GST Exemption List Singapore: Complete Business Guide for 2025

Complete guide to Singapore's GST exemption list. Learn which supplies are exempt, out-of-scope, or zero-rated and how it affects business compliance.

You may think that your financial records are flawless, but in the current landscape where businesses work with multiple banks and vendors, oversights in transactions could lead to heavy losses. Bank reconciliations help you avoid these losses.

In this article, you will learn the fundamentals of bank reconciliation. We will show you how to implement it seamlessly into your business’s workflow, ensuring you can always be confident that your financial records are accurate. We will also share how Wise Business allows you to streamline your bank reconciliation process.

| Table of contents |

|---|

Bank reconciliation is the process of double-checking that transactions from your financial records match those on your business bank statements. A bank reconciliation statement¹ may be produced, giving you a list of transactions that do not tally, and changes made to keep your accounting up to date.

Bank reconciliation helps you catch errors in your financial records, spot missing payments, identify double charges or fraud, and ensure that your business is not overspending. This process also helps keep your books tidy for efficient financial reporting and subsequent tax filings.

Ever had the experience where your wallet had less cash than you thought you had? Maybe it was because you forgot that you had bought that extra pack of M&Ms. In business, this could be due to a lag in expense reporting, a missed payment or worse, fraudulent transactions. Here’s an example.

You had invoiced an international client for USD 1,800 and received updates that the payment had been made via wire transfer. Your records were updated with the invoice amount, but upon reconciliation, you find that the amount doesn’t tally because of fees and foreign exchange rates. This is how it might look:

As per accounting records:

| Transaction Date | Transaction Description | Transaction amount (USD) | Transaction amount (SGD) |

|---|---|---|---|

| 18 June 2025 | Invoice to Client A (1 USD = 1.29 SGD) | USD 1,800 | SGD2,322 |

As per the bank statement:

| Transaction Date | Transaction Description | Transaction amount (USD) | Transaction amount (SGD) |

|---|---|---|---|

| 19 July 2025 | Incoming payment from Client A (1 USD = 1.28 SGD) | USD 1,800 | SGD2,304 |

| 21 July 2025 | Handling fee | SGD 10 |

In this case, your accounting records would be off by SGD 28 due to the difference in foreign exchange rates and the failure to record the handling fee.

You would need to update your accounting records accordingly to ensure they match up with your bank statement.

This depends on the size of your business. If you are a one-man business, the task will fall on your shoulders. However, if your finances are complex or if you have a bigger team and budget, you should outsource or delegate this task to:

It is ideal to assign someone who is detail-oriented to work on your bank reconciliation. For an added layer of accuracy, bank reconciliation reports should be reviewed by the business owner or a third party periodically.

How do you start your bank reconciliation process? Here is a quick step-by-step guide:

In general, bank reconciliation involves the matching of your financial records to your bank records. That said, businesses handle a range of financial transactions in their day-to-day operations. You can break down your bank reconciliation processes by transaction types or delegate them to multiple staff to minimise potential human errors in the bank reconciliation process as well.

Here are the different types of bank reconciliation to consider:

Now that we understand the process of bank reconciliation in Singapore, here are some common challenges and discrepancies you should take note of.

Missing Entries, duplicate entries or wrong amounts

Transactions in your bank statement that were not recorded or recorded incorrectly in your accounting records or spreadsheets. These are usually due to manual input errors, which can be easily avoided if you are using a reliable accounting software.

Another common cause for such issues is bank fees or interest, which are usually charged by the bank and reflected on bank statements, but are not captured within your business’s financial records. Likewise, accounting software can help negate this issue.

Finally, such errors may also be a result of lapsed payment from clients, refunds from vendors or overpayment of suppliers. Your team should actively seek to rectify this to reduce any hidden losses.

Time lag

Some transactions take a while to be reflected in your bank statements, even if they have been recorded in your financial records. Such examples include uncleared cheques, weekend transfers, or even pending GIRO payments. Such discrepancies may affect your balances but do not require any further action.

Foreign currency issues

Differences due to exchange rate fluctuations or foreign currency conversion fees. Such issues can lead to confusion during reconciliation, but can be rectified easily by accounting for foreign exchange rates accurately. Using a multi-currency account like Wise Business can help to reduce such issues, as you can hold your money in foreign currencies instead of being forced to convert all foreign currencies back to SGD.

Unauthorised or fraudulent transactions

Such transactions are usually unexpected and often unapproved. They could signal serious problems like misuse of company funds or phishing scams. Having a regular bank reconciliation schedule helps you to catch such transactions early, allowing you to reduce your risks and losses.

| 🚀 How a Singapore software development company identified gaps in their finances and cut costs through bank reconciliation |

|---|

| For Axpara, a fast-growing remote-first company in Singapore, cross-border payroll started to become a headache as they scaled. Working with numerous clients and remote teams meant countless transactions, hidden fees, and hours lost to reconciliation processes. To make things worse, inefficiencies of legacy financial systems meant they were losing tens of thousands of dollars annually.Hence, they turned to Wise Business for transparent foreign currency conversion rates, easy batch payments, and simpler, automated reconciliation. The shift saved them over SGD 50K a year.➡️Read Axpara's full case study here. |

At this point, you should be convinced of the importance of bank reconciliations. Here are some tips to help you further:

| 💡Pro-tip: Consider consolidating your currencies into a single multi-currency business account like Wise Business, which lets you hold and manage 40+ currencies while enjoying low-fee transactions and saving on hidden foreign exchange markups. |

|---|

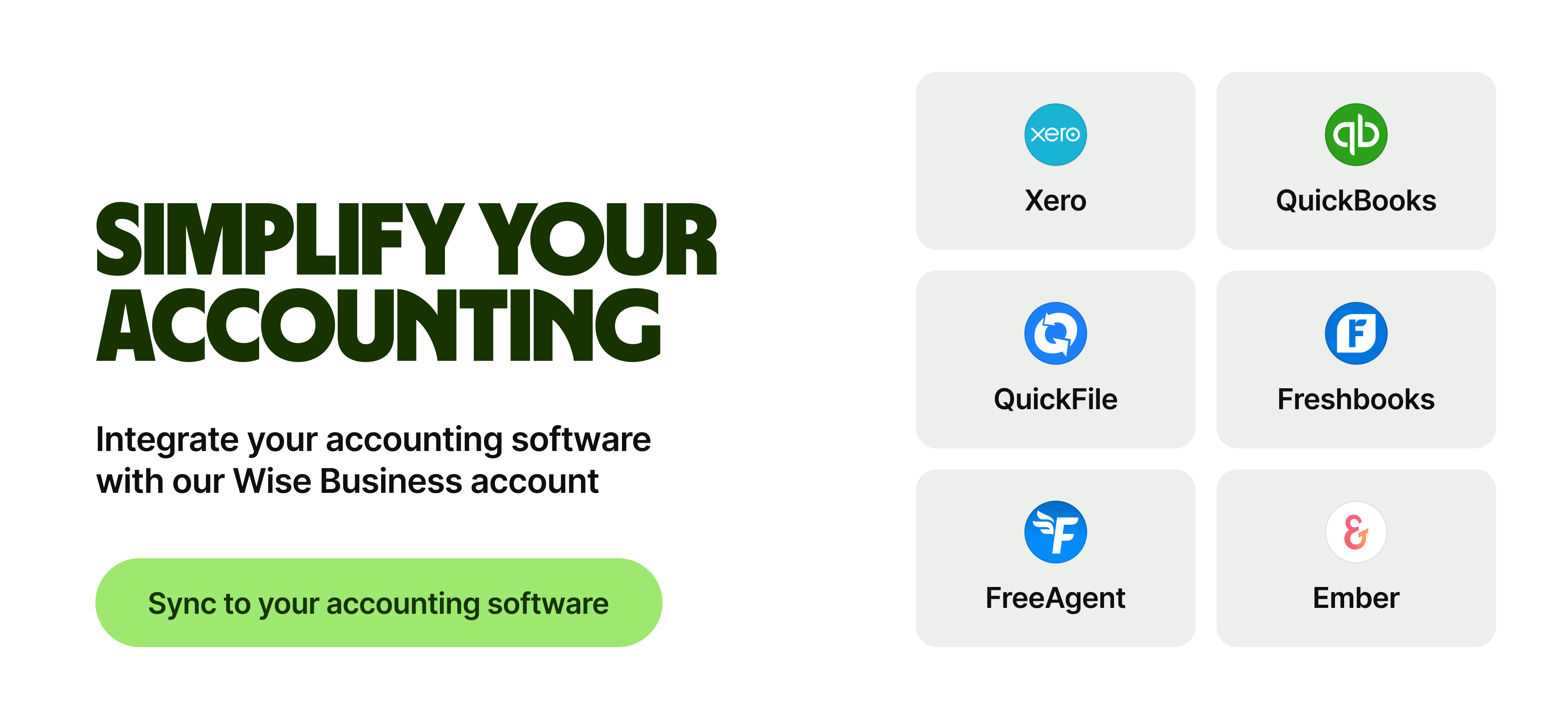

| 💡Did you know that Wise Business users can choose to integrate their business account with a wide selection of accounting software? Simple one-time integration with popular accounting tools like Quickbooks and Xero could help you eliminate unnecessary manual work and make bank reconciliation a breeze for your finance team and accountants. |

|---|

Bank reconciliation helps you spot discrepancies in your financial records and raise potential risks or fraudulent transactions. Here, we have provided a step-by-step guide so that you can carry out your bank reconciliations independently. Consider using accounting software that integrates seamlessly with your bank or multi-currency accounts like Wise Business to save time and minimise errors.

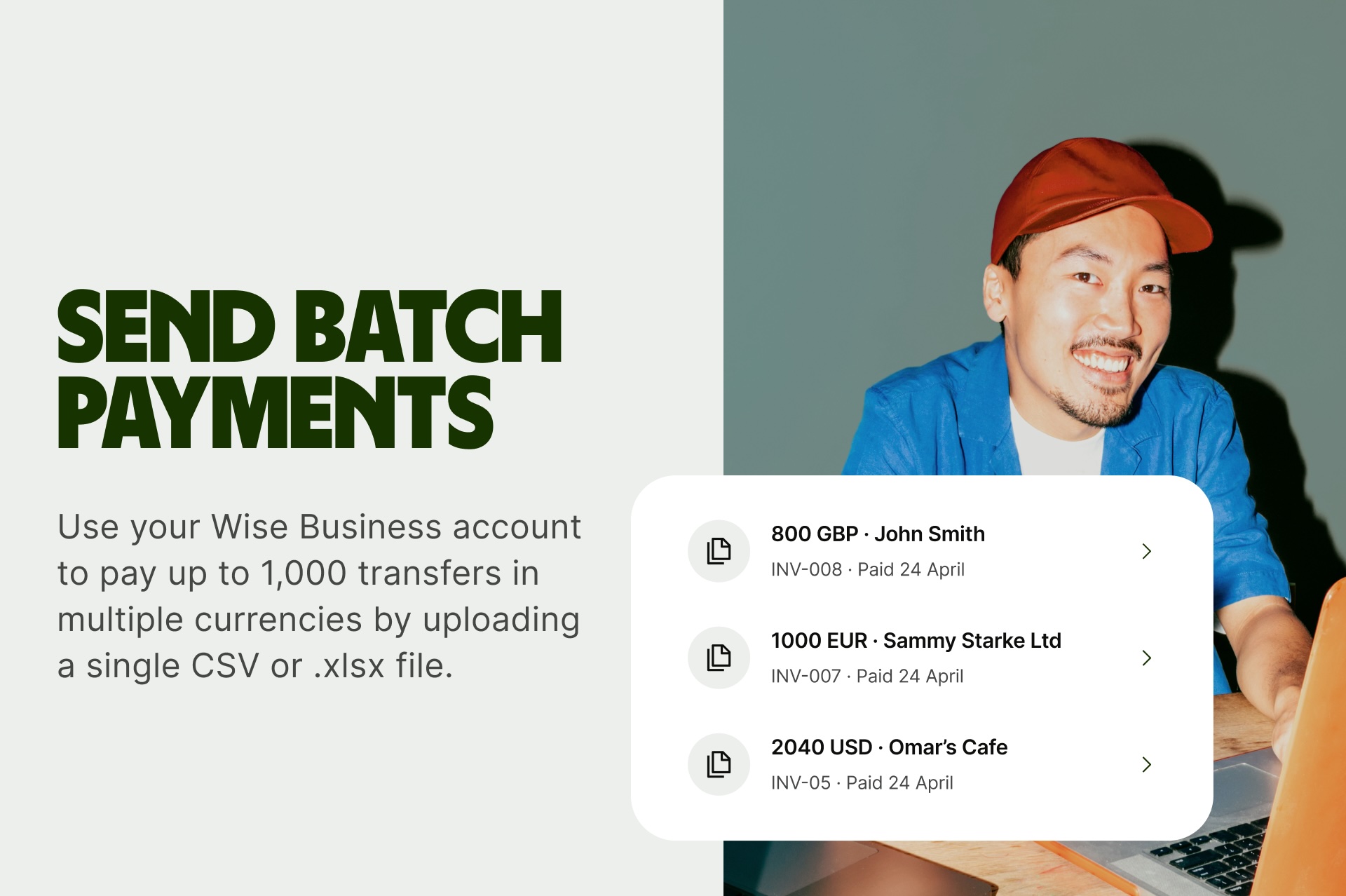

| 💡Having trouble managing multiple invoice payments efficiently? Wise Business can streamline your payment process, save you hundreds of manpower hours, and do it all with no hidden exchange rate markups. |

|---|

➡️Explore Wise Business Batch Payments today

Sources:

Sources checked on 25 July 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Complete guide to Singapore's GST exemption list. Learn which supplies are exempt, out-of-scope, or zero-rated and how it affects business compliance.

Discover what Zero-Rated GST is, how 0% GST can help your Singapore business save on taxes, how to qualify for it and more.

Compare the top accounting software for small businesses in Singapore. See features, pricing, and how to simplify finances with Wise Business.

Explore whether sole proprietors in Singapore can hire employees or work with independent contractors, as well as business expansion options.

Discover how to calculate your gross and net burn rates, what makes a good burn rate and how to use it to improve your business.

Learn how sole proprietorship tax works in Singapore, from rates to deductions — plus tips to avoid penalties and stay compliant with IRAS.