All-In-One Corporate Services: Is a Sleek Business Account Right for You?

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Citibank corporate cards are some of the most popular business credit cards in Singapore. You can use your card to pay invoices, manage your expenses or earn cash back rewards.

Let’s take a look at everything you need to know about Citibank’s corporate credit cards, including key features, fees and benefits.

We’ll also look at Wise Business – your international transfer alternative. Send, spend and receive your money across the globe. Let’s dive in!

| Table of contents |

|---|

Here’s a quick snapshot of how the cards compare – we’ll take a look at each card in a little more detail later.

| Card | Annual fee | Minimum income | Foreign transaction fee | Cash back and benefits |

|---|---|---|---|---|

| Citibank Corporate Card | 150 SGD per card¹ | 100,000 SGD net worth – depending on years of operation¹ | Citibank may add up to 3.25% in administrative fees for foreign currency payments² | Earn up to 0.5% cash back rewards Citi World Privileges – get global discounts and deals¹ |

| Citibank Business Card | 150 SGD per card³ | Citibank doesn’t mention minimum income requirements online – speak to your Citibank branch for more information | Citibank may add up to 3.25% for foreign payments² | Earn 2x cash back points for spending with your card Travel accident insurance coverage – up to 1,000,000 SGD per card member³ |

| Citi Purchasing Card | 28.04 SGD per card⁴ | 100,000 SGD net worth – depending on years of operation⁴ | Citibank may add up to 3.25% in administrative fees for foreign currency payments² | Get up to 0.5% cash back rewards Travel accident insurance cover – up to 1,000,000 SGD⁴ |

| Wise Business Card | No annual fees** – pay a one-time fee of 99 SGD to access foreign currency account details | No minimum income requirements | No foreign transaction fees or exchange rate markups | Earn returns of up to 3.64% on your Wise Business account Send money from 0.26% |

*Details accurate as of 17th January 2025

**Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Corporate cards help business owners manage and control their expenses. You can issue a corporate credit card to your employees for business purchases, such as trips abroad.

You can also analyse how your employees spend company money – and you can often integrate accounting software to keep on top of your cash flow.

| 💡Unlike a business credit card, which is typically available to all businesses, you may need to own a large, well-established company before you can apply for a corporate card. |

|---|

These credit cards tend to solve issues like unchecked spending. You can easily cap your employees’ spending limits and review your receipts online.⁵

As well as Citibank’s corporate credit cards, you can also access a Citi Travel Account for your business.

This is an easy way for international Singapore companies to get cash back rewards and customised corporate travel expense reports.⁶

Good Reads:

➡️ Which Company Credit Card is Best for Businesses in Singapore in 2025?

➡️ Review of HSBC Business Credit Cards in Singapore: Features and Benefits

The Citibank Corporate Card can help you keep on top of your business expenses, with advanced cash flow support and cash back rewards for spending.

Key features of the Citi Corporate Card include:

Let’s take a look at some pros and cons of using the Citibank Corporate Card for your business.

| Pros | Cons |

|---|---|

| Get exclusive memberships and discounts, such as worldwide travel deals¹ | You’ll pay a foreign currency transaction fee of 3.25% for international payments |

| Pay your Citibank Corporate Credit Card bill via the bank’s online banking portal⁷ | Your business may need a minimum net worth of 100,000 SGD to qualify |

| Make multiple payments and repayments at once | You’ll pay 150 SGD per card each year |

The Citibank Business Credit Card is suitable for small and medium business enterprises in Singapore. You can use your card to enhance your company’s cash flow and better manage your business expenses.⁶

Key features of the Citibank Business Card:

Here are some pros and cons of the Citi Business Card.

| Pros | Cons |

|---|---|

| Get up to 55 days of interest-free credit to extend your cash flow³ | You’ll pay 150 SGD per card each year |

| Access expense statements to view and track your company’s spending³ | You’ll pay a 15 SGD or 8% fee to withdraw a cash advance, plus interest charges² |

| Get travel accident insurance for up to 1,000,000 SGD per card member | You may pay up to 3.25% in administrative fees for foreign currency payments |

The Citi Purchasing Card is suitable for Singaporean businesses of all shapes and sizes. You can streamline your expenditure and access affordable features to improve your company’s growth.⁴

Key features of the Citi Purchasing Card:

Let’s take a look at some pros and cons of the Citi Purchasing Card for businesses in Singapore.

| Pros | Cons |

|---|---|

| You’ll only pay 28.04 SGD per card each year | Your business may need a net worth of 100,000 SGD to qualify |

| You can access a corporate liability waiver and travel accident insurance cover⁴ | You can’t get cash advances with the Citi Purchasing Card² |

| Get consolidated spending data about your business⁴ | You’ll pay late payment charges of 100 SGD per month plus 2% of your outstanding balance² |

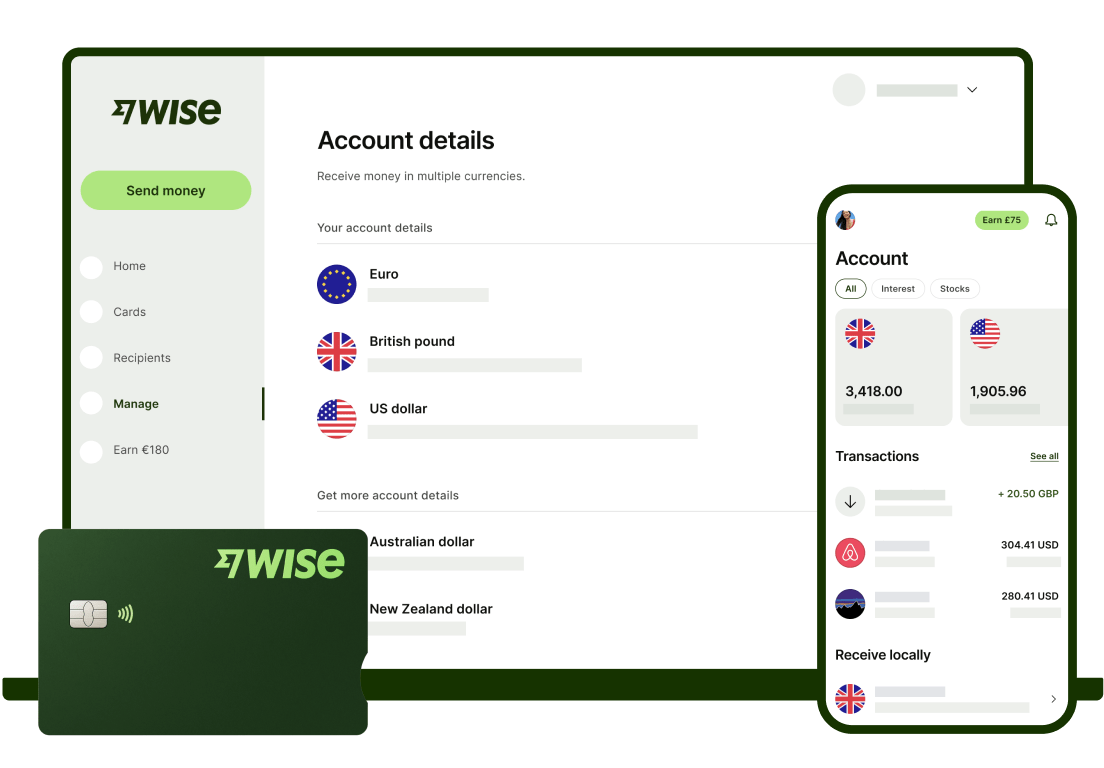

Illustration of Wise Business products

Wise Business is an alternative business banking solution built to handle global payments for growing businesses.

Send and receive your money across the globe, with low transfer fees and no currency conversion markups – all for a one-time fee of just 99 SGD.

You can use your Wise Business card to:

🔸Although Citibank’s corporate cards offer good cashback rewards, you’ll pay a transaction fee for any foreign purchases. 🔸Your foreign currency transactions will be converted to US dollars, then Singapore dollars. This conversion is based on Citibank’s foreign exchange rate rather than the standard mid-market rate you might see online. 🔸The bank also adds up to 3.25% for foreign transfers. This can all add to the cost of your international card payments.² |

|---|

At Wise, you’ll never pay a markup on the fair mid-market exchange rate for card payments in foreign currencies.

Wise doesn’t add hefty hidden fees for international transactions and you can even use Wise’s pricing calculator to work out exactly how much you’ll pay.

Make quick and easy cross-border transactions – all without eating into your profits. Learn more about how to use the Wise Business card for your global spending.

| 📝 Citibank corporate credit cards have carved out a space for themselves in the business world, catering to well-established companies of all sizes in Singapore. You can use your Citi corporate credit card to access cash back rewards and complimentary deals or discounts. However, you’ll need to think about how much it costs to use your card, particularly if you regularly spend money overseas. |

|---|

Use your Wise Business card to avoid hefty exchange rate costs or hidden fees abroad, whether you’re paying an invoice in India or buying goods in the UK.

With Wise Business, it's easier than ever to manage your international spending and access a transparent forex conversion fee pricing structure for you and your company.

Get started with Wise Business today!

Sources checked on 17th January 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.

Compare Airwallex vs Wise Business for Singapore companies and find out which multi-currency account suits your business needs best.

Everything you need to know about using multi-currency business accounts in Singapore.