How to Accept Payments Online in the UK - 2025 Guide

It’s increasingly important for UK businesses to be able to process payments online, to be able to connect with the biggest possible pool of customers...

Many businesses in the UK use a debt management and collections system to streamline the process of following up unpaid invoices and other failed payments, such as missed customer card payments. Using debt management software can make it easier to track and manage the payments which are due to come into your business, and give you off the shelf tools to follow up with customers in a way that encourages payment while retaining engagement and brand loyalty.

This guide covers some great options for debt collection software which you may want to consider for your business, to make the process of following up delinquent payments simple and customer-centric.

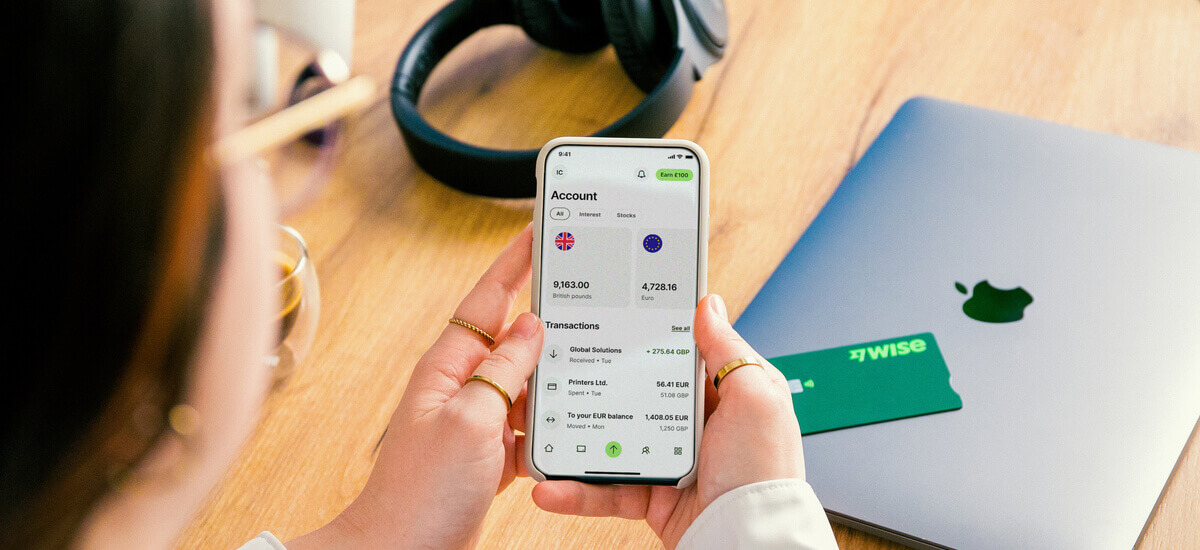

Managing your business finances means having all the right partners lined up to streamline transactions and keep costs low. While you’re thinking about improving your business collections, why not also look at Wise Business to hold and exchange 40+ currencies, and get paid in 8+ currencies, with the mid-market exchange rate and low, transparent fees every time.

💡 Learn more about Wise Business

Debt management and collections software is often offered by specialist providers which have cloud based solutions that integrate with your existing business systems, to make debt collections faster and easier.

Your debt management and collections system can help you keep an overview of all of the debts and missed payments which may be owed to your business, and devise appropriate approaches to settle each scenario. Many tools use AI and machine learning to generate customer-centric solutions which can help you get paid whilst protecting the relationship you have with your customer. The software can automate customer messaging for example, sending reminders and simple ways to pay, with legally compliant and rules based systems in place for payments which are not settled within your preferred timescales.

Depending on the needs your business has, the debt management and the collections process can be combined from one provider, or they can be found in separated solutions. Many software services have a customisable or configurable system which allows you to pick the modules you need, and leave those which aren’t relevant to your specific business model.

While debt and collections management may not be a highlight of the job for most business owners, it is extremely important. Not only is it needed to manage your own profits and cash flow, it’s also an area which requires compliance to law and best practices. Get the process wrong and you may not be paid - and you may also lose the customer’s future business entirely. Get it right and you may find issues are resolved easily, and can even build brand loyalty where customers feel they’ve been fairly treated in the end.

Keeping this balance can be far easier with effective debt and collections management software which automates some or all of the process, keeping on top of things so you can focus your energies elsewhere. This review of popular debt management and collections software providers in the UK should give you some inspiration to start your research.

There are many different debt management and collections software providers which work with UK businesses to help support the entire collections lifecycle. The products which they offer do vary in some of the features available - but providers generally offer a product tour or demonstration to allow you to assess if the provider may be a good fit.

In this guide we’ve selected 4 popular debt management and collections software providers, with a quick highlight of the features on offer. To learn more you’ll need to talk to a member of the sales team from your preferred provider, to get a view of the costs, features and benefits which you can expect. Here are the providers we will look at today:

| Provider name | Main features | Best for |

|---|---|---|

| C&R Debt manager | Highly configurable, cloud based end to end debt management solutions | Suite of solutions you can deploy without need for additional hardware of customisation |

| Sidetrade Cash Collection | Customer focused and AI driven collections and dispute resolution processes | Machine learning approach to debt management to predict and respond to customer behaviour |

| CivicaCollect | Centralised, customisable and compliant debt management and recovery tools | Integrations with your existing systems, to manage the full collection cycle smoothly |

| Exus debt collection | Flexible model which allows you to import various data sources and collaborate with third party providers as needed | Tools to support the full debt lifecycle and automate routine processes and tasks to reduce the admin needed |

C&R Debt manager1 systems have been in use in over 20 industries for 40+ years. The system is cloud based and works on a configuration model - so you simply pick the pieces of the software which you need based on your business requirements, rather than having to build out a full custom made service from scratch. The tools offered include a dashboard for overview of the debts your business is owed, customer and account level workflow protocols, full customer communication history for ease of ongoing case management, and rules based repayment options.

C&R Debt manager systems are also innovating with AI powered chatbot tools which offer a self-serve experience for customers in collection.

Sidetrade Cash Collection2 services are AI and machine learning based which allows for augmented tools to help you get paid faster and with less friction. Tools include augmented order, invoice and collection products which automate processes to streamline getting paid and reduce the days sales outstanding at any given time. Examples include customer specific collection strategies which take into account customer profile and payment behaviours. This saves your finance team needing to manually categorise customers to decide on the approach to take, and can result in better outcomes.

Sidetrade’s tools also cover dispute resolution, credit risk management and analytics to make the management of your business finances more straightforward.

CivicaCollect3 debt management and recovery software can be integrated with your existing business software to allow you to see all of the ongoing cases that are being managed conveniently in one place. The tools cover the full debt collection cycle, and have pre-built workflows which can help ensure recovery opportunities are never missed. Customers can access a self service portal to manage their own debts in a convenient way, which makes timely payment compliance more likely.

The software is compliant with all relevant regulations and industry best practices and offers real time data so you can keep on top of all debt recovery actions easily and without unnecessary administrative burden.

Exus debt collection4 tools support the full debt lifecycle and can automate routine processes and tasks to reduce the admin needed. The software supports customer interaction and offers data driven decision tools to allow your team to better manage customer debts. You can also seamlessly integrate third party partners where needed to enhance your in house debt collection abilities.

To see how the system works you can book a demo and a product tour with the provider, which gives insights into the configurable build designed to help you keep ahead of developments in technology or best practice.

If your business also collects international payments Wise can help you get paid by customers in multiple currencies, with low fees and the mid-market exchange rate.

Your Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

All you need to do is pass these account details to your customer, or add them to invoices, and your customer can make a local payment in their preferred currency. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Get started with Wise Business 🚀

Debt management doesn’t have to be antagonistic, and with a good debt management software provider you’ll find it far easier to manage collections while retaining customer loyalty. This guide gives a few ideas for places to start your search.

Plus, while you’re looking for partner providers for your business, why not also look at Wise Business for accounts which support 40+ currencies, with local account details for 8+ currencies, which you can use to receive customer payments in a foreign currencies stress-free.

Sources used in this article:

Sources last checked March 31, 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

It’s increasingly important for UK businesses to be able to process payments online, to be able to connect with the biggest possible pool of customers...

If you want to take customer payments digitally, you may be trying to decide which merchant account to open. A merchant account is sometimes used to receive...

Compare Takepayment card machine fees, contract flexibility, and service in our 2025 review. See if it hits that sweet spot for your business!

Read our complete guide on merchant payment services. We cover what it is, how it works and how to choose your merchant payment service provider.

If you’re selling goods or services online, or taking online payments for any other business type, you’ll need to learn about how online payment processing...

Discover how Airwallex's payment gateway works to facilitate global payments for UK businesses.