Funding for international students in the UK: loans, funds, grants, and more

Read our essential guide to funding for international students in the UK, exploring loans, scholarships, bursaries, grants, awards and more.

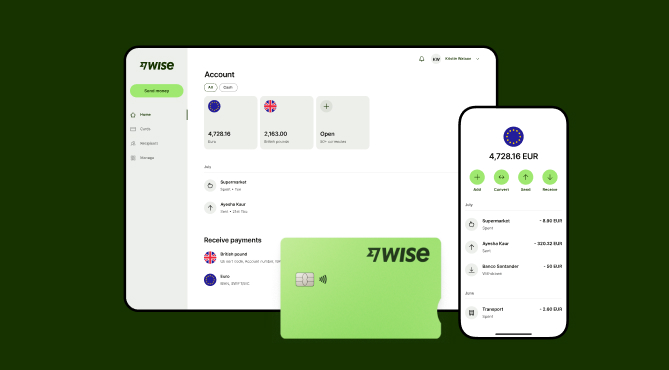

Like the idea of managing your money internationally, with a powerful multi-currency account? Then you might be interested in opening a Wise account.

In this handy guide, we’ll walk you through how to open a Wise account in the UK, step-by-step. The good news is that it’s pretty easy, from verifying your identity through to opening your first currency amount within your account.

We’ll also explain some of Wise’s best features, so you’ll know what you can do with your account once it’s up and running.

Before you get started opening your Wise account, it’s worth taking a moment to check your eligibility. You’ll just need to be:

It should only take a few minutes to complete the online registration process.

Here’s how to get started in just a few steps:

You can create a Wise account online at Wise.com or download the Wise app. It’s available for both Android and iOS devices.

Just hit the ‘Register’ button and enter your email address. If you prefer, you can sign up with your Google, Facebook or Apple account.

If you sign up using your email address, you’ll be prompted to go check your inbox for an email from Wise. Click the link in the email and you’ll be taken back to Wise to complete the registration process.

You’ll have a choice between ‘Personal’ and ‘Business’ accounts, and then you’ll be prompted to enter the country you live in. Select ‘United Kingdom’ from the drop-down list if applying for a Wise account in the UK.

Type in your phone number when prompted. And to make sure your account is fully secure, you’ll receive a text from Wise with a security code. Enter it when prompted.

This will safeguard your account, so make sure it’s a strong password that’s not easy to guess.

The last step is to verify your identity with a few quick checks, which we’ll cover in more detail next. You’ll just need to make sure you have the following ready:

You might also want to take a look at our handy tips for getting started with Wise.

Verifying your account is an important step, as it means that your identity has been checked and you are who you say you are. You know this of course, but it should also give you peace of mind that everyone else using Wise has also been verified too.

This reduces the risk of scams and fraud, as well as ensuring Wise meets the UK’s strict rules and regulations for electronic money companies.

Getting verified also unlocks all your account’s features.

It’s a simple process to complete. Once you’ve registered for an account, you’ll be prompted to upload photos of your photo ID and proof of address, and then a selfie photo to be checked against your ID.

And that’s it! Once approved, you’ll have a fully functional Wise account.

With your account open, you’ll want to create your first currency account.

To do this, follow these steps:

Once that’s done, you’re ready to add money to your new currency account. Read more on how to do it here.

And don’t forget that you can open multiple currency accounts, available in all major currencies including GBP, EUR, USD, AUD, CAD and many, many more.

With Wise, you can also get local account details for 8+ currencies.

For UK account holders, this includes: GBP, EUR, USD, AED, AUD, BGN, CAD, CHF, CNY, CZK, DKK, HKD, HUF, ILS, JPY, NOK, NZD, PLN, SEK, SGD, TRY, UGX and ZAR.

This lets you receive money in those currencies for free, just like you have an actual account in that country. Remember though that Wise isn’t a bank, although it offers some similar features.

To get local account details, you’ll need to follow these steps:

You’ll then be able to top up your account, send money and crucially, give the account details to anyone who wants to send you money. You can find your account details for each currency by heading to 'Payments' under the heading 'Account details'

📚How to get local account details

Want to know what you can do with your Wise account? Here are just a few of the many fantastic features on offer:

Capital at risk. Growth not guaranteed. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you’re uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

Your Wise account is waiting 🌍

There is even a whole suite of dedicated services for businesses, including the global Wise Business account.

After reading this, you should have all the info you need on how to open a Wise account in the UK - and be ready to take the plunge.

If you need to send, receive, hold or exchange international payments, a Wise account is the ideal solution.

Wise lets you hold 40+ currencies all in one place, and switch between them on the go in the Wise app. You’ll also get local account details for up to 8+ currencies, to receive local payments from all over the world.

Whether you want to send money to a friend overseas, pay an international bill, or withdraw a foreign currency back to your local GBP account, you’ll get the mid-market exchange rate every time, with no markups and no surprises.

There’s no monthly fee to pay for personal accounts, and no minimum amount needed to open an account — just straightforward transparent fees* which makes it easy to see what you’re really paying whenever you transact.

Sources used:

All info taken from Wise.com

Sources last checked on date: 05-Feb-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our essential guide to funding for international students in the UK, exploring loans, scholarships, bursaries, grants, awards and more.

Looking for graduation money gift ideas? Here are physical and digital options for gifting or sending money to a graduate.

How much are weddings abroad? Use this guide to understand what costs go into a destination wedding, and how to manage your budget.

Shopping online with overseas sellers? Understand your rights on refunds, returns and extra fees and spend globally with a Wise account.

Investing globally? Don't let hidden currency fees shrink your returns. Learn how to fund your international portfolio the smart way with Wise.

Can I keep my US bank account if I move abroad? Find out everything you need to know here in our handy guide.