Opening a business bank account in the US as an Irish non-resident

Are you doing business in the United States from Ireland? Let's look at the requirements for opening a business bank account in the country.

For Irish residents running a business in Switzerland, having an account which lets you manage your money conveniently in CHF offers lots of advantages. You’ll be able to get paid in Swiss francs easily by customers, and send payments to local contractors and suppliers without needing to convert to and from euros. However, opening a business bank account in Switzerland from Ireland may be trickier than you expect.

This guide looks at some options to open a business bank account in Switzerland as a non-resident, so you can explore options based on your entity type and needs.

As Swiss non-resident business accounts can be pretty inconvenient to open, we’ll also explore how Wise Business can help you easily open an account which also lets you cut the costs of managing your business finances in CHF and EUR side by side.

Switzerland has a reputation as a financial hub, and many local, regional and international banks have a presence there. You can open many different types of business bank accounts in Switzerland - but some are reserved for large or resident businesses only.

Common bank account types in Switzerland can include:

- Corporate accounts for day to day business transactions

- Savings accounts to hold spare business cash

- Multi-currency accounts for international trade

- Merchant accounts primarily for online payments

In this guide we’re mainly considering your options for a day to day account for sole traders, SMEs or more established businesses. For other account types, consider contacting local Swiss banks directly to discuss their offerings based on your entity type and size.

There’s no legal reason why you can’t open a business bank account in Switzerland as a non-resident. However, banks in Switzerland tend to market their services at resident businesses, and large global multi-nationals, rather than SMEs with non-resident owners or directors.

This might mean that getting a business account from a bank is more hassle than you expect. If you want to stick with a Swiss bank for your business account, one to look at is CIM Banque¹, which lets you complete an online form stating the country your business is registered in, to get a call back to discuss your needs. If you’re eligible this could mean you can open a CHF denominated account, or get an account in a foreign currency if you need it.

Another option from a bank which operates in Ireland and Switzerland is N26. You can open a business account with N26 if you’re a sole trader working under your own name.² However, accounts are usually only EUR denominated, so this won’t necessarily be the cheapest or most convenient option if you’re looking for ways to send and receive CHF payments more frequently.

If neither of these options suit, you can call around Swiss banks, or work with an agent to help you find the right bank for your business needs. Or, if you're looking for another solution, skip the banks and take a look at Wise Business.

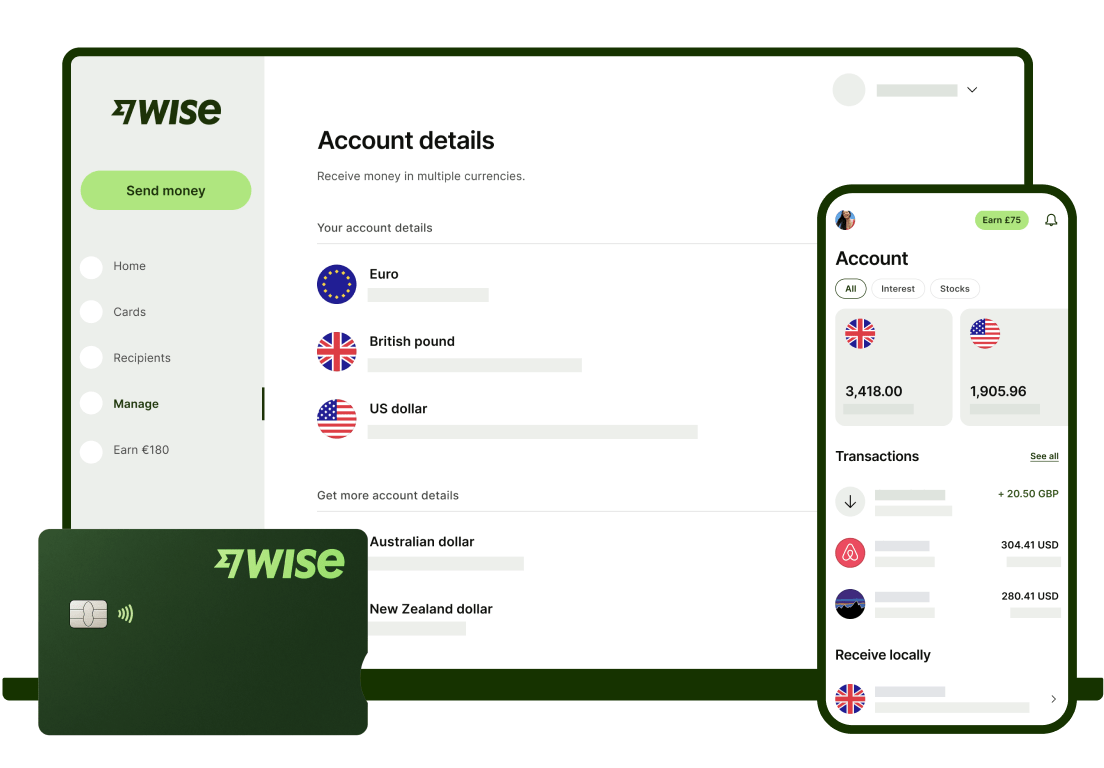

Wise as a payment institution which offers a business account that allows to hold CHF, EUR and 40+ other currencies, all in the same account. More on that later.

The documents you need to present to open a business bank account in Switzerland can vary depending on the bank you select, and your entity type. Banks are likely to put other eligibility criteria in place aside from the basic verification required by all customers, so what you need to produce may also depend on the specific account you’ve selected.

Check the details with your preferred bank, and be prepared to provide paperwork including:

- Valid passport or other government issued photo ID

- Proof of your address like a utility bill or rental agreement

- Certificate of incorporation or registration

- Tax Identification Number

- Other paperwork which varies by entity type and bank - such as your articles of association, business plan or organisational chart.

You’ll pretty much always need ID and address information for the account signatory, but you may also be asked to provide this for other important company members, such as directors or major shareholders. Check what’s needed - and if other directors can nominate a proxy to work on their behalf - before you start to open your account.

The best options for you to open a business bank account in Switzerland as a non-resident may depend on your specific needs, and the type of transaction you will make frequently.

Some banks with a physical presence in Switzerland may allow you to open an account there as a non-resident. However, this is likely to be a personalised process which means you need to contact the banks you’re interested in directly to discuss your needs and situation.

You may find it easier to get everything set up if the bank you use for your business in Ireland is also present in Switzerland. If that's the case, check if your local bank can help you move your account overseas without needing to complete more applications.

If you’re focused on convenience and need an account which lets you manage your finances in Switzerland digitally and with minimum fuss, there are still options.

Instead of a bank, take a look at digital providers like Wise Business which have account and card services you can open from Ireland, to hold CHF easily. You can also use your Wise Account in Switzerland to receive CHF payments with SWIFT details.

| Read also: Wise Business account features |

|---|

Wise isn’t a bank - but with a Wise Business account you can conveniently hold, send, spend, receive and exchange payments in CHF as well as EUR whenever you need to.

There are no ongoing fees for a Wise Business account, and you’ll be able to manage Euros and Swiss francs alongside 40+ currencies and convert your balance to the currency you need whenever you need to, with the mid-market exchange rate and low, transparent fees.

Wise Business accounts offer local and SWIFT account details to get paid in 8+ currencies. Use your SWIFT information to receive payment in CHF for a low fee of 3.55 CHF, or use your local EUR account details to receive transfers in euros for free.

Plus you can send money to 140+ countries, and get expense and debit cards for you and your team to spend and withdraw around the world.

Need more? Use Wise to save time too, with cloud accounting integrations, batch payment solutions, multi-user access and a powerful API to automate workflow.

Open your Wise Business

account online 🚀

Sources used:

1. CIM Banque - corporate

2. N26 - business plans

Sources last checked on date: 25/03/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Are you doing business in the United States from Ireland? Let's look at the requirements for opening a business bank account in the country.

Is it possible to open a business bank account in the UK as a non-resident? Read all about it in this article.

Wise Business account key features One account, low fees, fast payments, no monthly subscription Wise Business account enables businesses to hold and send...