Sprout pricing and plans guide for the UK (2025)

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Setting up an ecommerce business and need to choose a payment processor? This guide is for you, as we’re pitting two of the biggest names in the industry against each other - it’s Stripe vs. Paddle.

Below, we’ll compare Stripe and Paddle on all the things that matter. This includes pricing, features, security and much more.

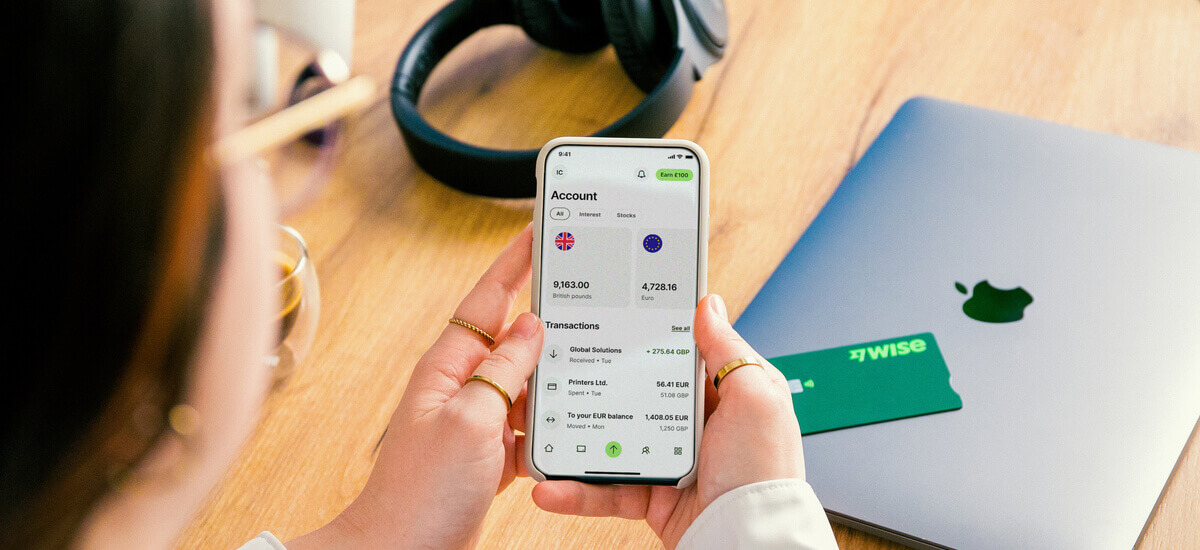

We’ll even show you a way to get paid easily from customers all over the world using a Wise Business account, which links seamlessly to payment service providers (PSPs) like Stripe.

💡 Learn more about Wise Business

Let’s start out with a head to head comparison of both Paddle and Stripe based on their pricing and key features. We’ll look at each option in more detail in just a moment.

| Service | Stripe | Paddle |

|---|---|---|

| Pricing | Varied fees per transaction type, plus costs for physical POS terminals Standard fee 1.5% + £0.20 for local cards¹ | 5% + $0.50 USD per transaction Custom pricing available² |

| Trustpilot rating | 2.4³ ⭐ | 4.2⁴ ⭐ |

| Invoice payments | ✅ | ✅ |

| Recurring payments | ✅ | ✅ |

| International payments | ✅ | ✅ |

| API integrations | ✅ | ✅ |

| Checkout solution | ✅ | ✅ |

| Payment links | ✅ | ❌ |

| In-person payments | ✅ | ❌ |

Paddle is a UK-based company which bills itself as a “complete payment infrastructure provider for software companies.” ⁵ Its target customers are Software-as-a-Service (SaaS companies). Paddle uses a merchant of record (MoR) model to provide an all-in-one payments, billing, and sales tax solution.

Paddle supports 29+ currencies,⁶ popular debit and credit cards, wire transfers and wallets (including Apple Pay, Google Pay, PayPal, and Alipay).

Features and services available at Paddle include:

- Billing solutions, including subscriptions, invoicing and payments

- Built-in sales tax compliance for Europe, US, Canada, and Australia

- Fully customisable localised checkout options across multiple countries, languages and currencies

- Automated VAT collection, filing and verification capabilities

- One-click instant payouts directly to all major banks globally

Paddle has a ‘Great’ rating of 4.2 on TrustPilot, based on over 7,700 reviews.⁴

Paddle provides payment gateway services, as well as payment processing services.

A payment gateway is an online platform which allows businesses to accept payments from their customers, usually via credit or debit card, as well as other forms of electronic payment (such as Apple Pay and Google Pay, for example).

Paddle is safe to use for payments. It has PCI DSS Level 1 compliance, as well as Service Organization Control (SOC) 2 compliance.⁷ This means it has passed an extensive audit, assessing its sophisticated security measures. This includes bank-level encryption and extensive fraud protection.

Paddle doesn’t provide information on how it’s regulated in the UK.

So, how much will it cost your business to use Paddle? It offers Pay-as-you-go pricing, with a fixed charge per transaction, no monthly fees and no extra costs. You can also contact Paddle for a custom pricing model.

| Transaction type | Paddle fee |

|---|---|

| Online payments | 5% + $0.50 USD² |

| International | 5% + $0.50 USD² + 2-3% if currency conversion is required⁸ |

| Refund | Up to £20⁸ |

| Chargeback | Up to £20⁸ |

Stripe is a comprehensive payments processing platform aimed at businesses of all sizes. The Irish-American company’s customers are primarily ecommerce businesses, but anyone who sells online will find its services useful.

Features of the Stripe platform include:

- Local and global card payments

- Physical card terminals

- Online and digital payment methods

- Invoicing and recurring billing solutions

- Payment links

- Low and no code solutions as well as more complex, tailored options

- Support with tax, user identification, business management and more

| New to Stripe? You can get our full Stripe Payments review here |

|---|

As for what its existing and former customers think about Stripe, it’s not brilliant news. The company gets a ‘Poor’ rating of 2.4 on TrustPilot (from more than 14,000 reviews).³

Yes. Stripe is safe to use, and a level 1 Payment Card Industry Data Security Standards (PCI DSS) provider.⁹

To maintain this status, Stripe has to have a number of security measures in place. This includes:

- Maintaining a secure network and systems

- Encrypting and securely storing any sensitive data held

- Using industry level security to prevent malware and viruses

- Having strong access control measures

- Regularly testing systems and processes to spot and correct any vulnerabilities

- Having policies in place that clearly set out security measures expected and applied

| Find out more about Stripe security here |

|---|

Now we’ll turn to Stripe and its fees. It doesn’t charge subscription fees, instead imposing charges for each payment and individual service you use. It’s called per-transaction pricing. Here are the main charges you need to know about:¹

| Transaction type | Stripe fee |

|---|---|

| Local cards payments | 1.5% + £0.20 for standard UK cards 1.9% + £0.20 for premium UK cards |

| International card payments | 2.5% + £0.20 for cards issued in the EEA 3.25% + £0.20 for cards issued anywhere else + 2% fee if currency conversion is needed |

| Chargebacks (disputes) | £20 per payment |

| Recurring payments (billing) | 0.5% per payment |

| Invoicing | 0.4% per invoice |

To help you choose the most cost-effective payment processing solution for your needs, here’s a head-to-head comparison of fees for both Paddle and Stripe:

| Transaction type | Stripe fee¹ | Paddle fee |

|---|---|---|

| Online payments | 1.5% + £0.20 for standard UK cards 1.9% + £0.20 for premium UK cards | 5% + $0.50 USD² |

| International | 2.5% + £0.20 for cards issued in the EEA 3.25% + £0.20 for cards issued anywhere else + 2% fee if currency conversion is needed | 5% + $0.50 USD² + 2-3% if currency conversion is required⁸ |

| Refund | Varies | Up to £20⁸ |

| Chargeback | £20 per payment | Up to £20⁸ |

While you’re researching payment gateways and processors, it could also be worth looking into how you’ll manage business funds across borders.

Open a Wise Business account and you can hold and exchange 40+ currencies at once. You can send payments to 140+ countries and get local account details to get paid in 8+ currencies like a local.

Use your Wise account to get paid in a selection of major foreign currencies by customers and clients, through marketplaces - and via PSPs like Stripe. Whenever you need to send, spend or exchange foreign currencies, you’ll benefit from the mid-market exchange rate, with low, transparent fees.

You’ll also benefit from all of these features:

- No ongoing fees, minimum balance requirements or foreign transaction fees

- Debit and expense cards for you and your team, which you can use in 150+ countries

- Multi-user access for team members, with ways to control and manage permissions

- Pay up to 1,000 people at once with the Wise batch payments feature

- Integrate with your favourite cloud accounting solutions, and use the Wise API for automation and streamlining workflow

- Use the Wise Interest feature to make your money work harder when you’re not using it

With the help of a truly global account, your business can grow beyond international borders.

Get started with Wise Business 🚀

After reading this, you should have all the info you need to compare Stripe and Paddle, and choose the right payments solution for your business.

Stripe may be one of the biggest names in payments processing, but there are also plenty of Stripe alternatives and challengers out there. It always pays to do your research and find the right fit for your company’s needs.

Sources used:

Sources last checked on date: 20-Jun-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Learn how much tax you’ll pay as a UK sole trader in 2025. Our guide explains what type of taxes UK sole traders pay, when they have to pay them, and more.

Learn about Lumen5's pricing, plans, and features. Find the right subscription for your needs and get tips on how to save money on your account.

Learn how to set winning rates for social media management. Our 2025 guide covers pricing packages, retainers, and strategy to maximise your freelance income.

Unlock your earning potential with our freelance SEO pricing guide for 2025. Learn how to set profitable rates, factors that affect pricing, and more.