Best business bank accounts in Australia 2025

Learn about some of the best business bank accounts in Australia, covering fees, features and account types.

If you’re a UK business owner, and have excess business cash on hand, you’ll want to make sure it’s working for you. That means looking for the best business savings rates in an account where you can leave your funds - either with instant access when you need it, or for a fixed term.

However, there’s no single best business savings account out there - the right one for you will depend on your specific needs.

This guide will help you to compare the best business savings accounts in the UK to find a good fit. We'll cover some popular options, and we’ll also touch on reasons why you may want to look at a non-banking alternative like Wise Business Interest.

Get started with Wise Business 🚀

You probably already know the importance of having a dedicated business current account, separated from your own personal finances. In fact, for many UK businesses, this is mandatory. But what about business savings?

Leaving excess cash in your normal business account may mean you don’t earn interest - or at least, you don’t earn as much as you could. Instead, you could find and open one of the best business savings accounts for instant access, and simply transfer your excess cash there. This means you’ll still have access to your funds when needed, and earn interest while you’re not using the money.

You can choose from a wide variety of business savings accounts in the UK, including options from banks and non-bank alternatives like Wise.

Banks offer a full suite of business services, and while digital providers like Wise might not have all the same options available, many do have some great interest features. For example, with Wise, you can earn returns on money held in GBP, USD and EUR - a service not always available from UK bank instant access accounts.

Capital at risk. Growth not guaranteed. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you’re uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

Here’s a preview of the banks and providers we'll review in this best savings account for business guide:

- Tide

- Revolut Business

- Wise Business

- Barclays

- HSBC

- Natwest

- Virgin Money

Let’s start with an overview to compare the providers and banks we’ve selected on some important features:

| Bank | Trustpilot score | Savings interest rate | Monthly fee |

|---|---|---|---|

| Tide | 3.9 - ‘Great’ (24,980+ reviews)¹ | 3.60% to 4.22% AER depending on balance⁷ | £0 to £69.99 (current account required)¹³ |

| Revolut Business | 4.5 - ‘Excellent’ (220,930+ reviews)² | 2.25% to 3.51% AER depending on plan⁸ | £10 - £90 per month (current account required)¹⁴ |

| Wise Business | 4.3 - ‘Excellent’ (261,950+ reviews)³ | 3.74% on GBP balances, 4.07% on USD balances, 1.95% on EUR balances (after annual fees) Capital at risk. Growth not guaranteed. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you’re uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website. | £45 one off fee to register |

| Barclays (Business Premium Account) | 2.1 - ‘Poor’ (12,360+ reviews)⁴ | 1.26% to 1.76% AER depending on balance⁹ | From £8.50 /month (current account required)¹⁵ |

| HSBC (Kinetic Account) | 3.9 - ‘Great’ (13,060+ reviews)⁵ | 1.44% to 1.64% depending on balance and tenure (rates from 29.07.25)¹⁰ | None¹⁰ |

| NatWest | No claimed profile | 1.11% - 1.71% depending on balance (Instant Access)¹¹ | None |

| Virgin Money | 3.3 - ‘Average’ (11,330+ reviews)⁶ | 3.55% (Business Access Savings Account)¹² | None |

*Data correct at time of research - 24th June 2025. Interest is variable and changes frequently - check the provider website for the latest details.

Next, let's look at the options from these banks and non-bank alternative providers in more detail. The comparison criteria we'll cover for all providers through the article include:

- Eligibility

- Rates

- Assets availability

- Related fees

Let’s dive right in.

Tide offers UK business customers a good selection of account products including the free Tide business account, savings account, Plus account, Pro account and Cash Back account. You can also get help to register your UK business, with invoicing and accounting, or to take payments using payment links.

Tide savings accounts are available for customers who already have the Tide business account - but the good news is that there’s no monthly fee with the basic version of the Tide business account.

Here’s a summary:

- Eligibility: UK residents, 18 or over, with a Tide Business account

- Rates: 3.60% to 4.22% AER depending on balance⁷

- Assets availability: Instant access

- Related fees: The Tide Business account basic plan has no monthly fees, but fees range from £12.49 to £69.99+VAT per month for paid plans.¹³

| Check our full Tide business savings account review | |

| :----------------------------------------------------------------------------------------------------------------: | - |

Revolut Business customers in the UK can pick from several different plans, each with their own pricing and features. Costs range from £10 to £90 per month, with custom pricing also available.¹⁴ The higher tier plans offer more features and higher no-fee transaction limits. The interest rate you can earn on savings will also vary depending on the plan you pick.

Revolut business accounts offer multi-currency features, ways to pay and get paid in foreign currencies, linked cards, and some no fee weekday currency conversion with the Revolut exchange rate.

Here’s a summary:

- Eligibility: Resident in the UK, EEA, Switzerland, Australia, Singapore or the US, with an active registered business in an eligible country - not available to sole traders

- Rates: 2.25% AER to 3.51% AER depending on plan⁸

- Assets availability: Instant access

- Related fees: £10 to £90 per month depending on plan; transaction fees may apply depending on how you use your account¹⁴

| Before you open a Revolut business savings account check out this review | |

| :-------------------------------------------------------------------------------------------------------------------------------------------------: | - |

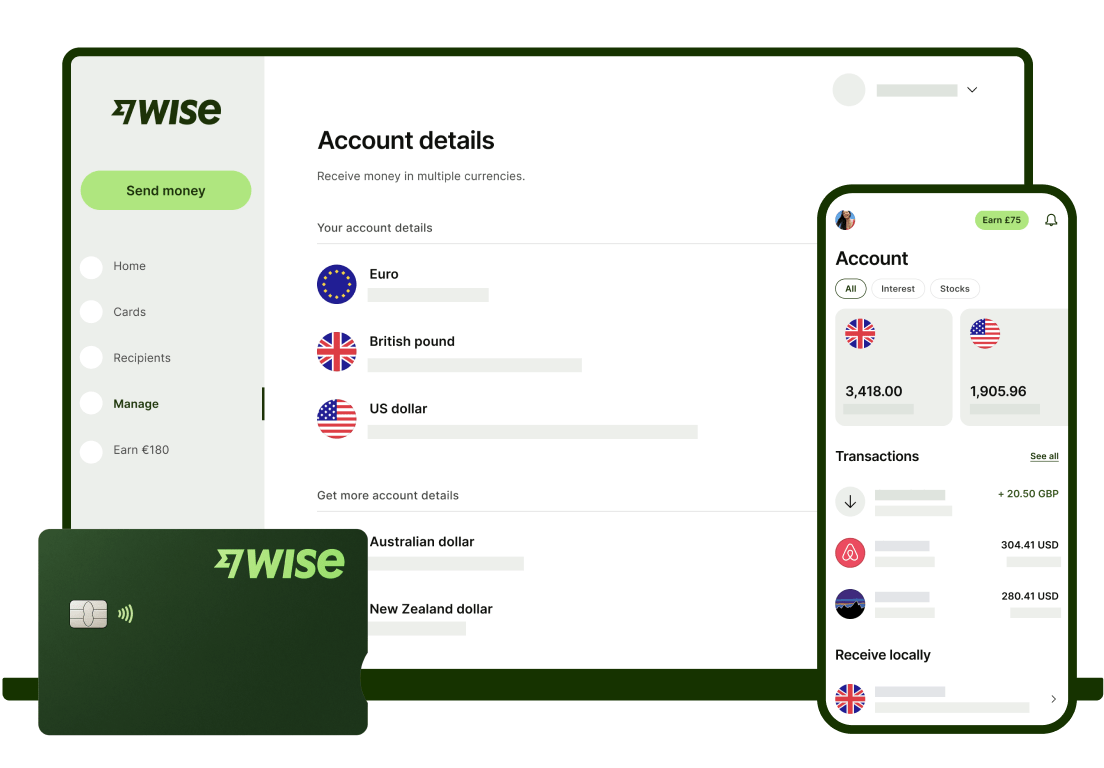

Wise Business offers powerful multi-currency accounts for businesses, which lets you hold and exchange 40+ currencies, and come with ways to send payments to 140+ countries. You’ll also be able to order debit or expense cards, and access local and SWIFT account details to get paid in multiple currencies by customers, PSPs and marketplace sites.

There’s a one time fee to open a Wise account but then no ongoing charges. You can earn interest on the GBP, EUR, and USD you hold, making this a good choice for businesses that trade internationally and hold money in multiple currencies.

Here’s a summary:

- Eligibility: Eligible business types, with account holders resident in a country supported by Wise - including UK, EEA, US and many other countries and regions globally

- Rates: 3.74% on your GBP; 4.07% on your USD; 1.95% on your EUR (after annual fee). Capital at risk. Current rates do not guarantee future growth.

- Assets availability: Instant access

- Related fees: No monthly fee, one time account opening fee of £45, currency conversion from 0.33%

Capital at risk. Growth not guaranteed. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you’re uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

Get started with Wise Business 🚀

As a major UK bank, Barclays has a suite of accounts and products available for businesses who need to manage their money or save.

For this comparison, we’ve selected the bank’s instant access saving product, which has variable interest depending on the balance you hold in your account. However, you can also get fixed term and notice deposit accounts if you don’t need instant access to your excess business cash.

To open a Barclays business savings account, you’ll usually need a Barclays business current account which may come with its own fees. Fees do vary depending on the features you need, but start from £8.50 per month (after a 12 month free period).¹⁵

Here’s a summary:

- Eligibility; Business owners with an eligible Barclays business current account

- Rates: 1.26% to 1.76% AER depending on balance⁹

- Assets availability: Instant access (other products are also available, which may not have instant access)

- Related fees: You must have an eligible current account which has a fee from £8.50 a month.

| Read our Barclays business account review here | |

| :--------------------------------------------------------------------------------------------------------------------------: | - |

HSBC has lots of different business account products and services - but we've picked out the Kinetic account for this comparison as it’s suited to sole traders and single shareholder businesses. This makes it a good option for people just starting out.

HSBC Kinetic accounts have no ongoing fees, and you’ll be able to earn interest on any excess cash you have. The interest is set based on the balance of your account and how long you leave the money there - essentially rewarding you for leaving more money, for longer, in the account.

If you’re not eligible for Kinetic - or if you’re looking for something different for your business finances, you can check out the other account products HSBC has on offer.

Here’s a summary:

- Eligibility: Sole traders and single shareholder businesses in the UK

- Rates: 1.44% to 1.64% depending on balance and tenure (rates from 29.07.25)¹⁰

- Assets availability: Instant access (other products are also available, which may not have instant access)

- Related fees: Kinetic accounts have very few fees - other products have different costs

| Read our HSBC business account review here | |

| :------------------------------------------------------------------------------------------------------------------: | - |

Natwest offers business accounts including savings products to businesses registered in the UK. While many savings accounts are only available if you also manage your day to day business finances with the same bank, Natwest has an instant access account which does not require you to have another Natwest product. This could be a flexible option if you would like to deposit some of your business funds in a different bank to your primary account.

Here’s a summary:

- Eligibility: UK resident business customers - you do not need another Natwest business account to apply

- Rates: 1.11% - 1.71% depending on balance (Instant Access account)¹¹

- Assets availability: Instant access (other products are also available, which may not have instant access)

- Related fees: No monthly fee

| Read our Natwest business account review here | |

| :------------------------------------------------------------------------------------------------------------------------: | - |

You can open a Virgin Money Business Access Savings Account even if you don’t have a current account with Virgin Money. This means you can save separately to your business current account, from just £1 through to a balance of £2 million.

Eligibility rules do apply, so you’ll need to be a sole trader or SME to open this account.

Here’s a summary:

- Eligibility: The Virgin Money Business Access Savings Account is available for eligible UK business owners, other accounts may require you to have further products from the same provider

- Rates: 3.55% (Business Access Savings Account)¹²

- Assets availability: Instant access

- Related fees: The Business Access Savings Account has no other fees

| Check our Virgin Money business account review here | |

| :--------------------------------------------------------------------------------------------------------------------------: | - |

Yes. Businesses in the UK can choose to open a savings account from a bank or a non-bank alternative. Different accounts are available with their own interest earning opportunities, eligibility rules and fees.

Different business savings accounts have their own features so you’ll need to compare a few to decide which is best for you. Important factors include eligibility, rates of interest, how easily you can access your funds, or if they need to be blocked for a while and whether there are any other account fees to pay.

Business income earned from interest in a savings account may be taxable and as such you may need to declare it to HMRC when you file your tax return. Get professional advice if you’re unsure on the rules around paying tax on business savings account interest.

It’s best to keep your personal and business finances separate - and sometimes this is mandatory. This makes it far easier to track your business performance, pay taxes and keep on top of your company admin.

Whether or not business savings are protected by FSCS will depend on the bank or non-bank provider you pick. Reputable services will make it very clear to prospective customers whether funds qualify for FSCS cover or are protected through some other means such as safeguarding.

Open a Wise Business account to hold and exchange 40+ currencies, send payments to 140+ countries, and get debit or expense cards for you and your team. You’ll also be able to get local and SWIFT account details to receive payments in multiple currencies by customers, PSPs and marketplace sites.

Receive your business funds in whichever currencies you need — and you may earn interest on the money you hold in foreign currencies, too.

Wise Business Interest pays a variable rate on the pounds, US dollars, and euros you hold. At the time of research, this means you could earn: 3.74% on your GBP, 4.07% on your USD, and 1.95% on your EUR (after annual fees). Capital at risk. Growth not guaranteed. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you’re uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

Capital at risk. Current rates do not guarantee future growth. Variable rate is based on 7 day performance as of 24 June 2025.

Get started with Wise Business 🚀

Having a business savings account allows you the best possible chance to protect unused business cash from being eroded by inflation and increasing prices. Put your money into an interest earning account to let it grow, while you wait until the right time to use it. Choose from our selection of the best business savings accounts in the UK to see if any suit your needs - and remember to compare both bank services and non-bank alternatives, such as Wise.

Sources used in this article:

Sources last checked 24-Jun-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about some of the best business bank accounts in Australia, covering fees, features and account types.

Discover some of the best business bank accounts in the US, covering FX fees, eligibility and features.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Here’s an in-depth review of everything you need to know about OFX business accounts in the UK, From fees, plans and key features.

Read our essential guide to supported Airwallex countries and currencies, for sending, spending, receiving and opening an account.

Discover how Payoneer can help streamline global payments and expand your business.