Microsoft 365 and Copilot pricing and plan guide UK 2025

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

Running payroll sounds simple: pay people on time and stay compliant. But for small and growing UK businesses, it’s rarely that straightforward. From HMRC compliance to handling pensions, sick leave, and year-end reporting, payroll can take time and energy.

In this article, we’re looking at the best payroll service providers in the UK. We’ll walk through what they offer, who they’re best for, and how they compare to help you choose. We’ll also show how Wise Business can help send international payments without the high costs and delays that come with traditional banking.

💡 Learn more about Wise Business

A payroll provider handles the entire payroll process for you. That means calculating wages, deducting tax and National Insurance, submitting reports to HMRC, managing pensions, handling maternity or sick leave, and ensuring everyone’s paid correctly and on time.

For small and midsized businesses, using a payroll service saves time, reduces errors, and removes the risk of falling out of compliance. Here are some of the main services you can expect from payroll service providers in the UK:

In the following sections, we’ll cover the following payroll providers:

We will discuss each payroll provider's strengths and weaknesses. Here's a quick side-by-side look.

| Provider | Monthly fee | Best known for |

|---|---|---|

| Moorepay | Custom | Comprehensive payroll and HR solutions |

| Payescape | Varies, starts at £53¹ | Cloud-based payroll, managed payroll, outsourcing payroll, HR, and time management solutions |

| MHR | Custom | Automated payroll, real-time payroll, HR software, managed payroll service |

| Frontier Software | Custom | Global compliance, payroll outsourcing services, comprehensive HR and payroll software |

| Just Payroll | Custom | Fully managed payroll services, Bacs-approved bureau status, UK compliance, and international payroll support. |

| Zellis | Contact sales | AI-enabled HR, workforce management and payroll software and services |

Each payroll provider brings something slightly different to the table. Some are better for straightforward payroll, while others are built for bigger and/or international teams. Let’s see how they compare.

If your payroll provider doesn’t handle international transfers, try Wise Business. You can send money to over 140+ countries all at the mid-market exchange rate with no markups.

💡 Learn more about Wise Business

Moorepay has been around since 1966 and has over 500 team members; that scale translates into well-defined systems.³

They’re part of the Zellis Group⁴ and are HMRC and Payroll Assurance Scheme accredited. In 2023, they won the CIPP’s Payroll Service Provider of the Year award.

Best for: UK businesses that want reliable payroll services, integration with core finance and HR systems and 24/7 support.

Moorepay is best known for combining sector-wide compliance standards with strong automation. It handles complex pay adjustments, including net-to-gross calculations, maternity or sick leave, and over/underpayments, with built-in error validation aligned to FCA and Bacs requirements.

Moorepay’s platform generates essential statutory reports (P45s, P60s, and P11Ds), along with optional general ledger files and custom, audit-ready outputs that support reconciliation and year-end review.

While ideal for UK operations, Moorepay doesn’t support global payroll. If your team includes overseas employees or contractors, you’ll need a cross-border payment solution like Wise Business to manage international disbursements efficiently.

💡 Learn more about Wise Business

Pricing is custom and starts at around £5 - £8 per employee per month.⁶ Additional services, such as custom reports, may add between £100 and £300 to annual costs.

Moorepay integrates well with Enterprise Planning Solutions (ERPs), Customer Relationship Management Systems (CRMs), and time-tracking tools.⁷ These integrations reduce manual data entry and improve data consistency across departments.

Payescape has been simplifying payroll for UK businesses since 2006.⁸ With ISO 27001 certification, HMRC and Bacs approval, and a 98% client retention rate, it’s designed for UK businesses that want a reliable, no-fuss system to run payroll anywhere, anytime.

Best for: Businesses looking for an intuitive cloud-based payroll service.

Unlike more complex enterprise tools, Payescape integrates payroll, HR, and time tracking into one lightweight platform, with no need to juggle multiple systems.

It's built-in self-service portal empowers employees to view payslips and update personal info, reducing admin overhead. Payescape’s cloud-based service lets you manage taxes, HMRC filings and auto-enrolment from anywhere with any device.

Pricing starts at £53 a month, plus about £3.20 per employee¹. Which means a team of 30 would pay roughly £149. That makes it a solid choice for smaller businesses that want a clear monthly cost. It’s time and attendance tool is called TimeEscape,⁹ which is fully integrated for real-time data sharing, routine automation, and increased efficiency. They also support external integrations with third-party tools like Xero and QuickBooks.

MHR provides payroll services with over 40 years of experience and a 99.98% payroll accuracy rate.¹⁰ Their team of CIPP- and IPASS-accredited experts processes payroll for over 10% of the UK and Ireland workforce.

Best for: Small businesses and large or growing enterprises that need real-time payroll with built-in compliance.

They handle full responsibility for international payroll, from input and calculations to reporting and compliance, pension administration, and even emergency cover, helping you avoid errors. Their payroll software, People First,¹¹ allows employees to view their estimated monthly pay.

Pricing depends on the package, but smaller businesses might pay anywhere from £200 to £1,000 per month.¹² Cost varies based on the number of employees and the services you need. MHR integrates with tools like CloudPay to simplify payroll.

Frontier’s Pay supports payroll in over 26 countries², allowing you to manage global pay runs from one platform. For instance, if your business operates in the UK, Singapore, and the US, you can handle all payroll activity within a single, unified system.

Best for: Businesses that operate internationally and need a unified platform for global payroll compliance.

Frontier handles everything from calculations and payslip generation to legal compliance in each country it serves. They ensure that tax codes, deductions, and employment legislation are always updated.

You can securely input payroll data into their platform, from any location, and employees have access to self-service tools to view payslips and update details.

Pricing is custom, so you’ll need to contact their team. You can easily integrate it with your legacy systems. Their native API or pre-built Workato connector¹³ makes it possible to connect applications, automate tasks and get real-time data.

Just Payroll Services offers both UK and global payroll, but its standout feature is the level of personal service it provides. They assign dedicated account managers to handle your accounts, answer questions, and deal with pay cycle issues.

Best for: Businesses that value direct, personal support and need UK and international payroll in one place.

Their global payroll services cover 130+ countries and offer in-country set-up and employee payments.¹⁴ They offer tools for employee self-service and payroll reporting, such as journal and remittance reports. They’re also a Bacs-approved bureau, which means payments are processed securely and efficiently.

Pricing is fully bespoke. With integration to fit your current systems.

Zellis serves some of the UK and Ireland’s largest employers. Like Moorepay, Zellis is part of the Zellis Group but focuses on larger businesses with more than 1,000 employees. They earned the Payroll Software Supplier of the Year title at the Global Payroll Association Awards 2024.¹⁵

Best for: Mid-size to large businesses across UK territories with complex payroll needs.

Zellis delivers more than payroll processing. It automates over 400 compliance checks, including National Minimum Wage enforcement, pension auto-enrolment, P11Ds, off-payroll working regulations, and CEO pay ratio reporting.¹⁶ Their Faster Payments integration enables real-time payroll transfers, cutting errors and improving flexibility.

Reporting is a standout feature: finance teams gain access to 200+ templates and custom dashboards powered by the Zellis Intelligence Platform. The system also includes configurable self-service portals (MyPay and MyView), seamless Microsoft 365 integration, and dedicated modules for pensions and total reward statements.¹⁵

Pricing is custom and starts around £200 a month for smaller teams¹⁷, but it quickly scales based on requirements. Zellis allows integration with HR systems like Rotageek for integrated scheduling or Eploy for talent acquisition.¹⁸

Finding the right payroll provider starts with knowing what your business actually needs. Below are tips to help you choose:

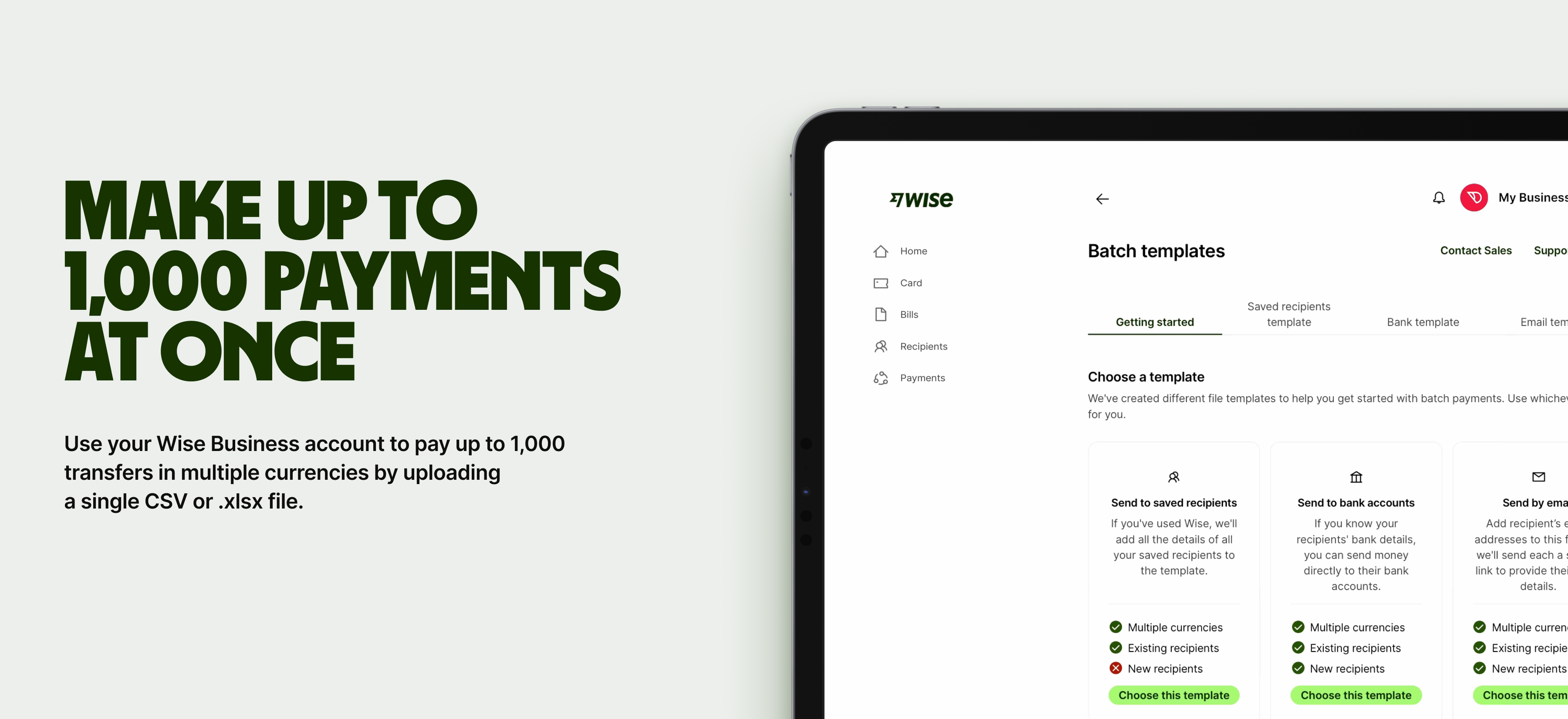

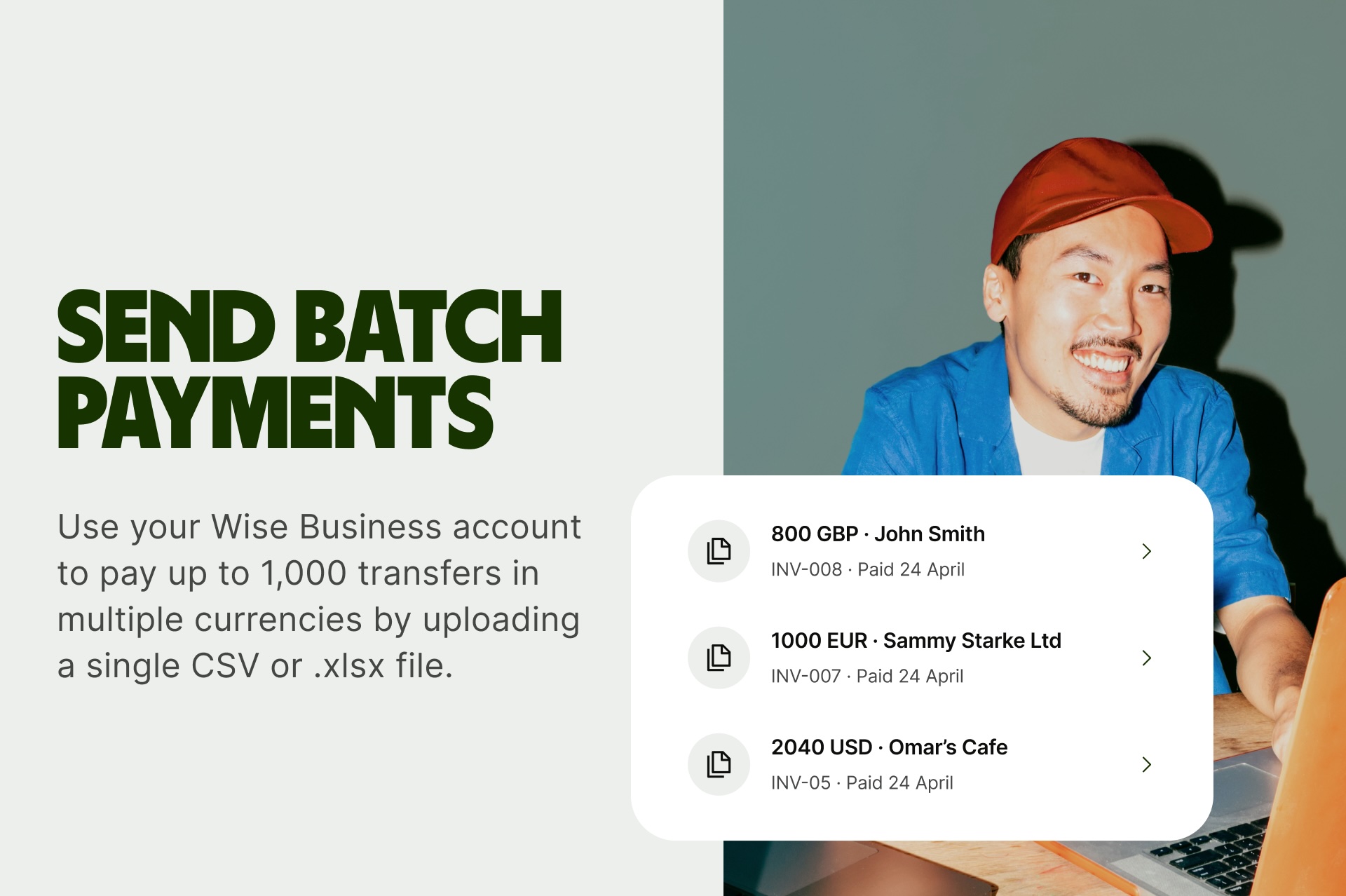

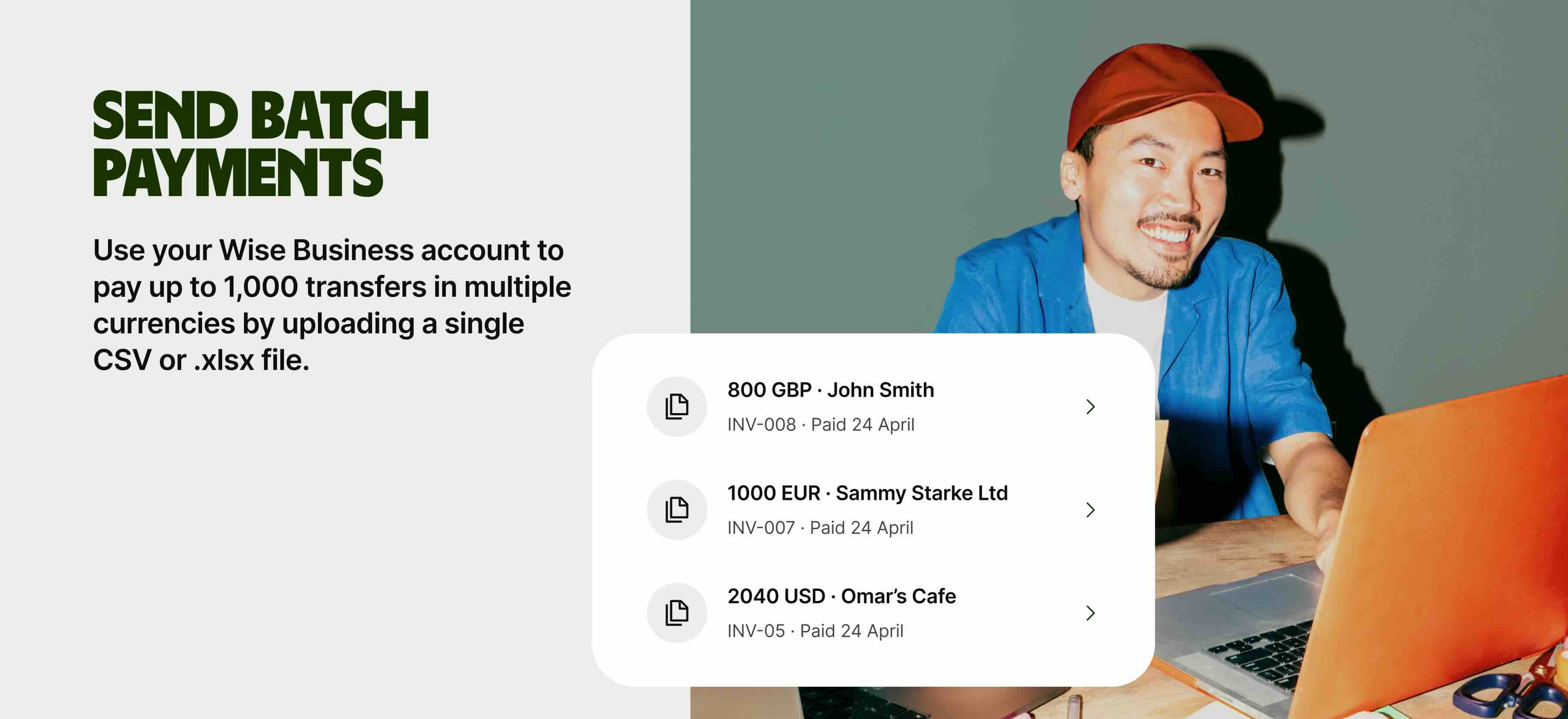

Open a Wise Business account and you’ll be able to pay international employees in their own currency. You can send to 140+ countries in just a few clicks using the Batch Payments tool or even automate the process entirely using the Wise API.

Wise payments are fast¹⁹ and secure (even for large amounts). Best of all, you’ll only pay low, transparent fees and always get the mid-market exchange rate.

Get started with Wise Business 🚀

Are you deciding whether to outsource payroll or keep it in-house? These common questions will help clarify your options.

A fully managed payroll service takes care of the entire payroll process from start to finish. This usually covers calculating salaries and processing statutory deductions. They also handle auto-enrolment for pensions, generate payslips, and submit RTI to HMRC.

Outsourcing payroll can be more cost-effective for small to midsized businesses that don’t have dedicated payroll staff. It reduces time spent on admin, lowers the risk of mistakes, and avoids the cost of payroll software and training.

Payroll software gives you the tools to run payroll yourself, while a managed service handles it for you. With managed payroll, the provider handles calculations, files with HMRC, and manages every technicality. You still review and approve pay runs, but they handle the rest. It’s a good option if you want to save time and reduce the risk of mistakes.

Sources used in this article:

Sources last checked on 27/06/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore the latest Microsoft pricing in the UK for 2025. Find out which plans and add-ons suit your business and how to save on your subscription costs.

Check out our helpful guide to transferring large amounts with Revolut Business, including transfer times, limits and how to set up your first payment.

Discover the best AI tools to automate your business in 2025. From marketing to HR, streamline workflows, save time, and boost productivity.

Streamline invoice processing and boost cash flow with AP automation. Learn how it works and the tools to help your business grow.

Discover the process related to cross border payments, steps, fees involved and providers that enable international payments, including Wise Business.

Discover the best accounts payable automation software providers for business in the UK. Check features, reviews and pricing.