Sending money for a graduation gift internationally

Looking for graduation money gift ideas? Here are physical and digital options for gifting or sending money to a graduate.

If you need to regularly send or receive money from abroad, it’s essential to have a safe and cost-effective way to do so. While there are various options available, including money transfer services or online payment systems, choosing the one most suitable for you can be challenging.

In this guide we’ll take a closer look at PayPal and Wise, two services you might be considering.

PayPal has been around since 1998 and it’s frequently used for online payments and peer-to-peer transfers. Founded in 2011, Wise offers personal and business accounts, travel cards, and money transfer services.

But which is the best option for you? Read on for a full PayPal vs. Wise comparison of fees, exchange rates, supported currencies, money transfers, travel cards and more.

| Table of contents |

|---|

We’ll begin with a brief overview of PayPal vs. Wise and their main fees and features.

| Feature | PayPal | Wise |

|---|---|---|

| Accounts |

|

|

| Subscription fees |

|

|

| Money transfer fees |

|

|

| Exchange rates |

|

|

| Large transfers |

|

|

| Supported currencies |

|

|

| Transfer times |

|

|

| Debit card |

|

|

| ATM withdrawals |

|

|

| Security |

|

|

***Note: Wise transaction speed claims depend on individual circumstances and may not be available for all transactions. See latest Q1 2025 speed report here. See more details on how Wise keeps you money safe.***

PayPal offers two account types: a personal account and a business account. You can have one of each, but there’s an option of signing up for a second one if necessary. You can also upgrade your personal account to a business account, but not downgrade the other way around.8

A personal PayPal account lets you link your bank account or cards, use them as a payment method and receive money. Additionally, the PayPal Pay in 3 option here in the UK is a buy-now-pay-later (BNPL) service which allows splitting your payments into installments.9

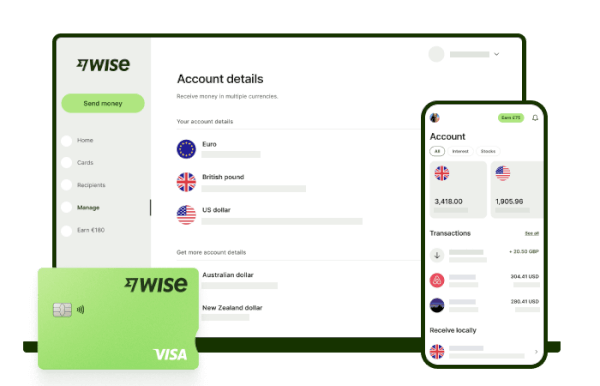

On the other hand, a Wise personal account allows you to hold 40+ currencies, convert between different currencies, receive money from abroad, and send and track transfers. You can also spend with the linked Wise card in 150+ countries, either online or in-person, and manage everything through the Wise app.

Wise also offers a feature called Wise Interest, which can help you earn variable returns on GBP, EUR and USD. With Wise Interest, your money is invested in a fund that holds government-guaranteed assets, but your money isn’t locked away and can be accessed. You can continue to send and spend and you can get instant withdrawal access up to £10,000 (or £100,000 if you’re a Wise business customer). Capital at risk. Growth not guaranteed.

Capital at risk. Growth not guaranteed. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you’re uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

Whether you use PayPal or Wise, you won’t pay any account opening or monthly fees.1

Both Wise and PayPal have money transfer services.

With Wise, you can use your account to send money across the world. When you enter the details of your transfer, you’ll see the exact fees, exchange rates and transfer times right away. A transfer can be confirmed in just a few clicks and tracked online or in the Wise app.

PayPal allows you to send money by entering the recipient’s PayPal handle, email or phone number. After that, you’ll simply enter the amount and choose the currency. Similarly to Wise, you’ll see the applicable fees and be able to review all transaction details.10

In case your recipient doesn’t have a PayPal account, you can also send money through Xoom, a PayPal service.10

When you’re sending a domestic personal transaction with PayPal, no fees apply. However, with international personal transactions, a 5% fee will apply, with a minimum of £0.99 and maximum of £2.99.2

When sending money with Wise, the fees won’t always be the same. They depend on the currency and the payment method (i.e. bank transfer, debit or credit card) and start at 0.33%*. However, the fee will always be visible upfront, before you hit send.

The exchange rate is a key factor when sending money transfers, as it can significantly affect the total cost.

When it comes to Wise, the exchange rate is always the mid-market rate, without any margin or mark-up included.

The rate used by PayPal can only be seen through their currency calculator, but there’s a mark-up included.

When making large purchases, such as buying property abroad, you’ll likely need to send a large amount of money overseas. In these cases, it’s crucial to consider how safe the transfer is and whether any limits apply.

The limit for PayPal transfers is $60,000 per transaction or the equivalent of that in another currency. However, if your PayPal account isn’t verified, you’ll have a personal limit that can be seen when you go to send money.3

Wise limits vary depending on which currencies you send to and from, and how you choose to pay. However, if you’re sending from the UK this limit is £1,000,000. However, if you’re sending GBP, you can send up to £20,000,000 per transfer. To do this, you’ll need to select and open a currency account for the currency you want to convert from (the source) and one in the currency you want to convert to (GBP).

We’ll use a quick example to help you visualise how exchange rates and transfer fees can contribute to the cost of your transfer.

Let’s say you’ve moved to Italy and you need £2,000 to cover rent and other initial expenses. Here’s how much it will cost to send this money from the UK to Italy with both PayPal and Wise:

| Provider | Transfer fee | Exchange rate | Recipient receives |

|---|---|---|---|

| PayPal11 | £2.99 | 1.13009 | €2,260.18 |

| Wise12 | £7.17 | 1.18869 - mid-market rate | €2,370.17 |

Note: Above fees and rates correct as of 12 May 2025

In the above case, Wise has a higher transfer fee. However, because Wise uses the mid-market exchange rate the recipient actually receives more.

Check out our live conversion comparison below. If your transfer with PayPal is cheaper, which might occasionally happen, we’ll always let you know up front.

The true cost of sending EUR to GBP

PayPal is available in 200 regions, but it only supports 25 currencies.4

With Wise, you can send, receive and spend in 40+ currencies and it's available in 160 countries.

A PayPal instant transfer typically takes a few minutes, though it can take up to 30 minutes. Standard transfers are usually completed within five working days, but this may vary depending on the bank.⁵

Wise transfer time depends on where you send to and your chosen payment method. Sometimes it takes seconds, while other transfers need 2 working days to complete. During January to March 2025, 95% of transfers were completed in under 24 hours. For more details, check out the latest Wise speed update.

The PayPal personal debit card isn’t available in the UK, only their business debit card.6

However, the Wise card lets you spend worldwide in 150+ countries, always using the mid-market exchange rate. It’s available for a one-time fee of £7 and you can use it in digital form as well.

PayPal doesn’t have a personal debit card available in the UK, so you won’t be able to use PayPal for withdrawals when travelling.6

Wise cards have a £4,000 monthly ATM withdrawal limit. You can withdraw up to £200per month in 2 transactions without fees. After that, a fee of 1.75% + £0.50 per transaction applies.

💡Tip: A handy way to save money on ATM withdrawals with any provider is to always choose to withdraw cash in local currency only, this avoids ATM providers adding their own currency conversion fee on top.

Every PayPal transaction is encrypted and monitored to prevent fraud and identity theft. PayPal also offers buyer protection by offering a reimbursement if the purchase you’ve made doesn’t arrive or match the description.

Wise maintains high security standards with a dedicated anti-fraud team, 24/7 transaction monitoring and two-factor authentication (2FA) to protect account access. It also verifies the identity of anyone who signs up for an account.

Whether PayPal or Wise are right for you depends on your personal preferences and needs.

PayPal lets you send and receive money securely and pay online wherever it’s accepted. However, it doesn’t offer a dedicated travel card, which may be a drawback when you’re abroad.

Wise, on the other hand, offers an international debit card, guarantees the mid-market exchange rate and charges transparent, low fees*. Your account is protected with strong security features and there are no monthly fees, just a one-time £7 debit card charge.

If you’re looking for an international debit card and a multi-currency account, Wise could be a great fit.

Sources used:

1. PayPal Help Centre - account fees

2. PayPal - consumer fees

3. PayPal Singapore - maximum transfer amount

4. PayPal - list of countries and currencies

5. PayPal Help Centre - transfer times

6. PayPal - Business debit card

7. PayPal - buyer and seller protection

8. PayPal Help Centre - account types

9. PayPal - how PayPal works

10. PayPal - send money

11. PayPal Help Centre - currency calculator

12. Wise - compare PayPal vs. Wise

Sources last checked on date: 12-May-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for graduation money gift ideas? Here are physical and digital options for gifting or sending money to a graduate.

Read out complete guide to Wise transfer limits in the UK, plus Wise limits for receiving, spending and withdrawing money.

Find out how to make a payment to an international bank account, including the details you'll need, steps and how long it takes.

What’s the quickest way to transfer money internationally? Find out about speed and average delivery times for leading transfer providers, including Wise.

How does transferring money from a credit card to a bank account work? Find out everything you need to know in our handy guide.

Read our guide on how to transfer Australian shares to a UK account, including how transfers work and how to get started if you trade in different currencies.