Sprout pricing and plans guide for the UK (2025)

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Looking for a new business account? There are lots of options out there, including a range of digital banking solutions.

Digital-only banking services are surging in popularity, with around 49% of UK SMEs preferring to manage business funds wholly online.¹ This demand has led to the emergence of a number of new challenger banks and digital solutions.

Two popular options right now for UK companies are Mettle and Tide. But what do they have to offer, and how do they compare? Read on for a full Tide vs. Mettle business account review , comparing everything from fees and features to security.

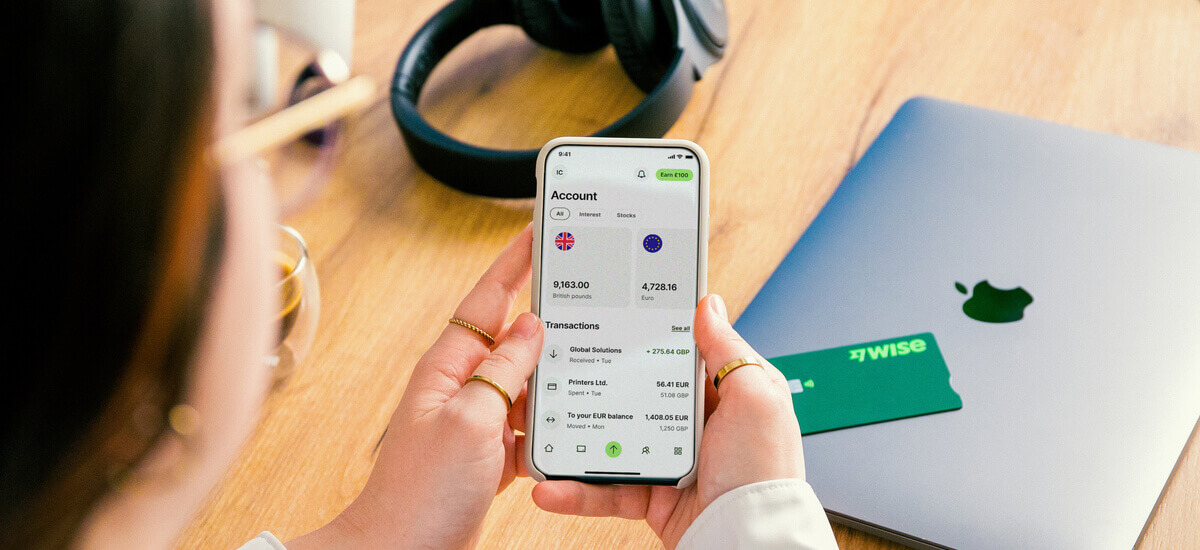

We’ll also show you an alternative - Wise Business, which lets you effortlessly manage your business finances across 40+ currencies, including GBP, USD and EUR.

💡 Learn more about Wise Business

Let’s start with an at-a-glance comparison of Tide and Mettle, based on the features and services on offer with both business account providers:

| Service | Tide Bank | Mettle |

|---|---|---|

| Free business account | ✅ | ✅ |

| Paid business account | ✅ | ❌ |

| Multi-currency account | ❌ | ❌ |

| International payments | ✅ - EUR (SEPA) only | ❌ |

| Business card | ✅ | ✅ |

| Savings account | ✅ | ✅ |

| Expenses cards | ✅ - up to 50 | ❌ |

| Overdraft | ❌ - but line of credit available | ❌ |

| Multi-user access | ✅ - read access only | ❌ |

| Accounting integrations | ✅ - Xero, QuickBooks, Sage, FreeAgent, Kashflow, Crunch and ClearBooks | ✅ - FreeAgent, Xero and QuickBooks |

| Phone support | ✅ | ✅ |

| Manage and send invoices | ✅ | ✅ |

| Bulk payments | ❌ | ❌ |

The main difference between Tide and Mettle is their target customer base.

Tide provides mobile-first digital banking for all kinds of small and medium-sized enterprises (SMEs), as well as freelancers and entrepreneurs.

But Mettle is solely focused on self-employed people, and only provides accounts to sole traders and limited companies with no more than two owners. It also has other eligibility criteria, accepting only certain business types.

Tide is an independent fintech company, while Mettle is owned by UK high street bank NatWest.

Another key difference is price - Tide has monthly paid plans available and charges fees for its services, while Mettle is completely free.²

Mettle is a free mobile-first business account from NatWest. It’s only available for sole traders or limited companies with up to 2 owners. Features include:³

- Mobile banking app

- Debit card

- Customisable invoices, and auto-match payments to invoices

- Sync with accounting software (FreeAgent included as standard)

- Earn interest in Savings pots

- Automatically save for tax

- Cash deposits

- Scheduled payments

- Payment notifications

- Upload receipts

- FSCS protection

However, the account doesn’t permit international payments, and has no access to credit. The maximum account balance is £1 million.⁴

Unlike many other business banking providers, Mettle doesn’t charge any fees. This means no monthly fee, and no fees for using any of its services.²

Yes, Mettle is safe to use for managing your business finances.

Mettle is owned by NatWest, one of the UK’s biggest banks, which provides its bank accounts. This enables it to offer Financial Services Compensation Scheme (FSCS) protection of up to £85,000 per account. NatWest is also regulated in the UK by the Financial Conduct Authority (FCA).⁵

The platform also uses sophisticated security measures to keep your money safe. This includes in-app protections such as Strong Customer Authentication, which is a form of multi-factor authentication designed to safeguard access to your account.

The Tide business bank account is available on one of four plans - Free, Plus, Pro and Cashback. Each comes with a monthly fee (except for the Free plan) but offers more perks, reduced fees and increased limits in return for the higher cost.

While it varies depending on the plan, features of Tide business accounts include:

- Tide business card.

- Expenses cards for team members.

- Create, send and manage invoices.

- Linked Instant Saver account - paying 4.33% AER variable.⁶

- Integrate with accounting software.

- Fully app-based banking.

- Tide Card Reader for in-person payments (optional).

- International payments in EUR via SEPA.

- 24/7 support in the app.

| Read more: Tide vs Revolut Business comparison |

|---|

So how much does it cost to use Tide? Unlike Mettle, Tide does have quite a few different fees and charges.

Take a look below for an example of charges with the Free plan (which has no monthly fee):

| Type | Fee⁷ |

|---|---|

| Monthly fee | £0 for Free plan £9.99 for Plus plan £18.99 for Pro plan £49.99 for Cashback plan +VAT |

| Getting a business debit card | Free |

| Payments and transfers | £0.20 a payment |

| ATM withdrawals | £1 |

| Expenses cards | £5 a month |

With paid plans like the Cashback account, fees for things like payments and transfers are waived - and you get 3 free expenses cards included.⁷ So it could be worth weighing up whether the monthly fee works out as better value for your company.

Yes, Tide has protection up to £85,000 under the Financial Services Compensation Scheme (FSCS). It isn’t a bank, but uses partner ClearBank to provide its bank accounts.⁶

However, it is authorised in the UK as an electronic money services provider by the Financial Conduct Authority (FCA).⁶

Of course, Mettle and Tide aren’t the only digital solutions out there for managing business funds.

If you need to deal in foreign currencies, you could be better off with a simpler and more straightforward option - the Wise Business account.

Whether it’s paying contractors and suppliers overseas, or accepting global customer payments digitally and through PSPs like Stripe, Wise has low cost solutions to help.

Wise Business accounts can hold and exchange 40+ currencies, send payments to 140+ countries and come with local account details to get paid in 8+ currencies like a local.

Use your Wise account to get paid in a selection of major foreign currencies by customers and clients, through marketplaces - and via PSPs. Whenever you need to send, spend or exchange foreign currencies, you’ll benefit from the mid-market exchange rate, with low, transparent fees.

So that you can compare with other providers, here are the main fees you need to know about with the Wise Business account:

| Service | Fee |

|---|---|

| Send local payments | Free |

| Send international payments | From 0.33% |

| Receive international payments | Free in 15 major currencies |

| ATM withdrawals | Free up to £200 a month (max. 2 withdrawals) 1.75% + £0.50 per withdrawal after that |

| Currency exchange | Mid-market exchange rate, with no mark-up |

| Business card fee | Free first card £3 one-off fee for each team member card |

When you open a Wise Business account, you’ll benefit from all of these useful features:

It’s quick and easy to open a Wise Business account, with a fully digital application, verification and on-boarding process. Check out the requirements here.

Get started with Wise Business 🚀

And that’s it - our full Tide vs. Mettle business account review, comparing the two digital providers on all the things that matter to you. This means features, services, fees, security and much more.

After reading this, you should be all set to compare providers - and see what else is out there - and choose the right option for your company.

Sources used:

Sources last checked on date: 20-Jun-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Learn how much tax you’ll pay as a UK sole trader in 2025. Our guide explains what type of taxes UK sole traders pay, when they have to pay them, and more.

Learn about Lumen5's pricing, plans, and features. Find the right subscription for your needs and get tips on how to save money on your account.

Learn how to set winning rates for social media management. Our 2025 guide covers pricing packages, retainers, and strategy to maximise your freelance income.

Unlock your earning potential with our freelance SEO pricing guide for 2025. Learn how to set profitable rates, factors that affect pricing, and more.