Best business bank accounts in the US, for startups and small businesses

Discover some of the best business bank accounts in the US, covering FX fees, eligibility and features.

If you run a UK business and plan on expanding or relocating operations to Australia, you most likely need to open an account with a traditional Australian bank. Usually, opening this type of account involves registering your business with the Australian government.

To help you pick the right bank for your business, we put together this detailed review of some of the best business bank accounts in Australia, including their fees, eligibility criteria, and features.

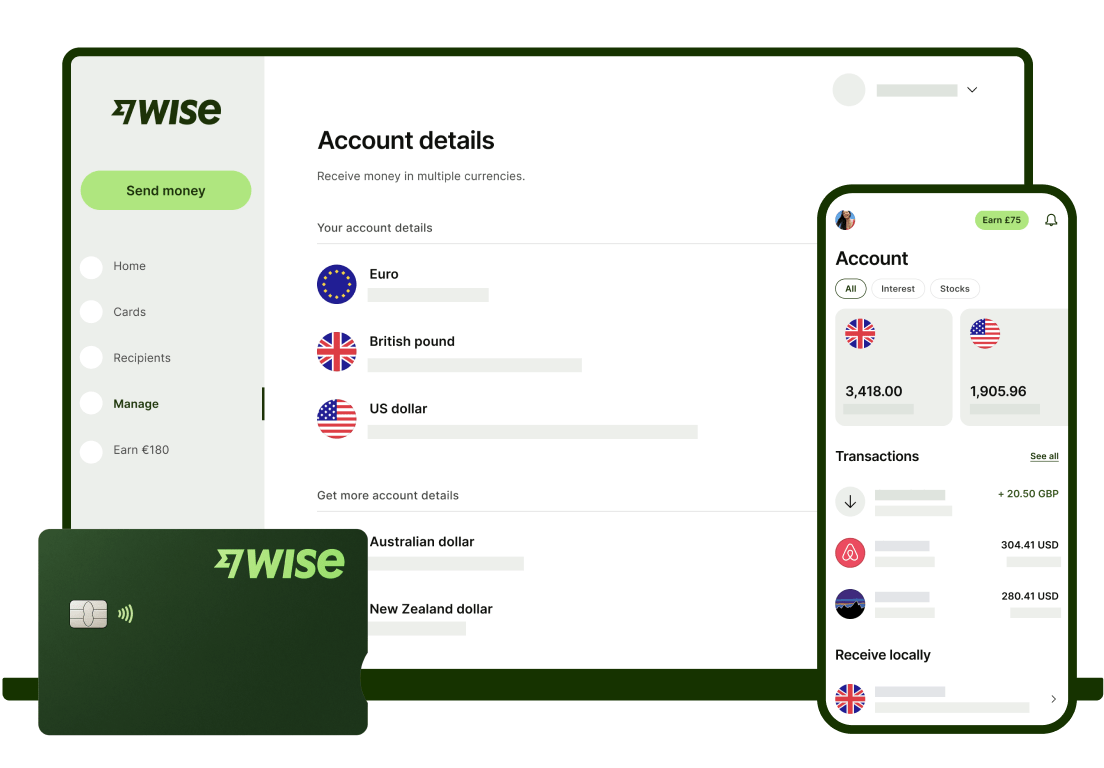

Alternatively, you can consider opening a Wise Business account and create local account details in Australia - which lets you easily transact in multiple currencies at the mid-market rate. It could be a great option if you need a fast and low-cost medium to start trading in Australia right away, without needing a physical presence.

Get started with Wise Business 🚀

Of Australia’s 97 authorised banks, the big four, ANZ Bank, Commonwealth Bank, National Australia Bank, and Westpac dominate the market¹. Compared to smaller and regional banks, they offer rounded banking services and have a wide network of branches. However, regional banks also have the perks of personalised services and niche (regional or industry) experience.

Generally, Australian banks offer three types of accounts:

If your preferred bank doesn’t offer foreign accounts, this isn’t a problem. You can open a Wise Business Account and transact in up to 40+ currencies and enjoy mid-market exchange rates without hidden fees. This means you’ll increase your ease, speed, and margin on international business.

Here’s an overview of some of Australia’s best business bank accounts with their key features, fees, and eligibility criteria

| Bank/ Provider | Business account options | Key features | Monthly fee | Opening requirements |

|---|---|---|---|---|

| **ANZ | Business transaction account² Business savings accounts² Specialist accounts² | Unlimited ANZ ATM and electronic transactions³ ANZ Business Visa Debit card⁴ Fraud protection⁴ | Business Essentials account: $0³ Business Extra accounts: $10 monthly service fee³ | Age: 18+³ Australian businesses only³ Owner/director with two types of ID and your ABN or ACN³ |

| Commonwealth Bank | Business transaction account⁵ Business Online Saver⁵ Capital Growth Account Flexi Business Investment Account⁵ Business Investment Account⁵ | Visa Debit Card⁵ Smart Mini EFTPOS with same-day payments and 1.1% transaction fees⁶ Business overdraft with flexible repayment⁷ | $0-$10 monthly account fee⁵ | ABN and ACN (if you have one)⁵ ID e.g. Australian driver's licence, birth certificate, passport⁵ Confirm directors, beneficial owners or trustees.⁵ |

| Westpac | Transaction accounts⁸ Savings account⁸ Specialist⁸ Not for profit accounts⁸ | Partner discounts ⁹ Business Debit Mastercard with temporary card lock feature¹⁰ Optional overdraft facility¹¹ | $0 Business One⁹ $10 Business One Plus⁹ | Be a sole trader or sole director within Australia¹⁰ Applicant and signatories must be 18+ years old¹⁰ |

| National Australia Bank | Business¹² transaction accounts Savings and term deposit accounts¹² Specialised accounts¹² | Accounting software integrations¹³ Unlimited standard NAB transactions¹³ | $0 account fee¹² or $10 monthly fee for 15 free most expensive eligible transactions monthly¹². | Sole trader, partnership, director of an Australian private company or a trustee of a trust¹³ Be tax resident in Australia¹³ Active ABN or ACN unless you are a sole trader with no ABN¹³ |

| Wise Business | Multi-currency account and cards | Hold, send and receive 40+ currencies at mid-market rates Batch payments and payment links Multi-user access Built-in integrations | £45 one-time set-up fee | Registered business details Company photo ID information and proof of address Business documents - depending on entity type |

Before delving deeper into the providers, it’s worth considering the types of business accounts available to ensure its capabilities match your organisation’s financial goals and priorities.

The common types of accounts are:

ANZ offers varied business bank account types, including transaction accounts, business savings accounts, and specialist accounts designed for solicitors, real estate agents and conveyancers².

The bank is one of Australia's largest banks in assets (AUD 1.3T in assets, March 2025).¹⁴ It also won Canstar’s Small Business Bank of the Year between 2022 and 2025.

You can earn up to 0.90 tiered interest rate p.a. through its Business Online Saver account and 3.60% fixed interest rate p.a. on term savings from $5,000 plus.

If you offer legal or agricultural services and products, you can benefit from ANZ’s Statutory Trust Account and its Farm Management Deposit Account. Additionally, the bank’s FX platform is available to businesses with a minimum of $250,000 (AUD) annual transactions in foreign currency¹⁵.

Trustpilot Score: 1.3 ( from 594 reviews)¹⁶

Best for: ANZ is best for sole traders and SMEs looking for a simple, secure, and cost-effective online and in-person business bank account.

Some key features of ANZ’s business accounts include:

| Type of business account | Features | Fees |

|---|---|---|

| Business transaction account² | Unlimited ANZ ATM and electronic transactions² ANZ Business Visa Debit card⁴ Fraud protection⁴ | Business Essential account³: $0 monthly account service fee³ $2.50 for staff-assisted transactions, manual merchant deposits and cheque transactions³ Varying fees for other transaction types³ Business extra accounts: $10 monthly with overdraft and 20 cheque withdrawals and deposits, manual merchant deposits and staff-assisted transactions (combined) per month³ |

| Other benefits | Business Transaction account: Integrates with MYOB and other accounting software³. Offers 11 months of MYOB access for 1 1-month MYOB subscription³ No terminal rental fees (first 6 months)³ | - |

Founded in 1911, with its headquarters in Sydney, Australia, Commonwealth Bank (CommBank) has assets worth $810.28 billion¹⁷, serving over 17 million corporate customers in Australia¹⁸. CommBank is one of Australia's top banks with an award-winning $0 Business Transaction Account⁵. It also offers business savings and term accounts.

You can earn from CommBank’s savings accounts, including⁷:

Trustpilot Score: 1.6 (258 reviews)³⁰

Best for: Sole traders and small businesses looking for affordable banking and EFTPOS with low rates.

Here are some key features of the Commonwealth Bank’s business bank account

| Type of business account | Features | Fees |

|---|---|---|

| Business transaction account⁵ | Visa Debit Card⁵ Smart Mini EFTPOS with same-day payments and low 1.1% transaction fees⁵ Business Overdraft with flexible repayment⁷ | Online: $0 monthly account fee⁵ $5 for each assisted transaction or $10 per QuickCash deposit⁵ In branch: $10 monthly account fee⁵ 5 assisted transactions (included)⁵ $5 for each assisted transaction or $10 per QuickCash deposit after using five⁵ |

| Other benefits | Syncs with accounting software Google Ads credit bonus (expires 31 December, 2025)⁵ 25% off on Google Workspace Business Standard plans (expires 31 December, 2025)⁵ |

Westpac is Australia’s oldest bank, founded in 1817 with 800 branches across Australia²⁰ and aims to expand co-located branches to 140 by 2027²¹.

With Westpac business accounts, you can open an account for daily business transactions and earn up to 3.90% p.a. fixed interest through a fixed term deposit account and complete international transactions using a foreign account.

Additionally, you can enjoy Westpac’s partner discounts on business services like Optus, MYOB, Bit Defender, and AWS⁹.

Trustpilot Score: 1.6 (309 reviews)²³

Best for: Businesses of all sizes with a global customer base and a need for discounted online business services.

Some key features of Westpac's business accounts include:

| Type of Business Account | Features | Fees |

|---|---|---|

| Transaction accounts⁸ | Business One: Partner discounts¹⁰ Business Debit Mastercard with temporary card lock feature¹⁰ Optional overdraft facility¹⁰ Business One Plus: Same as Business One¹¹ 25 staff-assisted transactions a month¹¹ | Business One: $0 monthly fee¹⁰ $0 international transfers¹⁰ Unlimited free electronic transactions¹⁰ $3 staff-assisted transactions¹⁰ Business One Plus: $10 monthly fee¹¹ |

| Eligibility |

NAB is one of Australia's largest banks, serving over 8.5 million customers²⁴. Its business banking services include transaction accounts, savings accounts and specialised accounts, which include foreign currency accounts that offer 16 major global currencies²⁵. You can earn up to 3.70% p.a. fixed interest rate on your term savings²⁶.

NAB was awarded the Best Small Business Bank in Australia by The Digital Banker’s 2025 Global SME Banking Innovation Awards.

Trustpilot Score: 1.6 (from 394 reviews)²⁷

Best For: Businesses of all sizes with an international customer base.

Here are some key features of National Australia Bank business accounts:

| Type of business account | Features | Fees |

|---|---|---|

| Business transaction accounts¹² | NAB Business Everyday Account ($0 monthly fee)¹² Accounting software integrations¹³ Unlimited standard NAB transactions¹³ NAB Business Everyday Account ($10 monthly fee with 15 free eligible transactions every month)² | No account or electronic transactions fees¹³ $0 account fee or $10 monthly fee for 15 free, most expensive eligible transactions monthly.¹³ $3 per transaction: Express Business Deposits (EBD), Coin Deposit Machine (CDM), Express Cheque Deposits (ECD) (+$3 for each cheque to be deposited)¹³ $3: Banker-assisted transactions¹³ |

| Other benefits | Business credit card²⁸ Business visa card²⁸ EFTPOS, Payments and Merchants services²⁸ Offers and discounts from partners like Honcho, Virgin Australia, Easy Companies, and Microsoft.²⁹ NAB integrates with MYOB, Xero and NAB Bookkeeper (6 months free trial)²⁹ |

Wise Business is a reliable alternative to the best Australian traditional business bank accounts. It is built to offer transparent and low-cost international banking services to UK businesses, including SMEs and startups.

Wise offers a single account for 40+ currencies with no monthly fees or hidden transaction charges. You can send and receive payments at the real mid-market exchange rate.

With Wise Business, you can open a UK account and create a local account in Australia to hold funds in AUD and handle foreign transactions. It's a great place to begin before opening a traditional bank account in Australia, especially if you want to expand and trade there from the UK quickly.

| Type of business account | Features | Fees |

|---|---|---|

| Wise business multicurrency account | One multi-currency account Payment links Accounting software integration Free invoicing tool Hold, send and receive 40+ currencies at mid-market rates without markups | £45 one-time Account opening fee |

Find out if you can open a bank account using your UK business structure or if you need to register an Australian business. Most traditional banks require an ACN, ABN and tax residence in Australia to open an Australian bank account.

Non-bank entities like Wise Business let you to create a local Australian account to send and receive payments to Australian individuals and businesses

The big four Australian banks dominate the banking sector and offer business transaction accounts, savings accounts and specialised accounts for different industries. Other regional and smaller banks may offer other services like profit sharing and more flexible lending criteria.

Choose bank accounts with features that fit your business needs, such as multi-currency access, lower exchange rates, and accounting software integrations.

If you're opening a savings bank account, find out the interest rates, preterm withdrawal conditions, minimum balance required to earn interest and term options. Some banks offer up to 4.0% interest rates p.a., while others require much less. Some require $5000 minimum savings to earn interest, while others may require $50,000 minimum balance.

Research the fees, like account set-up fees, account maintenance fees, international transfer fees, and staff-assisted transaction fees to calculate the total cost of banking.

Assess their foreign exchange services, what's their exchange rate? Does it include a markup? How many currencies can you transact in?

Wise Business is an easy way to get AUD account details for non-residents, so you can begin expansion or trading in Australia right away.

Opening a business bank account internationally can be a bit of a nightmare for non-residents. Visiting in person may not be possible, and international bank accounts require a hefty financial commitment.

If your local bank has a correspondent banking relationship, this could be a good solution for you — but it could take some time to set up. It’s worth calling your bank and seeing how they can help.

Though if you need a fast and low-cost way to send and receive AUD, then try Wise Business. After the fast registration, all you need to verify your identity is your government ID. You can then top-up your account and start sending and receiving payments around the world!

Get AUD account details with Wise Business 🚀

Sources used in this article:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover some of the best business bank accounts in the US, covering FX fees, eligibility and features.

Learn about Mettle business bank account, its core features, limitations, eligibility requirements, fees and customer service.

Here’s an in-depth review of everything you need to know about OFX business accounts in the UK, From fees, plans and key features.

Read our essential guide to supported Airwallex countries and currencies, for sending, spending, receiving and opening an account.

Discover how Payoneer can help streamline global payments and expand your business.

Find out how the Airwallex direct debit service works here in our helpful guide, covering everything you need to know.