All-In-One Corporate Services: Is a Sleek Business Account Right for You?

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

American Express Corporate Card programs stand among the most established and trusted business payment solutions globally. For Singapore businesses, these cards offer a comprehensive suite of benefits tailored to various corporate needs, from travel management to purchasing control.

In this guide, we'll look at the different American Express corporate card options available in Singapore, comparing their features, benefits, and potential drawbacks to help you make an informed decision. Then, we’ll introduce an alternative to complement your business card needs: the Wise Business card.

Here's a quick comparison of the available Amex business cards along with the Wise Business Card:

| Card | Annual Fee | Minimum Annual Revenue | Foreign Transaction Fee | Key Benefits |

|---|---|---|---|---|

| American Express Corporate Gold Card | S$168.95 | Information not available | 2.95% | Higher reward points, premium travel benefits |

| American Express Corporate Card | S$130.80 | Information not available | 2.95% | Basic travel insurance, expense management |

| American Express Corporate Purchasing Card | Information not available | Information not available | 2.95% | Supplier and procurement controls, detailed reporting |

| American Express Corporate Meeting Card | Information not available | Information not available | 2.95% | Event spending management, consolidated billing |

| AMEX Singapore Airlines Business Credit Card | S$304.59 | S$50,000 | 3.25% | KrisFlyer miles earning, travel perks |

| Wise Business Card | S$0 | None | No foreign transaction fee. Wise uses mid-market exchange rate. A small conversion fee is charged, starting at 0.26%. | Low fees on international payments 24/7 customer support No annual fee |

*Details correct at time of research - 27th January 20252

**This information is based on limited publicly available sources. Contact American Express directly for full details on each card's charges, and benefits.

Corporate cards fundamentally transform how businesses manage employee spending and company expenses. Unlike personal credit cards, these programs offer company-level liability options that protect both the business and employees.

The system integrates directly with expense management platforms, providing real-time visibility into all transactions and simplifying the entire expense reporting process.

For Singapore businesses, corporate cards solve several common challenges. They eliminate the need for employees to use personal cards for business expenses, simplify reimbursement processes, and provide better control over company spending.

➡️ Check Out: Which Company Credit Card is Best for Businesses in Singapore in 2025?

American Express is a popular choice for Singapore businesses for many reasons. The @Work platform offers online account management with detailed spending analytics, while integration with accounting software simplifies expense tracking. This means real-time expense tracking, custom reports, automated receipt matching, and full management of employee spending limits.

Additional benefits include:

The Corporate Gold Card is Amex's premium offering for larger businesses, designed for companies with significant travel and entertainment expenses.

| 📝 The Gold Card's strengths lie in its superior rewards earning potential and premium travel perks, but not every company will get enough value to justify the variable higher annual fee. |

|---|

Amex’s foundational corporate card balances benefits with lower costs. It's suitable for most business needs, making it a popular choice for growing companies that need reliable expense management tools.

| 📝 The Amex Corporate Card works well for most SMEs prioritising expense management. But you get fewer perks than with the Gold Card - think basic insurance instead of comprehensive cover, and no fancy lounge access. |

|---|

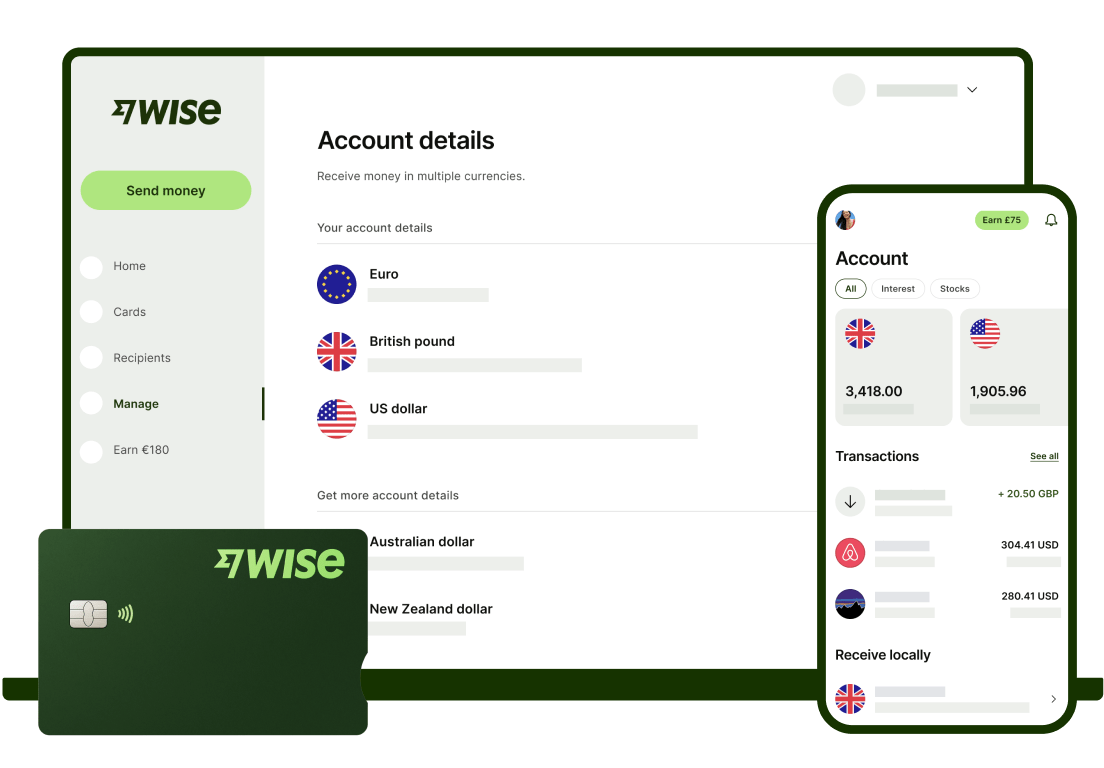

Illustration of Wise Business products

Companies engaged in international transactions can benefit from adding the Wise Business Card to their financial toolkit.

The key differentiator for Wise is its handling of international payments.

Rather than marking up the exchange rate or charging higher fees, Wise provides businesses with the real mid-market rate and transparent pricing for the conversion fee.

This can result in significant savings for companies that regularly send or receive international payments. You can compare the costs directly - while traditional corporate cards often charge 3-4% on foreign transactions, Wise doesn’t charge foreign transaction fees at all.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information

The Corporate Purchasing Card is specifically designed to help with regular supplier payments, high-volume purchasing, and detailed spending data.

| 📝 The Purchasing Card works best for businesses with significant spending needs and, by simplifying supplier relationship management, aims to cut procurement costs. It offers fewer rewards than other Amex corporate cards, putting the emphasis on control and visibility rather than perks. |

|---|

If your company runs regular events, the Corporate Meeting Card can help track and manage those costs.

| 📝 The main drawbacks come from its limited use beyond meeting expenses - it might not be cost-effective for businesses that only occasionally host events. |

|---|

For businesses that frequently fly with Singapore Airlines, this co-branded card offers specialised travel benefits - particularly for travel between Singapore and key Asian business hubs.

| 📝 The benefits of this card are focused on making the business travel experience better and improving the productivity of layovers. As a result, companies that don’t already use Singapore Airlines will find less value. |

|---|

Instead of offering one-size-fits-all solutions, Amex has created specific cards for distinct business needs.

Take their Meeting Card - you won't find a dedicated card for this function from other providers. This specialisation extends across their range. Their Gold Card works best if your team travels frequently, offering airport lounge access and comprehensive travel insurance. The standard Corporate Card, on the other hand, handles everyday business spending with solid expense tracking.

But remember, specialised cards entail specialised costs.

Businesses should check that their spending in each category justifies separate cards and annual fees. Some businesses need multiple cards to cover all their needs, but this can get expensive. Others find that a single multi-purpose card, like the standard Corporate Card, better suits their spending patterns.

| 💡Many Singapore businesses find they get better results by mixing different cards. |

|---|

| ● Keep your Amex business cards for local spending and travel perks, but add a Wise Business Card to get better exchange rates and lower fees on global payments. |

| ● Start with what matters most to your business right now. You can always add additional cards later as your business needs change. |

| ● Check the costs carefully before you choose. Different sized companies get different fees and terms, so you'll need to speak with Amex directly. |

>> Get Started with Wise Business today >>

Sources checked on 27.01.2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.

Compare Airwallex vs Wise Business for Singapore companies and find out which multi-currency account suits your business needs best.

Everything you need to know about using multi-currency business accounts in Singapore.