How to Accept Payments Online in the UK - 2025 Guide

It’s increasingly important for UK businesses to be able to process payments online, to be able to connect with the biggest possible pool of customers...

If you’re selling goods or services online, or taking online payments for any other business type, you’ll need to learn about how online payment processing fees work and what your costs are likely to be. Finding the cheapest online payment processing for your most common types of transactions can mean that you keep more of your money in the end, and lose less in fees and charges.

This guide looks at an overview of some of the cheapest card processing fees in the UK for different business types, to help you figure out which may work for you.

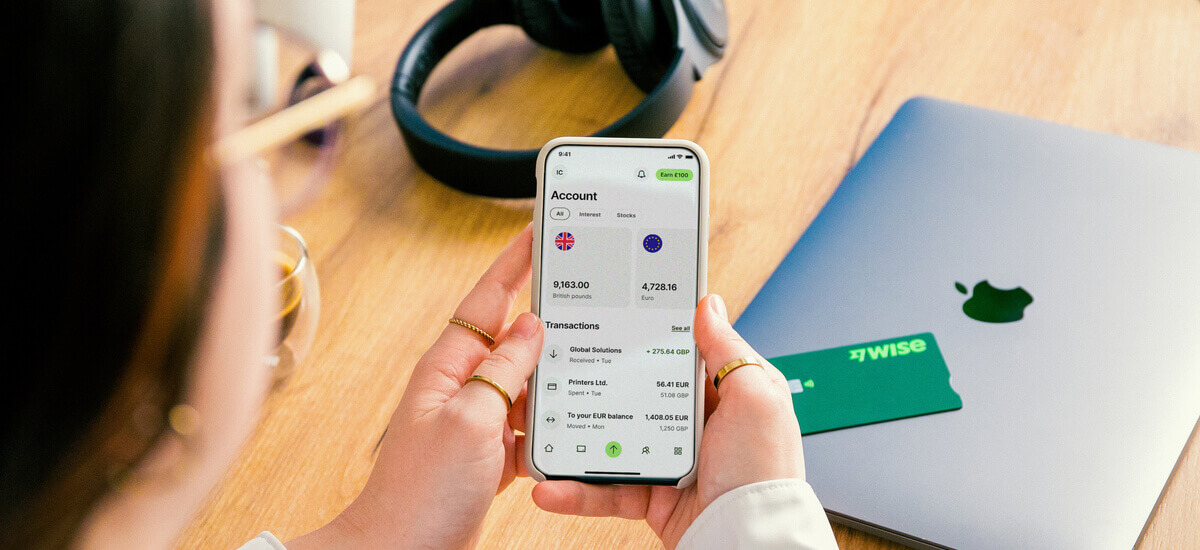

Accept customer card payments in 18+ major currencies with Wise Business. Plus, receive payments using local and SWIFT account details, payment links and QR codes - all with no ongoing charges and just low, transparent transaction fees.

💡 Learn more about Wise Business

Before we look at the cheapest payment processing online in the UK, let’s start with a look at how payment processing works. As a UK business owner, you’ll need to line up a few things before you start to take customer online payments - usually including a payment processing provider and a payment gateway. These services might be provided by the same service, or may be from 2 separate companies.

Once you have all the tools needed to take a payment, the flow will go like this:

The ways that a provider’s pricing structure works for online payment processing can depend on the services you need to access. This means that there are different ‘cheapest’ payment processing services depending on exactly what you need - the provider which offers the cheapest online credit card payment processing may not offer the cheapest processing for recurring bank transfers, for example.

This means you need to compare a few different options based on the way you need to take payments, to see which is cheapest for you.

The fees you need to watch out for when you compare the pricing structures available from different providers can include:

The best way to reduce costs when accepting payments online is to shop around. It takes time, but it’s an investment in your business, as finding the cheapest payment processing service based on your specific business needs can mean you spend less on fees and earn more in profit in the end.

The cheapest online payment processing in the UK for your business will depend on a range of factors including the type of payments you want to take, the way you sell to your customers, and whether you want to pay a monthly fee. There’s no one simple answer here as every business is different. Here we’ve highlighted some of the core costs for 5 great options in the UK for you to consider:

| Provider | Payment processing fee | Might be cheapest for |

|---|---|---|

| Wise | 1% for domestic cards and 2.9% for international or business cards - received in the payment currency, to avoid currency conversion costs at the point of payment | Global payments |

| Shopify¹ | From 1.5% + £0.25 on the Advanced plan, which also has monthly fees of £259 | Ecommerce sellers |

| Gocardless² | From 1% + £0.20 for domestic recurring payments and 2% + £0.20 for international | Recurring payments |

| Stripe³ | From 2.5% + £0.20 for European Economic Area cards + 2% if currency conversion is required | Standard card payments from in the EEA |

| Worldpay⁴ | Get a custom quote to check pricing in your specific case | Large businesses accepting high volume payments |

*Details correct at time of research - 29th June 2025

Wise Business lets you take customer card payments in 18+ major currencies with no need to convert your funds back to GBP instantly.

This means you avoid the currency conversion fees that are common with payments from abroad, and can hold your balance in foreign currencies to pay suppliers or contractors later if you would like to. If you choose to convert back to GBP later, you’ll get the mid-market exchange rate.

Wise also has ways to get paid using local and SWIFT account information, payment links and QR codes.

| Payment type | Wise fee |

|---|---|

| Accept domestic UK card payment | 1% |

| Accept international card payment | 2.9% Currency conversion available using the mid market rate and low fees which vary by currency |

| Accept business card payment | 2.9% |

| Accept bank transfer | No fee to receive payments using local account information Small fees apply if you receive SWIFT payments which vary by currency and Wire USD payments |

*Details correct at time of research - 29th June 2025

Get started with Wise Business 🚀

If you’re an ecommerce seller using Shopify, you’ll pay an extra fee if you use a separate payment processing service. You can avoid this by using the Shopify payments system which has variable fees depending on the plan you select.

You can sign up to Shopify with a monthly cost of 19 GBP/month or choose one of the more advanced plans which cost up to 259 GBP monthly. These plans come with lots of features that are necessary or helpful for online selling, with payment processing as an extra perk.

| Payment type | Shopify fee¹ |

|---|---|

| Accept domestic UK card payment | From 1.5% + £0.25 on the Advanced plan, which also has monthly fees of £259 |

| Accept international card payment | From 2.5% + £0.25 on the Advanced plan |

| Accept Buy Now, Pay Later payment | From 4.99% + £0.30 |

*Details correct at time of research - 29th June 2025

Gocardless offers bank to bank payment processing rather than card payments, which can be especially useful for taking subscription or recurring payments from customers. Fees depend on where the payment is from, and there are a range of different price points depending on exactly which services you need.

| Payment type | Gocardless fee² |

|---|---|

| Accept domestic UK payment | From 1% + £0.20 on the Standard plan |

| Accept international payment | From 2% + £0.20 on the Standard plan |

*Details correct at time of research - 29th June 2025

Stripe is one of the biggest payment processing services in the UK, and has an extremely broad range of service options including custom plans for larger businesses. You can take many different types of payment and also get extras like fraud prevention tools. We’ve set out some of the core payment costs here, but there’s plenty more to read on the Stripe website.

| Payment type | Stripe fee³ |

|---|---|

| Accept domestic UK card payment | 1.5% + £0.20 for standard UK cards 1.9% + £0.20 for premium UK cards |

| Accept international card payment | 2.5% + £0.20 for European Economic Area cards 3.25% + £0.20 for international cards + 2% if currency conversion is required |

| Accept Buy Now, Pay Later payment | From 4.99% + £0.35 |

| Accept bank transfer | 1% for Bacs Direct Debit Minimum fee of £0.20 With a £4 cap |

*Details correct at time of research - 29th June 2025

Worldpay⁴ processes a huge proportion of the online payments which initiate in the UK, and works with large and small businesses. Services cover online, in person, omnichannel and embedded payments, with extras like fraud prevention tools available.

Worldpay pricing is done on an individually quoted basis, so to learn how much the services might cost for your business you’ll need to initiate a quote based on your likely transaction types and volumes.

Complex payment gateway integrations are in the past, you can start accepting credit and debit card payments in 18+ currencies in minutes with Wise, no code required.

Just send a payment link, invoice, or QR code to your customers, and let Wise handle the rest, ensuring timely payments and improving your cash flow. This streamlined approach wipes out the technical challenges and time-consuming setup associated with traditional payment gateways, allowing you to focus on what truly matters: growing your business.

Say goodbye to high and complex payment processing fees. Wise Business offers a transparent, low-cost solution with just 1% fee for domestic cards and 2.9% for international and business cards.

And once the payment is done you can manage multiple currencies effortlessly, all in one account. Enhance your customer relationships and support your business's global expansion with a payment solution that prioritises simplicity and efficiency.

Get started with Wise Business 🚀

The costs of online payment processing depend on the provider, and can be influenced by the payment method, card type, currency and where the payment is initiated. International payments can be more expensive than domestic payments, and can include costs of currency conversion.

Read the fee schedule for your preferred provider carefully, looking out for all costs you may run into. While all costs should be set out clearly, some may be unexpected - in particular look at currency conversion costs for international payments and fees for things like chargebacks and disputes.

Different payment processors have very different fees, so the only way to know which is cheapest for you will be to compare a few options. Monthly fees can vary from under 20 GBP/month, to several hundreds of pounds a month, but can also mean you get lower per transaction fees and many more features to help you run your business. Shop around to decide which combination is best for you.

There’s no single cheapest online payment processor for UK businesses - it will depend on the type and volume of transactions that you need to accept. This guide covers some popular options, and gives you some pointers to consider when you choose.

Don’t forget to take into consideration the costs of international payments and currency conversion - see if you can save with Wise Business, to accept customer card payments in 18+ major currencies and get paid using local and SWIFT account details, payment links and QR codes - all with no ongoing charges and just low, transparent transaction fees.

Sources used in this article:

Sources last checked 29/06/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

It’s increasingly important for UK businesses to be able to process payments online, to be able to connect with the biggest possible pool of customers...

If you want to take customer payments digitally, you may be trying to decide which merchant account to open. A merchant account is sometimes used to receive...

Compare Takepayment card machine fees, contract flexibility, and service in our 2025 review. See if it hits that sweet spot for your business!

Read our complete guide on merchant payment services. We cover what it is, how it works and how to choose your merchant payment service provider.

Discover how Airwallex's payment gateway works to facilitate global payments for UK businesses.

Discover how to accept card payments as a small business in the UK, check providers, fees and best practices.