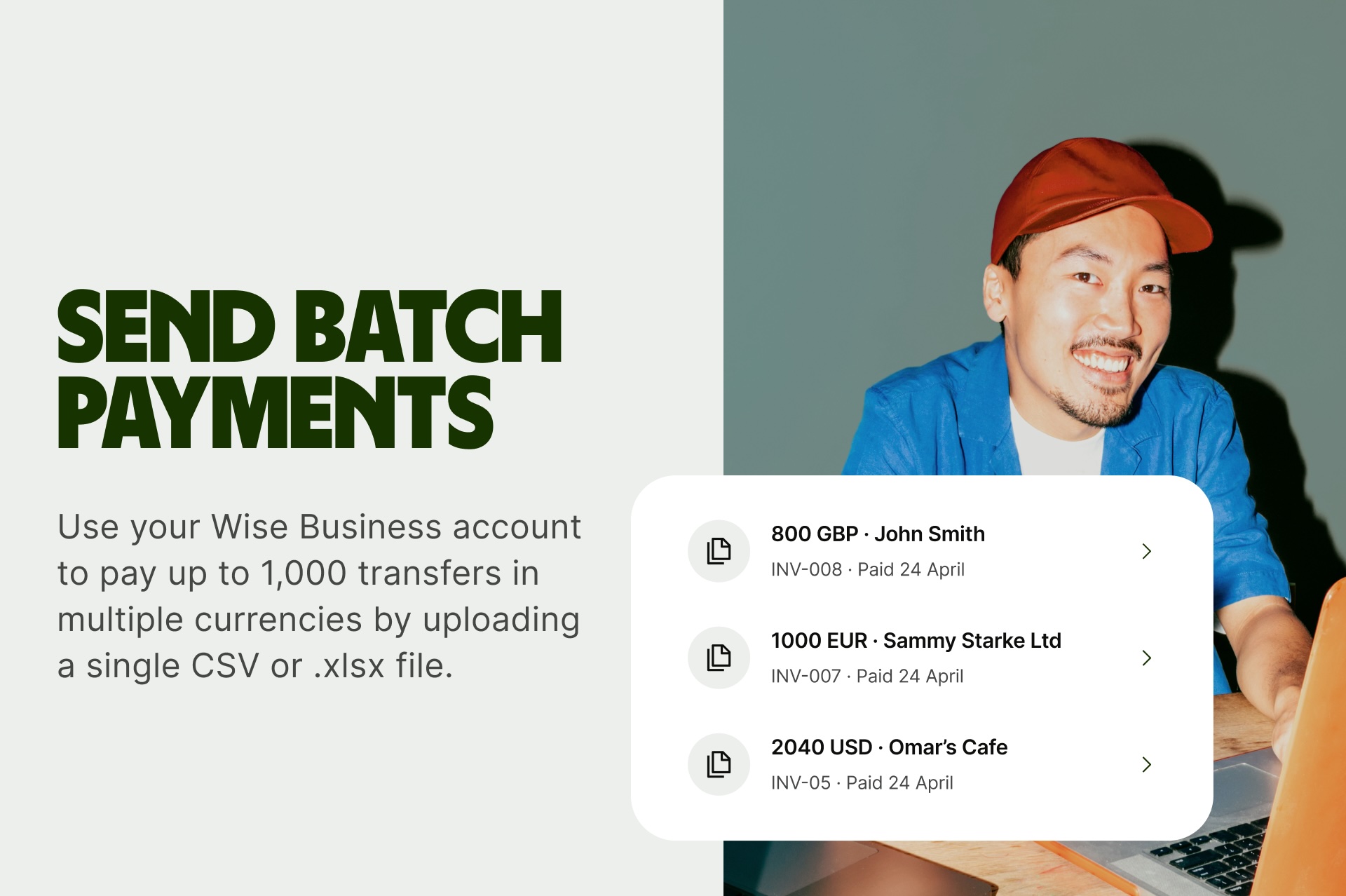

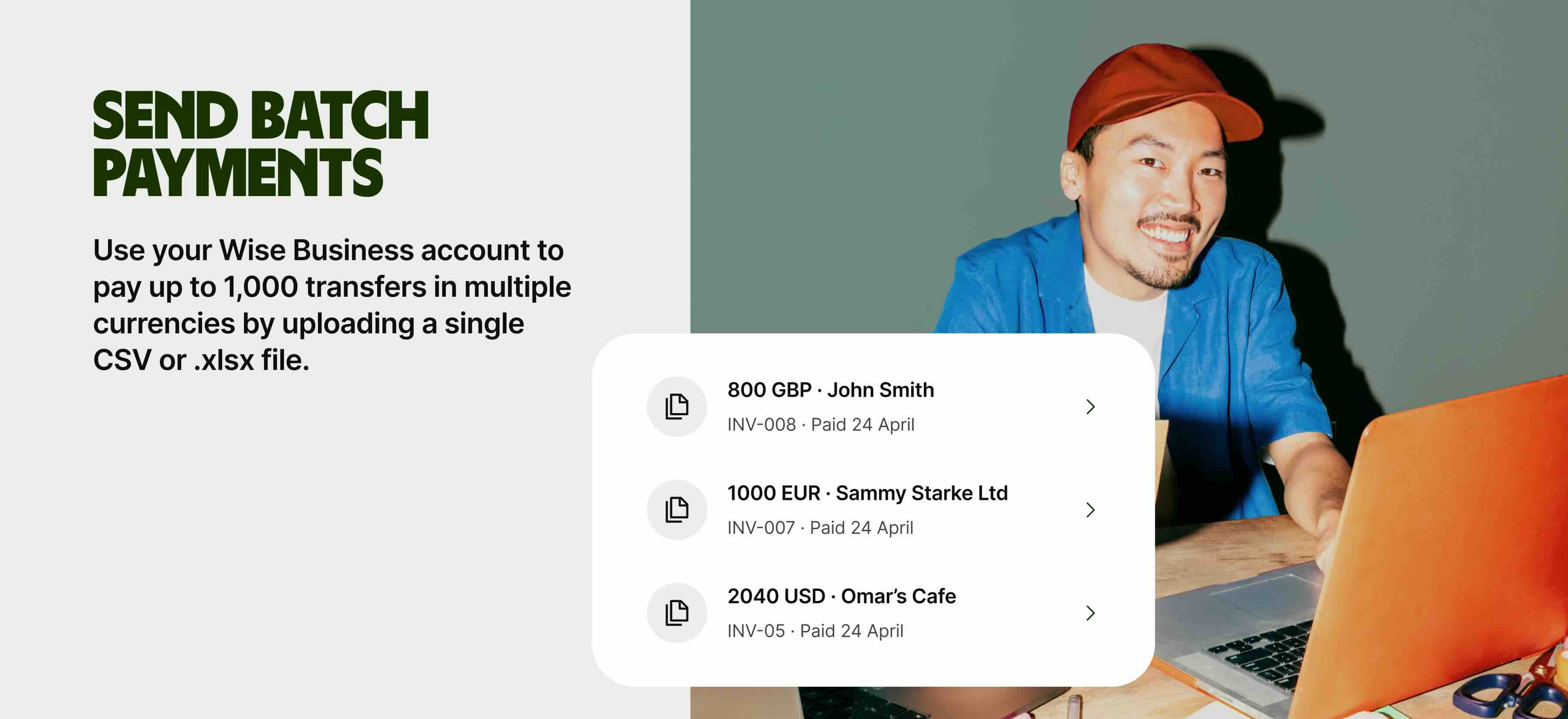

You can use tools like Wise Business to automate payroll tasks and send up to 1,000 payments at once! All you need to do is upload a spreadsheet with your employees' bank account info or email, and our smart tech will do the rest. What is best? If you need to send overseas payments for international employees you get the mid-market exchange rate, without any expensive mark-up on top.

Get started with Wise Business 🚀

A refined payroll management system compiles everything under one roof. From tasks as minor as tracking attendance to overtime and benefits, it keeps tabs on everything!

When it aligns with the existing tools and automated routine tasks, it lightens the load on your HR team. Eventually, your company will have more time to focus on employee well-being and strategic initiatives. Real-time access to payroll and employee data means faster, smarter decisions and easier reporting.

As for keeping the system secure and updated, you can either manage it internally or lean on your software provider’s maintenance and support packages. The point is to make payroll less of a chore and more of a breeze, and there’s no harm in going the extra mile for that.

The high risk of human error and time consumption make manual payroll challenging for companies. A well-designed payroll management system features the following:

Hook up your payroll system to a dashboard, and you’ll see real-time data at a glance. This can include the pay runs, shifts, leave requests, and employee info, all in one spot. It keeps things fast, clear, and under control.

Pro tip: Look for a tool that covers the essentials and grows with your business as your needs evolve.

As your team grows, so do the challenges. This makes it even more important to have the right tools in place.

A few perks you can notice with this digital payroll structure are:

An intelligent payroll system keeps employee details, pay history, and hours worked in one tidy spot. No need to chase scattered files or double-check figures. Everything updates in real time, giving you reliable data when needed.

Manual entries often lead to slip-ups that cause delays, complaints, or even penalties. A digital payroll setup handles calculation automatically. It helps avoid common mistakes and keeps your payroll processing smooth and stress-free.

Everyone wants to get paid on time and correctly. When your payroll runs like clockwork, it builds trust and boosts morale. Happy staff are more motivated and likely to stay longer, saving time and turnover costs.

Payroll software includes built-in tools that keep your processes aligned with UK laws. It handles tax codes, pension contributions, GDPR rules, holiday pay, and more, cutting the risk of errors and avoiding costly penalties.

Modern systems give you quick access to payroll trends, staff costs, and reports that support big-picture thinking. These insights help you stay in control of budgets and plan ahead with confidence.

Using payroll software is a great start, but it doesn’t always mean things run perfectly. Mistakes can still creep in, particularly when your team’s juggling too much or the system isn’t quite keeping up. That’s why it’s worth reviewing your payroll setup regularly.

A quick audit can highlight what’s working and what needs tweaking, so your processes stay sharp as your business grows. The following are some common slip-ups that tend to cause trouble:

Missing overtime entries often leads to underpaid staff and frustration. When overtime isn’t logged correctly, payroll figures fall short, and team morale takes a hit. A reliable system helps track and process every extra hour worked.

Using the wrong tax code affects take-home pay and creates compliance issues. Too much or too little tax deducted means more admin later and possibly fines. Checking codes early avoids costly backtracking.

Incorrect or outdated records create confusion during payroll runs. Changes in job titles, bank details, or hours must be updated promptly to avoid errors that affect accuracy and trust.

Poor holiday tracking can lead to payment mistakes and legal risk. A well-structured system calculates leave balances and applies them to payroll, preventing overpayments or missing pay.

Outdated processes often miss new payroll rules. National Minimum Wage changes, pension rules, and reporting requirements shift often. A modern payroll system stays in the learning loop and reduces compliance risk.

Navigating the finance department comes with its fair share of troubles. Even if the procedures aren’t conducted manually, there’s always a need for a human supervisor to watch over data and ensure accuracy. Although the number of workers required may be cut down, you can’t leave it all in the hands of a digital program.

Open a Wise Business account and you’ll be able to pay international employees and contractors in their own currency. You can send 40+ currencies in just a few clicks using the Batch Payments tool or even automate the process entirely using the Wise API.

Wise payments are fast³ and secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

Get started with Wise Business 🚀

Pay management refers to how businesses handle employee compensation. It ensures fair, compliant pay practices while covering more than wages. It also includes bonuses, pay rises, and tax deductions, all managed per company standards.

Reliable payroll keeps your business running smoothly and your team happy. Nothing knocks staff morale more than late or incorrect pay. It’s also essential to stay on top of tax filings. Mistakes or delays can lead to fines, so it’s well worth putting the right time and tools into getting payroll right.

The way you manage payroll plays a big role in how long it takes. Manually handling payroll can take from a few hours to several days, depending on team size and compliance tasks.

Using payroll software speeds things up, often finishing the job in minutes. Outsourcing takes it off your hands completely. The right choice depends on your business size and how much time and support you can commit to payroll.

Ending Remarks

The discussion drives us to the point that getting payroll right isn’t just a back-office task. It’s the backbone of a happy, compliant, and smooth-running business. Invest in the right tools, stay on top of the details, and let payroll be one less thing to worry about!

Sources used in this article:

Sources last checked 15/07/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

Check out our helpful guide to transferring large amounts with Revolut Business, including transfer times, limits and how to set up your first payment.

Discover the best AI tools to automate your business in 2025. From marketing to HR, streamline workflows, save time, and boost productivity.

Streamline invoice processing and boost cash flow with AP automation. Learn how it works and the tools to help your business grow.

Discover the process related to cross border payments, steps, fees involved and providers that enable international payments, including Wise Business.

Discover the best accounts payable automation software providers for business in the UK. Check features, reviews and pricing.