Microsoft 365 and Copilot pricing and plan guide UK 2025

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

Manual accounts payable is time-consuming and inefficient. A 2022 report found that finance teams spend 10+ hours per week settling supplier payments¹. For small UK businesses, that’s time better spent on growth.

That’s why many are turning to accounts payable automation, a better way to manage supplier payments. If you're ready to ditch the manual hassle, you’re in the right place.

In this guide, we’ll break down what accounts payable automation is, how it works, and how to get started.

Before we dive in, check out Wise Business, a smart way to pay suppliers in 140+ countries with the mid-market exchange rate, all from the UK.

💡 Learn more about Wise Business

Accounts payable automation involves using software to digitise and improve your company’s invoice-to-payment process. By automating this process, you can minimise manual tasks, save time, and pay vendors and suppliers on time.

Without automation, here’s what the traditional AP process typically looks like:

On the other hand, automating your accounts payable process looks like this:

Now that you understand what AP automation is, how exactly does it work?

The automation of accounts payable typically involves using software to handle everything from invoice receipt to payment processing and reconciliation, all from one central system.

AP automation was a lot different in the past, with rule-based systems in the 1990s that needed manual setup and intervention. Today, AP automation tools are powered by advanced technologies like AI, and Optical Character Recognition (OCR)².

Modern AP software uses AI to capture data, verify invoices, route them for approval, and schedule payments, all with minimal input. This is made possible with a pre-established set of rules that can be changed with manual adjustments. Plus, AI can spot patterns, reduce errors, and aid in better financial reporting through efficient data analysis.

Here’s a breakdown of how an AP process usually works using accounts payable automation software:

Invoice Data Extraction:

The automation tool receives the invoices through email, or manually as a scanned copy, and it uses OCR to pull the data. That means no manual data entry, which saves time and reduces the possibility of errors for you and your team. Most tools can automatically assign ledger codes to invoices, making it easier to allot codes, track and categorise invoices.

Data Matching and Verification:

Once the data is captured, the system then compares the captured invoice data with your purchase orders, contracts, or delivery receipts to spot any mismatches. This helps you and your team avoid errors before approving an invoice.

Invoice Approval:

Upon verification, the software routes the invoice to the right person (e.g., your manager or director) for approval. This is done based on your business’s pre-established invoice approval hierarchy, which is set during the initial implementation.

Payment Scheduling and Processing:

After approval, the system schedules the payment, either instantly or at the right time depending on your cash flow policies. Some AP automation software can even choose the best payment method and handle the transaction with minimal human effort³.

Reconciliation and Archiving:

Finally, the accounts payable software cross-checks payments with your bank statements and archives all relevant documents. Remember those ledger codes? They come in handy for audits and reporting subsequently.

Here is a quick rundown of some accounts payable tasks you can automate:

Data Entry:

Accounts payable software uses Optical Character Recognition (OCR), a technology that scans invoices, extracts data from them, and stores it in an accounting system. This technology reduces the need to manually input data and the possibility of human errors and duplication.

Ledger Code Generation:

Before automation, you had to sort invoices manually and find the right ledger code. Now, most accounts payable automation software uses machine learning to automatically suggest or assign the right code as soon as the data is captured.

Invoice Matching and Verification:

Instead of digging through contracts, purchase orders, or receipts manually, you can use an AP software program to match invoices to the right documents. This prevents the possibility of fraud and ensures that the invoice is coming from the right transaction.

Approval Routing and Follow Ups:

Accounts payable software can send invoices to the right person for approval. Additionally, it can also handle routing and even send reminders if there’s a delay in response.

Payment Processing:

After approval, with the data extracted from the invoice, you can automate payment processing using accounts payable software based on due dates and your company’s cash flow rules. This saves you the time and effort of manually processing payments

Archiving:

You can automate keeping an up-to-date record of all your financial documents, including invoices t for audits or future reference.

Here are 7 steps to help you automate your accounts payable process:

Assess Your Current AP Process

Start by reviewing your existing AP workflow. Where are the hitches? What tasks slow you down? This will help you understand what features to look for in an automation tool. For example, if you struggle with making payments on time, you can pick an automation tool that can help you schedule them in advance. You can even set it to pay early and enjoy supplier discounts.

Choose the Right Automation Tool

Pick software that integrates smoothly with your ERP system, handles e-invoicing/OCR, and supports basic workflow automation. Consider factors like cost, ease of use, security, scalability, and how the tool meets your business needs.

Set Up Digital Invoice Capture

Once you’ve picked your tool, configure it to receive invoices automatically and extract data using OCR. Encourage your vendors to send digital invoices to streamline the accounts payable process further. You can even build a vendor database for easier data access and verification.

Create Automated Approval Workflows

Next up is to set up approval workflows that mirror your internal structure. For example, if your invoice approval structure is very simple, e.g accountant to CEO, you can use the automation tool to create a workflow based on this. This ensures invoices are routed to the right people quickly, with minimal delay.

Test for Compatibility

Run some tests to ensure the tool works well with your existing systems. This lets you spot any issues early and fix them before full deployment. A simple test you can run is using low-risk, smaller invoices to check how well the tool transfers payment data into your accounting system.

Train Your Team

Once you’ve set up your automation software, get your staff up to speed with proper training and guides on how to efficiently use the tool. Some vendors provide training resources on how to use their tool, while some have a dedicated team of experts to help with onboarding.

Monitor and Optimise

Don’t just set it up and leave it be. Use the software’s built-in analytics, or plug in your own reporting tools, to track AP performance, flag inefficiencies, and continuously improve your process.

Now that you know how to automate your AP process, here are the best 5 payable automation tools to consider:

Coupa

Coupa is a cloud-based platform primarily focusing on Business Spend Management. Its AP solution includes e-invoicing, 2-way and 3-way invoice matching, payment compliance, real-time cash flow analytics⁴ and fraud detection⁴. It’s ideal for businesses of all sizes looking to streamline spend across the board.

Nanonets

Nanonets is perfect for businesses dealing with document-heavy processes like accounts payable. It uses OCR and deep learning to extract data from invoices and other documents, turning them into usable, actionable information⁵. Nanonets is ideal for companies that want a tool that processes large amounts of data fast and turns them into useful information for their AP processes.

Basware

Basware focuses on end-to-end invoice automation through its Intelligent Invoice Lifecycle Management platform. From invoice capture to payment, it ensures every stage is seamless and compliant, making it a solid choice for businesses with complex AP needs⁶.

Sage Intacct

Sage Intacct offers a full suite of financial automation tools to businesses in various industries. Its AP features include data extraction, document verification, and automated workflow creation. It’s ideal for small to midsize businesses with 20+ employees⁷.

Ramp

Ramp is a modern finance platform that brings easy-to-use AI-driven automation to the entire AP process. From data entry to workflow creation and supplier payments, Ramp keeps things simple, smart, and efficient⁸.

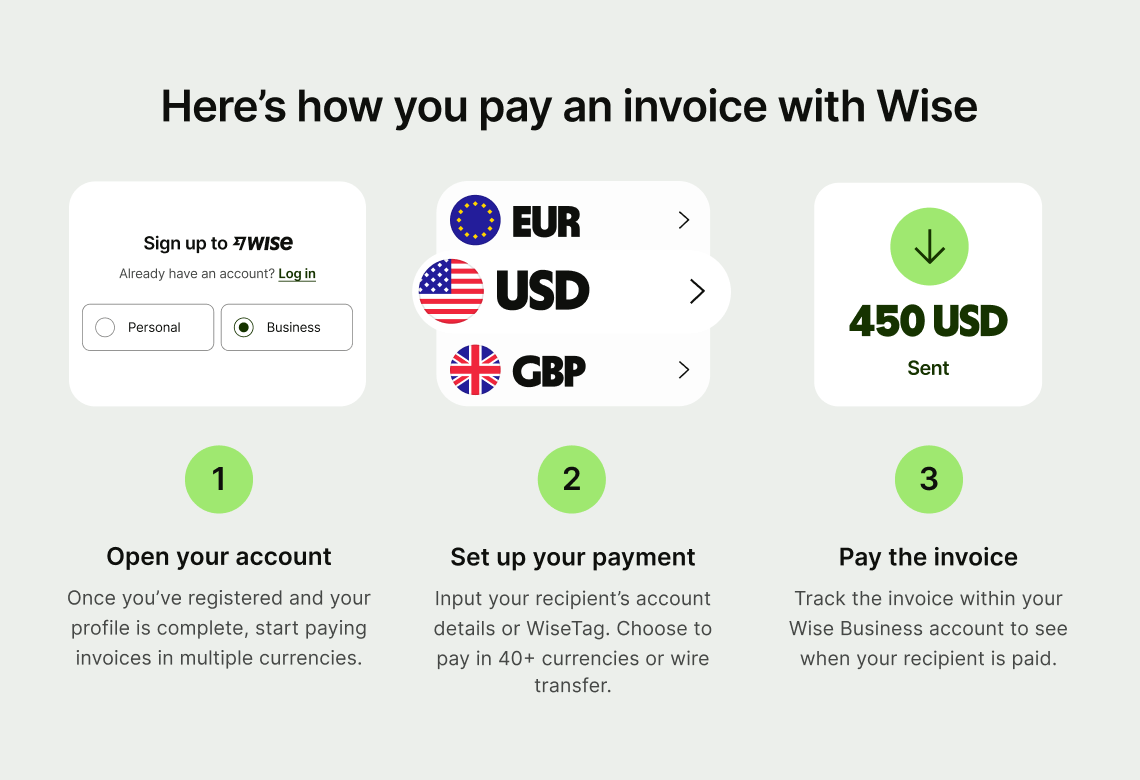

Open a Wise Business account and you’ll be able to pay suppliers and contractors in their own currency. You can send USD, EUR or 40+ other currencies in just a few clicks.

You can easily make batch payments when paying multiple suppliers at once, and even automate the process using the Wise API to save even more time.

Wise payments are fast and fully secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

Get started with Wise Business 🚀

Automating your AP process speeds up invoice approvals, improves accuracy, keeps your cash flow predictable and frees your team to focus on higher-value tasks.

Yes, it can. Tools like Nanonets, Basware, and Ramp are built to integrate seamlessly with the most popular accounting systems.

It gives you real-time visibility into your financial obligations, helps you schedule payments strategically, and reduces the risk of late fees or fraud. This improves working capital and lets you take advantage of early payment discounts.

A typical implementation process for accounts payable automation involves:

Your business most likely needs accounts payable automation when there is:

With AP automation, teams of all sizes can speed up approvals, reduce errors, manage cash flow better, improve supplier relationships and move on to more important tasks. This reduces the manual output of these teams while increasing their efficiency and productivity.

With Wise Business, you can settle both international vendors without having to worry about payment delays or high FX rates.

Sources used in this article:

Sources last checked 13/08/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

Check out our helpful guide to transferring large amounts with Revolut Business, including transfer times, limits and how to set up your first payment.

Discover the best AI tools to automate your business in 2025. From marketing to HR, streamline workflows, save time, and boost productivity.

Discover the process related to cross border payments, steps, fees involved and providers that enable international payments, including Wise Business.

Discover the best accounts payable automation software providers for business in the UK. Check features, reviews and pricing.

Learn how to choose the best Cloudflare plan for your business needs and how to save on costs in the UK.