VAT registration for UK sole traders: A quick guide

Discover everything you need to know about VAT registration for UK sole traders, including when to register, how to remain compliant, and more.

Staying up-to-date with innovative business solutions is essential. This can be especially true for payroll processing, a vital aspect of any business's financial operations.

In 2015, Xero introduced a fresh approach to payroll management, addressing a market longing for new and efficient solutions. Payroll is about maintaining tax compliance, adhering to legal requirements and understanding the individual needs of your employees.

In this guide, we'll review Xero Payroll, exploring its pricing, features, and how it fits into the larger picture of modern business operations. We'll also showcase how Wise Business can help you run payroll more seamlessly.

💡Learn more about Wise Business

Xero Payroll aims to modernise payroll management for UK businesses and is integrated within the Xero accounting software suite.

The tool allows teams to process payroll with ease, streamlining the complex aspects of financial administration by simplifying tax, pay, and pension calculations while ensuring HMRC compliance.

Automated Payroll Processing:

Xero Payroll automates wage calculations, bonuses, and CIS scheme deductions. Customizable pay schedules and rates empower businesses to tailor payroll to their unique needs.

Accurate Tax Calculations and Compliance:

The software calculates taxes at various levels, including federal, state, and local, guaranteeing precise withholding. It generates essential tax forms for seamless reporting.

Direct Deposit and Pay Runs:

With support for direct deposits, Xero Payroll simplifies electronic wage transfers, allowing customizable pay run scheduling to match your business's rhythm. That can also be integrated with Wise Business.

Empowering Employee Self-Service:

Employees gain access to a dedicated portal via Xero Me, to view payslips, update details, request time off, and manage tax preferences. This enhances employee engagement and independence.

Integration with Time Tracking:

Seamlessly integrating with time tracking systems ensures accurate wage calculation based on actual worked hours, streamlining the process for both employers and employees.

Fast Pension Re-enrolment

The software assists in managing employee pension contributions, automating calculations, generating reports, and facilitating compliant fund submissions.

Dynamic Compliance and Legislative Updates:

Adapting to ever-changing payroll regulations, Xero Payroll ensures that businesses remain compliant with the latest legislative requirements.

Integration with Xero Accounting:

Seamlessly connects with Xero's accounting software suite, Xero Payroll simplifies the synchronisation of payroll data with the general ledger, enhancing financial oversight.

Efficient with Cloud Access:

Xero Payroll's cloud-based accessibility allows easy usage from any device, ensuring convenience and flexibility for businesses of all sizes.

Moreover, Xero Payroll's collaboration with Wise Business adds an extra dimension to its utility. This connection offers even more streamlined cross-border financial management, making international transactions smoother than ever before.

Get started with Wise Business 🚀

When it comes to evaluating accounting software solutions, real-world experiences hold substantial weight. According to Trustpilot's 9,693 user reviews, Xero Payroll has received a rating of 4.0 out of 5 stars².

Positive reviews highlight Xero Payroll's user-friendly interface, seamless integration with Xero's accounting tools, and its ability to automate complex payroll tasks. Users have noted its efficiency in tax calculations, compliance adherence, and its role in streamlining payroll processes. Many users have also highlighted Xero's customer support and its quick and efficient problem-solving.

| Read more about Xero vs Freeagent |

|---|

Xero offers four plans tailored to different business needs. These plans are designed to facilitate financial management, invoicing, expense tracking, and more. With the integration of Xero Payroll, businesses can expand their toolkit to encompass the critical realm of payroll management.

Here's a snapshot of the Xero accounting software plans and the corresponding monthly costs for adding the Xero Payroll feature:

| Plan | Monthly price (excl. VAT) | Payroll included | Cost for additional people (200 people max) | Who is it for? |

|---|---|---|---|---|

| Ignite | £16 | Not included by default | £1.50 per person | Caters to small businesses, sole traders, and self-employed just starting their journey. |

| Grow | £37 | 1 person included | £1.50 per additional person | Designed for growing businesses with more complex financial needs. |

| Comprehensive | £50 | 5 people included | £1.50 per additional person | Provides advanced features for established businesses. |

| Ultimate | £65 | 10 people included | £1.00 per additional person | Tailored for larger businesses and more complex small businesses that require scalability. |

Xero Payroll handles the full run-cycle end-to-end: you set up HMRC credentials, add employees with their tax and NI details, define a pay calendar, then create and post each pay run4.

When you post, Xero files the RTI submissions to HMRC for you5 and publishes payslips to employees (via Xero Me or email). You can then pay staff using a BACS file (if you have a BACS Service User Number) or pay manually from your bank (e.g., Faster Payments). Journals from the pay run flow straight into your accounts for tidy reconciliation.

Wise and Xero can integrate closely to help you pay bills and reconcile faster, especially if you operate in multiple currencies. Wise Business offers a quick, easy and affordable way to make international payments with the mid-market exchange rate*.

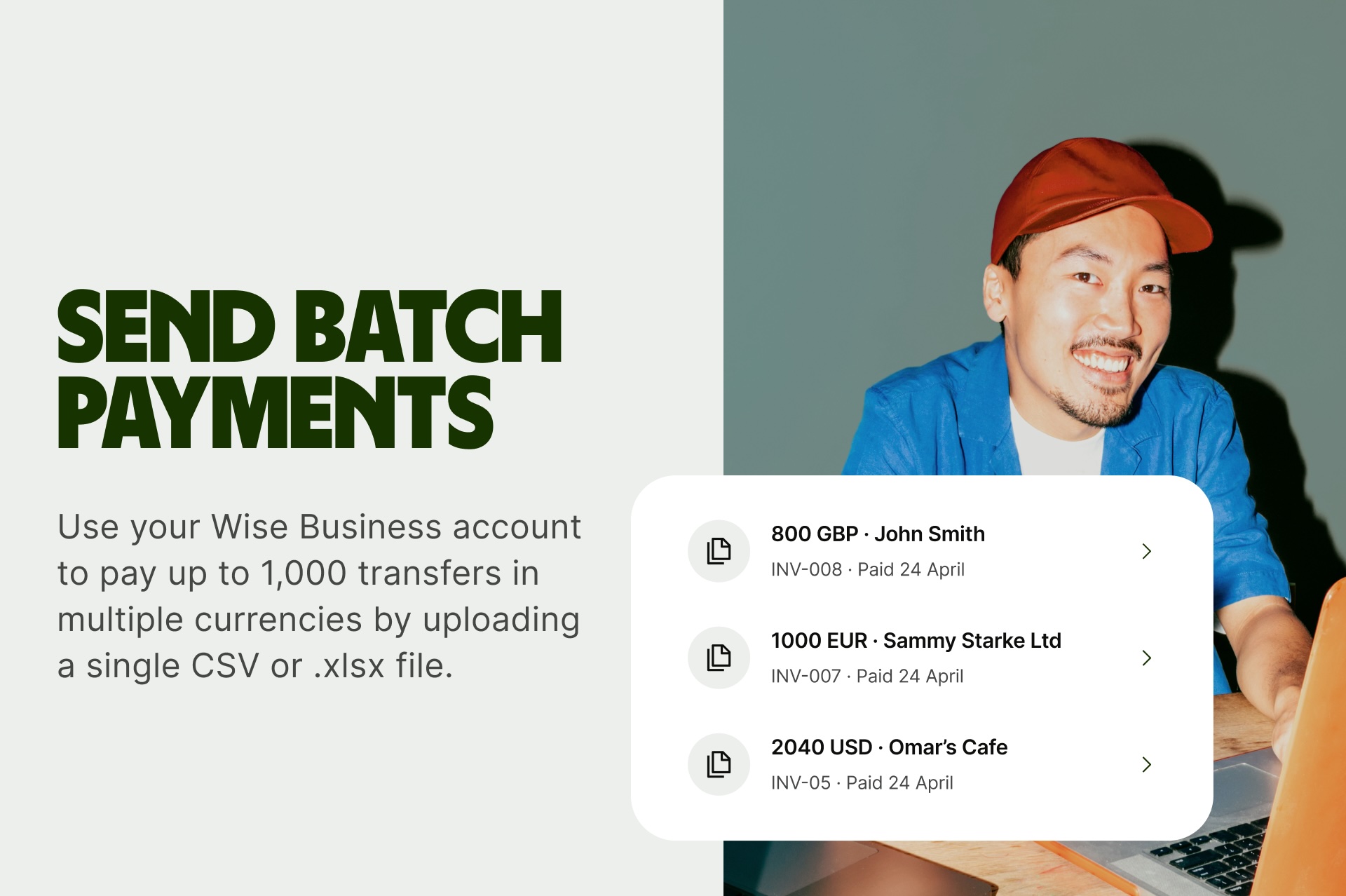

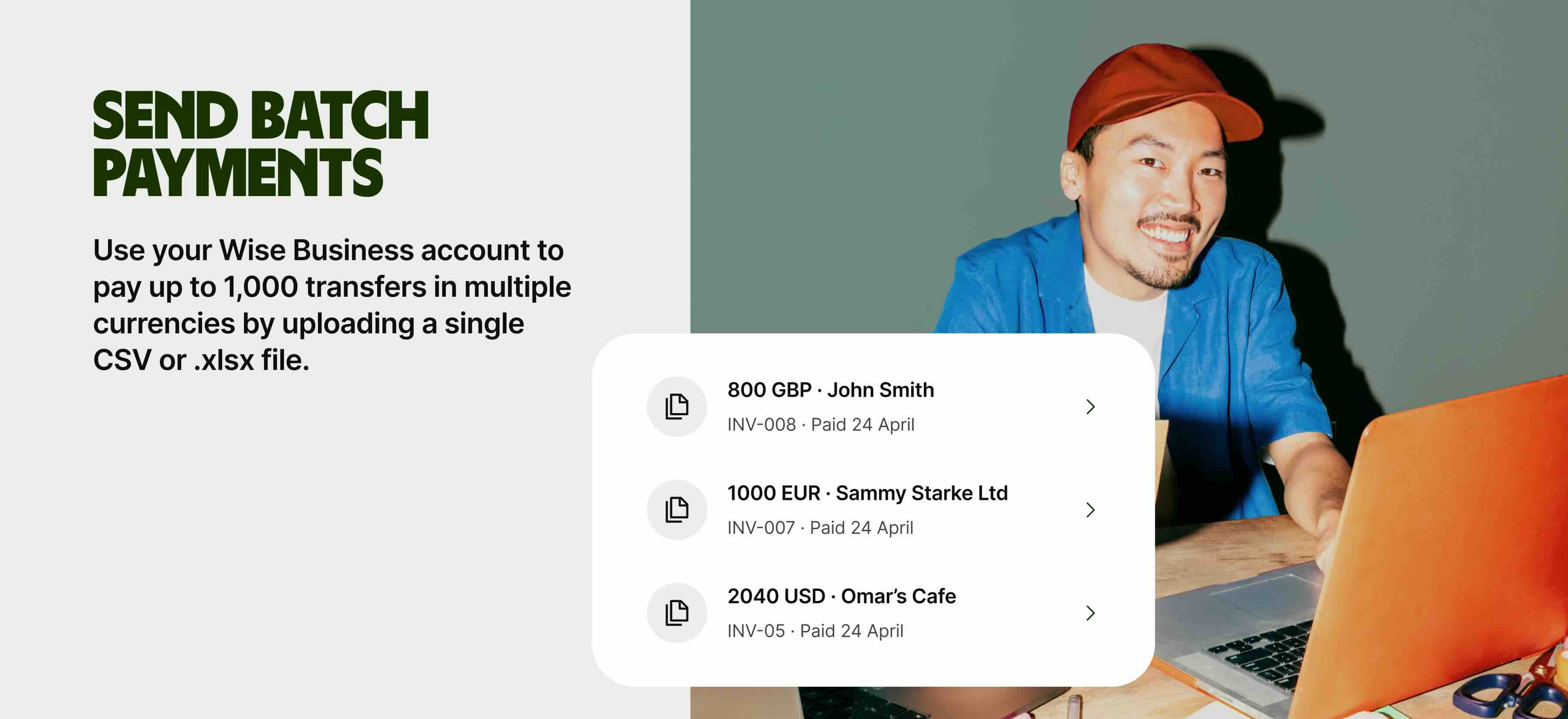

Sign up for a Wise Business account, and you’ll get access to a cheaper way to make bulk global payments. If you’re making payments in multiple currencies, you’ll always get the mid-market exchange rate*, and there's just a low, transparent fee to convert between currencies, so there are no surprises.

Wise Business is simple to use and can save you time and money, allowing you to make up to 1,000 payments in multiple currencies with the click of a button. Payroll can be automated with the open API, with large volumes of payments distributed in seconds. There’s no need to manually pay out to vendors or employees. Just fill in one spreadsheet and Wise’s smart tech will do the rest.

As an authorised and regulated financial services provider, Wise Business uses advanced security tools to protect its customers. You can automatically sync your activity with accounting software such as Xero and QuickBooks to manage your accounting needs seamlessly and meet HMRC and Making Tax Digital compliance requirements.

Get started with Wise Business 🚀

In the ever-evolving landscape of business management, embracing innovative solutions is paramount. Xero Payroll, seamlessly integrated with Xero's accounting suite, transforms payroll processing for UK businesses.

With features like automated calculations, compliance adherence, and self-service options, Xero Payroll simplifies financial tasks. Its collaboration with Wise Business further enhances its global utility, allowing you to manage international payments with ease.

Sources used in this article:

Sources last checked: 16-Sept-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover everything you need to know about VAT registration for UK sole traders, including when to register, how to remain compliant, and more.

Read our complete guide to merchant account fees in the UK, covering how they work, tips to save money and a comparison of fees from popular providers.

Learn how to optimise your accounts payable process to improve cash flow, cut errors, and pay vendors on time

Mezzanine financing is a middle ground for businesses running short on capital. Understand the pros, cons, and key features of mezzanine debt in this guide.

Find out how VAT on export of services from the UK is charged, including the rules and exceptions for businesses trading overseas.

Read our essential guide to renting commercial property in the US, covering lease types, legal information, rent, costs and the steps involved.