All-In-One Corporate Services: Is a Sleek Business Account Right for You?

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

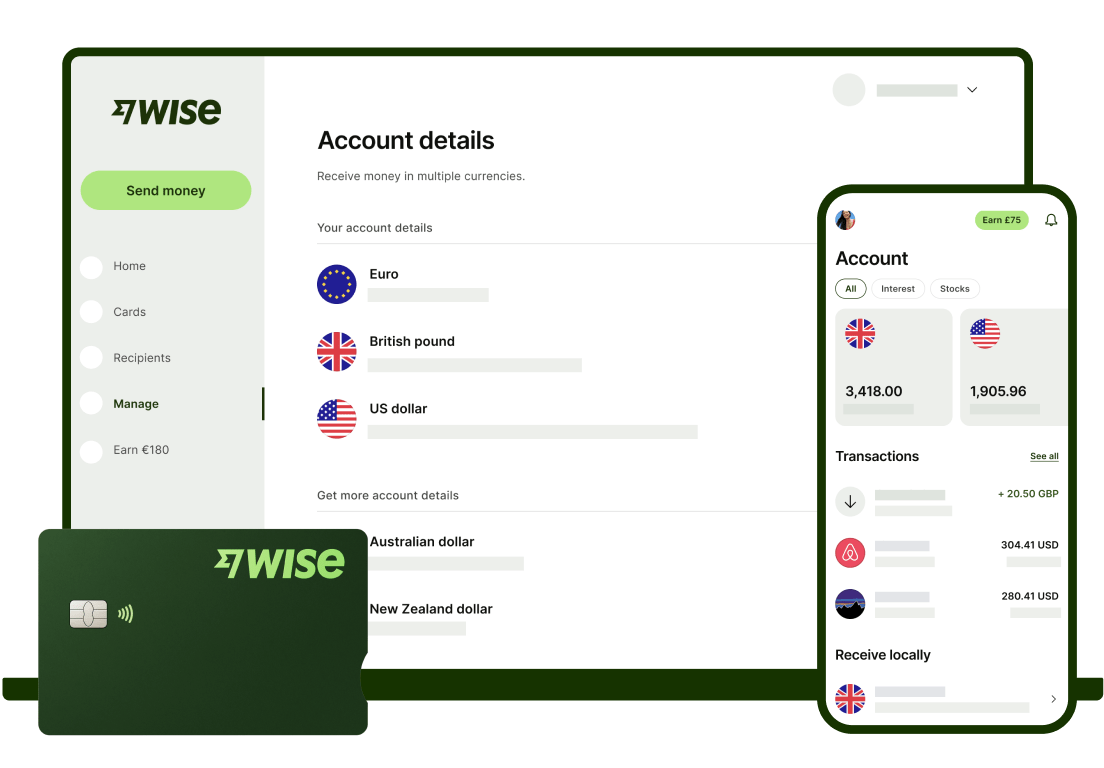

Wise is a financial technology company specialising in currency conversion which uses the mid-market exchange rate, with account options for personal and business customers. The company launched in the UK in 2011, with international payment services which stood out for being fast, efficient and using the mid-market rate. Over time, Wise also added in personal account and card services, and then Wise Business accounts and cards to support freelancers and business owners trading at home and abroad.

In Singapore, Wise is licensed by the Monetary Authority of Singapore (MAS) as a Major Payment Institution under the Payment Services Act.

If you’re not sure whether to open a Wise personal account or an account with Wise Business this guide is for you. We'll cover:

| Table of contents |

|---|

| Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information. |

|---|

The major difference between Wise Business vs personal accounts?

Wise Business adds on some pretty smart features to help businesses grow and operate on a global scale - like more visibility and control of expenses, batch payments, and accounting integrations.

Here’s a quick overview of the main differences between the Wise personal and business accounts - there’s more detail coming up later on each.

| Feature | Business | Personal |

|---|---|---|

| International transfers at the mid-market rate with low, transparent fees | ✔️ | ✔️ |

| Hold over 40+ currencies | ✔️ | ✔️ |

| Account details for 8+ currencies | ✔️ | ✔️ |

| Send money to 140+ countries | ✔️ | ✔️ |

| Interest | ✔️ | ✔️ |

| Free invoicing tool | ✔️ | ❌ |

| Accounting software integrations | ✔️ | ❌ |

| Batch payments | ✔️ | ❌ |

| Multi-user permissions | ✔️ | ❌ |

| Receive Stripe and Amazon payouts | ✔️ | ❌ |

| Wise open API | ✔️ | ❌ |

| Wise Business Card | ✔️ | ❌ |

| Employee cards and expense management | ✔️ | ❌ |

| Download statements, including tax statements, trade order report or holding statements | ✔️ | ❌ |

*Details correct at time of research, 27th February 2025

Both Wise personal and business accounts in Singapore offer an easy, low-cost way to send international transfers and receive payments in a selection of foreign currencies - they both also have the option to add on a linked debit card for spending and cash withdrawals around the world.

However, there are some key differences you need to be aware of.

The personal Wise account is ideal for individuals who travel for work and leisure, or need to send, spend, or receive money internationally on a frequent basis. The account can hold over 40 currencies, with conversions made at the mid-market exchange rate. Account holders can also obtain a Wise Multi-Currency card, which can be used to spend in different currencies across without any foreign transaction fees across 231 countries.

| 📝 It's important to note the personal account cannot be used for business transactions, as this is against the terms of use. If a customer wishes to use Wise as a business, they can get a Wise Business account instead as it offers more features with business functionality. |

|---|

The Wise Business account offers an affordable way for Singapore businesses to send international transfers and receive payments from abroad in multiple currencies. With conversions at the mid-market exchange rate, this account includes features and tools designed to streamline business operations, organise your company's finances and expenses, reduce transaction costs, and ensure timely payments.

Let’s imagine you already:

If you then launch a business in Singapore you might be thinking about continuing to use your Wise personal account to pay your overseas suppliers, or to receive payments through PSPs like Stripe and marketplaces like Amazon.

This isn’t necessarily a good plan, for a couple of important reasons.

Even where it’s not obligatory to have a separate business account, you’ll still find there are good reasons to open a Wise Business account.

Illustration of Wise Business products

Wise Business accounts offer extra benefits which are optimised for business customers, including:

TLDR: By continuing to use your Wise personal account to manage your company finances, you’re missing out on a lot of great perks that Wise Business has to offer.

When you open a Wise Business account, you'll get access to a slew of exciting business account features for a one-time fee of 99 SGD. That's right - No hidden fees or monthly subscriptions, or monthly bank charges.

Let's dive into some of these features in detail.

With a Wise Business account you can create professional looking invoices to issue to customers. This isn’t an option with a Wise personal account.

Being able to bill clients with a sleek and professionally appropriate invoice is important to build your company’s brand.

Issue your invoice and then use the Wise Business account to receive payment, allowing you to offer your customer the choice to pay you in their preferred currency, even if they’re abroad.

The easier you make it for customers and clients to pay, the better for everyone!

| ➡️ Check out the Wise Business Invoicing Tool here ⬅️ |

|---|

Wise Business accounts offer a Batch Payments tool to make up to 1,000 payouts in one go.

This can be very helpful if you’re paying multiple suppliers or contractors, or if you’re using your account to handle payroll. All you’ll need to do is upload one spreadsheet to send multiple payments in whichever currencies you need, hassle free, and with low and transparent Wise transfer costs.

The Wise Business account offers accounting integrations with your favourite cloud accounting solutions like Xero and QuickBooks. This makes it easy to keep track of your business finances, with all your payments and transactions reconciled across multiple currencies.

Wise personal accounts do not offer cloud accounting tools - so to use this handy feature you’ll need to register your Wise Business account instead.

The final important difference you should be aware of is the availability of multi-user access.

With Wise Business you can set and manage user permissions to allow your team members to access your account in the ways which are important for their specific job.

You can choose from various different user profiles to make sure different team members can only access the information you want to share with them. This allows you - for example - to give your finance team access to manage payments, while still restricting the access for other employees for security.

If you issue employee expense cards, you can set permissions to ensure individual card owners can see only their own transactions and limits, allowing them to manage their business expenses without impacting account security at all.

Keeping costs to a minimum is a no-brainer when running a business - and using a Wise Business account can be a very simple way to manage your finances with flexible account and card services with low service fees and no ongoing costs to worry about.

Here’s a look at the Wise Business fees compared to the Wise personal fees to give you a quick idea.

| Service | Wise Personal | Wise Business |

|---|---|---|

| Register a Wise account | Free | Free |

| Monthly fee | No monthly fee | No monthly fee |

| Hold 40+ currencies | Free | Free |

| Order a Wise card | 8.5 SGD one time fee | Free for first card 4 SGD for replacement |

| Send international payments | From 0.26% | From 0.26% |

| ATM withdrawals | 2 withdrawals, to 350 SGD/month fee free* 1.5 SGD + 1.75% after that | 2 withdrawals, to 350 SGD/month fee free* 1.5 SGD + 1.75% after that |

| Get account details for 20+ foreign currencies | Free | 99 SGD one-time fee for full account features |

| Receive local payments in AUD, CAD, EUR, GBP, HUF, NZD, SGD, TRY, and USD (non SWIFT, non wire) | Free | Free |

| Receive USD wire or SWIFT | 6.11 USD | 6.11 USD |

| Receive CAD SWIFT payment | 10 CAD | 10 CAD |

*Details correct at time of research - 27th February 2025

*Wise will not charge you for these withdrawals, but some additional charges may occur from independent ATM networks

| 💡 Remember, Wise Business gives you access to a host of business tools and integrations at no extra cost. Unlike many other business account providers that charge extra subscription fees for these features, Wise Business only charges a low one-time fee. There's no monthly or annual fees after that. Register online and use the features you need, when you need them. |

|---|

The Wise Business account is designed for business use. 600,000 business customers already use Wise Business each quarter.

Most Singapore business types will be able use the Wise Business account, including:

| Take your SG business global with powerful Wise Business features | |

|---|---|

| 🚀 Always Get the Mid-Market Rate No more hidden markup fees or foreign transaction fees - We give you the exact mid-market exchange rate + a transparent, low conversion fee. | 🌍 Global Multi-Currency Account that Feels Local Send money to over 70 countries and manage multiple currencies without breaking a sweat. Get account details to receive payments in GBP, EUR, AUD and more currencies just like a local |

| 💸 Pay Once, Unlock Forever Forget about monthly charges or annual fees. With Wise Business, you can unlock the full suite of features for a one-time fee of 99 SGD | 💼 Batch Payments Brilliance Too many invoices? Power through up to 1,000 invoices in just one click with our Batch Payments Tool |

| 💳 Command Your Cash Flow with Wise Business Cards Give your team their own corporate debit cards to keep expenses clean and easy to monitor. Need more control? Approve payments, set spending limits, and freeze your card if you've lost it. | 📄 Free Invoicing Tool Level up your invoicing game with our free tool. Create and send professional invoices that not only get noticed but get paid. |

Learn more about Wise Business

You can easily register for a Wise Business account either from the Wise app or through the Wise desktop site. The process is designed to be very easy to navigate, so all you need is your phone or laptop and some key personal and business documents, like your passport or NRIC for ID, and your business registration information.

To get full feature access to your Wise Business account you’ll need to pay a one time fee 99 SGD. You’ll also be able to order your Wise Business debit and expense cards through the app, to transact easily at home and abroad.

There's no need to switch. Just open a personal account alongside your business one.

Keeping them separate makes it easier to track business receipts and expenses, and simplifies reconciliations and audits. Remember, a Wise personal account is not for business use.

To add a personal account from your business profile, click your name in the top right corner of the account screen, select “Get a personal account,” and follow the instructions.

If you prefer using just the personal account, withdraw funds from your business account and close it. You’ll then have only the Wise personal account.

Now you’ve got a clearer idea of the similarities and differences between Wise business and personal accounts, you should be able to decide if you need a Wise personal account or if you could get more benefits from Wise Business.

If you have a Singapore-registered business, then opening a business account to keep your personal and company finances separate is good practice.

The Wise Business account is one great option, but if you want to shop around some more,

| ➡️ Check out our full review of the best business banking accounts in Singapore ⬅️ |

|---|

⭐ Wise Business offers all of the great features you get with a Wise personal account - plus some handy extras focused on helping business owners including features like:

Get started with Wise Business today

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.

Compare Airwallex vs Wise Business for Singapore companies and find out which multi-currency account suits your business needs best.

Everything you need to know about using multi-currency business accounts in Singapore.