Sprout pricing and plans guide for the UK (2025)

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Small and medium-sized businesses in the UK lose up to £250 billion¹ each year to unpaid invoices. That's why choosing the best invoicing software is non-negotiable for any business that wants to maintain a healthy cash flow.

The right invoicing app can help you create invoices, send timely reminders and significantly cut down late payments and unpaid bills. In this guide, we will review six of the best invoicing software for UK businesses. We will compare these invoicing tools based on their features, cost, integrations and Trustpilot reviews and also help you figure out which is best for your business.

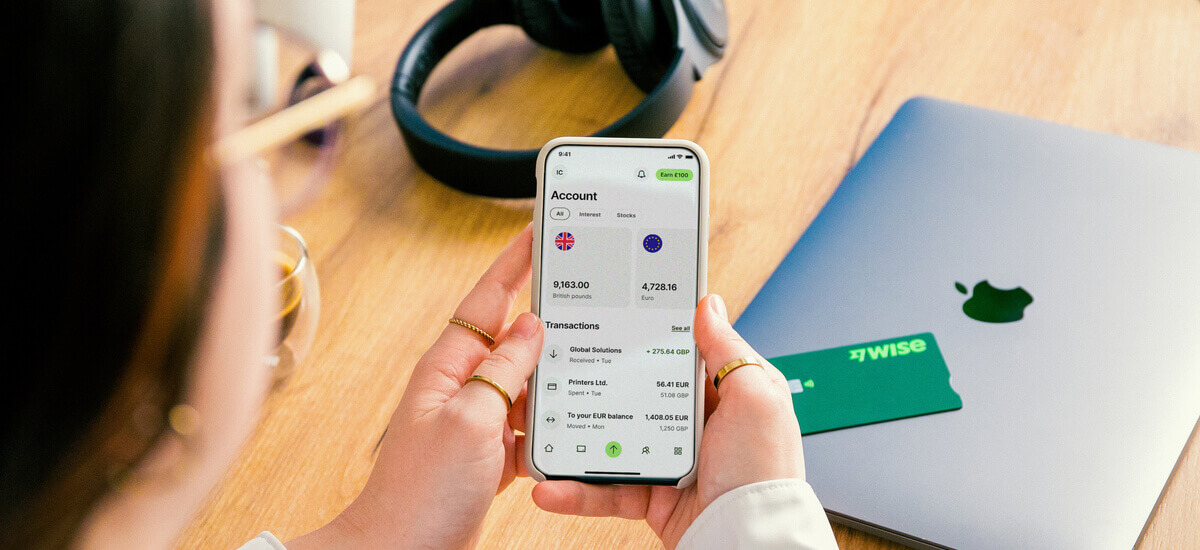

As you explore the best app for invoicing, consider solutions like Wise Business. This easy-to-use multicurrency account seamlessly integrates with popular invoicing software and helps you get paid fasterfrom clients around the world.

💡 Learn more about Wise Business

Proper invoicing helps your business get paid on time and maintain a healthy cash flow. With the right tools, you can significantly reduce invoicing errors, cut down on late and missed payments and free up time to focus on other tasks. The best invoicing software for UK businesses offers key features like invoice creation, automated reminders, scheduling, payment integrations, client management and reporting. To help you choose the best app for invoicing, we will review six invoicing software in this guide, including:

| Provider | Trustpilot score | Best known for |

|---|---|---|

| Freshbooks | 3.9 from 947 reviews² | Easy-to-use accounting features for small businesses |

| Zohobooks | N/A | Affordable all-in-one invoicing and accounting |

| Sage | 4.1 from 18.9k reviews³ | Modern and user-friendly invoicing and accounting |

| Quickbooks | 4.2 from 16k reviews⁴ | Comprehensive accounting solutions and a user-friendly interface |

| Xero | 4.0 from 9k reviews⁵ | Intuitive invoicing, real-time financial tracking and strong integrations |

| Simplybill | N/A | Simple and affordable invoicing solutions |

We’ll compare the best invoicing software for UK businesses based on the following criteria:

FreshBooks is an all-in-one payroll and accounting software for freelancers, solopreneurs and small businesses. With FreshBooks, you can create and send invoices, track expenses, and collaborate with clients and teams. You can also integrate FreshBooks with Wise Business to sync all your transactions and save time on admin. FreshBooks has a Trustpilot score of 3.9 from 947 reviews², with many users praising it for its ease of use:

"FreshBooks is the way to go…it is far better than other financial programs on many levels" – Bonnie.

Features and services

Pricing⁶

You can also reach out to a consultant for a custom quote. For each of these plans, you have the option to add team members for an extra £8/month.

Integrations

Zoho Books is one of the best invoicing software for small businesses in the UK. As part of the Zoho business suite, it offers an all-inclusive accounting solution that lets you send custom invoices, accept multicurrency payments, stay VAT compliant and submit Making Tax Digital returns to HMRC. When integrated with Wise Business, you can pay supplier bills directly, automatically match bank charges and reduce reconciliation errors.

Features and services

Pricing⁷

Integrations

Sage has more than 40 years of experience helping businesses of all sizes with their accounting, payroll and HR. Its modern design and easy-to-use, customisable features make it one of the best invoicing software options in the UK, especially for small businesses looking for simplicity. Sage currently has a Trustpilot score of 4.1 from 18.9k reviews³, with many users praising its responsive customer support. This review sums it up:

“Sage is an excellent company to deal with. Great support and no waiting. Agents are always knowledgeable” – A Spencer.

Features and services

Pricing⁸

Integrations

Check out our guide on how to create an invoice with Sage.

It's nearly impossible to talk about the best app for invoicing without mentioning QuickBooks. QuickBooks is an accounting and bookkeeping software developed by Intuit and trusted by millions of users. With QuickBooks, you can create customisable, unlimited invoices, accept online and in-person payments and manage taxes effortlessly. It also integrates seamlessly with Wise, helping you save time on admin tasks by syncing transactions, automating reconciliation and helping you pay bills. QuickBooks has a Trustpilot score of 4.4 from 16k reviews⁴.

Features and services

Pricing⁹

Integrations

Still unsure if QuickBooks is the best invoicing software for your team? Check out our full QuickBooks review to help you make the right decision.

Xero is an accounting software designed to help small businesses with invoicing and routine accounting. It's often mentioned as one of the best invoicing software solutions because of its extensive integrations. When you connect Xero to your favourite tools, including Wise Business, you can sync transactions, pay outstanding bills and automate reconciliation. Xero has a Trustpilot score of 4.0 from 9k reviews⁵. Here's what a customer has to say:

“Xero is good to send invoices and keep a track of expenses” – Shirkant Subramaniam

Features and services

Pricing⁹

Integrations

Check out our guide on how to create your first invoice with Xero.

Simplybill is one of the best invoicing software solutions and is designed specifically for freelancers and small businesses. It's a great option if you're looking for an affordable and straightforward web-based tool to create and manage invoices.

Features and services

Pricing¹⁰

A 14-day free trial is available on all of these plans.

The best invoicing software will help you save time and get paid faster. Here are some key features to look out for when choosing an invoicing software:

Wise can help UK businesses to get paid by customers in multiple currencies, with low fees and the mid-market exchange rate.

Your Wise Business account comes with local account details to get paid in 8+ major foreign currencies like Euros and US Dollars just as easily as you do in Pounds.

All you need to do is pass these account details to your customer, or add them to invoices, and your customer can make a local payment in their preferred currency. You can also use the Wise request payment feature to make it even easier and quicker for customers to pay you.

Get started with Wise Business 🚀

Invoicing software helps businesses create, send and manage invoices. All-in-one accounting platforms, on the other hand, provide different services in addition to handling invoicing. They offer tools for managing finances, tracking inventory, forecasting revenue, handling payroll, bookkeeping, submitting taxes and reconciling bank transactions.

Yes, credible invoicing software providers make keeping your data secure a top priority. Check for invoicing software that has bank-level encryption, secure cloud storage and GDPR compliance.

Look out for invoicing software that provides payment status reports (paid, unpaid or overdue invoices), aged receivables report, revenue trends, Tax VAT reports, client/customer reports, and item/service reports to see which products and services generate the most income. This way, you have clear visibility of your business cash flow and can make smarter decisions.

Yes, many invoicing software providers provide multicurrency support that lets you issue invoices in your customer's local currency with automatic conversions and up-to-date exchange rates. Invoicing tools also allow you to issue invoices in multiple languages, so your clients have no trouble understanding your invoices.

A good invoicing software should prioritise customer support. Look out for tools that offer 24/7 assistance, free onboarding sessions and access to an agent to walk you through any challenges you may experience

Ultimately, the best invoicing software is one that meets your business's unique needs and makes managing cash flow easier. To decide on the best app for invoicing, consider the features, pricing, integrations and how accessible customer support is. You can also opt for a free trial to get firsthand experience before committing.

Sources used in this article:

Sources last checked 19/08/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Learn how much tax you’ll pay as a UK sole trader in 2025. Our guide explains what type of taxes UK sole traders pay, when they have to pay them, and more.

Learn about Lumen5's pricing, plans, and features. Find the right subscription for your needs and get tips on how to save money on your account.

Learn how to set winning rates for social media management. Our 2025 guide covers pricing packages, retainers, and strategy to maximise your freelance income.

Unlock your earning potential with our freelance SEO pricing guide for 2025. Learn how to set profitable rates, factors that affect pricing, and more.