Microsoft 365 and Copilot pricing and plan guide UK 2025

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

As a business owner, you want to spend less time on admin and finances, and more time doing what you actually love. Freeing up your time and headspace has never been easier with a whole range of accounts payable automation software available in the UK to help businesses streamline their processes. But with so many services on offer, it can be hard to know where to start and which software will give you the best value for money.

Wise Business has collated a list of the best accounts payable automation software in the UK so that you can make the right decision for your business. In this article, we’ll explore each option in depth and give you tips for picking the best accounts payable automation software. Find out how Wise integrates with accounts payable automation software.

💡 Learn more about Wise Business

As the UK Government rolls out their Making Tax Digital requirements, more and more businesses will be required to use accounts payable automation software which is approved by HMRC. While all the providers differ slightly, there are some key features that every company should offer.

Integrations with your bank and a range of helpful dashboards, allow you to view all your business finances quickly and easily. This also means you can see your cashflow at a glance, empowering you to make strategic financial decisions for your company, and giving you the reassurance you’ve got the money you need to pay your bills.

Accounts payable automation software helps you extract all the key information from an invoice and ensure that you pay the right amount of money, to the right person, at the right time. It can also capture the key information from paper receipts allowing you to store all your expenses, whether bought online or in a physical store, in one place.

There’s nothing worse than missing a payment and dealing with late payment fees and strains on relationships with providers. Accounts payable automation software helps you avoid this type of situation, freeing up your time and headspace.

The joy of automated software is that it doesn’t make human errors. It’ll flag any duplicate transactions, verify bank details, and do all the hard calculations for you.

As mentioned above, digital tax reporting is being introduced by HMRC. Most major accounts payable automation software providers are already approved by the HMRC but make sure the provider you’re considering is compliant. These software tools can also ensure VAT is handled correctly and keep your digital records in order for audit.

The rest of this article will review and compare the following service providers in more detail:

Before we dig into the best accounts payable automation software list in more detail, let’s take a bird’s eye view of the competitors. In the table below, we’ve included their G2 score, a renowned software review platform, and what they do best.

| Provider | G2 score | Best known for |

|---|---|---|

| Tipalti | 4.4¹ | Handling international payments which allows users to make payments across 200+ countries and territories in 50+ currencies². |

| Quickbooks | 4.0³ | User-friendly, all-in-one tool for small businesses. |

| Sage | 4.3⁴ | Straight-forward tool with solid VAT handling. |

| NetSuite | 4.1⁵ | Ideal for larger businesses who want all their enterprise resource planning in one place. |

| Spendesk | 4.6⁶ | Focusing on spending management. |

| Xero | 4.3⁷ | A wide range of integrations at your disposal. |

| Medius | 4.4⁸ | Streamlining invoicing. |

| Microsoft Dynamics 365 | 4.0⁹ | Creating tailored workflows. |

For this data to serve you best, we’ve established some comparison criteria that we’ll look at for each service provider. This will give you the key information and give you the confidence that you’re choosing the right tool, with the right features, at the right price. For each accounts payable software solution, we’ll look at:

Best known for: Tipalti describes itself as a single solution for all your global financial needs and as such, is best for mid-sized companies who are looking to scale their business and handle mass payments with ease.

With a G2 score of 4.4¹, Tipalti is our second-highest scorer among reviewers. Users particularly praised how easy it was to use, the excellent customer support, and efficiency with one reviewer stating that:

“Tipalti seriously changed the game for us. What used to be a mess of emails and spreadsheets is now smooth and super easy. Vendor setup, invoice approvals, and payments all happen in one place, and the whole process feels effortless. It saves us time, keeps things organized, and just works².”

Tipalti’s pricing plans start from £99 per month for their Starter plan¹⁰ with the option to add expenses at an additional cost.

Best known for: Quickbooks is best known for being a one stop shop for all accounting needs and designed for sole traders through to medium sized businesses.

Quickbooks receives a G2 score of 4.0³ with its strengths including ease of use, expense management, and automatic backups. One medium sized business owner explained how much time it saved her:

“The dashboard gives a good overview of everything from payroll to expenses and outstanding invoices. I also find the bank feed connection and automation for recurring transactions super helpful—it saves us a lot of time on the manual stuff³.”

Quickbooks plans start from £10 a month for the sole trader plan with the upper end being £115 for the advanced plan¹¹. Unlocking payroll plans comes at an additional cost for every plan.

Best known for: Sage is a cloud-based accounting software with AI integrations designed for small businesses.

Sage receives a G2 score of 4.3 out of 5⁴. One reviewer described it as a “complete accounting tool”, while another described it as “powerful, intuitive, and a game-changer for our accounting processes⁴.”

Sage plans range from £18 a month to £59 a month¹². Payroll and additional employees come at an extra cost.

Best known for: NetSuite is an Enterprise Resource Planning platform designed for growing or larger companies who are operating globally.

NetSuite is given a 4.1⁵ by G2 reviewers with the ability to customise it and its functionality being noteworthy. One reviewer described it as “the best ERP in the world⁵,” highlighting that you can design specific workflows, the ease of use, and support NetSuite provides.

NetSuite’s prices are tailored to each business and billed annually.

Best known for: Spendesk is a procurement and spend management platform which aims to give you 100% control and visibility on operational spend¹³.

Spendesk is the highest scoring software in our best accounts payable automation software list, scoring 4.6⁶ from G2 reviewers. One reviewer describes it as “the best expenses platform I’ve used⁶,” going on to praise its user interface, processes, and app performance.

Spendesk prices are tailored to each business, composed of a flat-fee for platform use and variable fees for transactions. Procurement and accounts to pay are both add-on features.

Best known for: Xero is perhaps the best known accounting platform for small businesses, priding itself in automating admin and integrating well with other apps.

Xero has a G2 score of 4.3⁷ with one review stating that:

“Xero makes accounting genuinely simple even for users who don’t come from a traditional finance background. The interface is clean, intuitive, and incredibly easy to navigate. Everything from bank feeds to invoicing to reconciliation just works seamlessly, right out of the box⁷.”

Xero has four plans available ranging from £16 per month to £59 per month¹⁴ with the ability to submit CIS returns always being an add-on.

Best known for: Medius is a smart spend management suite which manages the source-to-pay process.

Medius is another high scoring service provider with a G2 rating of 4.4⁸. Reviewers commented on how easy it was to use, the ability to customise the tool, and AI features spending up their processes.

Medius offers two different packages and provides a custom quote to each business.

Best known for: Microsoft Dynamics 365 is an AI-powered Entreprise Resource Planning and Customer Relationship Management platform.

Microsoft Dynamics 365 receives a score of 4.0⁹ and is praised for its ease of use, integrations, and financial management capabilities. One review stated that:

“The integration with other Microsoft tools (like Outlook, Excel, and Teams) is a game-changer. We particularly appreciate the real-time reporting and financial visibility, which helps us make informed decisions faster. It's flexible, scalable, and perfect for companies looking to digitize operations without overwhelming complexity⁹.”

Microsoft Dynamics 365 offers a free trial before offering plans at £53.80 or £76.90 a month¹⁵, both billed annually. You can also add team members with limited capabilities for an additional £6.20 a month.

With so many accounts payable automation software options available, making the right choice for your business can feel overwhelming. Here are some tips for picking the best accounts payable automation software for your business. Consider:

Once you’ve established the answers to these questions, you’ll have some key data points you can use to compare your potential suppliers, especially when it comes to pricing.

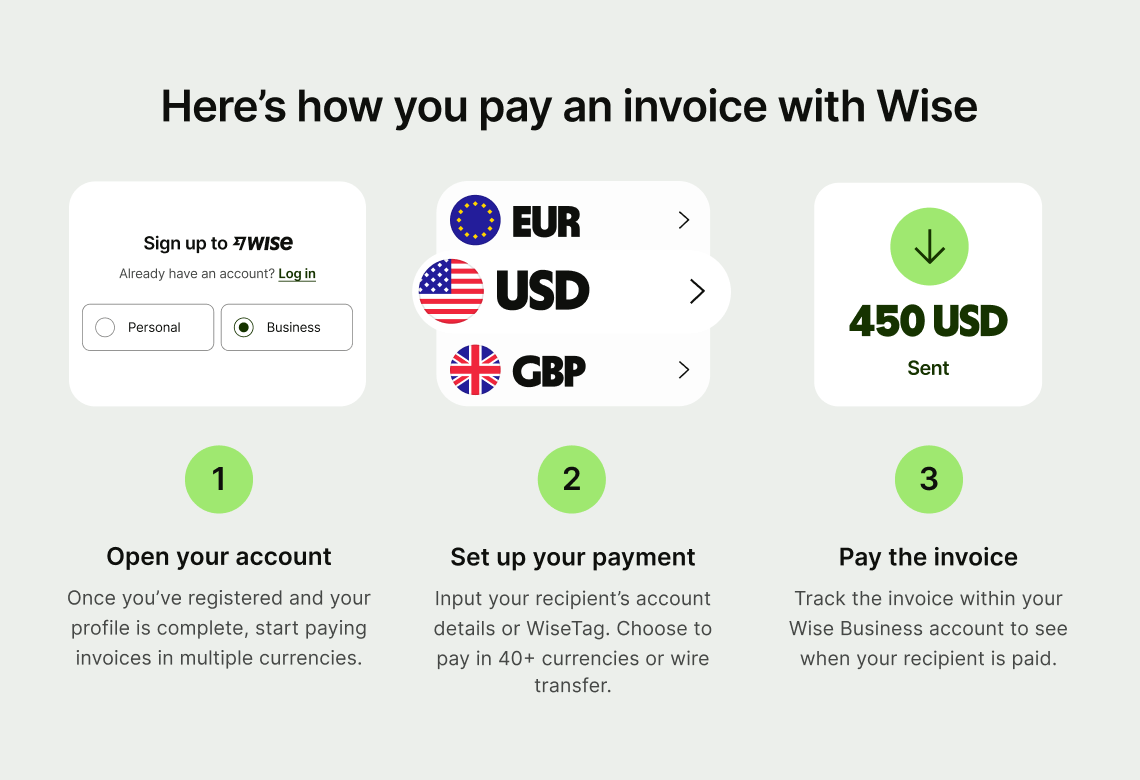

Open a Wise Business account and you’ll be able to pay bills and invoices in 40+ currencies in just a few clicks.

You can easily make batch payments when paying multiple suppliers at once, and even automate the process using the Wise API to save even more time.

Wise payments are fast and fully secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

Get started with Wise Business 🚀

One of the key benefits of accounts payable automation software is that it saves you time by automating your processes. At the same time, it can also reduce errors by flagging any duplicate or suspicious transactions.

Accounts payable automation can enhance security and compliance in a number of ways. Firstly, it provides you with a digital audit trail you can trace at any time. It also has the ability to verify bank details so that all your invoices are paid to the correct person. Finally, it detects any duplicate or suspicious transactions, flagging these before they become potential issues.

Implementing accounts payable automation software is increasingly straightforward with many providers receiving praise for how easy their products are to use and their user interface. In addition, many offer simple switchover methods should you ever change provider.

Yes, some accounts payable automation tools can help your business with global payments. However, not all software providers are able to process international payments. Wise Business specialises in global payments, making it the ideal account to send all your international payments regardless of which accounts payable tools you choose to implement.

Get started with Wise Business 🚀

As you can see, there are many accounts payable automation tools available and a number of factors to consider before making a decision. When you’re deciding on the right tool for your business, make sure you consider the features you need most so that you’re not paying for features that your business won’t use. You may also want to consider how your chosen tool integrates with other software you already use. For example, if you use Wise Business to receive international payments, we’d recommend using an accounts payable automation tool which has a native integration with Wise.

Find out more about Wise Business

Sources used :

Sources last checked on 12-Aug 2025.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

Check out our helpful guide to transferring large amounts with Revolut Business, including transfer times, limits and how to set up your first payment.

Discover the best AI tools to automate your business in 2025. From marketing to HR, streamline workflows, save time, and boost productivity.

Streamline invoice processing and boost cash flow with AP automation. Learn how it works and the tools to help your business grow.

Discover the process related to cross border payments, steps, fees involved and providers that enable international payments, including Wise Business.

Learn how to choose the best Cloudflare plan for your business needs and how to save on costs in the UK.