Is it possible to open a business bank account in Switzerland as a non-resident?

If you're looking to open a business bank account in Switzerland, you've come to the right place. Read all you need to know.

Tapping into the US market with your Irish business can be a hugely beneficial move. But to manage your money effectively, you’ll need to figure out how to open a US business bank account. While it’s possible in some cases to open a US business bank account from abroad, getting a business bank account for non-US residents can be subject to meeting pretty strict eligibility criteria.

This guide is here to help you understand how to open a business bank account in the US from Ireland. For a fully digital multi-currency business account, we’ll also introduce Wise Business for an account which also lets you cut the costs of managing your business finances in USD, EUR, and 40+ other currencies side by side.

You can open a US business bank account either in person in the US if you travel there often, or you may be able to open a US business bank account online if you meet eligibility rules and get approved for digital services.

The account options and providers open to you can depend a lot on your entity type and where it’s registered.

Common bank account types in the US can include:

- Checking accounts for day to day business transactions

- Business savings accounts and CDs (certificates of deposit) to hold spare business cash

- Merchant accounts primarily for online payments.

This guide is looking at standard checking accounts for business - for other account types, you’ll be able to contact individual banks directly to get advice on the products which may suit your needs.

Some US banks do allow you to open a business bank account in the US from Ireland, but eligibility rules apply, and not all accounts are offered to all business customers.

In some cases, such as for major banks like Bank of America, even if you’re a non-resident you will need to physically visit the US to open your account, which isn’t necessarily very practical. You’ll also usually need to have a US registered business and a US tax ID, for yourself and your business.

US business bank accounts are usually only offered in USD, rather than as multi-currency accounts. This may also be a drawback if you need to manage your money between the US and Ireland. To move your money back to Ireland from the US, you’ll need to send a bank wire, which can come with pretty steep fees.

We’ll touch on Wise Business, a smart option for cross border money management and low cost international payments a little later. With Wise you can hold USD and EUR in the same account, and send between them easily and often instantly.³

If you have an eligible business you may still be able to open a business bank account online, which means you avoid the need to travel in person.

Accounts are subject to meeting eligibility criteria and approval, but you may want to check out the options from providers like American Express¹, or banks like Chase², which both offer some digital account opening options for eligible customers.

The exact documents needed to open a business bank account in the US depend on the entity type you have, and the bank you pick.

However, in all cases you’ll need to complete a verification step, either online or in person. Generally you must provide the following documents to open a business bank account in the US:

- Your Employee Identification Number (EIN) or Taxpayer Identification Number (TIN)

- US business documents, like your Articles of Organisation or a Certificate of Formation

- Proof of ID and address for anyone with ownership of at least 25% of the business

- SSN or ITIN for anyone with ownership of 25% at least of the business.

| Read also: Wise Business account features |

|---|

Some banks do extend business banking services to non-residents, although rules usually apply here. For example, you may need to be pre-approved by the bank based on your business type and structure, and you’ll usually have to register your company in the US.

To figure out whether a US bank can offer you an account you’ll need to do a little legwork. Take a look at the eligibility rules for different accounts you like, to see if any can be opened digitally - in some cases you can only apply for a foreign entity or as a non resident if you go to a bank branch in person. While this may be possible if you travel to the US frequently, it’s not a quick or easy option in many cases.

US banks are likely to only offer business account services for SMEs in US dollars. While this is fine for your local trade, it can be expensive to send money back to Ireland when you need to.

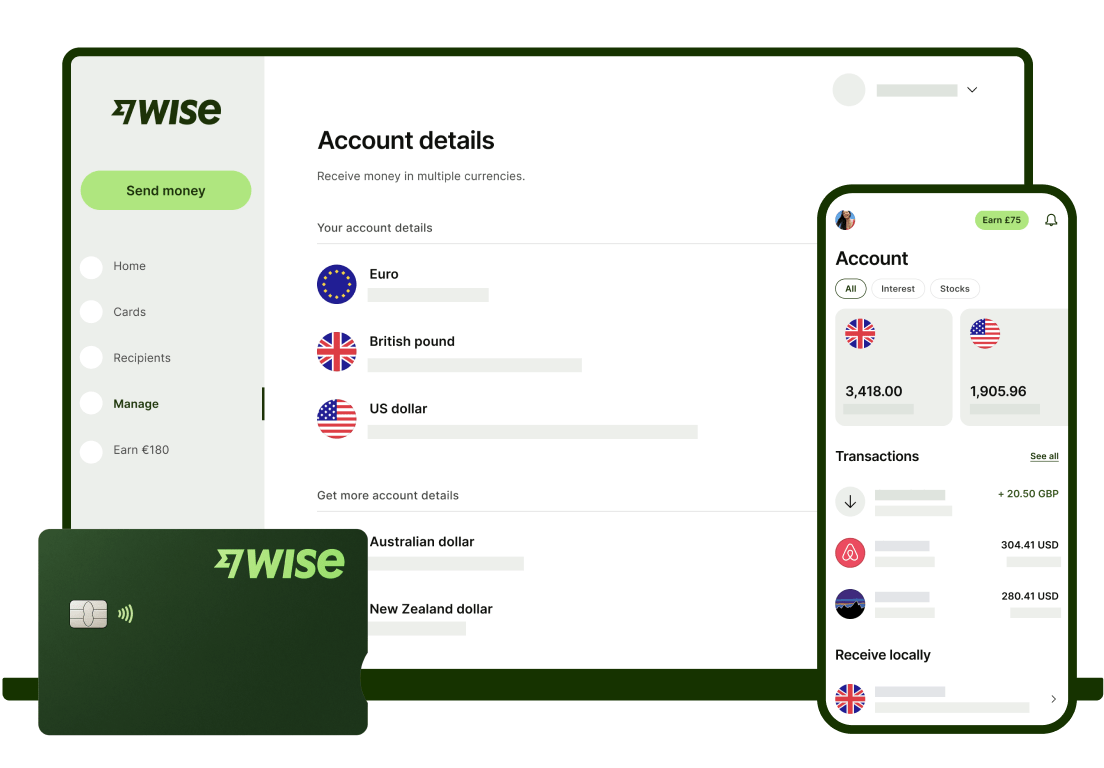

To get a digital multi-currency account which lets you manage your money in both USD and EUR in the same place, check out providers like Wise Business, which have account and card services you can open from Ireland, to hold, send, spend and receive USD.

For ways to manage your business finances across 40+ currencies, including EUR and USD, consider opening a Wise Business account.

Open your Wise Business account from Ireland to hold and exchange currencies with the mid-market exchange rate and low, transparent fees. You'll be able to manage and converter between currencies in one account, and also receive money via local US account details.

Get the Wise business debit card for your company and for your team, and pay in +140 countries. The first card on the account is free.

As a business owner you’ve got a lot on your plate - so Wise can help you save time too. Get cloud accounting integrations with your favourite services like Xero, batch payment solutions to pay 1000 people at once, multi-user access and a powerful API to automate workflow. Cut costs and admin time when transacting internationally, with Wise Business.

Open your Wise Business

account online 🚀

Sources used:

1. American Express Business Checking

2. Chase Business Checking

3. Transaction speed claimed depends on funds availability, approval by Wise’s proprietary verification system and systems availability of our partners’ banking system, and may not be available for all transactions.

Sources last checked on date: 26/03/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

If you're looking to open a business bank account in Switzerland, you've come to the right place. Read all you need to know.

Is it possible to open a business bank account in the UK as a non-resident? Read all about it in this article.

Wise Business account key features One account, low fees, fast payments, no monthly subscription Wise Business account enables businesses to hold and send...