Sprout pricing and plans guide for the UK (2025)

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Ecommerce payment providers can include payment service providers (PSPs) and payment gateways, which both offer tools to allow online businesses to take customer payments. Some offer an end to end service covering payment processing alongside anti fraud measures and other useful tools to make selling online frictionless. Others offer more niched products which look after only one part of the process.

Whichever model you prefer, finding the best PSP or payment gateway for your ecommerce business is crucial. This guide is here to help.

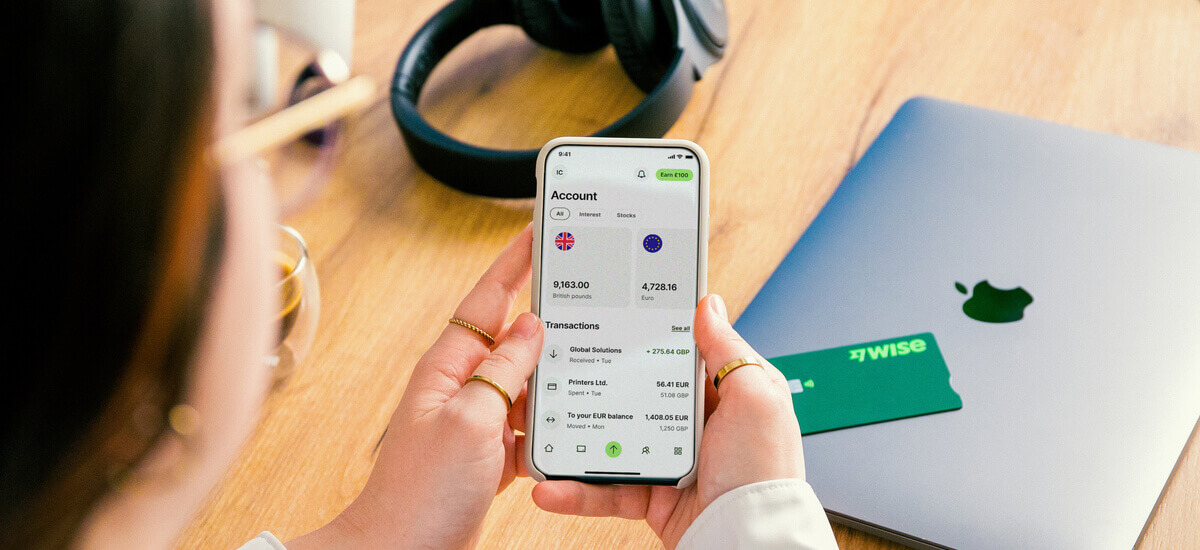

While you’re thinking about the best ecommerce payment providers in the UK, why not also check out Wise Business? Open a Wise Business account to receive payments from PSPs, marketplaces and directly by customers in 8+ currencies.

💡 Learn more about Wise Business

In this guide we walk through some top UK ecommerce payment providers to help you decide if any suit your specific needs and preferences. We’ll start with a roundup of price and Trustpilot score, and then look at each in more detail later. Let’s dive right in.

| Provider | Pricing | Trustpilot score |

|---|---|---|

| Stripe | 1.5% + £0.20 for UK cards 2.5% + £0.20 for EU cards1 | 2.1 star out of 5, Poor, from 15,000+ reviews2 |

| Shopify Payments | Monthly fees from £19 - £259 depending on plan Card payment fees up to 2% + £0.253 | 1.4 star out of 5, Bad, from 2,000+ reviews for Shopify Trustpilot account4 |

| Square | Monthly fees from £0 - £29 depending on plan Card payment fees up to 2.5%5 | 3.9 star out of 5, Great, from 2,000+ reviews6 |

| Worldpay | Not publicly available - make an appointment to talk to the sales team | 4.3 star out of 5, Excellent, from 8,000+ reviews7 |

| PayPal | Various processing fees, up to 2.9% + fixed fee depending on currency8 | 1.3 star out of 5, Bad, from 31,000+ reviews9 |

| Skrill | 2.5% processing fee for most major card brands10 | 2.6 star out of 5, Poor, from 21,000+ reviews11 |

Details correct at time of research - 18th February 2025

If you’re operating an ecommerce business, you’ll need to use various ecommerce payment providers and solutions to be able to take customer payments through your website or app.

You might choose to use a payment service provider (PSP) like Stripe, which offers a payment gateway alongside many other solutions to create an end to end service to help you run your business. Or you might prefer to pick out a stand alone payment gateway provider yourself, and then use different services, or your own in-house team to set up all the other functionality needed to take customer payments smoothly and securely.

This guide looks at some top UK ecommerce payment processors and gateways to help you choose what may fit your unique business needs.

The good news is that there are many different ecommerce payment solutions in the UK, so you’ll be able to find one which fits your needs with a bit of research. To start you off, let's look at some of the top picks for payment gateway solutions for ecommerce, including who they may suit and how their pricing works.

Stripe is a very popular global provider with a huge range of features including ways to take payments and manage ongoing billing, risk management tools and support with chargebacks and disputes. Stripe has no ongoing fees to pay, making this a solution for even smaller businesses, with a very broad range of services you can add on as you grow.

Best for: Businesses from startup to enterprise level, looking for an all in one payment processing solution

Billing model and pricing: Pay as you go model; 1.5% + 0.2 GBP for UK cards, 2.5% + 0.2 GBP for EU cards, 3.25% + 0.2 GBP for international cards - 2% currency conversion fee

Top features:

Read our complete Stripe Payments guide here.

Shopify Payments is the Shopify ecommerce platform’s built-in payments solution. This is the easiest way to take payments if you’re already using Shopify for your store, as Shopify will support your transaction end to end, and won’t charge the third party transaction fees which apply if you pick your own payment gateway. Shopify payments has several different plans with a monthly fee. The higher the monthly fee, the lower the payment processing costs you’ll pay.

Best for: Businesses using Shopify stores for ecommerce sales

Billing model and pricing: Monthly fees from 19 GBP - 259 GBP depending on plan - Card payment fees up to 2% + 0.25 GBP, check our complete guide on Shopify payment processing fees.

Top features:

Read more: check our Shopify guide here.

Square has several different plan options depending on your business needs. You can get a basic package which has no monthly fee and is fully pay as you go, or you can pay a monthly fee to unlock specialist tools such as appointment scheduling or inventory tools. These more advanced plans are aimed at specific business types, such as food and beverage businesses and retail stores. Processing fees are flat no matter which plan you pick

Best for: Particularly good for restaurant, retail and beauty businesses

Billing model and pricing: Monthly fees from 0 GBP - 29 GBP depending on plan, card payment fees from 1.4% + 0.25 GBP up to 2.5%

Top features:

Read more: Stripe vs Square, comparison for UK Businesses.

Worldpay’s tools cover taking online and in person payments, disbursing funds, safeguarding, analysing payments and performance, and building customer loyalty through schemes and offers. Worldpay markets itself to businesses of all sizes, with custom made packages and pricing. This means you need to call their sales team directly to learn more about the costs for different services you might be interested in for your business.

Best for: Large target market from online and digital businesses through to physical retail, restaurant and travel businesses

Billing model and pricing: Not disclosed

Top features:

Check our comparison between Stripe and Worldpay.

PayPal is a trusted name in ecommerce which means that customers are happy to select this payment method at checkout. You can take payments online and in person, with many low or no code options to use PayPal on your website. PayPal also offers a very good selection of additional services like seller protections, risk management, working capital and debit cards for customers.

Best for: Ideal for online sellers, and hybrid businesses which may need to take occasional in person sales

Billing model and pricing: No ongoing fees, processing up to 2.9% + fixed fee depending on currency, 3% currency conversion fees

Top features:

Read our guide on how to accept payments on Paypal.

Skrill offers multi-currency digital payment options for commerce businesses in the UK. You can take card payments and 100+ local payment methods, with competitive fees and no ongoing charges as long as you use your account regularly. Accounts also offer chargeback protections and built in fraud prevention tools.

Best for: Ecommerce businesses which want to take card, local and crypto payments

Billing model and pricing: No ongoing fees, 2.5% processing fee for most major card brands, high foreign transaction fees apply

Top features:

Now you have some providers to think about, let’s close out with a few things to consider when choosing a payment provider for ecommerce.

Ecommerce businesses typically offer customers ways to pay using debit, credit and prepaid cards on a broad range of networks. Digital wallets and bank transfers are also commonly supported in a range of currencies. You may also get more conversion if you offer local payment methods like Klarna, or buy now, pay later options which can appeal to customers looking to spread the costs of a purchase over a few months.

In most cases you can use more than one ecommerce payment provider. However, each payment provider will have its own terms and conditions so you’ll need to check what the situation is depending on who you select. Third party fees may apply if you don’t use the payment provider offered by your ecommerce site hosting service for example.

A payment gateway is where your customer will enter their card details when they get to the checkout. The gateway will securely pass these details to a payment processor, which is the next step in the chain to manage the payment. The payment processor will authorise and clear the transaction and then pass the money from the customer’s account to the business.

Wise can help UK businesses to receive payments in multiple currencies, with low fees and the mid-market exchange rate.

A Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds, these payments can come directly from your customers, from PSPs like Stripe and Amazon.

All you need to do is add the relevant currency account details to the platform you need to withdraw the funds. Once you receive the payment in Euros, Dollars or other supported currencies, you can hold this money into your multi-currency account, send with Wise Business debit card or convert back to Pounds with low fees and the mid-market exchange rate.

Get started with Wise Business 🚀

Managing a UK business, on or offline, means you have a lot on your plate. Picking the right payment provider can mean you and your customer both get a seamless experience when taking and making payments, cutting down on admin and hassle. Use this guide to get a feel for which payment provider might work for your business - and don’t forget to also check out Wise Business for smart, simple multi-currency business accounts you can open and operate with just your phone.

Sources used in the article:

Sources last checked February 18, 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Learn how much tax you’ll pay as a UK sole trader in 2025. Our guide explains what type of taxes UK sole traders pay, when they have to pay them, and more.

Learn about Lumen5's pricing, plans, and features. Find the right subscription for your needs and get tips on how to save money on your account.

Learn how to set winning rates for social media management. Our 2025 guide covers pricing packages, retainers, and strategy to maximise your freelance income.

Unlock your earning potential with our freelance SEO pricing guide for 2025. Learn how to set profitable rates, factors that affect pricing, and more.