All-In-One Corporate Services: Is a Sleek Business Account Right for You?

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

If your Singapore business serves an international clientele or works with partners and vendors globally, you will likely be managing payments and transactions across multiple currencies.

While traditional banks do allow you to make payments globally, they often come with hefty fees and conversion costs. There may even be instances where you have had to pay on both ends: the sender’s bank and the recipient’s bank.

The solution? Multi-currency business accounts, such as Wise Business, which enable your company to manage foreign currency transactions while enjoying low conversion fees and mid-market foreign exchange rates.

If you are getting your feet wet with multi-currency accounts and need a quick primer, this essential guide will cover all you need to know.

As its name suggests, a multi-currency account allows you to hold, send, and receive money in multiple currencies all in a single account, without the need to convert them back to your home currency immediately.

This removes the need to set up separate bank accounts in different countries, allowing businesses to save costs, time, and avoid unnecessary paperwork.

If you already own a personal multi-currency account, you may be wondering if there’s a need to set up a separate corporate account for your business.

While Sole Proprietors, Partnerships, and Limited Partnership businesses in Singapore can use a personal bank account, businesses are highly encouraged to use a separate multi-currency account for multiple reasons.

We'll dive into these later on.

| ➡️ Read more about using your personal bank account for business in Singapore |

|---|

Other than keeping your finances separate for tax filing and compliance, most corporate multi-currency accounts usually offer additional features not available in personal accounts, at no extra cost.

These include¹:

We’ve all been there. Having to refer to a master list of account details and logins, and having to locate the right authenticator software before you can log in to a bank account, just to process one transaction.

A multi-currency business account allows you to manage all your international transactions within a single account, a single login. Plus, you get to see all your currencies on a single screen, too.

If you have sent or received money via an overseas bank, you would have felt the pinch of the hefty costs.

Plus, many banks charge a fixed fee on foreign transactions regardless of the amount being sent, which feels punishing, especially for Singapore businesses trying to break into a new international market.

A multi-currency business account, such as Wise Business, allows you to save costs in several ways.

Traditionally, international transactions are known to take days to process.

Long lead times of foreign payments and international banking fees can dampen a business’s global growth and strain relationships with your employees, partners and vendors - because they are all expecting to be paid as soon as possible.

Axpara, a Singapore-headquartered software development company that helps businesses build and manage remote software development teams across Southeast Asia, had to solve these issues before it could unlock growth. Switching to a Wise Business account allowed them to scale internationally while saving upwards of SGD 50,000 a year.

| 🚀 Read how Axpara used Wise Business to overcome clunky international payment methods and unlock growth in new markets. |

|---|

Managing all your foreign transactions within a single account gives you a consolidated view of your income and expenses. Many multi-currency business accounts can be integrated with accounting software like QuickBooks, allowing you to skip the manual work of consolidating your finances.

Managing the finances of multiple subsidiaries can be a complicated process with so many moving parts. Having a multi-currency business account helps streamline your cash management while allowing you to keep track of your finances as they occur.

| 💡If you're growing a global business, you'll quickly face a daunting wall of costs, complexity, and hidden fees when receiving international payments. Wise Business helps you bypass this wall, making it easy to receive money from around the world and start getting paid like a local today. |

|---|

➡️Get started with Wise Business today

Depending on the provider, you can open a multi-currency business account either online or offline at a physical branch. Thanks to Corppass², most businesses in Singapore can apply for a multi-currency account within a single verification and multiple clicks. However, if you prefer to work with a representative, you may need to visit a branch to set up your account.

As long as you have a registered business in Singapore, most providers would allow you to open a multi-currency business account. Depending on the provider, you may be required to make an initial deposit before the account can be activated.

You may need to produce your government-issued ID, ACRA business profile and supporting documents such as a certified True Copy of Constitution and Account Opening Resolution, in order to proceed.

While multi-currency accounts help your business to lower expenses, there are still fees involved. Depending on the provider, you may need to pay the following:

Also known as the account opening fee, you may be charged a one-time set-up fee for your multi-currency business account.

Depending on your provider, you may need to set aside cash for an initial deposit. There may be different requirements depending on the currency that you wish to transact in as well.

This is typically a fixed monthly maintenance fee required by certain providers. For example, DBS’s³ and OCBC’s⁴ multi-currency accounts come with a SGD 10 monthly account fee.

Some providers charge a fee whenever your account balance drops below their minimum balance requirement.

These fees can be calculated based on a daily or monthly minimum balance.

The good news is, most digital multi-currency account providers do not charge this fee. If you do not wish to have cash idling in your account, you should take note of this requirement when selecting your multi-currency account provider.

This fee is charged whenever you perform a currency conversion in your multi-currency account. The amount depends on your provider.

Wise Business keeps conversion fees low and transparent, so you always know how much you’re being charged before you approve any transactions.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

You may be required to pay a cash holding fee on certain currencies when you hit an upper limit. The upper limit and its resultant fee vary depending on the provider of the multi-currency account.

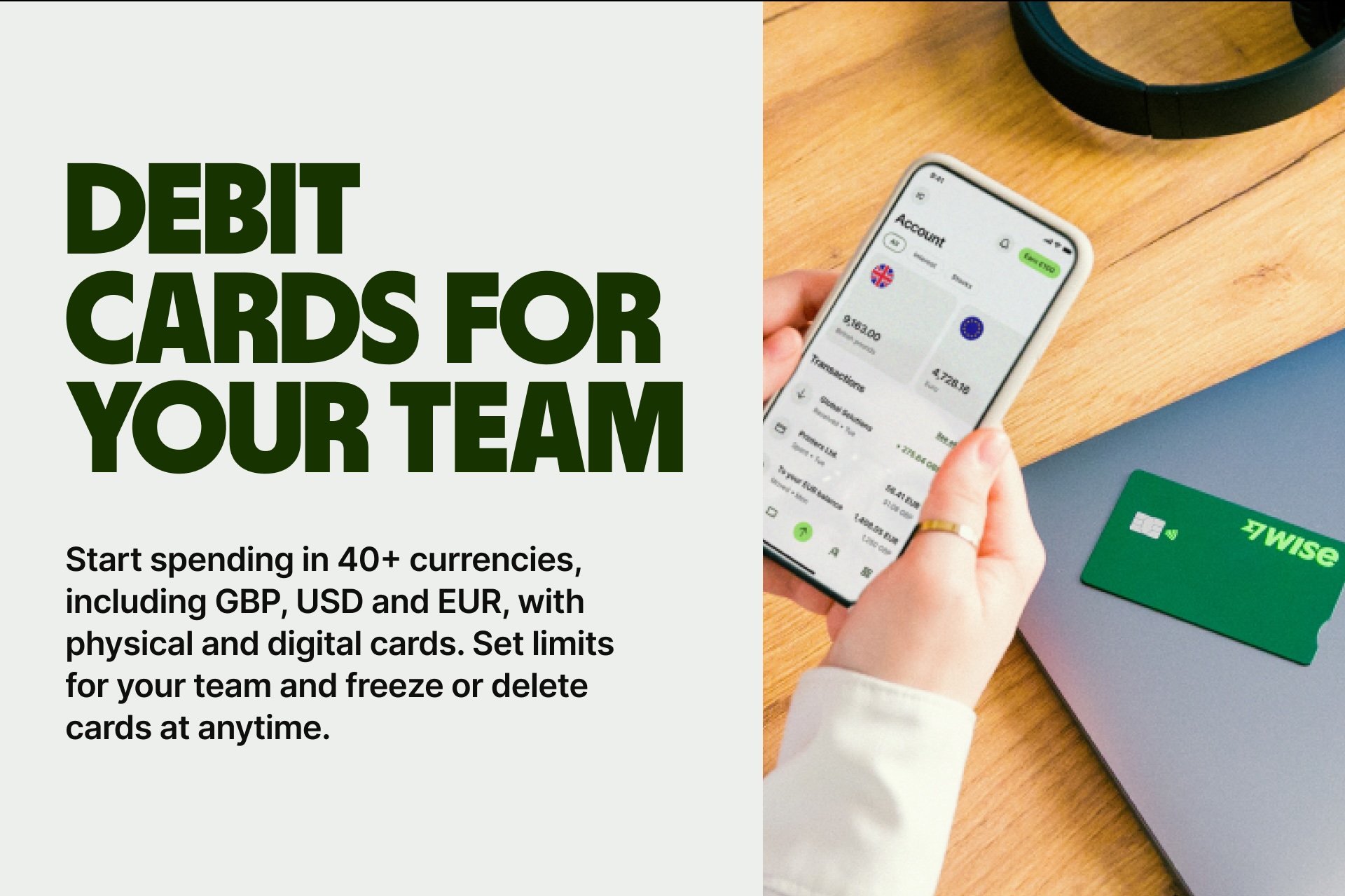

Most, if not all, multi-currency business accounts can issue physical or virtual debit cards. The fee structure for the use of these cards varies across providers and their offerings. If you intend to issue debit cards to your employees, you should take note of the card transaction fees that you may be liable for. Some common examples of these fees include ATM fees, conversion fees, foreign transaction fees, and withdrawal fees.

| 💡Need to manage your team’s expenses more efficiently? Give them their own Wise Business Cards and connect them to your Wise Business account. No more using personal cards for business expenditure. No more manually reconciling personal card reimbursements. Wise Business lets you monitor and approve card payments instantly. |

|---|

➡️Get your Wise Business Card today

Singapore businesses are spoilt for choice with a range of familiar traditional business banks and some non-bank providers to select from. Here’s a brief overview of the most popular ones.

DBS Business Multi-Currency Account lets you hold and transact in SGD and 12 other currencies, including AUD, CAD, CHF, CNH, EUR, GBP, HKD, JPY, NOK, NZD, SEK, and USD. The account also offers free FAST and GIRO transactions and the option to enjoy cashback on its debit card.

OCBC’s multi-currency business account lets you trade in 13 currencies, including USD, EUR, AUD, JPY, GBP, CNH, HKD, CAD, NZD, CHF, SEK, DKK, and NOK. There are no set-up fees, fall below fees or initial deposit required.

UOB’s Corporate Global Currency Account lets users trade in 9 foreign currencies, including USD, AUD, CAD, EUR, JPY, NZD, GBP, CHF, HKD and CNH, while earning daily interest on selected currencies.

Aspire lets users transact over 30 currencies and offers free local transfers in SGD, USD and IDR, without requiring any minimum balance or charging fall below fees.

Wise Business lets you manage 40+ currencies while enjoying low-fee transactions and saving on hidden foreign exchange markups. You can also opt to get physical or digital business cards that let you control expenses, while letting your team members spend conveniently without the hassle of paying out of pocket and having to process claims later.

➡️ Learn more about Wise Business

Revolut Business lets users manage 30+ currencies within the account while enabling withdrawals in over 140 currencies with the Revolut Business card. While they offer a free tier, you may wish to subscribe for more features, depending on your business’s needs.

YouBiz allows users to hold and transact across 9 currencies, including SGD, USD, EUR, GBP, JPY, HKD, AUD, CHF and THB. Businesses also enjoy unlimited cashback and 0% FX fees with their YouBiz corporate card.

| ➡️ Still unsure which one to choose? Check out our review of the best corporate business accounts in Singapore. |

|---|

Other than low foreign exchange rates and low conversion fees, you should also look out for features that could help improve the efficiency of your business’s financial processes. For example, batch payment options allow you to make numerous payments in one go. Having an invoicing tool allows you to invoice and keep track of payments easily. Integration with accounting software enables you to skip the manual work of consolidating transactions across accounts.

The whole point of opening a multi-currency business account is to save on fees and charges. Hence, you should pay special attention to fee structures, transaction fees, currency conversion fees, account fees, and any other charges that you are liable for.

Select the best multi-currency account for your business based on your usage volume, required currencies and the option to scale.

Depending on your business’s usage volume, this may be an important feature to consider. If you require a high volume of foreign exchange transactions each month, you may need to select providers that offer unlimited transactions or those that do not charge fees based on the number of transactions you process.

And if your business is required to hold a large sum of cash in another currency, you should check if your provider charges a cash holding fee.

This comes in particularly handy to ensure you get help when things go wrong, giving you the confidence that your business’s day-to-day workflows will not be disrupted.

Reputable institutions comply with strict regulations and industry standards to protect your business’s money and financial information, giving you peace of mind.

Having physical branches, ATMs, and online access enables you and your team to process payments and make withdrawals seamlessly without worry.

Integration options with your accounting systems enable efficient onboarding and accurate financial tracking and processes without affecting what already works for your business now.

Corporate cards allow your team to spend globally with ease while simplifying expense management.

| ➡️ Further Reading: Which Company Credit Card is Best for Businesses in Singapore in 2025? |

|---|

If your Singapore business is looking to grow globally, having a multi-currency business account will empower your team to operate internationally with confidence, control, and cost-efficiency. From reducing hidden fees to streamlining expense tracking and improving cash flow visibility, having the right multi-currency account sets the foundation for smarter, faster global expansion.

Don’t let clunky systems or costly foreign exchange conversions hold you back. Take the first step toward a more borderless business today.

➡️ Get Started with Wise Business today

Sources:

Sources checked on 18 July 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.

Compare Airwallex vs Wise Business for Singapore companies and find out which multi-currency account suits your business needs best.

Discover Instarem Business for Singapore companies, and compare features and fees with Wise Business to find the best fit for your needs.