Mission Update

Min fees. Max ease. Full speed.

Your payments, transfers and top-ups are now the cheapest and fastest they’ve been in years — plus, they can go further.

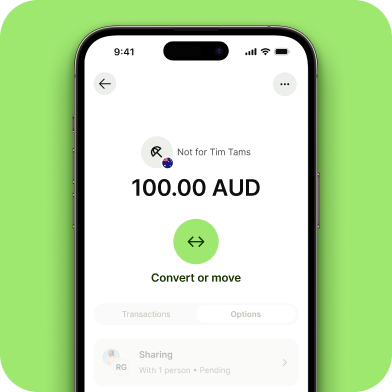

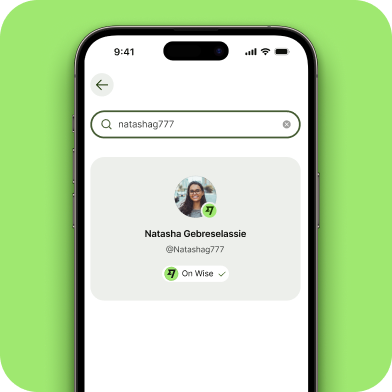

Plan, travel, spend — together

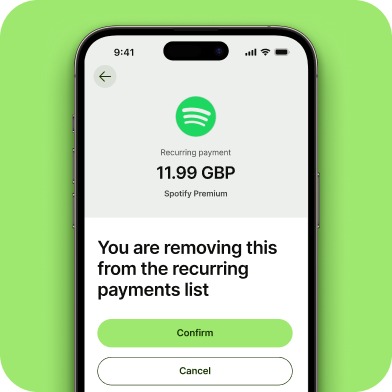

Smarter money management

¹ The price provided is a global average based on a fixed basket of representative currencies as of Q2 2025 and may not reflect specific prices for consumers in their regions. Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing information.

² Transaction speed claimed depends on individual circumstances and may not be available for all transactions.

³ Countries include Malta, Cyprus, Poland, Greece, Romania, Bulgaria, Croatia, Czech Republic, Latvia, Lithuania, Slovakia, and Slovenia.

⁴ Capital at risk. This fund has returned a 1.31% annual average on GBP, 1.8% on USD and 0.14% on EUR annual average over the last 5 years, excluding Wise and fund manager fees. The current rates do not guarantee future growth and your return may increase or decrease. For the full 5 year past performance of funds, please visit our website.