Global payment methods - Guide for UK businesses

Read our guide to global payment methods for UK businesses, including cards, bank transfers, PayPal and multi-currency solutions like Wise Business.

As a service provider in the UK, value-added tax (VAT) is an essential aspect of how your business functions. Yet, VAT on services in the UK can vary when exporting services, compared to the typical standard and reduced VAT rates employed by businesses.

The differences can be complex and too much to keep up with. Therefore, understanding how VAT on overseas services works is necessary to avoid fines, losses, and maximise your revenue.

In this guide, we’ll examine how VAT on export of services from the UK works and provide you with practical tips to navigate the system successfully. In addition, we’ll discuss Wise Business, a powerful international payments platform that enables you to send and receive money in 40+ currencies with low and transparent fees.

💡 Learn more about Wise Business

VAT on exports is a tax levied on goods and services you sell to customers overseas. If your business is registered for VAT in the UK, you are required to charge VAT on the goods and services you sell, unless you are exempt¹.

Some examples of VAT-exempt goods and services are²:

Additionally, companies can charge a zero rate on goods exported from:

Although exports from this location are at a zero rate, you must include VAT on your invoice, but at 0% instead of charging the standard rate³. You also need documentary evidence of goods leaving either the UK from Great Britain or the UK and the EU from Northern Ireland³.

Unlike exempt goods and services, which are not taxable, zero-rated goods and services are taxable, but the VAT rate applied is 0%.

However, if your customers ask for a delivery to be made to a UK address, you must not zero-rate these sales³. This is because delivery to a UK address means these goods and services will be “consumed” in the UK.

A UK company may also pay VAT on exported services, depending on their nature, such as digital (like streaming) or consulting (like investment).

Generally, there’s no VAT charged when a business in the UK exports goods³. However, they need to retain proof of export, such as customs declarations or shipping documents.

For example, if a UK-based sportswear manufacturer sells stocks to a retailer company in South Africa, the VAT is at 0% because the goods supplied are not “consumed” in the UK.

When exporting services, the rules usually vary. While there is no VAT on overseas services, the rules depend on the type of consumer and service.

For exported goods, the place of supply is outside the UK, while for some types of exported services (consulting, telecommunications, etc.), the place of supply can still be the UK.

The place of supply refers to the location where you supply services, i.e., where you may be charged and pay VAT⁴. Its rules differ based on the customer type (individual or business) and the service type (events or digital).

Let us consider the customer type:

Let us consider the service type:

When it comes to VAT on overseas services, businesses must be informed of and follow the rules that control the process. Below is a quick rundown of how to account for VAT when exporting services as a business in the UK:

Rules and exceptions when exporting services

Generally, you charge a zero rate on services to overseas customers. This is because while the service is taxable, no VAT is added to the price. However, you must record VAT on your invoice, but at 0%.

In some instances, the place of supply is determined by the type of service supplied. For certain services, VAT applies, even if the customer resides overseas. Digital services, for example, such as streaming and downloading, may require a VAT charge depending on the customer’s location.

In such instances, businesses need to register for VAT in the relevant countries in which they operate. This would enable them to efficiently collect and remit the taxes.

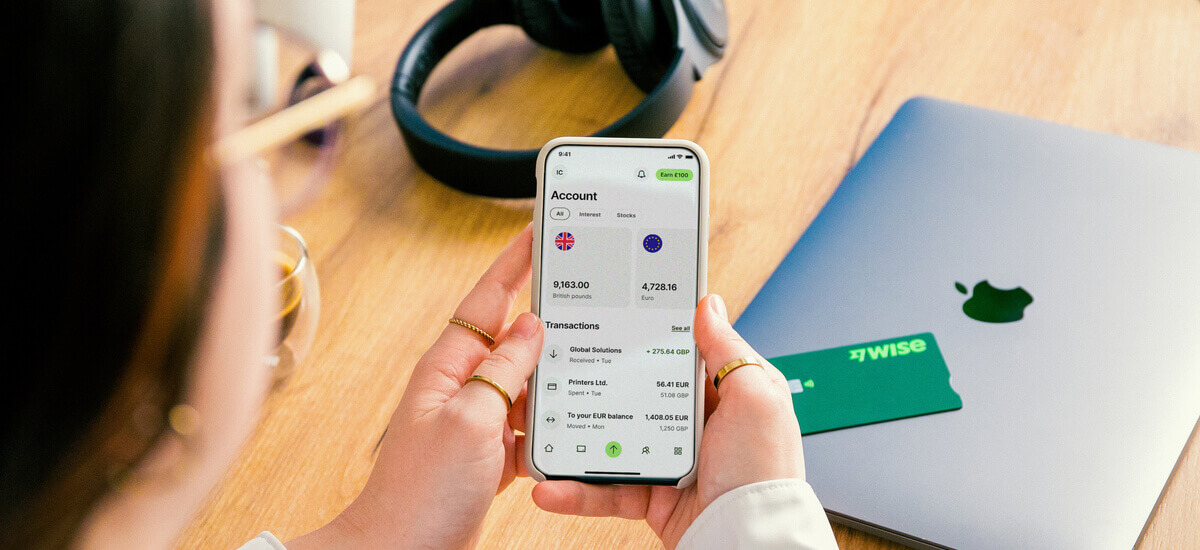

Wise can help UK businesses exporting services to get paid by customers in multiple currencies, with low fees and the mid-market exchange rate.

Your Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

All you need to do is pass these account details to your customer, or add them to invoices, and your customer can make a local payment in their preferred currency. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Get started with Wise Business 🚀

Here are some of the frequently asked questions on VAT on the export of services:

For digital services, VAT is typically charged in the consumer’s location. This means UK businesses offering digital services must follow the VAT rules in their customers’ country, or utilise the VAT MOSS (Mini One-Stop-Shop) scheme⁶.

Yes, in some instances, the type of service a B2B company provides may be considered supplied in the UK, even if the customer is overseas⁷. For context, services such as accountancy, legal services, and consultancy provided to a business in the US on a UK contract may be subject to UK VAT.

If UK VAT is incorrectly charged on an exported service, the business will need to amend the invoice and refund the surplus to the customer. Similarly, customers can also request a refund through the HMRC if the business can’t or doesn’t amend the invoice. The company may incur a penalty or interest if the overcharged VAT isn’t corrected promptly.

When exporting services, businesses are required to provide a VAT invoice (even if it is zero-rated). The invoice should include the customer’s VAT number, place of supply, and documentation that states the service is exempt from VAT.

Understanding VAT on the export of services from the UK is essential for businesses with customers overseas. This would enable them to be efficient and avoid errors, leading to fines or losses.

Generally, there is 0% charged as VAT on services to overseas customers. However, there are certain exceptions and rules when exporting services, particularly for B2B, B2C, or digital services.

For businesses in the UK with customers abroad, having a reliable payment solution like Wise Business makes receiving international payments seamless. With a Wise Business account, you can open account details in 8+ and send money to 140+.

Sources used in this article:

Sources last checked 23/09/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our guide to global payment methods for UK businesses, including cards, bank transfers, PayPal and multi-currency solutions like Wise Business.

Learn about the top international payroll providers, their features, pricing, customer reviews and how to choose the right provider for your business.

Here’s an objective review of the best corporate tax software for International Businesses. Learn about their features, prices and ratings.

There are several reasons why international investment is appealing to UK startups at the moment. With economic uncertainty prevailing, the impact of Brexit...

Digital Product Passports are reshaping EU trade. Discover what’s required and how Wise Business makes compliance more cost-effective.

Learn how to start a business in Mexico, focusing on opportunities and regulations to navigate for successful operations.