All-In-One Corporate Services: Is a Sleek Business Account Right for You?

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

HSBC has been part of Singapore’s financial scene since 1877, when it opened its first branch on the island. Today, it remains one of the major players in the corporate financial services sector in Singapore and across Asia, offering everything from project finance and advisory services to foreign exchange and business credit cards.

In this guide, we’ll walk you through the different HSBC business credit cards you can get in Singapore, covering their features, fees, and benefits. We’ll also take a look at how they compare against the Wise Business Card, a non-bank alternative that might fit your needs.

| Table of contents |

|---|

Here's a quick overview of the HSBC business credit cards we'll review along with the Wise Business Card - there's more detail coming up later on each*.

| Card | Annual fee | Cashback | Minimum Annual Income | Foreign transaction fee | Cashback and benefits |

|---|---|---|---|---|---|

| HSBC World Corporate Mastercard** | 150 SGD (subject to GST) | Information not available | Information not available | 3.25% | Travel insurance Fraud detection and corporate liability waiver |

| Wise Business Card | No annual fee. One time 4 SGD fee to get the card. One time 99 SGD fee for full business account features | None | None | No foreign transaction fee. Wise uses mid-market exchange rate. A small conversion fee is charged, starting at 0.26%. | Low fees on international payments 24/7 customer support No annual fee |

| HSBC Corporate Card for Purchases** | 150 SGD (subject to GST) | Information not available | Information not available | 3.25% | Streamline procurement processes 53 days interest-free |

| HSBC Virtual Card** | 150 SGD (subject to GST) | Information not available | Information not available | 3.25% | Generate unique card details for transactions Set spending and merchant limits. |

*Details correct at time of research - 16th January 2025

**This information is based on limited publicly available sources. Contact HSBC directly for full details on each card's charges, and benefits.

Corporate credit cards are given to employees by their employers to cover approved business expenses like travel, hotel stays, or office supplies. They function much like your personal credit card, allowing cardholders to make purchases in stores with chip-and-pin or contactless payments, or online by entering the card details, as well as to withdraw cash from ATMs.

| 💳 Company credit cards simplify expense tracking and give businesses more control: |

|---|

| ● Employers can set spending limits and specify which merchants or types of purchases are allowed. |

| ● They also save employees the hassle of using their own money to cover expenses and waiting for reimbursement. |

The HSBC World Corporate Mastercard is tailored for travel and entertainment expenses, making it best suited for companies that frequently send employees on business trips. It comes with travel insurance included, as well as a corporate liability waiver to guard against misuse, and software to catch fraudulent activity.

Businesses can set spending limits, dictate which categories of purchases are allowed, and choose which vendors employees can use their cards with. Cardholders can conveniently withdraw cash from over 1 million HSBC branches and ATMs worldwide, and make quick payments using contactless¹.

Through HSBC's online business banking platform, MiVision, HSBC World Corporate Mastercard customers are able to monitor and control business expenditures simply and effectively.

Pros:

Cons:

HSBC World Corporate Mastercard holders can also complement their card with an HSBC Central Travel Account. This lets companies enforce their corporate travel policies more effectively by, for example, limiting spending to approved travel agents, reducing the risk of misuse⁴.

*This information is based on limited publicly available sources. Contact HSBC directly for full details on each card's charges.

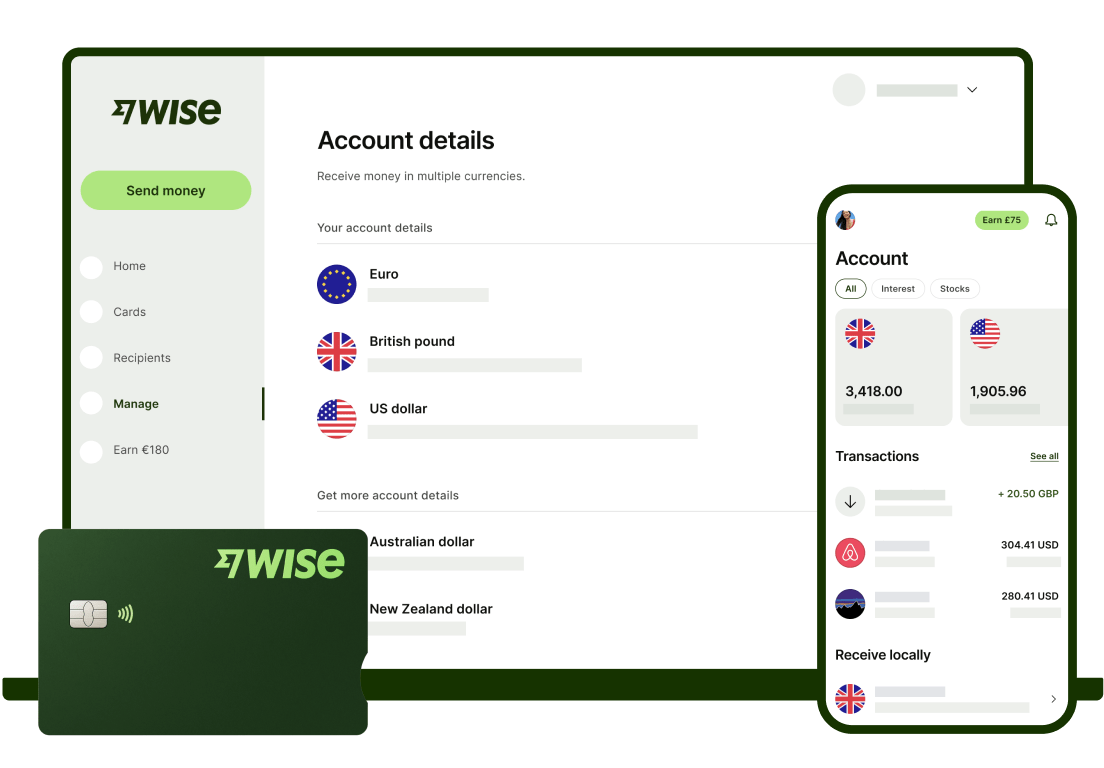

Illustration of Wise Business products

The Wise Business Card is a corporate debit card rather than a credit card, and Wise is a fintech company, not a traditional bank like HSBC.

However, the Wise Business Card can be issued by businesses to employees in much the same way to cover and manage day-to-day business expenses.

The card works hand-in-hand with the Wise Business Account, a multi-currency account that supports over 40 currencies for global transactions⁷. With the Wise Business Account, you can obtain local bank details, making it easier and cheaper to receive payments, just like you’re operating locally. The Wise Business Card uses funds from your account balance, automatically using the right local currency or converting it with low fees when needed.

The primary benefit of this card is the lower fees it offers businesses, especially for overseas payments. Wise uses the real mid-market exchange rate for transactions involving different currencies, applying only a small conversion fee starting at 0.26%, and does not charge any fees for overseas payments made in the same currency.

Pros:

Cons:

Learn more about Wise Business

*Pricing and Fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and information.

While the HSBC World Corporate Mastercard is more suited to travel and entertainment expenses, the HSBC Corporate Card for Purchases is designed for everyday expenses, such as office supplies, computer equipment and software, marketing spending, training, and other procurement needs.

It offers the same 53 interest-free days on purchases, the MiVision online management platform, and similar fees to the World Corporate Mastercard, but travel insurance is not included. Instead, it provides features that streamline the procure-to-pay process².

Pros:

Cons:

*This information is based on limited publicly available sources. Contact HSBC directly for full details on each card's charges.

For a card-free option, HSBC offers its Virtual Card. It lets you generate unique, single-use card and account numbers for transactions for more secure payments³.

Using a virtual card whenever possible helps to reduce the need for cash, physical cards, and cheques, which can make it easier to track and manage business expenses. It also saves the effort of issuing physical cards to employees. However, the downside is that this card can only be used for digital payments.

The HSBC Virtual Card comes with similar fraud protection, liability waivers, an online management and reporting platform, and fees as the other HSBC business credit cards.

Pros:

Cons:

To learn more about virtual cards, check out our review of the top virtual cards in Singaporehere.

*This information is based on limited publicly available sources. Contact HSBC directly for full details on each card's charges.

The HSBC business credit cards reviewed above are suitable for medium to large-sized Singaporean companies seeking robust safeguards, including:

| 📋 The HSBC World Corporate Mastercard may appeal to corporations with ongoing travel and entertainment expenses, while companies looking to streamline their procurement processes could benefit from the Corporate Card for Purchases. For employees who primarily make online payments, the Virtual Card may be a suitable option. |

|---|

However, one potential drawback to these cards is their associated fees, notably:

The Wise Business Card, on the other hand, may appeal to businesses of all sizes, including small businesses, due to its lower fees.

Unlike HSBC corporate cards, there is no annual fee with Wise—just a one-time fee of 4 SGD to order the physical card, and a one-time fee of 99 SGD to enjoy all business account features. You get two free ATM withdrawals or up to 350 SGD per month, after which there is a charge of 1.75% + 1.5 SGD on subsequent cash withdrawals.

It is particularly well-suited for companies that handle a large volume of international payments, thanks to its low currency conversion fee starting at just 0.26% and use of the mid-market exchange rate, ensuring profits aren’t eaten into by high or hidden foreign transaction fees.

| 🌟 Whichever HSBC business credit card you choose, the Wise Business Card can complement your international payment needs by offering: |

|---|

| ● No foreign transaction fees, |

| ● Low conversion rates, |

| ● Global expense management for your team, and |

| ● Superior flexibility for international transactions across multiple currencies. |

Get Started with Wise Business today

Sources checked on: 16th January 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.

Compare Airwallex vs Wise Business for Singapore companies and find out which multi-currency account suits your business needs best.

Everything you need to know about using multi-currency business accounts in Singapore.