The Best Mailchimp Alternatives for Businesses in Singapore [2025]

Looking for the best Mailchimp alternatives for your Singapore business? Here are our top picks.

If your business employs people, you will need to manage and process payroll.

Payroll in Singapore is regulated under the Employment Act¹, which serves to protect the rights of those working in Singapore.

As a business owner in Singapore, you should ensure that your company is compliant with the legal requirements under the Employment Act to avoid penalties, ensure long-term business success and maintain employee satisfaction.

Instead of having to pore over all 121 pages of the Employment Act, this comprehensive guide distils everything you need to know to manage and process payroll in Singapore efficiently.

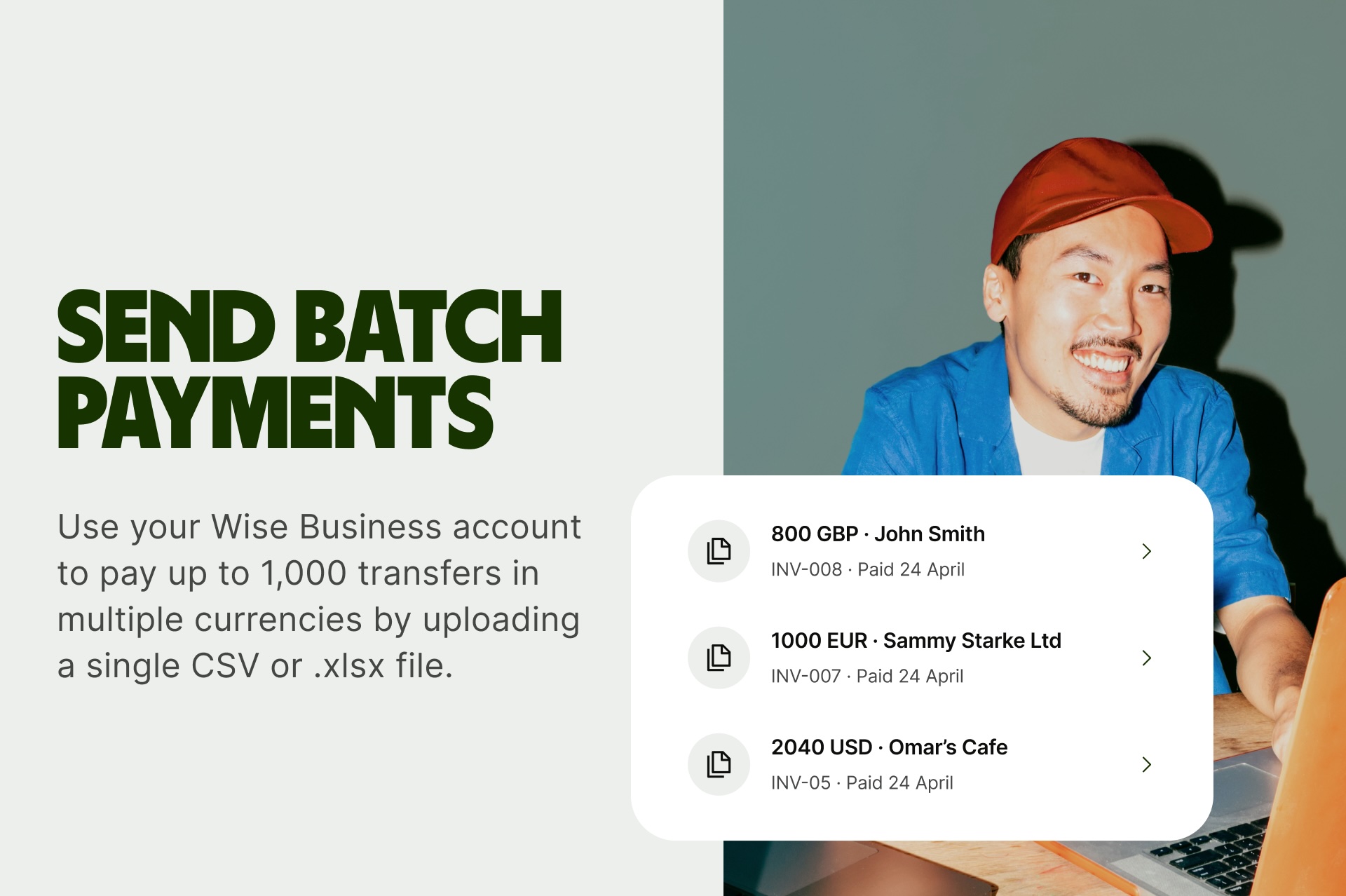

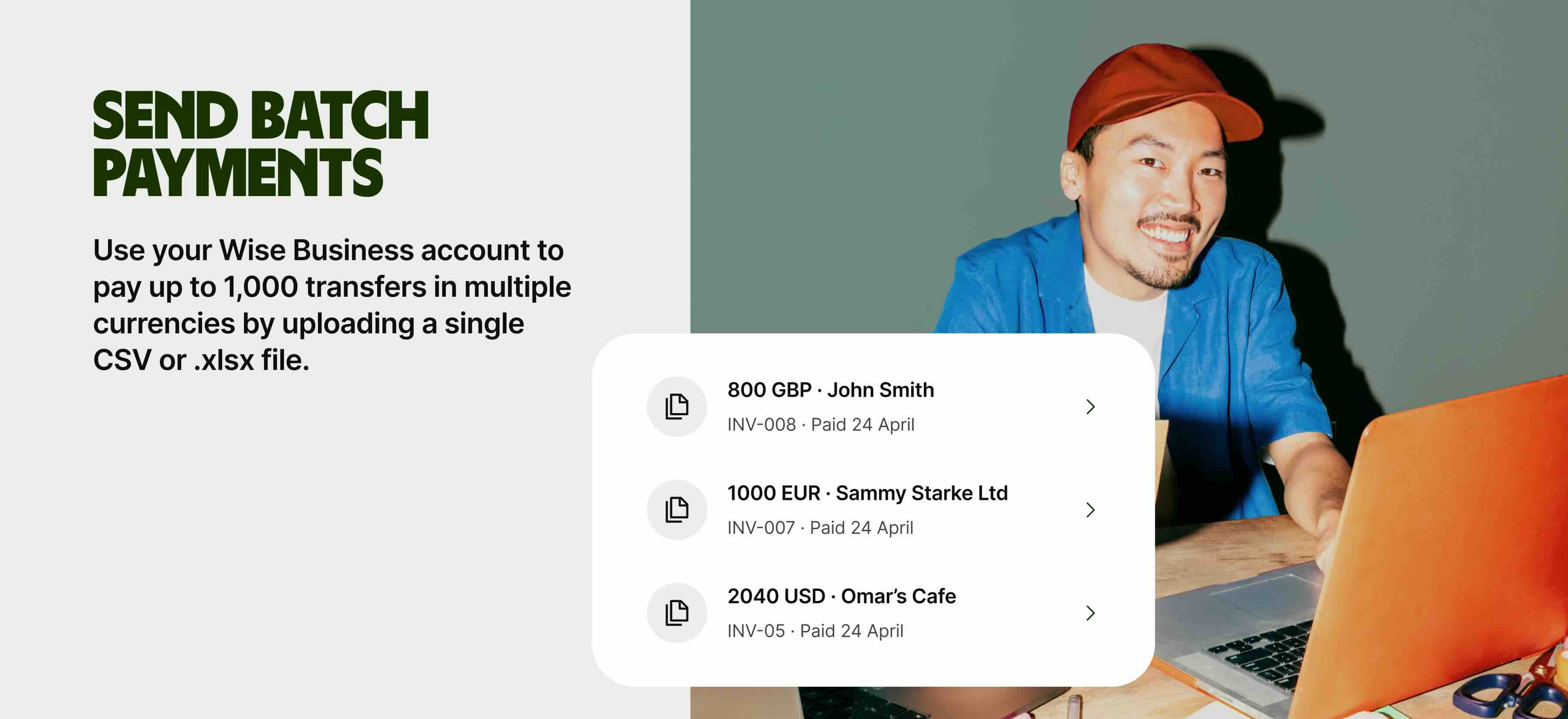

We'll also mention how Wise Business is an easy way for Singapore companies to manage payroll with its intuitive Batch Payments feature. You’ll be able to send payments to all your staff - both local and overseas - faster, and more cost-effectively as Wise always uses the mid-market rate for any foreign currency conversions.

| Table of contents |

|---|

For a start, here’s a typical payroll management and processing workflow in Singapore. Use this as a guide to design your internal workflow and ensure that your employees are compensated accurately.

You should also be clear about your payroll frequency. While most companies pay every month, if you are in the hospitality, retail or service sector, freelancers or contract workers may expect payment on a weekly or bi-weekly cycle.

Take note that Singapore employers are required to issue an itemised pay slip for employees, and you will need to keep records of pay slips for the past two years.

While this process is manageable for a small company, it can take a toll as your company grows. Payroll software can help you to automate this process while ensuring that your business is compliant with the Employment Act.

| 💡Having trouble managing multiple invoice payments efficiently? Wise Business can streamline your payment process, save you hundreds of manpower hours, and do it all with no hidden exchange rate markups. |

|---|

➡️Explore Wise Business Batch Payments today

Slasify, a Singapore-based global HR management platform, solved the bulk of challenges from managing international payments with Wise Business’s transparent pricing and efficient cross-border transfer capabilities.

| ➡️ Find out how Slasify uses Wise Business to save time and money, enabling businesses in 150+ countries to manage payroll payments in 130+ currencies. |

|---|

As a business owner in Singapore, you do not have to be an expert on Singapore’s payroll legislation. However, you should have a basic understanding of the following laws and legal requirements to ensure that your business remains compliant.

The Employment Act¹ has been the main labour law in Singapore since 1968 and covers the payroll legislation in the country.

Part Three of the Act focuses on salary and mandates that:

You should also note that the Act mandates that an itemised pay slip must be provided to all employees, either in soft or hard copy, in Part 12.

The CPF is a mandatory social security savings scheme. It is a key component of payroll management in Singapore because employers would deduct the employee’s CPF contribution from their gross salary.

Employers are required to contribute to their employees’ CPF if they are Singapore Citizens or Permanent Residents and are earning a combined wage of more than 50 SGD a month. Employees who earn above 500 SGD are also required to contribute to their CPF, with rates being determined by their age. The CPF board provides a handy CPF contribution calculator that helps you calculate both the employer and employee CPF contributions.

At the point of writing, the CPF contribution rates² are as follows:

| Employee's age (years) | By employer (% of wage) | By employee (% of wage) | Total (% of wage) |

|---|---|---|---|

| 55 and below | 17 | 20 | 37 |

| Above 55 to 60 | 15.5 | 17 | 32.5 |

| Above 60 to 65 | 12 | 11.5 | 23.5 |

| Above 65 to 70 | 9 | 7.5 | 16.5 |

| Above 70 | 7.5 | 5 | 12.5 |

Source checked: 16 Jun 2025

Do note that there will be upcoming increases to the CPF contribution rates for senior employees (aged from 55 to 65) from 1 January 2026³.

In general, CPF contributions are required on all wages⁴, which are defined as any monetary or cash remuneration under the CPF Act. These would include basic salary, overtime pay, bonuses, allowances, commissions or cash incentives.

You do not have to contribute to CPF for any non-cash benefits, gifts, reimbursements and termination benefits.

Levies are another key component in payroll management. Here are two common worker levies you may need to include in your payroll processing workflow.

Skills Development Levy (SDL): SDL is a compulsory levy on all employees working in Singapore, including foreign employees⁵. It is collected alongside CPF contributions. The SDL is collected by SkillsFuture Singapore Agency (SSG) and is used to support skills upgrading and to fund training grants for employers who send employees for training under the National Continuing Education Training system.

The minimum amount payable is 2 SGD for employees earning less than 800 SGD per month and up to 11.25 SGD for employees earning more than 4,500 SGD per month.

Foreign Worker Levy (FWL): Singapore businesses are required to pay a monthly levy for any Work Permit (WP) holders employed⁶. The FWL is calculated based on the worker’s qualification and the number of Work Permit or S Pass holders that your company hires.

Singapore businesses are not required to withhold taxes from employees. However, under the Singapore Income Tax Act⁷, you are legally required to submit details of your employees’ income to the Inland Revenue Authority of Singapore (IRAS).

There are four types of tax forms for employers⁸:

Submission of employee income is an annual process that can be done manually or via the AIS. This process can be automated easily using Singapore payroll software, too.

On top of their basic pay, Singapore business owners may choose to offer variable wage components⁹ that encourage productivity or reward employees for their work. The following are the most common variable wage components. Do note that they are eligible for CPF contributions as well.

Annual Wage Supplement (AWS): AWS, also commonly known as the “13th month bonus”, is an additional single payment on top of an employee’s total annual wage. While encouraged, AWS is not compulsory unless stated in the employee’s contract. The amount can be decided by the employer, depending on the company’s performance.

Bonus: Another one-time payment, bonuses are commonly used to reward employees for their contributions to the company. Like AWS, it is not compulsory.

Variable Payments: Commonly referred to as incentive payments, variable payments help drive and encourage productivity and are usually based on milestones or key performance indicators. These are not compulsory as well.

As a Singapore employer, you should know your rights and limitations when it comes to salary deductions. While you are allowed to make salary deductions, you should know that deductions are only allowed for specific reasons¹⁰, such as:

Any other deduction will require a written consent from the employee, and deductions are capped at 50% of the employee’s total salary payable in any one salary period.

Now that we’ve covered the key aspects of managing and processing payroll in Singapore, here’s a quick step-by-step process on how to calculate payroll for your employees.

Yes, overtime pay is mandatory in Singapore for eligible employees.

Eligible employees include:

Employers are required to pay at least 1.5 times the employee’s basic hourly rate, and the overtime pay is subject to CPF contributions. You should also note that employees are only allowed to work up to 72 overtime hours per month.

Yes. As of 1 April 2016, the Employment Act mandates that all employers must issue itemised pay slips to employees.

Itemised payslips must include the name of the employer and the employee, date of payment, basic salary, salary period, any allowances or additional payments, deductions and net salary paid in total¹¹.

You will be required to keep employment records of your employees and pay slip records from the past two years.

Do note that you should keep pay slip records from the last two years of any ex-employee for one year after they leave.

No. Singapore does not have a universal minimum wage regulation. Instead, we use a Progressive Wage Model (PWM)¹² that encourages the increase of workers’ wages through skills upgrading and improvements in productivity.

The PWM determines a required PWM wage level for eligible employees and a Local Qualifying Salary (LQS) for all local employees, by sector or occupation.

In this comprehensive guide, we’ve given you the essential overview to managing and processing payroll in Singapore, which ensures your business is compliant with payroll regulations.

By leveraging solutions like Wise Business, you can streamline your payroll process, saving time and money while ensuring accuracy and compliance.

| 💡Whether you're handling one-off invoices, recurring payments, or mass payouts, Wise Business makes it easy to simplify your financial operations and maximise profits. |

|---|

➡️Start Paying Overseas Invoices for Less with Wise Business

Sources:

Sources checked on 17 Jun 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Looking for the best Mailchimp alternatives for your Singapore business? Here are our top picks.

How does WhatsApp Business pricing work for Singapore companies? Explore 2025 pricing, WhatsApp APIs, and how to save money on international subscriptions.

Compare HubSpot vs Salesforce for Singapore businesses in 2025. Analyse features, pricing, and pros and cons to help you choose the right CRM platform.

Compare Google Meet vs Zoom for Singapore businesses in 2025. Explore pricing and features to find the best video conferencing app for your team.

Explore Airwallex Corporate Card's features for Singapore businesses, including online and in-person spending capabilities, pricing, and more.

Compare Loom's pricing plans and features for Singapore businesses and discover money-saving strategies for managing international SaaS subscriptions.