GCash Cash In Fees: A guide to fees, limits and free methods in 2025

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

Western Union1 is a popular provider of international money transfers. In this guide, we'll talk you through the process of receiving money via Western Union in the Philippines, including the costs involved in the transfer process.

For this guide we’re looking at Western Union Philippines, and Western Union US, to give examples of the process and costs involved. If your sender is not in the US, they’ll need to check the terms, conditions and fees of their local Western Union service - but this guide should give a good outline to start with.

To get started - a few requirements to remember:

If the person sending you money plans on using Western Union from abroad to send transfers to the Philippines, they’ll usually be able to send it online, in app, in person at an agent location, and in some cases by phone.

The most convenient options may be to send online or in the Western Union app - here’s how3:

How long your money will take to arrive will depend to a large extent on the exact service the sender selects. As an example, in the US, Western Union customers can select from the following4:

So - someone is sending you money. Let’s look at how you might be able to receive money through Western Union in the Philippines.

If your money has been sent for cash pickup you’ll need to head out to an agent to get you cash. To find where you can claim a Western Union remittance, you can use the Western Union branch location tool to find an agent nearby. You’ll need to ask the sender to give you the MTCN – Money Transfer Control Number - that they received when they sent the payment. Then go to your nearest agent, with5:

ID documents are government issued documents like a passport or driving license - if you don’t have these, there are many other documents which can be accepted - a full list of documents is available on the Western Union PH website.

You can receive money through Western Union to be deposited in your bank account if you bank with:

All you need to do is to give the sender your bank information, including the account number and your full name. The money will be deposited to your account without you needing to take any further action - this may take a week or so, though.

Looking for a faster transfer - or use a different bank? We’ll cover an alternative that might suit you - Wise - coming up in just a moment.

Western Union supports payment to the following mobile wallets:

As long as you have a fully verified wallet with your preferred provider, all you’ll usually need to do is to give the person sending you money your phone number. The money will be deposited into your account automatically. Ask the sender to give you the MTCN number in case you need to claim or track the transfer.

You will not pay a fee to Western Union when you receive money in the Philippines6. If you’re getting paid to a bank you’ll need to check if your own bank will deduct any fee for an incoming money transfer. Similarly if you are receiving money to a mobile money wallet - although with major wallets like GPay and Maya there are usually no fees to receive a remittance.

All that said, it’s not free to use Western Union. The person sending you money will have to pay fees - which can be quite steep. Let’s take a look.

Western Union uses variable transfer charges which depend on the country and currency the sender is sending from, the value of the payment, how you want to receive your money, and how the sender chooses to pay. Charges vary, and can be different online compared to an agent location for example.

The fees can depend a lot on where your sender is, but generally costs rise when there’s labor required - so if the sender arranges the payment in a Western Union location, or if you choose a cash collection. Transferring from one bank to another is often the cheapest option, while paying by credit card can mean very high fees indeed.

Your sender will be able to check and compare the costs of the payment easily either online or when they go to a Western Union location. Bear in mind that the transfer fee isn’t the only cost - currency conversion fees may also apply. More on that next.

When you arrange a payment with Western Union, the exchange rate used to convert the sender’s currency to PHP is very likely to be different from the mid-market exchange rate you usually see on Google. This markup can vary - including varying between sending online or in a store - and can be pretty tricky to spot.

Not all providers use exchange rate markups. Read on for an alternative which may have a more transparent approach to exchange rates, which could mean lower fees.

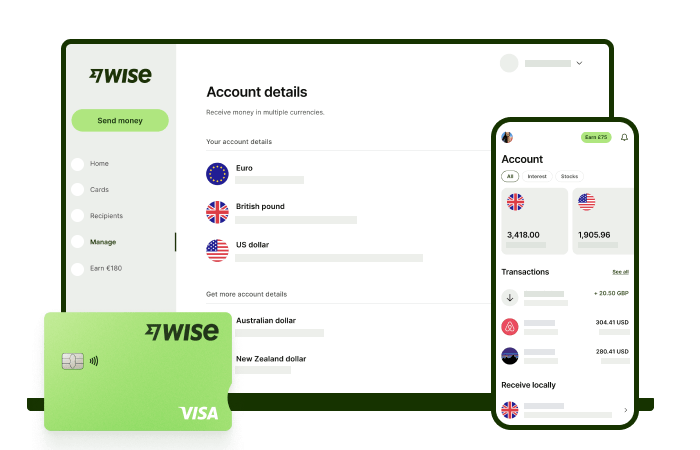

Sa Wise, makakakuha ka ng 8+ local account details, kasama ang PHP, USD, GBP, AUD at marami pang iba. Kaya, mas madali at convenient na makatanggap ka ng pera direkta. Mag sign-up ka lang ng libreng account, at mae-enjoy mo nang i-manage ang pera mo gamit lang ang phone mo.

Kapag natangap mo na ang pera mo, madali mo itong i-convert sa 40+ na currencies, with low fees, at sa mid-market rate - ito yung totoo at nakikita mong rate sa Google. Kasama na dito ang pag-exchange ng peso na may one-time conversion fee na nagsisimula sa 0.57%. Kitang-kita na agad yan upfront, walang patong o hidden fees.

Kaya, tumanggap, mag-exchange, at ilipat ang funds mo sa iyong local bank account gamit ang Wise.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

Want to cash out from Lazada Wallet to GCash? Learn more about how to transfer, convert, and refund credits.

Want to transfer money from BPI to GoTyme? Learn more about how to send money across platforms.

Want to transfer money from Maya to SeaBank? Learn more about how to send money across platforms.

Want to transfer money from BDO to Maya? Learn more about how to send money across platforms.

Want to transfer money from SeaBank to PayPal? Learn more about how to send money across platforms.