Best international payroll providers in 2025

Learn about the top international payroll providers, their features, pricing, customer reviews and how to choose the right provider for your business.

Run a UK business but want to reach a global audience? If you plan to sell, trade or otherwise do business overseas, you’ll need to accept a range of global payment methods.

To help you as you’re setting up your ecommerce site or working on an international expansion plan, we’ve put together a useful guide to global payment methods.

This includes popular and widely accepted payment methods ranging from debit cards and bank transfers to PayPal and Wise Business, along with how each method works, fees and processing times.

💡 Learn more about Wise Business

For any company that wants to sell or do business outside the UK’s borders, it’s essential to offer multiple payment methods.

Crucially, these should be easy, convenient options that your clients and customers use already.

You’ll need to do some research on this, to find out the most commonly used payment methods in the countries you’re targeting or doing business in.

It’s also important to weigh up the best payment methods in terms of factors that can affect your bottom line, such as cost and speed.

Popular payment methods can vary by country, and won’t always be possible to offer absolutely every one to your customers.

For example, customers in China commonly use payment apps and services like Alipay and Wechatpay. But this could be too expensive and complex to integrate into your existing payment system - especially if you only have a small number of Chinese customers.

So the key is to choose globally popular payment methods, those that are the most commonly used across all the countries you’re targeting.

We’ll look at 8 of these below, including:

We’ll cover everything you need to know, including how each method works, fees, timelines and what it’s best for.

Best for: broad global acceptance

Debit and credit cards are used and accepted worldwide, especially for cards issued by major providers such as Visa and Mastercard.

In fact, in the UK alone, there were an enormous 31.4 billion debit and credit card transactions in 2024. The total value of these transactions was an eye-watering £1 trillion.¹ Customers are comfortable and used to making card payments, and that includes other businesses.

There are many different ways to accept card payments, including via payment gateways for online payments on your website and point of sale (PoS) devices for taking in-person card payments.

The only downside is the potentially high fees. You may have to pay payment processing fees, interchange fees, website checkout integration costs and payment gateway fees, as well as terminal fees if you’re using a PoS device. And these can often be more expensive for international debit and credit cards.

For example, if you use Stripe to accept international card payments (non-Europe), you’ll pay a fee of 3.25% + 20p per payment. There’s also an additional 2% if currency conversion is required.²

You can also simplify online payments with Wise Business, accepting card payments in +18 currencies. The processing fee for international and business cards is 2.9%, and you can access an easy-to-use solution that ensures timely payments and enhances customer satisfaction, helping you grow your business efficiently.

Get started with Wise Business 🚀

In terms of payment processing times, card payments are usually pretty quick - taking around 1 to 3 days in total to process.³ In some cases it can be much quicker, with many card payments clearing almost instantly.

Best for: fast, easy online payments

Digital wallets such as Apple Pay and Google Pay are rising in popularity, and for many customers they’re the go-to way to make payments online. If you’re an online retailer selling to a global marketplace, it makes a lot of sense to accept digital wallet payments.

They’re fast, convenient and secure, which can give your customers confidence when paying online.

Fees for digital wallet payments tend to be in line with card payments. This makes sense, as users will usually have a credit or debit card set as the default payment card in their mobile wallet.

The timeline for processing digital wallet payments is also similar to cards, taking between 1-3 days in total to process³ (while some payments are almost instant).

One of the more popular global B2B payment methods is a bank transfer. If you’ve a bill or an invoice to pay to another business, the chances are you’re going to use your bank.

When it comes to sending or receiving international payments as a business, it’ll either be a SEPA or SWIFT payment - it all depends on the destination and currency.

Transfers sent in euros (EUR) to a bank account located in Europe will be sent via SEPA. This stands for Single Euro Payments Area, and it includes a total of 41 countries including all EU member states. The system was designed to facilitate seamless electronic payments in euros across Europe.

For funds sent in non-EUR currencies or to a destination outside of the SEPA zone, SWIFT will be used instead. This stands for Society for Worldwide Interbank Financial Telecommunication, and is a global messaging network that allows banks to send and receive information about financial transactions.

While it may depend on the bank, SEPA payments are usually cheaper and faster than SWIFT.

To receive a SWIFT payment from overseas into your UK business bank account, you can expect to pay up to £7 in fees. SEPA payments are generally free to receive, although it can vary between banks.⁴

In terms of processing times, it depends on the payment type:⁵

Read more about business bank account fees here.

Best for: managing subscriptions

If your business model involves recurring payments or subscriptions (for example, for a monthly magazine, veg box delivery or software subscription) then a Direct Debit could be a good choice of payment method.

Fees for collecting Direct Debits can vary by provider. For example, Stripe charges 1% to collect Bacs Direct Debits,² although this is only for customers based in the UK.

Other options for international customers include SEPA Direct Debit (offered by Stripe) - ideal for customers in Europe - or recurring payments collected via the customer’s card rather than their bank.

Standard Direct Debit processing times tend to be around 3 working days.³

Best for: Saving money on multi-currency transactions

If your business regularly sends and receives payments in different currencies, you’re going to need an easy and cost-effective way to manage it all.

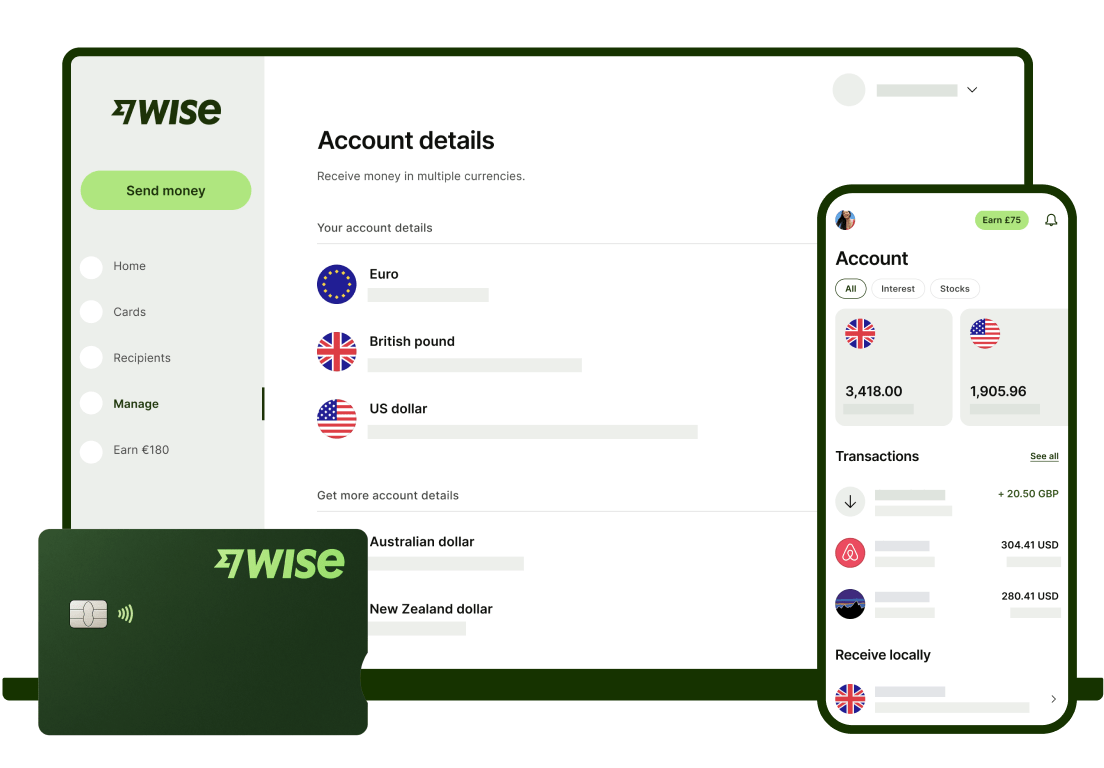

Wise Business offers the ideal solution. It’s a powerful online multi-currency account which gives you multiple ways to accept global payments. This includes:

There’s a one-time fee of £45 to sign up with Wise Business, but no monthly costs after that. It’s free to accept international payments to your local account details, with currency conversion fees starting from just 0.33%. All conversions are carried out using mid-market exchange rates.

You’ll pay 1% in processing fees to accept UK card payments, and 2.9% for international and business cards.

Payment times vary on method, but are broadly in line with the standard processing times for bank transfers and card payments. Payment links and QR codes are Quick Pay solutions, so they tend to be very easy and quick to use.

Get started with Wise Business 🚀

Best for: online checkout solutions

If you sell online and have an integrated website checkout solution, one of the payment methods you’re likely to accept is PayPal.

PayPal is a trusted name in the world of payments, and it remains a popular choice among consumers. It offers a number of payment solutions for businesses, including instalment payments, guest checkout, point-of-sale (PoS) solutions, invoicing, recurring payments and payment links.

However, there can be a number of fees to watch out for, and pricing can be a little complicated.

To accept domestic payments via PayPal in the UK, you’ll pay around 1.2% plus a fixed fee (based on currency received) for a card-funded payment. This rises to 1.5% to 2% for QR code payments.⁶

For international payments, you’ll pay the fee above, plus an additional fee based on the sender’s market or region. This is 1.29% for the EEA and 1.99% for everywhere else.⁶

There’s also a £20 monthly fee for PayPal’s Website Payments Pro and Express Checkout solution, and an additional £20/month fee to use its Recurring Payment Tool.⁶ Plus, currency conversion fees may apply.

The good news though is PayPal tends to be very quick when it comes to processing payments, with many arriving instantly. However, the exact transfer time varies depending on the payment method and PayPal platform or solution used.

Best for: providing easy, convenient payment services to customers

If you want to give your customers the option to spread the cost of a payment into instalments, you might want to look into buy now, pay later (BNPL) services. These can be particularly useful for online retailers with high-value goods, who want to incentivise customers into making purchases by giving them easier, more affordable ways to pay.

Popular BNPL services which work for international payments include PayPal (with its Pay in 3 service in the UK and Pay in 4 service in the US) as well as Klarna and Clearpay.

Fees for accepting these kinds of payments can vary by provider, but you can expect to pay around 2% to 8% of the total cost in fees.⁷

You’ll also need to be comfortable with the fact that you won’t receive the total sum upfront, and will need to plan your company’s cashflow accordingly.

Best for: an all-round global online payments solution

Rather than have to figure out ways to accept each kind of global payment method, many businesses use business platforms and payment gateways. These typically offer a wide range of payment methods to suit customers, businesses, merchants and retailers in multiple countries.

They offer solutions such as integrated website checkout, point-of-sale (PoS) terminals for in-person payments and lots of other services. This means that there should be a flexible solution for every kind of business, suiting the way it usually collects payments from customers (or would like to).

There are lots of options out there, including the following:

Read more here about business payment services.

Fees and payment processing times vary between providers, and may depend on the services or payment methods used.

If you want a simple, secure and cost-effective way to accept global payments, check out Wise Business. Open an account and you can start accepting payments in multiple currencies, from customers and clients all over the world.

There are lots of ways to get paid with Wise Business. Either send a payment link, invoice or a QR code to your customers, and let Wise handle the rest - ensuring timely payments and an improved cash flow.

This streamlined approach eliminates the technical challenges and time-consuming setup associated with traditional payment gateways, allowing you to focus on what truly matters: growing your business.

For easy B2B payments, you can create local account details in 8+ - so that clients can pay you in their own currencies.

Once the payment is done, you can manage multiple currencies effortlessly, all in one account.

Enhance your customer relationships and support your company’s global expansion with Wise Business, a payment solution that prioritises simplicity and efficiency.

Get started with Wise Business 🚀

Sources used:

Sources last checked on date: 22-Sep-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the top international payroll providers, their features, pricing, customer reviews and how to choose the right provider for your business.

Here’s an objective review of the best corporate tax software for International Businesses. Learn about their features, prices and ratings.

There are several reasons why international investment is appealing to UK startups at the moment. With economic uncertainty prevailing, the impact of Brexit...

Digital Product Passports are reshaping EU trade. Discover what’s required and how Wise Business makes compliance more cost-effective.

Learn how to start a business in Mexico, focusing on opportunities and regulations to navigate for successful operations.

Discover the 10 best European cities to start or grow your business in 2025 with funding, talent, and speed you won’t find in the UK.