Sprout pricing and plans guide for the UK (2025)

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Looking for a new payment solution for your business? Whether you’re an ecommerce business or have a subscription model, you’ll need to compare all available platforms and services to find the right fit for your needs - and at a cost-effective price.

In this helpful guide, we’ll take a close look at popular payments solutions Stripe and Chargebee. We’ll compare them head-to-head on the most important factors, including pricing, features, security and much more.

We’ll even show you a way to get paid easily from customers all over the world using a Wise Business account, which links seamlessly to payment service providers (PSPs) like Stripe.

💡 Learn more about Wise Business

Let’s begin with a head-to-head comparison of Chargebee and Stripe based on their pricing and key features.

We’ll look at each provider in more detail in just a moment.

| Service | Stripe | Chargebee |

|---|---|---|

| Pricing | Varied fees per transaction type, plus costs for physical POS terminals Standard fee 1.5% + £0.20 for local cards¹ | Plans from £0 to £499 a month Payment fees vary depending on payment processor² |

| Trustpilot rating | 2.4³ ⭐ | 2.7⁴ ⭐ |

| Invoice payments | ✅ | ✅ |

| Recurring payments | ✅ | ✅ |

| International payments | ✅ | ✅ - depending on payment processor |

| API integrations | ✅ | ✅ |

| Checkout solution | ✅ | ✅ |

| Payment links | ✅ | ✅ |

| In-person payments | ✅ | ❌ |

The main difference between Stripe and Chargebee lies in the types of payments each platform focuses on.

Stripe is designed for online payments of all kinds, including one-off, recurring and ecommerce payments. This may include subscriptions too.

But Chargebee is specially designed for subscriptions for goods and services, making it ideal for companies with recurring payments - especially Software as a Service (SaaS) businesses.

Crucially, Stripe handles payment processing, while Chargebee must partner with payment gateways like Stripe to facilitate the processing of transactions.

Chargebee is a US company which provides a payment platform for subscription businesses. Its target customers are Software as a Service (SaaS) and utilities companies, along with any other businesses which charge customers on a regular and recurring basis.

Its main features include:

- Billing - managing subscriptions and invoicing at scale

- RevRec - automated, compliant revenue recognition

- Receivables - including tools to create a proactive collection strategy

- Customer retention tools

- Analytics - including insight-driven and interactive dashboards

- Integration with accounting and other business tools

Chargebee has a ‘Poor’ rating of 2.7 on TrustPilot, although this is only based on 44 reviews.⁴

Chargebee isn’t a payment gateway, but it does provide support for payment gateways such as Stripe and GoCardless.

A payment gateway is an online platform which allows businesses to accept payments from their customers, usually via credit or debit card, as well as other forms of electronic payment (such as Apple Pay and Google Pay, for example).

Chargebee is safe to use. It is a PCI-DSS Level 1 Service Provider, meeting all compliance and audit requirements. The company adheres to ISO, SOC 1 & SOC 2, and MFA standards on data security.⁵

In order to achieve compliance, Chargebee is required to use advanced security measures to protect client accounts, data and funds. These include industry-standard encryption, 2-factor authentication to secure account access, and encrypted data storage.⁵

Chargebee doesn’t provide information on how it’s regulated in the UK. However, the payment gateways it supports such as GoCardless and Stripe are regulated by the Financial Conduct Authority (FCA).

Now we turn to Chargebee’s pricing model, and what kind of fees you can expect to pay to use the platform.

It has a subscription model, with different plans available for each of its main services - including Billing and Retention.

For Chargebee Billing, you can choose from the following plans:²

- Starter (pay as you go, no annual commitment) - Free up to £200,000 of cumulative billing, 0.75% above that

- Performance (annual commitment) - £499 a month up to £80,000 of cumulative billing, 0.75% above that

- Enterprise - custom pricing on request

As for the Chargebee fees for individual payments, it all depends on your payment processor.

| Transaction type | Chargebee fee |

|---|---|

| Online payments | Varies by payment processor |

| International | Varies by payment processor |

| Refund | Varies by payment processor |

| Chargeback | Varies by payment processor |

Stripe is a comprehensive payments processing platform aimed at businesses of all sizes. The Irish-American company’s customers are primarily ecommerce businesses, but anyone who sells online will find its services useful.

Features of the Stripe platform include:

- Local and global card payments

- Physical card terminals

- Online and digital payment methods

- Invoicing and recurring billing solutions

- Payment links

- Low and no code solutions as well as more complex, tailored options

- Support with tax, user identification, business management and more

New to Stripe? Find out everything you need to know in our complete Stripe Payments review.

| New to Stripe? Find out everything you need to know in our complete Stripe Payments review |

|---|

As for what its existing customers think about Stripe, it’s not overwhelmingly positive. The company gets a ‘Poor’ rating of 2.4 on TrustPilot (from more than 14,000 reviews).³

Yes, Stripe is safe to use, as it’s a level 1 Payment Card Industry Data Security Standards (PCI DSS) provider.⁶

To maintain this status, Stripe has to have a number of security measures in place. This includes:

- Maintaining a secure network and systems

- Encrypting and securely storing any sensitive data held

- Using industry level security to prevent malware and viruses

- Having strong access control measures

- Regularly testing systems and processes to spot and correct any vulnerabilities

- Having policies in place that clearly set out security measures expected and applied

| Read more about Stripe security here |

|---|

So, how much will it cost you to use Stripe? Let’s put Stripe and its fees under the microscope.

Stripe uses per-transaction pricing. This means that it doesn’t charge subscription fees, instead imposing charges for each payment and individual service you use.

Here are the main fees you need to know about:¹

| Transaction type | Stripe fee |

|---|---|

| Local cards payments | 1.5% + £0.20 for standard UK cards 1.9% + £0.20 for premium UK cards |

| International card payments | 2.5% + £0.20 for cards issued in the EEA 3.25% + £0.20 for cards issued anywhere else + 2% fee if currency conversion is needed |

| Chargebacks (disputes) | £20 per payment |

| Recurring payments (billing) | 0.5% per payment |

| Invoicing | 0.4% per invoice |

To help you choose the most cost-effective payment processing solution for your needs, here’s a head-to-head comparison of fees for both Chargebee and Stripe:

| Transaction type | Stripe fee | Chargebee fee |

|---|---|---|

| Online payments | 1.5% + £0.20 for standard UK cards 1.9% + £0.20 for premium UK cards | Varies by payment processor |

| International | 2.5% + £0.20 for cards issued in the EEA 3.25% + £0.20 for cards issued anywhere else + 2% fee if currency conversion is needed | Varies by payment processor |

| Refund | Varies | Varies by payment processor |

| Chargeback | £20 per payment | Varies by payment processor |

While you’re researching payment gateways and processors, it could also be worth looking into how you’ll manage business funds across borders.

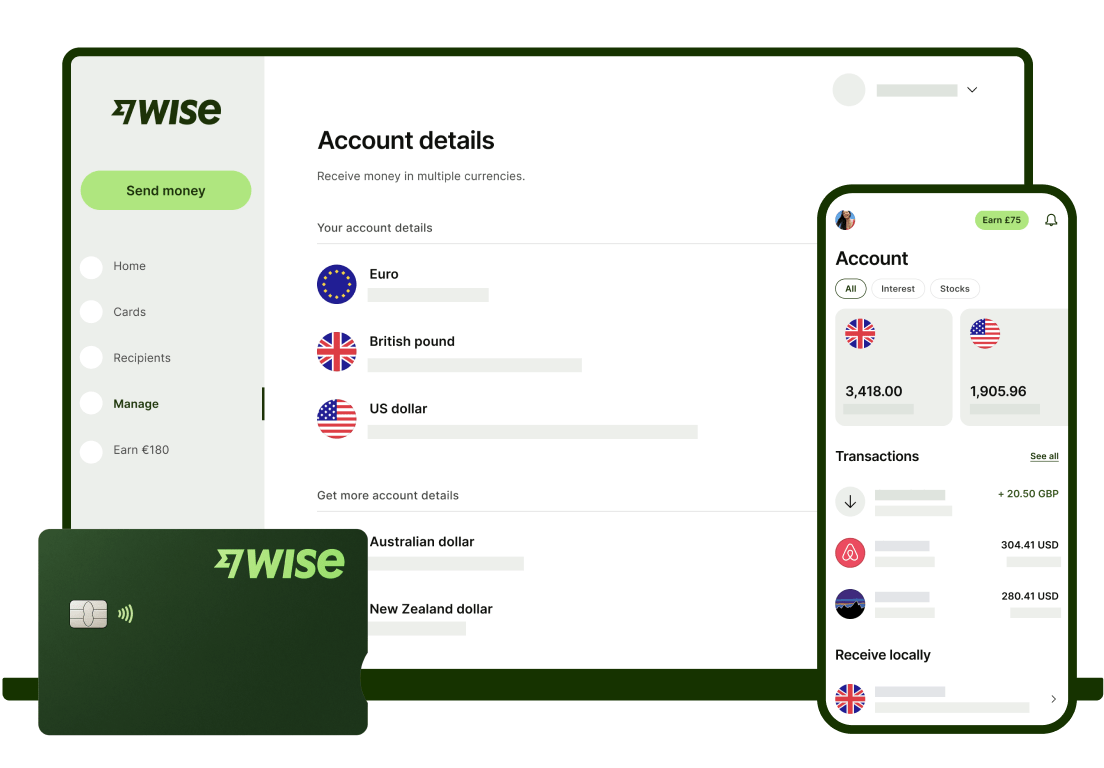

Open a Wise Business account and you can hold and exchange 40+ currencies at once. You can send payments to 140+ countries and get local account details to get paid in 8+ currencies like a local.

Use your Wise account to get paid in a selection of major foreign currencies by customers and clients, through marketplaces - and via PSPs like Stripe. Whenever you need to send, spend or exchange foreign currencies, you’ll benefit from the mid-market exchange rate, with low, transparent fees.

You’ll also benefit from all of these features:

- No ongoing fees, minimum balance requirements or foreign transaction fees

- Debit and expense cards for you and your team, which you can use in 150+ countries

- Multi-user access for team members, with ways to control and manage permissions

- Pay up to 1,000 people at once with the Wise batch payments feature

- Integrate with your favourite cloud accounting solutions, and use the Wise API for automation and streamlining workflow

- Use the Wise Interest feature to make your money work harder when you’re not using it

With the help of a truly global account, your business can grow beyond international borders.

Get started with Wise Business 🚀

And that’s it - our review of Stripe Billing vs. Chargebee Billing, comparing everything from fees and to features.

You should have all the info you need to compare the two and choose the right solution for your business.

Sources used:

Sources last checked on date: 20-Jun-2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Learn how much tax you’ll pay as a UK sole trader in 2025. Our guide explains what type of taxes UK sole traders pay, when they have to pay them, and more.

Learn about Lumen5's pricing, plans, and features. Find the right subscription for your needs and get tips on how to save money on your account.

Learn how to set winning rates for social media management. Our 2025 guide covers pricing packages, retainers, and strategy to maximise your freelance income.

Unlock your earning potential with our freelance SEO pricing guide for 2025. Learn how to set profitable rates, factors that affect pricing, and more.