Global payment methods - Guide for UK businesses

Read our guide to global payment methods for UK businesses, including cards, bank transfers, PayPal and multi-currency solutions like Wise Business.

VAT - Value Added Tax - applies on most goods and services sold by VAT registered businesses in the UK. If your UK business is growing and hits the VAT limit for registration you’ll need to learn about the HMRC VAT rules and registration process. This guide is here to help.

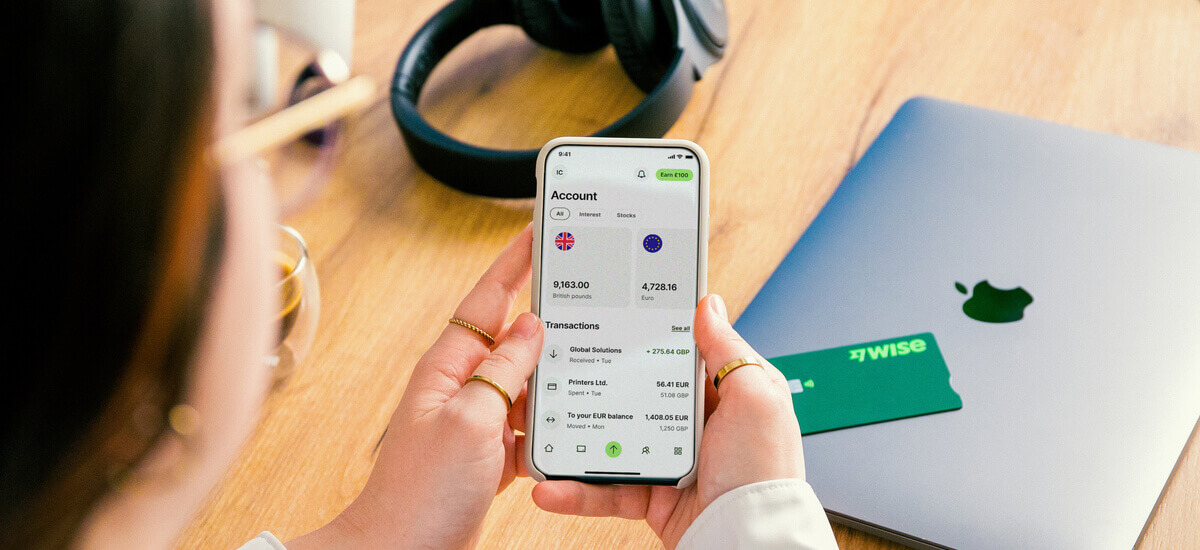

Check out Wise Business for ways to receive, hold, send and spend foreign currencies for your UK company. Hold and exchange 40+ currencies, receive payments in 8+ major currencies and exchange between them with the mid-market rate, making it easier than ever to manage your business finances across borders.

💡 Learn more about Wise Business

If you have a UK business you may be wondering: how does VAT work, and what do I need to do now?

VAT applies on most goods and services sold by VAT registered businesses in the UK¹. If you’re a VAT registered business owner you’re obliged to charge customers the relevant rate of VAT for the products or services you sell, and pass this payment on to HMRC after accounting for any VAT you’ve paid to other businesses yourself.

Local UK businesses must register for VAT once their annual taxable turnover exceeds the VAT threshold. If you, or your business, are based outside of the UK and you sell goods or services in the UK, you need to register for VAT regardless of your company turnover.

This guide is for information only - tax is often complex and if you’re unsure about what tax you should collect, report or pay for your UK business, you’ll need to seek professional support as soon as possible.

VAT rates in the UK are set according to the type of product or service being sold. The standard rate at the time of research (30th June 2025) is 20%, but some items qualify for reduced VAT or have a zero rating, which means they’re not VAT liable. Here’s an overview:

| VAT rating² | Product types |

|---|---|

| Standard rate - 20% | Most goods and services |

| Reduced rate - 5% | Some goods and services like select health products and home energy |

| Zero rate - 0% | Essential goods and services which must be affordable, like most food and children’s clothes |

*Details correct at time of research - 27th May 2025

Full listings of VAT rates are available online on the HMRC website - as categories can change from time to time, you’ll need to check the details based on the products or services you sell in the UK.

So - how much do you have to earn to be VAT registered?

UK businesses must register for VAT when their annual taxable turnover exceeds the VAT threshold - at the time of writing this is set at 90,000 GBP annually.

If you’re aware your annual income is going to exceed this amount in the next 30 days you need to start the registration process online. You may also register voluntarily for VAT if you choose to, regardless of your turnover.

There are some situations where you need to register for VAT, even if your turnover is below the VAT limit. This is the case if you or your business are based outside the UK and you supply any goods or services to the UK.

If you fail to register for VAT in good time, fail to submit your VAT filings on time or fail to pay the VAT you owe to HMRC, VAT penalties may apply.

These vary depending on the situation, but if you have any concerns about your VAT arrangements it’s important to seek help as soon as possible because the penalties can become more severe as time passes.

For example, if you’re late to register for VAT you may be issued a penalty based on a percentage of the VAT due from the date you should have registered, as follows:

| Registration date | Penalty³ |

|---|---|

| Up to 9 months late | 5% of VAT owed |

| 9 - 18 months late | 10 of VAT owed |

| 18 months+ late | 15 of VAT owed |

*Details correct at time of research - 30th June 2025

Once you register for VAT in the UK you’ll need to charge the appropriate amount of VAT on all sales, based on the goods and services you offer. This pushes up the cost to the consumer, which can reduce demand on some items. However, it’s not all bad news - if you sell to other VAT registered businesses, they can then reclaim the VAT they pay, which can be a benefit to them.

As a VAT registered business you’ll also need to think carefully about arranging the administration needed to manage VAT. This can make bookkeeping more complex, and also impact cash flow management if you’re not careful.

There are pros and cons to being VAT registered - but ultimately, many businesses are obliged to register and manage VAT, and so the key is to make the process run as smoothly as possible. Companies often choose cloud accounting software which can support VAT calculations, or work with accountants to manage the process without adding administrative burden to their own team.

As we’ve seen, there are some benefits of registering for VAT - which is why some businesses choose to register voluntarily.

VAT registered businesses typically have a larger turnover which can make them seem more professional - an appealing feature for many customers.

There can also be cost benefits of being VAT registered, because you’ll be able to reclaim VAT paid on supplies you buy for your business. Plus if you’re involved in business to business sales, and selling to other VAT registered businesses, the additional costs to your customers are negated as the customer will be able to offset their VAT when they complete their own HMRC filing.

You must register for VAT in the UK if your company’s taxable turnover meets the VAT threshold, or if you realise it will do so in the next 30 days. You are also obliged to register if you and your business are based outside of the UK and sell goods or services in the UK.

You can register for VAT entirely online using your Government Gateway user ID and password, and some essential information about yourself and your company⁴. It’s also possible to have an agent register on your behalf, but the process isn’t too tricky to manage yourself if you want to.

Once you’ve completed the initial registration you need to wait for some documents and information to arrive by mail - you can see how long this will take using tools on the HMRC website⁵. Finally, once you’ve registered you can set up an online VAT account to file and pay taxes digitally in future.

There are several situations in which it is compulsory to register for UK VAT, as we’ve seen:

You do not have to register if you only sell VAT exempt or ‘out of scope’ goods and services, but you can still choose to register voluntarily if you would like to.

Some businesses are able to apply for a temporary or permanent VAT exemption which must be approved by HMRC - there are also slightly different rules for businesses in Northern Ireland in some cases. If you’re ever unsure about how VAT works for your business, you’ll need to talk to an accountant or tax adviser to get professional advice.

You’ll be able to register for UK VAT yourself, or have an agent support your application if you would prefer. Here’s a step by step walkthrough of the process.

The information you need to register a limited company for UK VAT is a little different to what’s needed to register as an individual or as a partnership for UK VAT. In both cases you’ll need information about yourself and your business, which helps HMRC to register and confirm all your details.

To register a limited company for UK VAT you’ll need your company registration number and bank account details, your HMRC issued Unique Taxpayer Reference (UTR), and information about your annual turnover. You must also provide information about tax including your HMRC self assessment, corporation tax and Pay As You Earn (PAYE).

To register as an individual or as a partnership for UK VAT you’ll need your National Insurance number, a government issued ID, your bank account details, your HMRC self assessment, your payslips and your P60. You’ll also need your HMRC issued Unique Taxpayer Reference (UTR) and information about your annual turnover.

Visit the HMRC website where you can use your Government Gateway user ID and password to start the process of registering for VAT. You’ll need to have all the relevant information and documents to hand, but if you find you’re missing something you can save your application at any time and come back to it later.

HMRC will send a letter to your registered address which includes your 9-digit VAT registration number - this is essential for all VAT filings in future. You’ll also be told when to submit your first VAT return and payment so you can be prepared.

Using your 9-digit VAT registration number you can register for an online VAT account which is used to submit filings and make payments. Once you have your VAT registration in hand, visit the Government Gateway portal to get this set up for convenient VAT filings in future.

Wise Business can help UK businesses, freelancers and sole traders to manage finances across multiple currencies, with low fees and the mid-market exchange rate.

Wise Business account connects with Xero, QuickBooks, FreeAgent, FreshBooks and more solutions to help you seamlessly manage your finances across borders.

When you open a Wise Business account, you’ll benefit from all of these useful features:

Get started with Wise Business 🚀

VAT in the UK is not a sales tax. Sales taxes apply only on the final sale of a product to a consumer, while VAT applies on all transactions including business to business sales.

VAT in the UK is calculated according to the type of goods or services being sold. There are different rates of VAT depending on the situation. Some essentials are zero rated, meaning they’re exempt from VAT, some items have a reduced rate of 5% to make them more affordable, while most goods and services have a 20% rate of VAT applied.

Once you have registered your business for VAT you file your VAT return on the Government Gateway portal, usually every 3 months.

UK businesses can offset some VAT they pay against the VAT they charge customers. This means that the VAT you pay is usually the difference between any VAT you’ve paid to other businesses, and the VAT you’ve charged your customers.

If you’re selling goods and services in the UK you need to register for VAT if you or your business are based outside of the UK. If you’re unsure about the way VAT needs to be applied in your specific business you’ll need to get professional advice from a tax accountant or adviser.

If you need to register for VAT in the UK, the chances are that it means your business is growing. That’s good news - but it does also mean you need to learn about the VAT processes, rules and requirements to stay on the right side of the law. This guide has all the basics to start you off - and you can get help from an accountant or tax adviser if you need detailed information about managing your business’ unique situation most effectively.

Sources used in this article:

Sources last checked 30/06/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our guide to global payment methods for UK businesses, including cards, bank transfers, PayPal and multi-currency solutions like Wise Business.

Discover how to set profitable freelance writing rates. Our 2025 guide covers pricing by the hour, project, and value to help you command higher fees.

Check out our select of the best automated invoicing software for UK businesses.

Find out what to charge for freelance digital marketing. This 2025 guide details setting profitable rates for retainers, projects, and hourly consulting work.

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.