Sending money for a graduation gift internationally

Looking for graduation money gift ideas? Here are physical and digital options for gifting or sending money to a graduate.

If you’re using PayPal, you might choose to hold money in your account. This can be handy for sending money to friends and family, or for paying for goods and services online.

But before you use your PayPal for payments, it’s a smart idea to check out the fees first. PayPal isn’t always the cheapest option, especially if you need to make international payments.

In this guide, we’ll show you exactly how to put money into PayPal, ready for when you need it. We’ll also cover the fees PayPal charges, so you can work out the cost of payments. And we’ll even look at an alternative that could save you money - the Wise account.

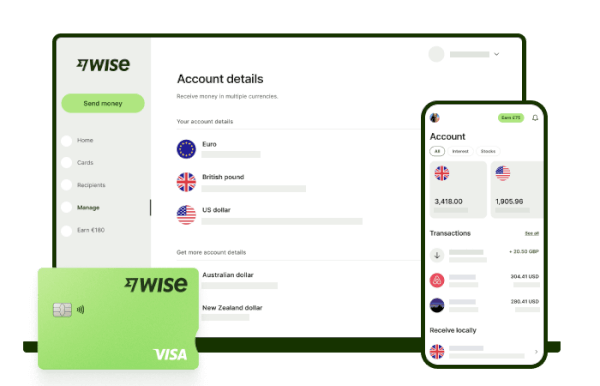

Learn more about the Wise account

Please see the Terms of Use for your region or visit Wise fees & pricing for the most up-to-date information on pricing and fees.

The first thing to know is that you don’t actually need funds in your PayPal account to pay for things online.¹ If you’ve linked a bank account or debit card to your PayPal account, you can still use PayPal for online purchases. The money will be debited straight from the bank account or card.

But if you’d rather hold money with PayPal to cover your purchases, you can add funds using a bank transfer.

PayPal recommends linking your bank account with your PayPal account, so that you can make payments quickly and simply. To add money from a bank account, simply follow these steps:²

You don’t need to add money directly to your PayPal account using a bank card to pay for purchases or send money to a friend. Rather, the next time you make a transaction, PayPal can debit the money from your card.

This means if you link a card to your PayPal account, you won’t need a balance to send money to people or pay for things.

To link a card to your account, follow these easy steps:³

When linking a card to PayPal, you may also be required by your bank to complete 3D secure or biometric authentication processes.

Of course, another way to top up your PayPal account is to have your friends and family send the funds to your account. It’s free to receive personal payments into your PayPal account⁴ provided that the sender uses a bank account, debit card or their PayPal account, and as long as no currency conversion is involved.

If you’re topping up your account using the PayPal app, you can simply tap your Wallet, go to Transfer Money and select ‘Add money to your balance’.² Then, follow any instructions on-screen, such as selecting a bank account to fund the payment and entering the amount you want to transfer.

| 📖Read more: How to withdraw money from PayPal |

|---|

The good news is that it’s free⁴ to add money to your PayPal account from your UK bank account, provided the money is in GBP.

But are there any other costs you need to know about? Here are some of the other PayPal fees to bear in mind:

| Service | PayPal fees⁴ |

|---|---|

| Receiving money from a UK sender, in GBP | Free |

| Sending money in the UK, in GBP | Free |

| Sending money outside the UK in another currency | 5% |

Need to pay for goods and services abroad, or send money to friends and family overseas? Wise can help.

Wise specialises in international payments, to make it simple and cheap to send and spend all over the world, just like a local.

Get a Wise account and you can send and spend in over 40 currencies - all with the fair mid-market exchange rate, so there are no hidden fees to worry about.

Please see the Terms of Use for your region or visit Wise fees & pricing for the most up-to-date information on pricing and fees.

That’s pretty much everything you need to know on how to put money into PayPal and top up your account. After reading this guide, you should be all set to transfer from your bank account in just a few clicks, or taps if you’re using the PayPal app.

But if you prefer, you can always just link a bank account or debit card and let PayPal debit payments automatically - without the need to add money to your PayPal account. It’s completely up to you.

Sources used for this article:

Sources checked on 22-06-2023.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for graduation money gift ideas? Here are physical and digital options for gifting or sending money to a graduate.

Compare PayPal vs. Wise for consumers in our comprehensive guide, covering fees, features, exchange rates and more.

Read out complete guide to Wise transfer limits in the UK, plus Wise limits for receiving, spending and withdrawing money.

Find out how to make a payment to an international bank account, including the details you'll need, steps and how long it takes.

What’s the quickest way to transfer money internationally? Find out about speed and average delivery times for leading transfer providers, including Wise.

How does transferring money from a credit card to a bank account work? Find out everything you need to know in our handy guide.