Paypal vs Wise: Which is best for consumers?

Compare PayPal vs. Wise for consumers in our comprehensive guide, covering fees, features, exchange rates and more.

Graduating from school, sixth form, or university is a huge milestone – one that deserves to be celebrated. If you have a loved one who has recently graduated, you could be in the market for gift ideas. Sometimes the simplest presents are the best, and for someone facing their next steps, graduation money gifts are a welcome treat.

But there are more creative ways to do things than handing over some notes. In this guide, we look at graduation money gift ideas, covering creative presentation options, UK etiquette, and adding personal touches from overseas.

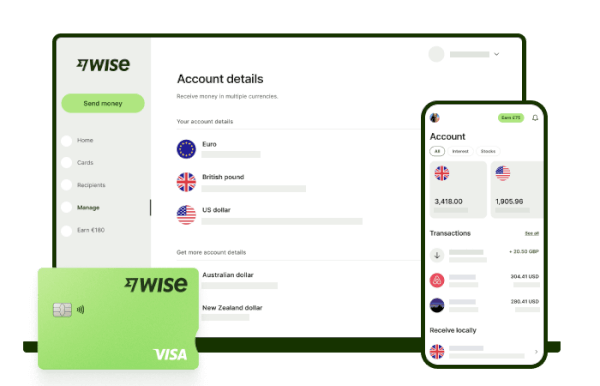

One of your options is doing things digitally. With a Wise account, you can send money internationally to 140+ countries at the mid-market exchange rate, with no foreign transaction fees if you already have the foreign currency in your account. Or for a low, transparent fee*.

➡️ Learn more about the Wise account

How much money you decide to give is up to you. There are personal factors to consider, like your budget and your relationship with the graduate. How much can you realistically afford to give, without putting yourself out of pocket? Is the person a close member of your family, or a casual friend? Consider these things before deciding the amount to give.

It might sound cliché, but as with any gift, it’s the thought that counts. However much you decide to give, it’s a kind and thoughtful gesture.

There’s no right or wrong amount of money to give. You could use the examples below as a baseline, or talk to friends and family about what to do.

You may feel closer to your friends than family, or have a strong relationship with extended family – so take the guide above with a pinch of salt. Even a heartfelt card and small gesture is a worthy gift.

Alternatively, you could pool money for a joint graduation gift, to take the financial burden off individuals. With the Wise Spend with Others feature, you can all add money to a single group for a joint gift.

Think beyond money in an envelope if you want to delight your recipient. Given the decline in cash use1, opting for electronic ways to give money is perfectly acceptable nowadays – and potentially more appreciated. You could use Wise, PayPal, or another method for electronic transfers.

Here are some ideas to get you started.

Take a playful approach to gifting money. Try:

You can combine money gifts with small, practical items. Try one of these options:

The right gift depends on the person – though, if they’re living in the UK, an umbrella is guaranteed to come in handy!

Gifting cash is easy if you live close to the recipient. But further away from them, you need to give more thought to transporting the gift. And with the addition of shipping costs, and the worry that your gift may not arrive on time (or in one piece), sending money digitally could be a more secure and convenient choice.

There are plenty of fintech services to choose from if you send digital graduation gift money, such as Wise, Revolut, or Western Union. These are often the cheapest and fastest options, with instant money transfers available in some cases.

PayPal is another option, though currency conversion fees apply, and you may need to pay a fee if you’re transferring overseas.2

Traditional bank and wire transfers might seem like a good, reliable choice, but bear in mind that they’re often slower and could be more expensive due to poor exchange rates and high bank fees.

Opting for a provider that specialises in overseas transfers can help you keep costs down and ensure your graduate sees more of the money.

The first step is deciding how much you want to send in your currency, and what that equates to for the recipient.

You could start with a ballpark figure in your own currency, for example, $50. Then see what that converts to in GBP, and decide if you’re happy with the amount.

Alternatively, you could decide how much you want to give the recipient in their currency, say, £100, and see how much that converts to in your local currency.

When you calculate the exchange rate, make sure you factor in transfer fees for the final amount. This is why picking a provider with low fees is important. It means your recipient will receive more of the money.

Use the currency converter below to help you work it out, simply change the currency route and amount:

If you’re concerned that gifting money lacks the personal touch, scheduling a digital card to arrive on the same day, or setting up a video call to congratulate them can help you feel more connected.

There are plenty of online services for sending digital or physical cards, where you can fully customise the design and message. You could send the card a few days in advance, to let your recipient know the gift is on its way.

Once upon a time, cash in a card was the only way to give money. Now, you can choose from digital transfers, cash, cheques, and more.

Here are your options:

Note: Transaction speed claimed depends on individual circumstances and may not be available for all transactions.

Gifting money with Wise is fast and simple. There are plenty of options, and your recipient doesn’t need to have a Wise account to receive the money quickly.

Go to the ‘Send’ section in your Wise account and ‘Add a new recipient’. Then:

Sending money can be as simple as sharing a link. Want to send money via a link with Wise? Using the Android app or Wise website, go to your balance and select ‘send’. Then:

If you set up a personal Wise account with account details, you get access to a Wisetag. This is indicated by an ‘@’ symbol, your name, and a number. Similar to a username on social media.

When you send money, you can choose to send it with someone’s Wisetag and you don’t need their banking details.

In the app or web home screen, head to the ‘New’ or ‘+’ icon, and select ‘Spend with a group’. Follow the instructions, add members to the group, and pool your money for a joint gift.

They say it’s the thought that counts, so however much you decide to send, and whichever way you choose to send it, your recipient is sure to appreciate the gift.

Get creative with the presentation or use money transfer services to make gifting from abroad simple and personal.

With a Wise account, you get a whole host of money sending options to choose from. Spend with Others for a joint present, use their Wisetag, or generate and send a payment link. The choice is yours!

Whatever method you choose, Wise gives you the mid-market exchange rate and low fees* or no fees if you have already converted the currency in your account and you can send to 140+ countries. So wherever they are, your graduate can keep more of the money and spend it on their future.

Sources used in this article:

1. UKFinance.org - decline in cash use from ‘UK Cash and Cash Machines report 2024’

2. PayPal - currency conversion fees with PayPal

Sources last checked on 26-Aug-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare PayPal vs. Wise for consumers in our comprehensive guide, covering fees, features, exchange rates and more.

Read out complete guide to Wise transfer limits in the UK, plus Wise limits for receiving, spending and withdrawing money.

Find out how to make a payment to an international bank account, including the details you'll need, steps and how long it takes.

What’s the quickest way to transfer money internationally? Find out about speed and average delivery times for leading transfer providers, including Wise.

How does transferring money from a credit card to a bank account work? Find out everything you need to know in our handy guide.

Read our guide on how to transfer Australian shares to a UK account, including how transfers work and how to get started if you trade in different currencies.