GCash Cash In Fees: A guide to fees, limits and free methods in 2025

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

If you have a ShopeePay balance but you’d prefer to have the money in your GCash account for easy spending in stores and online, you need to learn how to transfer ShopeePay to GCash. Generally you can make a direct transfer from ShopeePay to ewallets like GCash, setting up the withdrawal in ShopeePay using your phone.

This guide looks at how to convert ShopeePay to GCash in a few simple steps, including the process to follow and the fees involved. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

So - can I transfer ShopeePay to GCash directly, or do I need to move the money to my bank first?

The good news is that you can move money from ShopeePay to wallets like GCash directly if you’d like to¹, with a ShopeePay to GCash transfer fee. Your transfer is processed via InstaPay, and there’s a minimum transfer value of just 1 PHP. You do need to have a fully verified ShopeePay account to be able to transfer money out, but once you’ve uploaded your documents and information, you’re able to move your money fairly easily from ShopeePay to GCash.

If you’d prefer you can also move your money from ShopeePay to your bank and then into GCash in two separate transfers. This can help you avoid the fee if you bank with Seabank - we’ll look at this more later.

ShopeePay to GCash transfers usually arrive pretty much instantly, but can take a couple of hours to show up in your GCash account in some cases². If you’re ever concerned about a transfer you can reach out to the ShopeePay service team to ask for an update on the transfer’s progress.

To transfer money from ShopeePay to another account you must have a fully verified ShopeePay account.

To verify your ShopeePay account you’ll be prompted to enter some information about yourself and upload an image of an acceptable form of government issued ID.

You’ll need to add some information such as your full name, address, employment, income and the source of the funds you’re spending. Documents for identification can include a Philippine ID, driving license or passport, or for foreigners in the Philippines, a foreign passport or an alien registration card³.

By verifying your ShopeePay account you also raise your wallet limits which allows you to hold a balance of up to 100,000 PHP, and have an outflow limit which is also 100,000 PHP. This can mean you’re able to do much more with your ShopeePay account.

Once you have a verified ShopeePay account you can transfer funds out to external accounts, including banks and ewallets.

To transfer ShopeePay balance to GCash you’ll need to take the following steps:

Before you confirm your transfer to GCash make sure you’ve double checked all of the details you use are correct. GCash does warn that if you send a payment to an incorrect GCash account you may struggle to get your money back. Whether or not the payment can be returned depends on the policy of the wallet you send from, which means you would need to ask ShopeePay to help you refund the payment if you make a mistake⁴.

There’s a ShopeePay to GCash transfer fee of 15 PHP per payment.

If you’re sending your money from ShopeePay to GCash directly you can’t avoid this fee. The only way to have the fee waived is if you have a Seabank account. If you do, you could link this account to ShopeePay, and withdraw from ShopeePay to Seabank with no withdrawal fee. You can then use your Seabank account to top up your GCash account, instead of moving the money directly from ShopeePay to GCash. This adds an extra step but can help you cut the costs in the end.

If you’ve returned an item to a ShopeePay seller and want to have the money refunded to GCash you may be able to do so once you’ve sent the item back and had the refund confirmed. The payment method for the refund will depend on the merchant, but you can always request GCash as your preferred receive method.

Alternatively, if the merchant wants to refund the payment to ShopeePay directly, you could have them do that and then follow the steps outlined above to withdraw the funds to GCash yourself.

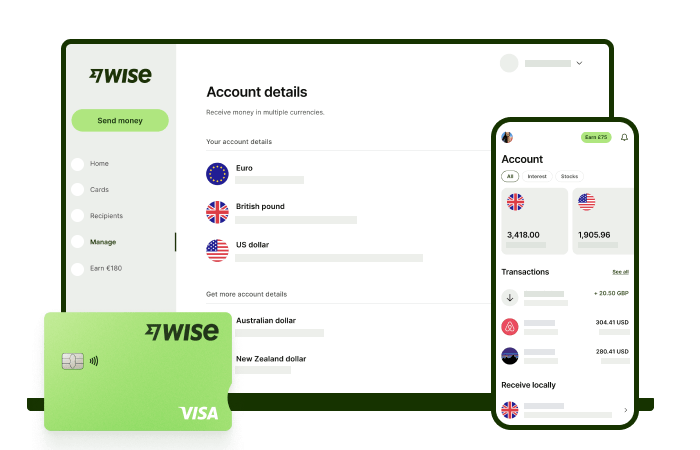

Receive foreign currency and exchange it directly to pesos at the mid-market rate with Wise.

Sa Wise, makakakuha ka ng 8+ local account details, kasama ang PHP, USD, GBP, AUD at marami pang iba. Kaya, mas madali at convenient na makatanggap ka ng pera direkta. Mag sign-up ka lang ng libreng account, at mae-enjoy mo nang i-manage ang pera mo gamit lang ang phone mo.

Kapag natangap mo na ang pera mo, madali mo itong i-convert sa 40+ na currencies, with low fees, at sa mid-market rate - ito yung totoo at nakikita mong rate sa Google. Kasama na dito ang pag-exchange ng peso na may one-time conversion fee na nagsisimula sa 0.57%. Kitang-kita na agad yan upfront, walang patong o hidden fees.

Kaya, tumanggap, mag-exchange, at ilipat ang funds mo sa iyong local bank account gamit ang Wise.

It’s simple and stress free - and lets you keep on top of your finances no matter what you’re up to.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

Want to cash out from Lazada Wallet to GCash? Learn more about how to transfer, convert, and refund credits.

Want to transfer money from BPI to GoTyme? Learn more about how to send money across platforms.

Want to transfer money from Maya to SeaBank? Learn more about how to send money across platforms.

Want to transfer money from BDO to Maya? Learn more about how to send money across platforms.

Want to transfer money from SeaBank to PayPal? Learn more about how to send money across platforms.