VAT registration for UK sole traders: A quick guide

Discover everything you need to know about VAT registration for UK sole traders, including when to register, how to remain compliant, and more.

If you have a UK business you’ll need smart and easy ways to pay your team members and comply with your payroll reporting and tax obligations. Using professional payroll services is a common choice. There’s a cost to using an outsourced payroll provider - but it can streamline processes and cut your admin time significantly. So - what about Revolut Business payroll as an option to outsource this job?

This full Revolut payroll review covers all you need to know, including Revolut payroll cost and how to set up payroll on Revolut.

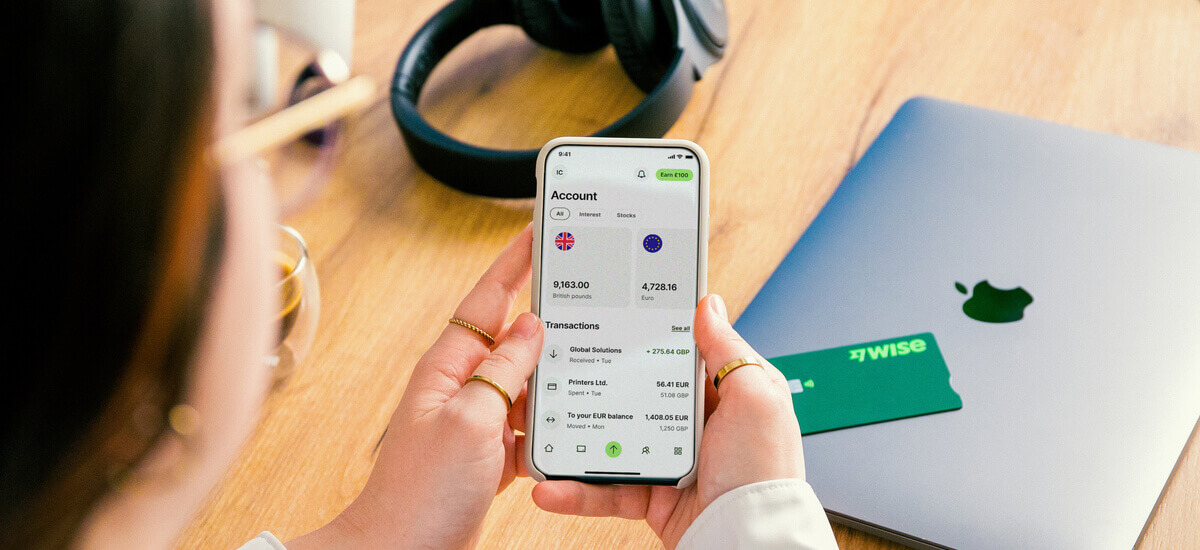

We’ll also introduce Wise Business which offers easy ways to pay employees in multiple currencies, with low fees and the mid-market exchange rate.

💡 Learn more about Wise Business

Yes. You can use the Revolut payroll feature to pay your employees if you have a Revolut Business account, including Basic, Grow, Scale and Enterprise plans. Monthly fees apply, which we’ll look at later.

Revolut’s payroll feature is available for Revolut Business customers only. Not sure which Revolut account is right for you?

| Check out our full Revolut Business vs Revolut Personal account review here |

|---|

If you have an eligible Revolut Business account, you can add in payroll services for a monthly fee per employee. This allows you to process employee pay, ensure deductions for tax and other contributions are made properly, provide the required paperwork to employees and HMRC, and complete all necessary reports.

Revolut Business account holders can nominate a user to be Payroll Admin, who can control and view features within the Revolut payroll feature. Options and services available in Revolut payroll include¹:

- Add and remove team members to make salary payments

- Calculate pay including gross versus net pay, tax contributions, national insurance, benefits and adjustments

- Set up defined pay runs on your preferred dates or at your preferred intervals

- Manage contributions to employees’ pension providers

- Communicate with HMRC to provide required tax code information up to date

- Download a CSV file of each employee’s pension information

As with all outsourced payroll options, there’s a fee to pay for using Revolut payroll. Exactly what you pay overall with Revolut depends on the plan you pick. There’s a monthly charge, and then the payroll service can be added in with a fixed monthly fee per employee. If you select the Enterprise package from Revolut, fees may vary.

| Plan/Revolut Business fee | Basic² | Grow³ | Scale4 |

|---|---|---|---|

| Monthly fee | No monthly fee | £19 per month | £79 per month |

| Revolut payroll fee | £3 per active team member/month | £3 per active team member/month | £3 per active team member/month |

Revolut is a licensed provider, which is considered safe to use. In the UK, Revolut is licenced by the FCA as an e-money institution, and must comply with strict legislation to protect customers, their money, and their accounts. This means safeguarding customer funds, using data protection measures, and building digital safety protections into their app.

Revolut payroll is an add on feature, which has extra fees on top of any monthly charge your Revolut Business account has. To use Revolut payroll you’ll need to add employees to your business account and then enrol them in payroll. Once you have team members added, you can automatically run payroll by setting the dates or intervals on which employees should be paid.

Here’s how to enrol your team members into Revolut payroll in the app⁵:

Once you have employees enrolled, you can create a pay schedule⁶:

Once your employees are added and your payroll set, you can allow it to run automatically, adding and removing team members as needed.

Looking for a convenient, flexible and low cost way to run payroll for your business? Check out Wise Business.

Wise offers business accounts with no ongoing fees and no minimum balance requirements. All accounts can hold and exchange 40+ 140+ countries - often quickly or instantly⁷.

Wise Business can be particularly helpful if you need to run payroll for international employees from the UK, with options to pay up to 1,000 people at a time, in 40+ currencies, with the mid-market exchange rate and low costs from 0.33%.

Here are some of the Wise Business features you can access:

- One time £45 account opening charge with no monthly fees

- Hold and exchange 40+ currencies using the mid-market rate with no markup

- Send money quickly or instantly to bank accounts in 140+ countries

- Run international payroll with batch payments of up to 1,000 people at a time

- Issue business debit and expense cards for you and your team

- Get local account details in 8+ currencies, to be paid easily by others

- Generate invoices and payment links to receive money easily from customers

- Access accounting integrations, and a powerful API

See how Wise Business can help you pay contractors and team members around the world easily, from your phone or laptop.

Get started with Wise Business 🚀

While outsourcing payroll comes with costs, it can help ensure compliance with legal and tax requirements, as well as drastically cutting the amount of admin you need to do as a business owner. Outsourcing payroll is particularly attractive for new businesses which don’t have internal resources to manage payroll - which may mean Revolut’s payroll feature works well for you if you’re just starting out or scaling up.

If you’re not sure about Revolut payroll or just want to compare an alternative, check out the options available from Wise Business to manage payroll with batch payments. The batch payment feature has no extra fee and allows you to pay up to 1,000 people in 40+ currencies, with just one spreadsheet. This can cut costs, and leave you more time to invest in your business in the end.

Sources used in the article:

Sources last checked June 17, 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover everything you need to know about VAT registration for UK sole traders, including when to register, how to remain compliant, and more.

Read our complete guide to merchant account fees in the UK, covering how they work, tips to save money and a comparison of fees from popular providers.

Learn how to optimise your accounts payable process to improve cash flow, cut errors, and pay vendors on time

Mezzanine financing is a middle ground for businesses running short on capital. Understand the pros, cons, and key features of mezzanine debt in this guide.

Find out how VAT on export of services from the UK is charged, including the rules and exceptions for businesses trading overseas.

Read our essential guide to renting commercial property in the US, covering lease types, legal information, rent, costs and the steps involved.