GCash Cash In Fees: A guide to fees, limits and free methods in 2025

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

Payoneer1 offers multi-currency business accounts to digital businesses, online sellers and freelancers. If you’re looking for ways to move your money from Payoneer into a local account in the Philippines, you may be considering using Maya2.

This guide covers all you need to know.

| Table of contents |

|---|

If you’re thinking of making Payoneer payments to a Maya wallet you’re likely to find this is not an option. Payoneer is not included in the list of Maya Wallet cash in partners4. However, there may be an alternative if you have a Maya Bank5 account as well as your Maya ewallet.

Maya Bank accounts - including business deposit account options - do offer ways to withdraw from other platforms using local bank details. Whether or not this will work for Payoneer may depend on the specific Maya Bank account type you have - previous users have reported mixed success in linking Payoneer and Maya Bank, but it’s certainly an option to consider.

As we’ve mentioned, you’re unlikely to be able to link Payoneer to a Maya wallet, but you may be able to link a Maya Bank account with Payoneer to make withdrawals. There’s not a specific partnership between Payoneer and Maya, so whether or not this is possible may come down to how your accounts are configured, as well as some basic eligibility requirements:

Got a basic Maya Bank account, or still using the wallet only? Upload some ID and record a video selfie to get an Upgraded account - to switch over to a business deposit account with Maya you may also need to provide additional information and documents.

Payoneer to Maya transfer limits may be set by Maya or by Payoneer. Payoneer’s withdrawal limits are set in USD, and run to the currency equivalent of 5,000 USD daily.

The first step in arranging a Payoneer to Maya withdrawal is to try to link your Maya Bank details to Payoneer. Here’s what to do6:

Payoneer will review the details of the account you’ve added, which may take up to 3 business days. You’ll get an email confirmation if the Maya Bank account has been approved for linking. If it’s approved you can follow the prompts to withdraw to Maya Bank. If not, you might want to choose an alternative - we’ll highlight one good choice, Wise, a bit later.

If you’re able to withdraw from Payoneer to Maya Bank, the money will usually be deposited on the same day, or within 2 business days in some cases. You’ll find Payoneer to Maya tracking information in your Payoneer app, or by logging into your account online.

There may be a couple of fees when it comes to sending or receiving a Payoneer to Maya transfer. Let’s take a closer look.

The fees you pay may depend on the exact type of withdrawal you’re able to make. Maya Bank has no fee for some deposit types7, but Payoneer may charge up to 3% of the withdrawal amount8, depending on how the payment is structured. If you need currency exchange to move your Payoneer balance into PHP for deposit to Maya, there may also be a fee to pay here, which we’ll explore next.

You may need to pay a currency conversion fee for your Payoneer to Maya payment if the balance you hold in Payoneer must be converted before you can withdraw it. This fee is likely to be set by Payoneer as you may need to convert your balance within the Payoneer app before you can withdraw it. Payoneer charges 0.5% of the amount converted as a conversion fee.

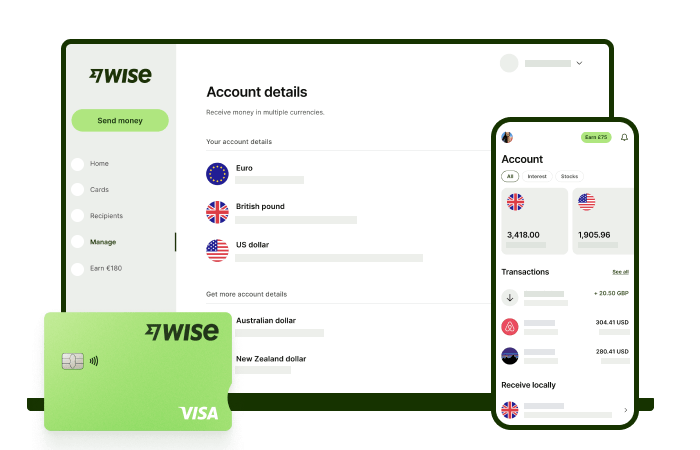

Sa Wise, makakakuha ka ng 8+ local account details, kasama ang PHP, USD, GBP, AUD at marami pang iba. Kaya, mas madali at convenient na makatanggap ka ng pera direkta. Mag sign-up ka lang ng libreng account, at mae-enjoy mo nang i-manage ang pera mo gamit lang ang phone mo.

Kapag natangap mo na ang pera mo, madali mo itong i-convert sa 40+ na currencies, with low fees, at sa mid-market rate - ito yung totoo at nakikita mong rate sa Google. Kasama na dito ang pag-exchange ng peso na may one-time conversion fee na nagsisimula sa 0.57%. Kitang-kita na agad yan upfront, walang patong o hidden fees.

Kaya, tumanggap, mag-exchange, at ilipat ang funds mo sa iyong local bank account gamit ang Wise.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

A transparent guide to GCash cash-in fees. Get a full breakdown of charges at different partners and learn the best methods to cash in for free.

Want to cash out from Lazada Wallet to GCash? Learn more about how to transfer, convert, and refund credits.

Want to transfer money from BPI to GoTyme? Learn more about how to send money across platforms.

Want to transfer money from Maya to SeaBank? Learn more about how to send money across platforms.

Want to transfer money from BDO to Maya? Learn more about how to send money across platforms.

Want to transfer money from SeaBank to PayPal? Learn more about how to send money across platforms.