Is it possible to open a business bank account in Switzerland as a non-resident?

If you're looking to open a business bank account in Switzerland, you've come to the right place. Read all you need to know.

If you’re based in Ireland but have a business in the UK, you’ll need ways to manage your money across both EUR and GBP. While UK banks have an excellent range of products and services for businesses, they’re typically aimed at resident customers who live full time in the UK. That can mean that setting up a business bank account in the UK is a bit harder than you may expect.

This guide looks at how to open a business bank account in the UK. And because opening a business account as a non-resident can be a tricky process, we also look at how specialist provider Wise Business can help you easily open an account which also lets you cut the costs of managing your business finances across currencies.

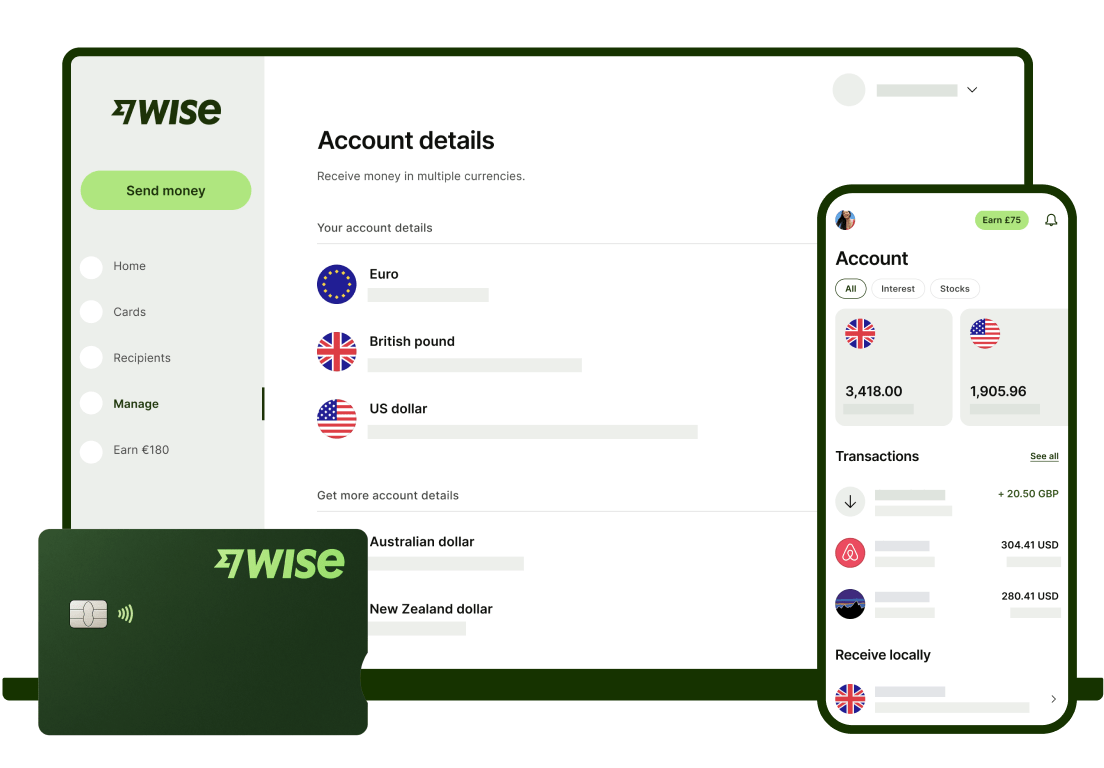

Wise business: Manage

EUR and GBP in one account

If you need to open a UK business bank account from abroad it’s worth spending a bit of time researching your options.

While you can legally open a UK business bank account as a non-resident, banks often put pretty strict eligibility criteria in place which mean not all accounts are available for all customers. Getting to know the market can help you navigate which types of account may suit your own needs best.

Some of the most common types of business bank accounts in the UK include:

- Digital only accounts: often aimed at small businesses and startups which need day to day account services with limited branch support

- Full service business accounts: can cater to larger organisations that need working capital, loans and other features

- Corporate accounts: aimed at large enterprise level companies, often with private relationship management included

- Foreign currency accounts: aimed to make international payments and treasury management easier

- Savings products: may be easy access or fixed term, and which let companies put spare cash to best use.

Because most UK banks primarily target resident business owners, as a non-resident you may not be able to open your bank account digitally, even once you’ve found a product you like.

If you want to open a business account online you may decide you’re better off with a specialist provider like Wise Business, instead of a bank.

Wise is a global technology company which has a streamlined and fully digital application, verification and onboarding process you can manage from anywhere. And with a Wise account your business will be able to manage both EUR and GBP, including sending and receiving payments.

So - can you open a business bank account without UK residency?

Whether or not you can open a business account with a bank will depend on many factors including the residency of all business owners and directors, and the size and turnover of the company.

If you have at least one UK resident director you may find the process is simpler. As a fully non-resident entity you’ll need to contact banks individually to understand their policies based on your unique circumstance.

One good place to start if you need a bank account for your business is Barclays. Barclays does sometimes offer business accounts to non-residents - but you’ll need to call them on 01624 684684 to learn about their approach to your specific case¹.

Or, if you want something simpler, skip the banks and choose a specialist like Wise instead, for business accounts which let you manage your money across currencies with nothing more than your phone or laptop.

| Read more: Wise Business Account - Key Features |

|---|

Different banks may have slightly different requirements when it comes to verification checks for a business account. It’s worth checking everything that’s needed in advance - but usually the documents needed to open a business bank account in UK include:

- Proof of ID and address for all named company directors

- Full business address and contact details

- Information about what your business does, including social media and website information

- Companies House registration number (for limited companies and partnerships)

- Estimated or actual annual turnover

You may have to provide proof of ID (usually a passport or photo driving license) for yourself as the account owner, and also any other directors or key shareholders in your business.

You may also need to prove your address information with a recent bank statement or utility bill, or an official government letter. Check the exact documents which are needed and accepted before you begin your application.

UK banks do not usually market business accounts for non-residents. This doesn’t necessarily mean that getting a business account from a bank is impossible if you’re not a UK resident - but it is likely to mean you need to call a few banks first to discuss your requirements.

Whether or not the bank will offer you an account may come down to the specific details of your business, and whether or not you can provide the paperwork the bank needs for verification checks.

The good news is that there are plenty of alternatives to banks if you need an account to manage your business finances effectively from Ireland, for a UK based company.

Specialist providers like Wise Business offer accounts to individual and business customers in many countries, including both the UK and Ireland, which you can open remotely and use to hold and manage multiple currencies all in one place.

With a focus on companies trading internationally, services like Wise can help you keep down the costs of foreign exchange, and make sending payments to contractors and suppliers cheap and easy. More on that next.

If you’re based in Ireland and run a UK business, Wise Business could be an ideal choice to let you manage your company finances effectively across both EUR and GBP.

Open a Wise Business account for a one off fee of 50 EUR, to get easy ways to hold, exchange, send and spend 40+ currencies. You'll also be able to get access to local account details in +8 currencies (GBP included).

This means you can receive GBP payments to your account for free, as a local company, and convert to EUR or any other supported currency whenever you need to, with the mid-market exchange rate and low, transparent fees.

Wise Business has no monthly fees and no minimum balance requirements so you’ll simply pay for the services you use, as and when you use them. Save money on your foreign exchange, and use Wise to save time too, with cloud accounting integrations to make bookkeeping a breeze, batch payment solutions and a powerful API to automate workflow.

Open your Wise business

account online 🚀

Sources used:

Sources last checked on date: 24-03-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you're looking to open a business bank account in Switzerland, you've come to the right place. Read all you need to know.

Are you doing business in the United States from Ireland? Let's look at the requirements for opening a business bank account in the country.

Wise Business account key features One account, low fees, fast payments, no monthly subscription Wise Business account enables businesses to hold and send...